A ‘Private Limited Company’ is owned either by shareholders/company members or non-governmental organizations. In India, the MCA is an authority that is accountable for regulating the Private Limited Company. Private Limited Company is regarded as one of the prominent business structure that is quite popular among the upcoming entrepreneurs. Being a government-authorized entity, Private Limited Company offers many benefits to the people out there looking to get started with a new business. If you are wondering about the investment concept in a private limited company, this blog is for you.

Benefits that Private Limited Company offers

- Private Limited Company, due to government intervention, is inherently easy to form.

- A few numbers of members can get started with this business structure.

- It offers limited liability as compared to other options.

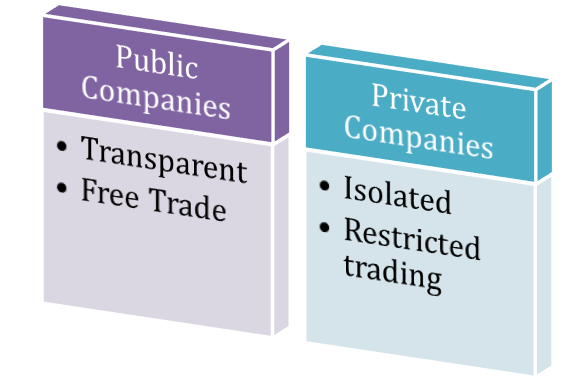

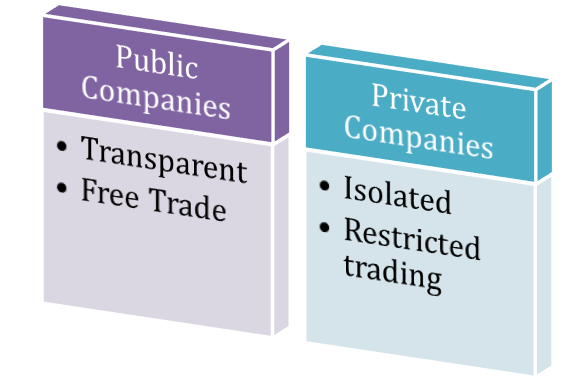

Despite these pros, there are some downsides as well. For instance- the private limited company is not entitled to issue shares to the public. The transaction and trading of share is a company’s internal affair with limited share ability with the outside world. Thus, a Private Limited Company isn’t a suitable platform for share-based fundraising, and the investors generally prefer it. The present article will cover the following aspect:

- Several parameters and attributes which one must consider before opting for investment in a Private Limited Company.

- Different modes of investment in a Private Limited Company.

Prerequisites for Investment in a Private Limited Company

The investments made in a private limited company, usually satisfying the following motive:

- Earning return (in the form of interest, dividend or principal appreciation, etc.);

- Safeguarding of the principal amount;

- Obtain hassle-free cash against the investment.

Based on the objectives above, the investor must consider the given factors before investing in a Private Limited Company.

Return on Investment

- The startup companies[1] are not good at rendering good returns due to stiff competition and low popularity, whereas an established company is potent in generating a good return consistently.

- If you opt for shares for investment- the chances are that you will reap higher returns. Meanwhile, investment through debentures could be a costly affair. So, be wise while making such an investment in a Private Limited Company.

Controlling operation w.r.t safety of the principal amount

If the investors purchase shares in the Private Limited Company, then such an investor will be treated as a member who has a right to vote. Additionally, it will also extend the limit of its power that allows him/her to control the company’s operation. Although investment in share often produces higher returns, the principal amount isn’t secured here.

Alternatively, in case of acquisition of debentures, the return is comparatively low, and safety on principle amount is higher. Henceforth, the investor needs to do their math before opting for investment in a Private Limited Company.

Read our article:Private Limited Company: Funding & Sources

Alternatives for third party investment in a Private Limited Company

There are few Alternatives for third party investment in a Private Limited Company. Those are as follows:-

Containment of shares

As mentioned earlier, a private limited company is not eligible to send an invitation to the public for share’s subscription. This restriction forced the company to conduct such activities within the company’s premises. Thus, the core members are the only contender involved in the trading of the share as per the Company Act provision. Now, the person who is looking forward to an investment in a private limited company needs to establish contact with the Directors or the promoter of the company.

Debentures

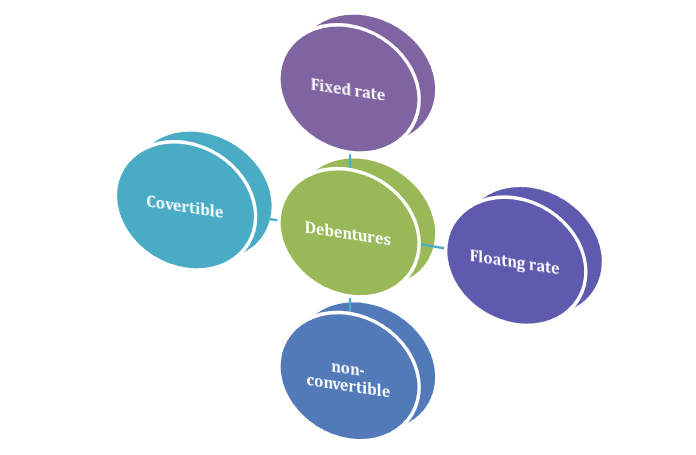

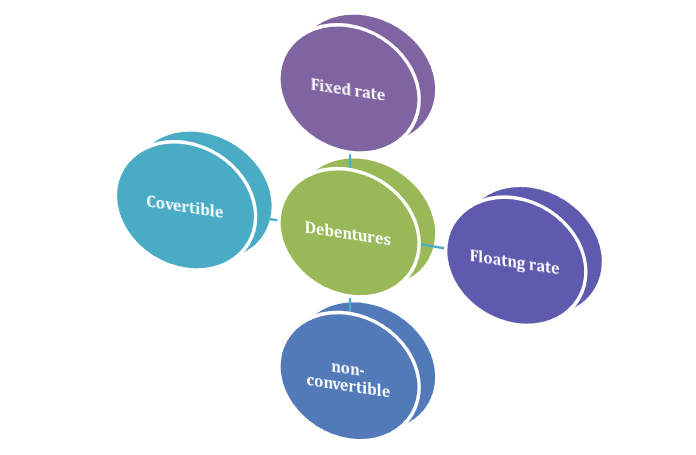

Investment via debentures is still regarded as the safest mode of investment in a private limited company. Debentures are generally found in two categories- convertible debentures and non-convertible debentures.

The convertible debentures offer the combined benefits of debt and equity. In addition to that, the investor can avail of an optional transformation for debt into equity. However, the return generated under this category would be average. On the contrary, non-convertible debentures don’t offer any conversion option to the investor, and it returns usually stays at the higher side.

Loan & Advances

If you prioritize full security of principal amount and optimal return, then investment in loans is the best option. Here the return comes in the form of interest. However, such investment comes under some strict provisions which limit the company’s authority to accept loans from the general public. Here is the list of contenders that can be a part of such investment.

- Directors

- Members

- Relatives of Directors

- Other Miscellaneous options

- Other Company

In case the investor doesn’t opt for any of these options, then they could go for alternatives like angel investors and venture capital. These options also advertised for their excellent ROI and less risk.

What are angel investors?

Angel investors are the individual that owned a large sum of money as a part of their asset. These investors generally backed up new companies who are willing a make higher ROI in the future. The role of angel investors is to provide required financial support to these companies and against the convertible debt or equity.

What is venture capital?

Venture capital is financing that usually provides financial aid to the new companies that are at high risk but can reap greater success in the future.

Conclusion

Every investment in a private limited company is prone to some degree of risk and limitation. After considering all the factors mentioned above, you can figure out an optimal platform that could yield a better ROI. Also, you must keep in mind that Investment in a Private Limited Company could be a costly affair if you choose your options blindly. If you are making a considerable investment in a private limited company, opt for an alternative that yields a perfect balance between risk and return. Similarly, if your investment amount is low, then you can take your chances with non-convertible debentures that might give great returns.

Read our article:A Complete overview on Business Structures & Raising Fund