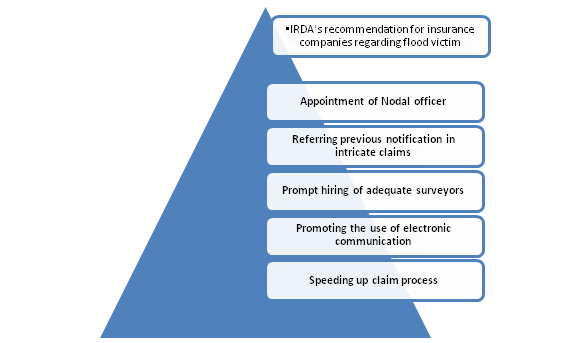

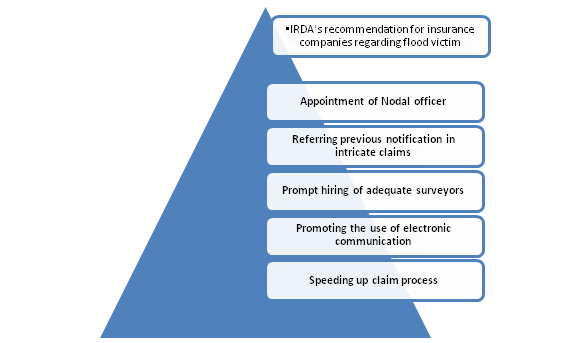

Insurance Regulatory and Development Authority of India i.e. IRDA announced guidelines for insurance claim for the flood victims in Andhra Pradesh. The notification primarily addresses the CEOs of the insurance companies. IRDA has rolled out the following directions for the insurance companies in view of the recent natural calamity:-

Appointment of Nodal Officer

The concerned entities are required to appoint a senior officer who would lead from the front and act as a nodal officer for the affected area. Such an individual would perform various tasks like processing, coordinating the receipt, and settlement of the claim. These officers are required to intimate their senior i.e. Chief Secretary in case of any issue without any exception.

Likewise, the concerned entities can also

appoint a Nodal officer at the District level in each affected district. These

individuals have to deal with the matter related to insurance claim for the

flood victims.

They will also have to report to the DM/District Administration.

Sharing Contact Detail of Nodal Officer

The contact detail of the Nodal officer must be shared with the IRDA. Such details can also be published in the local newspaper to speed up the filing of claims. Additionally, the 24/7 helpline number may be provided to the people of the affected region.

Read our article:List of Goods and Services where GST is Applicable: Latest Rates

Referring Previous Notification in Intricate Claims

In case if the appointed officers struggle to obtain a death certificate in the context of non-recovery of body etc, the process, then concerned entities can take advantage of notification GoI, No. 1/12/2014- Vs (CRS) Dated 12.09.2014 (encloses the elaborate directions regarding the action needs to taken in the case of missing person) released by the home ministry to address such an event.

Process of obtaining the death certificate

- A FIR must be filed by the close relatives or kin at the place of residence of a person who is missing.

- The FIR ought to be referred to the police station under whose jurisdiction the individual went missing. The affidavit regarding missing person must be authorized and signed by the notary and kept as a permanent record.

- The FIR should then forwarded to the SDM of the respective area along with a police report and documents such as ration card, bank passbook, and Registry of Family.

- The Designated officer will then initiates an investigation process as per the given guided principles.

- After wrapping up investigation as required, the designated officer will then issue a speaking order related to provisional presumption of death.

- The speaking order will then be published in the newspaper as well as on government website so that the claimant can file the process of claim.

- The designated officer offers the timeline of thirty days to encounter any objections or raise accordingly.

- If the officers do not receive any complain in the said timeline, then the officer will issue the death certificate without any issue.

Informing Masses about Office Address

The insurance companies are allowed to share the detail regarding the special camps/offices with the public via conventional means to enable the filing of claims. The insurance companies have to make sure that all the claims are examined promptly and claim payments are on schedule.

Hiring of Adequate Surveyors

Companies are required to appoint an adequate number of surveyors as required as soon as possible.

Conducting Extensive Awareness Campaign

The companies should take the initiative to share their efforts with the general public via an extensive awareness campaign.

Promoting the Use of Electronic Communication

In the purview of the COVID-19 virus, the insurance companies shall motivate the policyholders to take benefit of electronic communication while availing the claim and filing the relevant documentation.

All non-life insurers are requested to furnished detail regarding claims of floods to the General Insurance[1] Council via a format that is used for Amphan cyclone claims. The insurance companies are required to proactive measures for speedier settlement of claims in areas affected by flood and furnish info of the same in an aforesaid way.

Conclusion

IRDA has certainly taken a generous move in the purview of the recent natural calamity. This would come as a sigh of relief for the victim of the flood dealing unprecedented financial crisis. As soon as the aforementioned guidelines come into effect, the insurance companies soon start rolling out a claim to the policyholders. Contact CorpBiz to avail subtle detail on the said topic i.e. insurance claim for the flood victims.

Read our article:An Outlook on the Code on Social Security, 2020: Latest

Telangana-AP-Floods-Oct-2020