Companies in India usually differentiate by two categories, i.e., a public limited company and a private limited company. As per section 2(68) of Companies Act, the private company is the entity whose Article of Association (AOA) refuses the transferability of shares in any given state. It means that shares of the private companies are isolated from the outside public for funding purposes.

Whether it is private or public, every company needs ample funds to survive the competition. Finance acts as a fuel that propels the business and decides its fate. The Companies Act 2013[1] is the regulatory framework that governs all types of companies.

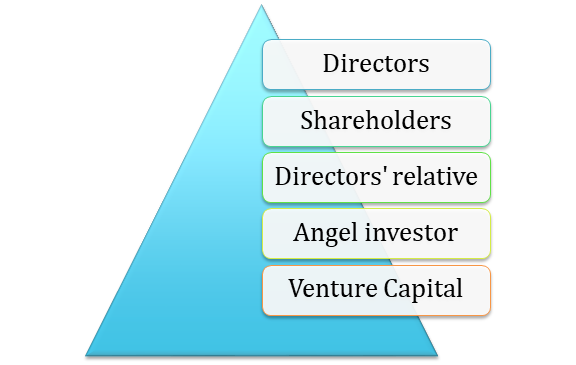

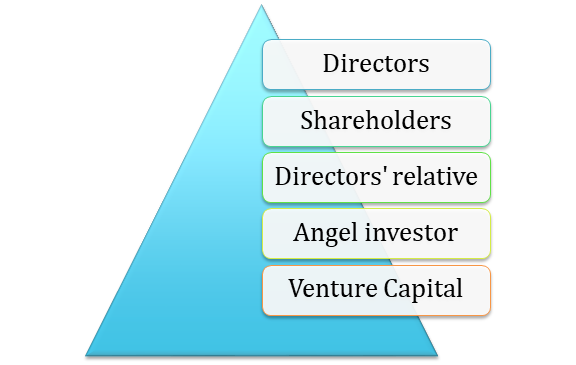

Private can borrow the fund from the following:-

Governing Act and Rules

Before we proceed, let us grasp the basic rules and provisions w.r.t funding modes for the Private Limited Company. All the company’s funding provisions are mentioned under Section 73 of the Companies Act, 2013 and the Companies (Acceptance of Deposits) Rules, 2014. Rule 2(1)(c) of the Companies (Acceptance of Deposits) Rules, 2014 elaborate the term ‘deposit’ and the same render the brief list of exempted deposits which are –

- Receiving any amount via State or Central Government.

- Receiving any amount via any company.

- Receiving any amount via directors or their relatives.

- Receiving any amount via FEMA governed bank or foreign bank.

- Receiving any amount via Public Financial Institutions.

Any fundraising of the private company seeks the approval of core members via Board’s Resolution, as per Section 179 (3) of the Companies Act, 2013

Funding alternatives for Private Limited Company

Funding in a Private Limited Company usually can get accomplished in two ways.

- Internal– The additional issue of share capital, deposits availed from the members, deposits done by the director.

- External – Bank finance, angel investors, venture capital, etc.

Internal funding options

An additional issue of share capital

When it comes to Funding in Private Limited Company, the issuing of additional share capital is regarded as one of the most suitable options. It could help the company to raise the fund in no time and render better incentives to the shareholders. However, the company needs to ensure conformity with section 62 of the Companies Act, 2013, to serve this purpose.

Deposits from Directors and their Relatives

Deposit from Directors and their relatives is another source of Funding in Private Limited Company. However, this nature of fundraising is subjected to the following conditions. The relevant directors must give a written declaration regarding their assurance w.r.t the nature of fundraising. If the acquired funds were raised through the others, then it shall not be accepted as a deposit. Moreover, the detail of such a deposit needs to incorporate in the Board’s report.

List of the eligible depositors serving as Directors relative

- Members of a Hindu Undivided Family

- Son, including stepson

- Father, including stepfather

- Spouse of Director

- Mother, including the stepmother

- Brother, including stepbrother(s)

- Daughter, including stepdaughter

- Daughter’s husband

- Son’s wife

- Sister, including stepsister(s)

Read our article:Private Limited Company Registration Procedure in India

Deposits from its employee

Fundraising via employee’s deposit in another conducive method of Funding in Private Limited Company. Such deposits cannot exceed the threshold of an employee’s annual salary as per the given provisions.

Deposits from its members

Section 73 (2) of the Companies Act, 2013, has a provision for Funding in Private Limited Company via member’s deposits. The following conditions need to be fulfilled in this aspect.

- A circular must be distributed about the same among the core members. The circular must cover the following aspects:

- Company’s credit rating

- List of depositors

- The amount due to the previous deposits.

- The circular’s copy ought to be submitted to Registrar within thirty days prior date of the issue of such circular.

- The sum of such a deposit should not be less than 20% of the sum of the deposit maturing in the bank account, aka deposit repayment reserve account. Such deposits are time-dependent, which needs to be procured, on or before April 30 every year.

- Certifying that the firm has not breached repayment’s provisions w.r.t deposit accepted and interest paid on such deposits.

The provisions above do not apply to the following private companies:-

- The company’s loan amount from its member is well behind the threshold of 100% of paid-up capital, Securities Premium account, and free reserves.

- The Private Limited Company is not older than five years.

- The Private Limited Company that covers the given conditions –

- The company should be a sole-runner instead of an associate or a subsidiary.

- The total amount of raised funds is lower of Rs 50 Crore or the twice of its paid-up capital.

- The company is not involved in the violation of repayment terms w.r.t existing borrowings.

External funding options

A loan from financial institutions: Fundraising via banks and other financial institutes is the most preferred way of money borrowing. Someone with a better credit record and market repo can easily raise loans from banks compared to other options, where money security is a major concern.

Private Placement of Shares

As per Section 42 of the Companies Act, 2013, private placement of shares to a selected group can also be a part of the fundraising strategy. Section 14 of Company Act 2013 and Companies (Prospectus and Allotment of Securities) Rules, 2014 cover the provisions for such arrangement.

Key factors

- A shareholder’s approval is a must when it comes to allotment of share. The Company Act directs companies to resolve such matters at a board meeting.

- The private allotment of shares shall be conducted as a trusted person; someone is known for years and had a stringent relationship with the company.

- The professional dealing with the securities under a scheme w.r.t employee’s stock option cannot be a part of such purpose.

- Threshold w.r.t allotment of share, in this case, is limited to 200 in a financial year.

This provision acts differently in case of allotment of securities. Such a section seeks approval of Registrar after the submission of relevant documents illustrating the detail regarding security holders, basic info, and the number of security.

Angel Investors and Venture Capital

Angel investors and venture capital also act as funding options available for private limited companies. The angel investors represent the groups of individuals, whereas the Venture capital is a company holding that seeks ownership stake in exchange for lending required funds.

Conclusion

Funds are crucial to run day to day business activities of the organization. The scarcity of finances can result in a liquidation of tangible assets. The deposits from different sources act as a reservoir of funds for the company that could be used to compensate for the loss. Since fundraising in the private limited company comes under strict compliance, the result could be penalty oriented if not undertaken correctly. If you still have some questions w.r.t Funding in a Private Limited Company Registration, kindly used our comment section for swift feedback.

Read our article:Powers of Registrar for Removal of Name of Company from Register of Companies