The Income Tax Appellate Tribunal (ITAT) Jaipur bench; in an assessee-friendly ruling has held that under section ’54F‘ of the Income Tax Act, 1961, the assessee can claim the benefit of capital gain deduction during the re-assessment records. It can be done in case of non-filing of income tax returns under section 147 and 148 of the Income Tax Act[1].

Factual Background

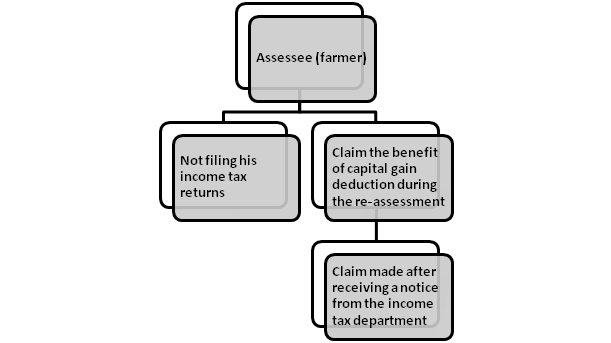

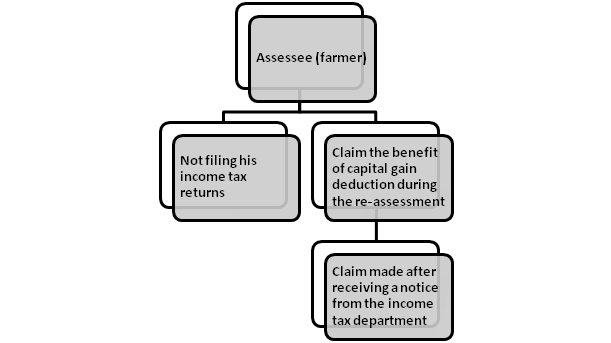

- A farmer, which is assessee in the case, possibly was not filing income tax returns. He filed the return and went on to claim deduction under section 54F of the Act towards the sale of the capital asset; after receiving a notice from the income tax department. The assessee sold it as a co-owner of the property.

- On the other hand, both the Assessing Officer and the first appellate authority repudiated the advantage of the provision to the assessee (Farmer).

Factual Brief

Read our article: Input Tax Credit for Masks, PPEs- Putting up a Fight against COVID-19

Contentions from Parties

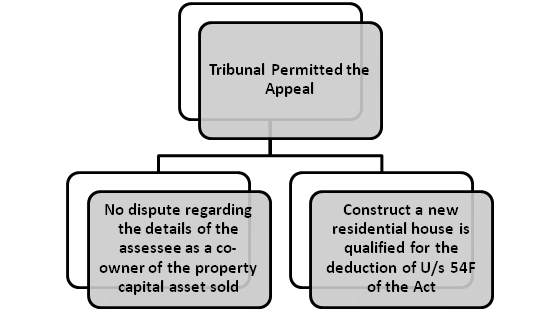

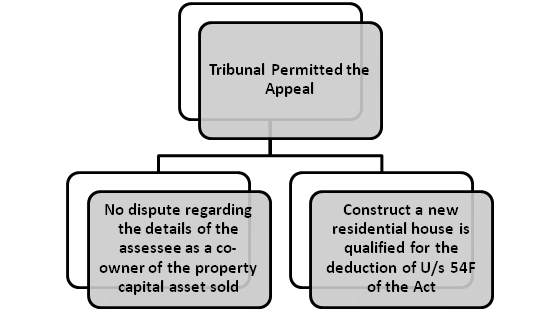

- The Tribunal permitted the appeal of the assessee & noted that there is no dispute regarding the details of the assessee as a co-owner of the property capital asset sold.

- “However, before the L’d. CIT (A), the assessee at the time of filing of the appeal, has specifically raised an issue U/s 54F of the Act of claiming of deduction. Moreover, it claimed that the sale consideration has been used to construct a new residential house that is qualified for the deduction of U/s 54F of the Act.

- Where the assessee is a farmer and a senior citizen has regard to the facts and circumstances, without verification of the existence of the utilization of the sale consideration for construction of the house, the claim of deduction U/s 54F of the Act cannot be denied.

Verdict in Brief

Conclusion

In the proceedings U/s 147 of the Act,” the Tribunal said that the A.O., in this case, has issued notice U/s 148 of the Act for assessing the capital gain in the hands of the assessee and it is a case of non-filing of return of income. Therefore, there is no bar against the capital gain proposed to be taxed by the A.O in claiming the deduction U/s 54F of the Act.

Read our article:MCA: Extensions for Resubmission of Forms and for Reserved Names