GST implementation has revolutionized the Indian taxation infrastructure by subsuming various taxes under one hood. The cascading effect of tax that was quite prominent with the earlier tax regime was also reconciled entirely with the advent of this tax structure.

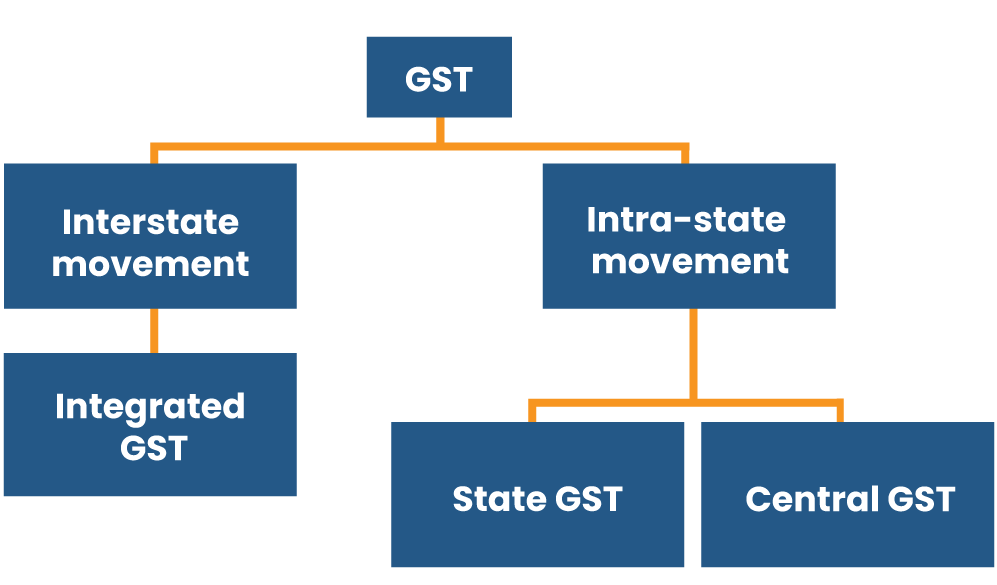

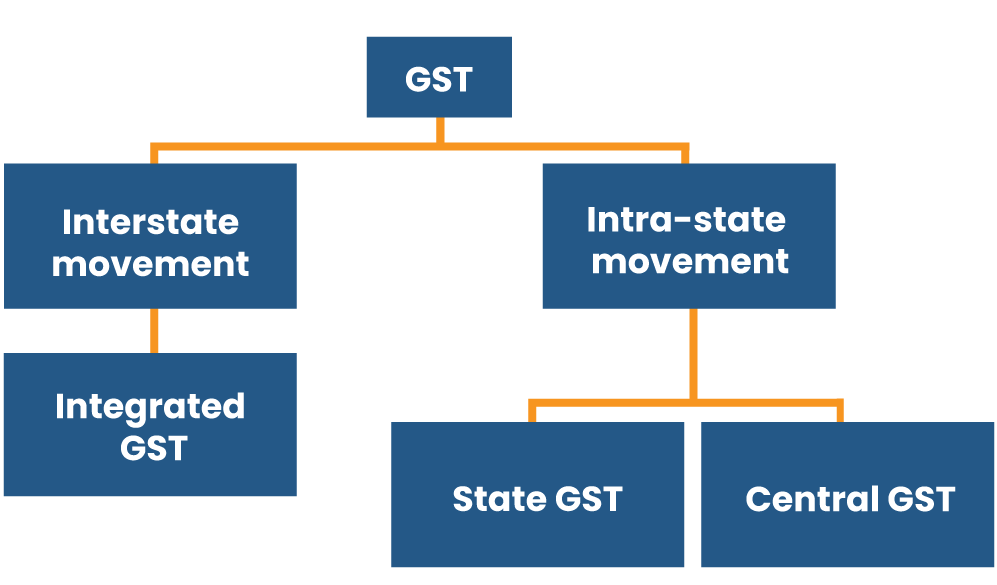

In Good and Services tax, the term interstate & intrastate has paramount importance in determining SGST, CGST, and IGST. The interstate supply lures IGST, whereas intrastate supply attracts SGST & CGST. In this write-up, we shall look into the concept of interstate supply and intrastate supply provided in the GST Act.

An Overview on Goods and Services Tax

GST refers to an indirect tax imposed on the supply of goods or services or both of them. To accumulate GST, supplies are tagged as Inter-State supplies, which implies goods arriving from one State to another, & intra-State supplies, which implies products in the State.

The Central Government[1] imposes the consolidated tax as per GST Act 2017 in case of inter-state supplies, whereas, in case of intra-State supplies, Central Government charges the fee as per GST Act 2017 & state tax as per SGST law of 2017.

What is the Concept Behind the Inter-State Supply?

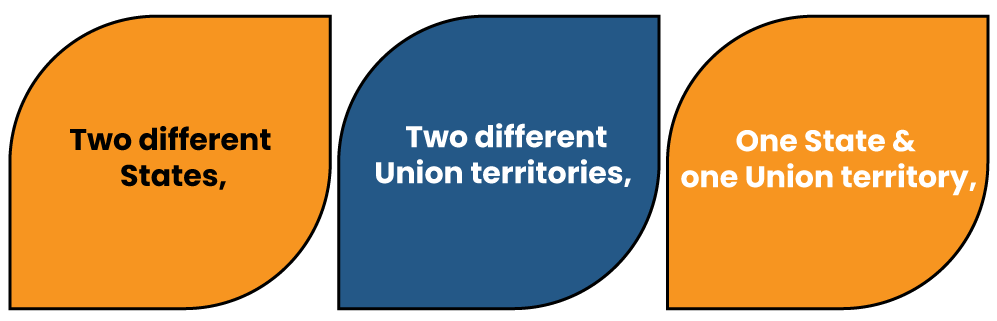

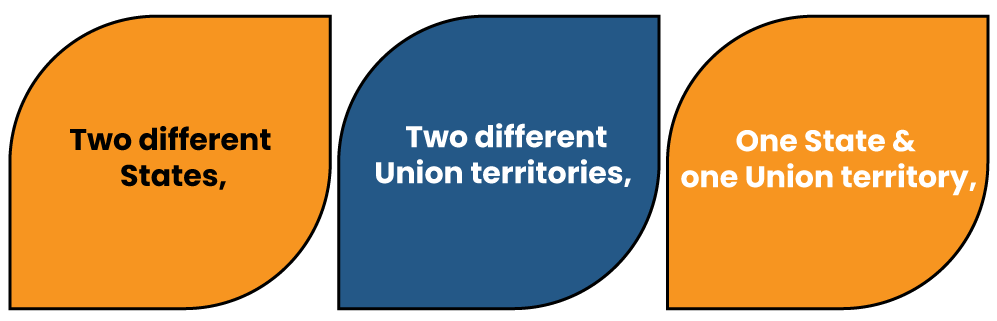

Sections 7 & 8 under the IGST Act talks about the criteria for determining the type of supply i.e. inter-state or intra-state. As per Section 7 of the said Act, if the supplier’s location & the supply’s place are in:

Then the supply would be tagged as inter-state supply.

Moreover, the goods’ supply imported from other nation is often regarded as an inter-state supply before landing at the customs station. Also, supplies of goods or services come under interstate suppliers from an exclusive economic zone or specific development zone.

Read our article:Key Highlights of GST Updates 2021

Examples of Interstate Supplies under GST

Example 1: Suppose you have a firm, viz ABC, in the State of Uttar Pradesh. Your company supplies product to another enterprise, namely XYZ, located in Delhi, then it comes under the ambit of inter-state supply.

Example 2: suppose Company A provides services to client B for Rs 7 lakhs. The services are rendered from company A in Hapur (UP) and are received in the client’s location in Delhi. Such supplies would come under the regime of inter-state supply.

It means that interstate supply will come into play if the supplies of the goods and services occurred in the place where the supplier belongs.

What is the Role of Intra State supply under GST?

Under GST, intra-state supply comes into effect when the supplies of the goods and services occurred within the same State or territory.

The intra-state supply would remain applicable as long as provider and buyer location falls in the same jurisdictions.

A seller must obtain both SGST & CGST from the buyer in case of intra-state transactions.

The CGST is furnished to the Central Government, and SGST is deposited to the State Government.

Examples of intrastate supplies under GST

Suppose Company A supplies equipment to firm B located in the State where the former entity belongs. Such a nature of supplies falls under the ambit of intrastate supply.

This indicates that the concept of intrastate is only applied to those supplies of goods and services that take place within the State or territory.

GST on Interstate vs Intrastate Supply

- Interstate supply attracts IGST, i.e. Integrated Goods and Services Tax.

- Both the CBT as well as State Goods and Services Tax (SGST) covers intra-state supply.

- For intrastate supply, the identical GST rate will apply to goods or services.

- The GST & tax rate shall be bifurcated into two headings equally: SGST & CGST.

- In light of prevailing GST law, taxes are chargeable on different goods or services based on the supply location.

- If the transaction falls under intra-state supply, the CGST is imposed by the Center of Commerce. Similarly, the state GST will be received by the State where the supply came into existence.

- In the interstate supply of services or goods, the Centre accumulates the IGST. SGST & CGST shall not be chargeable in such a case.

- The IGST rate shall be equivalent to the SGST + CGST rate.

- For example, when charges on a specific product are 9%, the interstate supply shall be chargeable @ 9% SGST & at @ 9% CGST.

- The interstate supply refers to as IGST is chargeable @ 18% (i.e., 9%+9%).

What is the need for supply’s categorization?

At present, the GST system entails four forms of taxes, i.e. SGST, UTGST, CGST, and IGST.

When an intrastate supply came to effect, SGST/UTGST and CGST are charged accordingly as per GST Act. Similarly, the IGST is charged & payable in cross border supply.

Hence, it can be concluded that different taxes are chargeable on the corresponding suppliers. The determination of supply for intra-state as well as inter-state suppliers is of utmost importance.

What if the Taxes Are Paid Without Intention or Accidentally?

- Where the valid taxpayer paid the CGST & SGST / UTGST pertaining to inter-State supply, no interest shall be chargeable during the imposition of IGST. The mistakenly paid former taxes will be claimable as per the GST refund provision.

- Where the valid taxpayer has paid IGST pertaining to intrastate supply, CGST & SGST/ UGST is payable without interest. The unintentional payment of IGST will revert to the taxpayer under the refund provision.

Hence, it is of paramount importance to determine the supply category in such a category.

Conclusion

We spoke about the fundamental of different tax forms exist within GST’s regime. A taxpayers are required to record the transaction based on Inter-State and Intra-State transaction as per the provisions of GST Act. Let us know if you have some doubt regarding this topic. Use our message box to share your concern.

Read our article:The Migration to the New Tax Structure under GST Transition Process