The Income Tax Appellate Tribunal (ITAT) held that the imposition of late fees is compulsory and consequential and the same cannot be deleted on the grounds of reasonable circumstances. The appellant in the case challenged the late fees imposed on Quarterly TDS Statement whose filing was delayed by the applicant.

Overall Interpretation

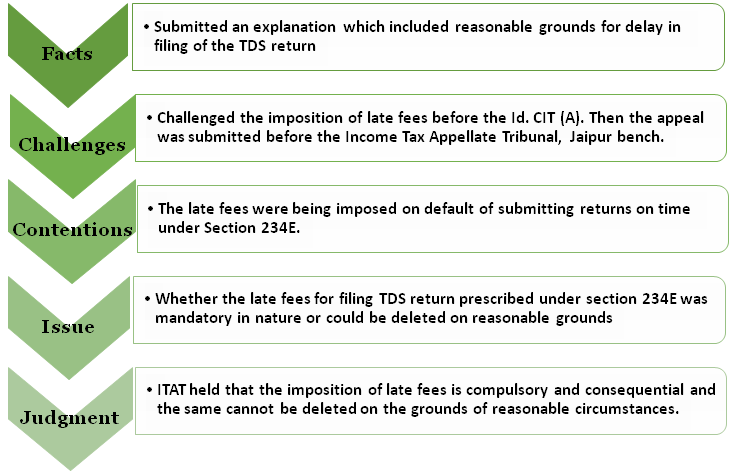

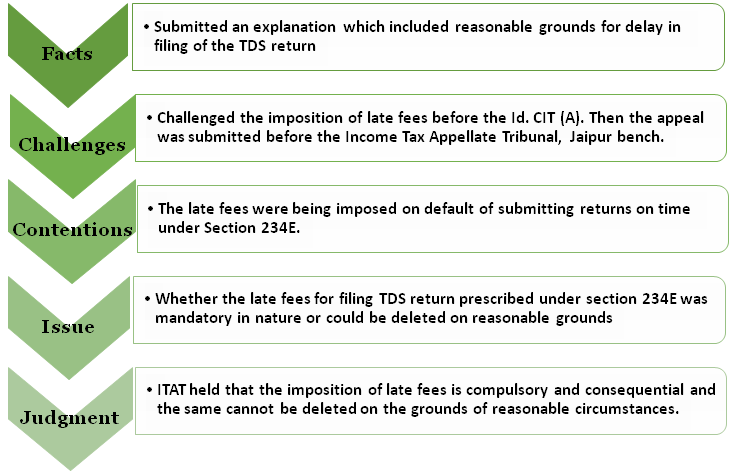

The facts of the case, issues raised and judgment of the case are given bellow:-

Read our article:CBDT notifies Guidelines for Faceless Assessment Scheme

Facts of the case: Block Development Officer vs ACIT

The appellant in this case is the Block development Officer. The appellant held that they had submitted an explanation which included reasonable grounds for delay in filing of the TDS return. The appellant also stated that they had deposited the taxes on time and due to certain circumstances, which were explained by them, had been unable to file the return on time. The appellant even explained that they were in no position to pay the late fees as they had neither asset nor the funds require furnishing the same. Due to this delay in filing of TDS return the Assessing Officer had made adjustments in the late fees to be imposed under section 234E of The Income Tax Act[1].

Challenges and Contentions

The appellant had first challenged the imposition of late fees before the Id. CIT (A), where the contention was not accepted. Then the appeal was submitted before the Income Tax Appellate Tribunal, Jaipur Bench. The respondent specified that the grounds for levying late fees were not those explained under Chapter XXI of the Act where the late fees can be waived off on reasonable grounds. The late fees were being imposed on default of submitting returns on time under Section 234E.

Issue Raised

The main issue here was whether the late fees for filing TDS return prescribed under section 234E was mandatory in nature or could be deleted on reasonable grounds.

Conclusion: Judgement

The Jaipur Bench held that the nature of Section 234E is such that it demands mandatory and consequential imposition of late fees and does not allow it to be waived off even on the grounds on reasonable circumstances.

The bench also made a point that the order by the Assessing Officer was an appealable order; it could only be challenged on the grounds that the Assessing Officer had failed in complying with the mandatory provisions of Section 200A under the Act while making adjustments. If such an allegation was absent then the appeal failed on such grounds. The bench dismissed all of the six appeals which were filed by the assessee.

Read our article:CBIC Notifies to facilitate Interest levied on Net Tax Liability as per Section 100 Finance Act 2019