According to provisions of section 3 of RERA Act, all the real estate projects from 01 May 2017 including ongoing projects which are in an extent of more than 500 sq meters and more than 8 unit must be registered with APRERA.

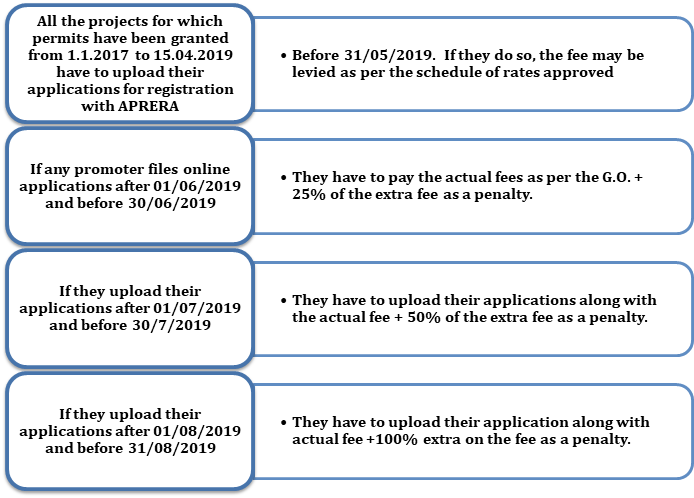

If the promoter contravenes with section 3, he must be liable to pay the penalty, which can be extended to 10 % of the estimated cost of a real estate project. APRERA has issued the circular dated 15 May 2019 in which projects are divided into two categories which are as all the project that got their plans approved between 01 January 2017 to 15 April 2019 and another category is the project which got their plans sanctioned after 15 April 2019 and fixed a late fee in addition to an actual registration fee according to the Government orders and cut off date was taken as 31 August 2019.

Authority issued a circular in connection with late fees on registration of projects

.For a project which has got approval from competent authorities from 01 January 2017 to 15 April 2019 following things will apply:-

- If the promoter files online application after 01 September 2019 on or before 31 October 2019, they have to pay actual fees according to the Government orders +150% extra of the registration as a late fee.

- If any of the promoters file an online application after 01 Nov 2019 and on or before 31 Dec 2019, they have to pay an actual fee according to the Government orders +200% extra of a registration fee as late fees.

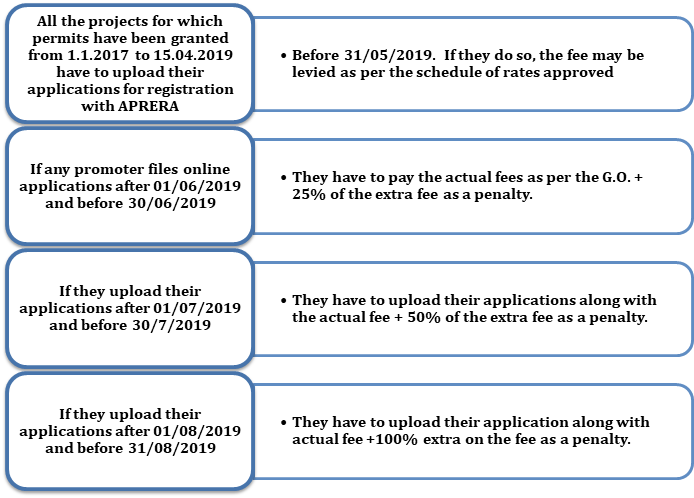

For the projects with government approval after 15 April 2019 the following fees and late fees will be levied:

- All promoters have to file online applications within 45 days from the date of approval of building or layout plans. If it is applied within 45 days, the fees will be levied according to schedule.

- If any of the promoters apply after 45 days and before 75 days after the plan’s approval, they have to pay the actual fees as per a G.O +25% extra of the registration fees as late fees.

- If any of the promoters file an online application after 75 days and before 105 days after the plan’s approval, they have to pay actual fees as per a G.O +50% extra of registration APRERA fees as late fees.

- If any of the promoters file an online application after 105 days and before 135 days after the plan’s approval, they have to pay actual fees as per G.O +100% extra of registration APRERA fees as late fees.

- If any of the promoters file an online application after 135 days and before 195 days after the plan’s approval, they have to pay actual fees as per G.O +150% extra of registration APRERA fees as late fees.

- If any of the promoters file an online application after 195 days and 255 days after the plan’s approval, they have to pay actual fees as per the G.O +200% extra of registration APRERA fees as late fees.

If any of the promoter who has not submitted his application to register their project before 31 December 2019 according to the schedule mentioned under clauses (a) to (f) mentioned above and after 255 days from date of approval of building or layout plan stringent action according to section 59(1) of the Act will be taken against the said promoter and must be liable to penalty of up to 10% of an estimated cost of a real estate project.

The circular has issued by the APRERA to impose penalties on unregistered projects. According to the Section 3 of the RERA Act, 2016[1], all real estate projects from 01 May 2017, including ongoing projects which are to the extent of more than 500 square meters, or have more than 8 units have to be registered with an authority.

Therefore according to the provisions of Section 59 (1) of the RERA Act 2016, if any of promoter contradicts with the provisions of Section 3, he must be liable to a penalty which can be extended up to 10% of an estimated cost of a Real estate project as determined by the Authority. So, all projects coming under the purview required to be registered. Recently, in an APRERA meeting was on 15 May 2019, the following procedure has been approved to levy APRERA fees and penalties.

Read our article: Guide on Permissible expenses can be charged to RERA Account

Procedure to impose a penalty

*Note: Penalties are not exhaustive; it is subjected to alteration in time to time basis

Fees policy for the projects after 15 April 2019

- All promoters have to file an online application within 45 days from the date of approval of building or layout plans. If applied within 45 days, the fee can be levied as per the schedule of rates approved by the Government vide order dated 12 September 2017.

- If any of the promoters file an online application after 45 days and before 75 days after approval of the plan, then they have to pay the actual fees as per the G.O. + 25% extra fee as a penalty.

- If any of the promoters file online applications after 75 days and before 105 days after approval of the plan, they have to pay actual fees +50% extra fee as a penalty.

- If any of the promoters file online applications after 105 days and before 135 days, they have to pay actual fee + 100% extra fee as a penalty.

Therefore if any of the promoter who has not submitted his application to register his project after 31 August 2019 for a penalty schedule mentioned above and after 135 days from date of approval of building or a layout plan for the fees policy schedule mentioned above, stringent actions according to Section 59 (2) of the Act must be taken against the said promoter and must be liable to a penalty which can extend up to 10% of an estimated cost of a Real estate project as determined by an authority.

Conclusion

In case a promoter who has not submitted his registration application to register their project in APRERA before 31 December 2019 after 255 days from date of approval of building or layout plan stringent action according to section 59(1) of the Act will be taken against a said promoter.

He will be liable for the penalty, which must be up to 10% of the estimated cost of a Real Estate Project as determined by the Authority. Our CorpBiz Team shall be at your disposal to assist you in any inquiries regarding APRERA fees and RERA registration/compliance work simultaneously. We shall be happy to serve you.

Read our article: APRERA Notification on Late Quarterly Compliance Filing