China is the centre stage of global trade. Most of the businesses around the globe prefer importing from Chinese OEMs and marketplace to outrank the competition in the domestic market. China’s economy is more liberal and favourable for international trade. India has a strong trade relationship with China despite ever-increasing border tension. Low labour cost, prompt turnaround time, and minimal production cost are the three prominent factors that entice Indian importers to trade from China. Major Chinese imports included telecom gears, consumer electronics, computer parts, electrical equipment, chemicals, & fertilizers. Businesses seeking Import from China needs to fulfil plenty of legal requirements.

In view of China’s prominence in Indian trade, this write-up aims to provide clarification on legal implications that one has addressed while importing goods from China.

We will talk about four essential aspects that every Indian importer should need to know

- Import Export Code

- Indian Standards compliance prerequisites

- Customs documentation & customs duty

- Labelling prerequisites

- Environmental compliances

Import Export Code (IEC) issued by DGFT for businesses seeking import from China

Well, IEC registration is the basic license that one must procure before venturing into the EXIM business. Directorate General of Foreign Trade issues such as a registration against a completed e-form and a license fee. An applicant seeking import from China must visit the online portal of DGFT to avail of an import-export code.

Basic documents required to be uploaded for IEC code

- Individual’s or Firm’s PAN Card copy

- Individual’s passport, voter id or Aadhar card copy

- Individual’s or company’s cancel cheque copies

- Rent Agreement copy or Electricity Bill Copy of the place of business

Read our article:Step by Step Guide to Raise IEC Certification for a Partnership Firm

BIS Registration for Businesses seeking import from China

The Bureau of Indian Standards (better known as BIS) is an Indian Standardized institution that outlines and regulates the safety & quality of products meant for consumptions in the nation. It is applicable to both domestic and international products.

BIS is obligated to perform three key functions:

- To underpin unified norms of quality for manufactured and agricultural goods

- To examine products

- To legalize the utilization of standard mark, aka ISI (Indian Standards Institute) Mark

The bureau enables businesses to use the ISI logo under its product certification schemes. In case of importation, these items come under two certification schemes as mentioned below:

Compulsory Registration Scheme (CRS)

It encompasses electronic & IT products such as PC, laptops, smart devices, Bluetooth gears, etc. It is a legal compulsion for an importer shipping a CRS item from China to legalize that product with BIS registration. Certification is bestowed to the OEMs and not the importer. The importer may act as a representative of Chinese OEM in India & apply for such a certificate on its behalf.

Foreign Manufacturers Certification Scheme

A wide array of products seeks ISI registration before making their way to the domestic market.

These include medical equipment, cement, iron and steel products, car tyres, fertilizers, batteries, toys and food items. Importers of such goods can avail of BIS registration under Foreign Manufacturers Certification Scheme.

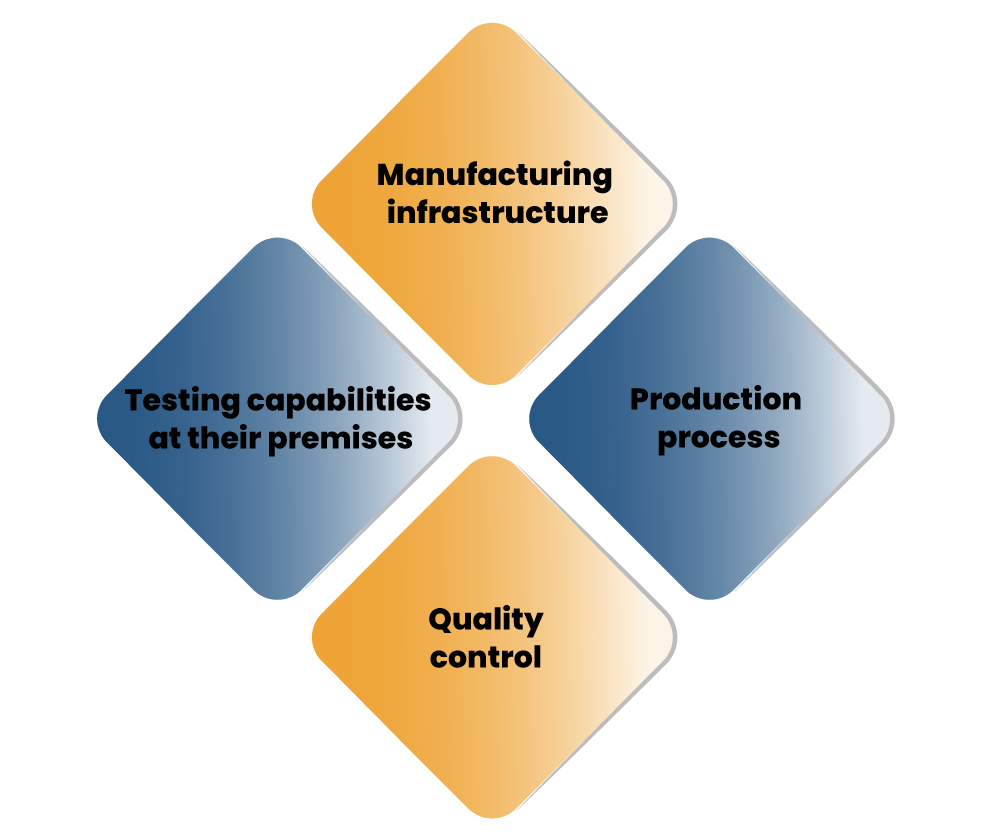

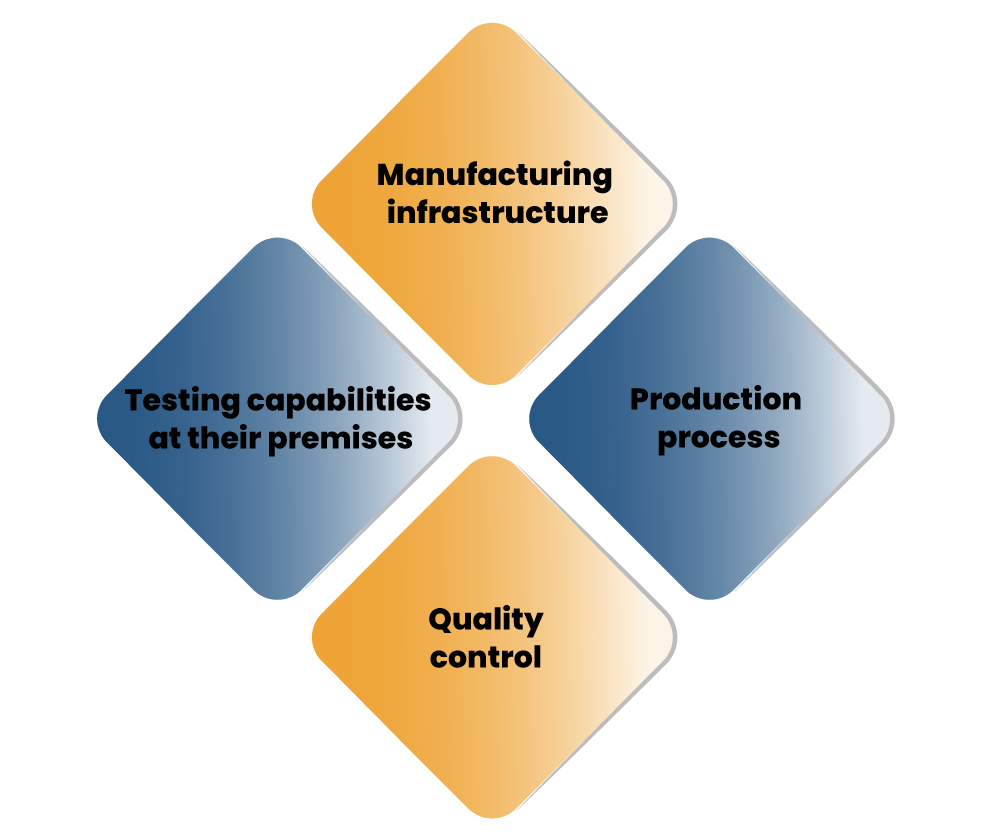

OEMs with a manufacturing facility located outside India can opt for BIS registration under this scheme provided they stay in line with underlying BIS’s regulations relating to the following

SCOMET products

SCOMET stands for Special Chemicals, Organisms, Materials, Equipment and Technologies. Products that come under SCOMET is listed in Appendix 3 of Schedule I (Imports) of the ITC (HS)* Classification.

ITC (HS)* better known as Indian Trade clarification on Harmonised system meant for EXIM activities.

The SCOMET List entails controlled substances such as electronics, toxins, and nuclear material. These might also come under FMCS or CRS.

SCOMET items must fulfil given requisites for mandatory registration

- Demand for such products ought to be continual.

- Their procurement must be done from known sources.

- They should adhere to confined consumption (expressed as the consumption of items produced by one division by another division of the same to produce another product)

Understanding Custom Duties for Indian Importers seeking import from China

The standard cargo time from China[1] to India is around 20 days via sea. Please make a note that at least one Chinese vessel makes its way to the Indian port daily.

So, how much does it cost for an Indian importer to get a cargo pass through Indian Customs.

For ocean shipments, the importation duty is computed based on the CIF value of the product. Here, CIF stands for cost, insurance, freight value. Anyway, the import duty has three essential components:

Basic Customs Duty (BCD)

Rate differs product-wise. The GOI can impose exemption on certain goods by waiving off such duty or reducing the duty rate on others.

Integrated IGST and GST compensation Cess

IGST is equivalent to the total of State and Central GST. GST compensation cess reimburses states for any damage incurred by the implementation of the GST.

Social Welfare Surcharge (SWS)

Imposed @ 10% of the sum of duties, taxes & cesses amassed under the Custom Act, 1962.

In addition to that, your cargo from China may lure other duties as given below:

- Anti-dumping Duty (ADD) – Imposed on imports prices less than the domestic market price. India imposed additional charges on the import of Chinese bottle-grade PET resin & some steel products.

- Countervailing Duty (CVD) – Imposed to safeguard local OEMs and manufacturers from subsidized imports. CVD is equal to the central excise duty on identical items manufactured in India.

Safeguard Duty – A safeguard against the viable losses to local OEMs and manufacturers owing to a surge in imports. The importation of Chinese origin solar cells attracts a 14.5% safeguard duty

- Protective Duty- Another Duty that is meant to safeguard local OEMs and manufacturers

- Education Cess – Imposed @ 1-2% of the total of custom duties

- Handling expenses– imposed for the loading, handling, and unloading of goods.

Mandatory Labelling Requirements to import from China

All overseas items making their way to the Indian Territory ought to comply with underlying labelling norms, which might differ from the global standards. Failure to meet such norms may compel the importers to face the rejection of the shipment by the Customs Authority. In the year 2018, China managed to secure the sixth position as a leading overseas supplier of edible products in India.

Business seeking import from China must comply with the given List as far as labelling requirement is concerned.

- Product name (common or generic)

- Ingredients mentioned in the descending order of volume Net weight, the volume of contents

- Batch number or lot number

- Date regarding manufacturing, packaging, and expiry

- MRP, i.e. Maximum retail price

- Name and proper address of the OEM, importer, packer

- Nation of Origin, name & proper address of the importer, Detail regarding packaging/bottling unit (If the item is produced abroad but packaged in India

- Proper marking highlighting whether the product is vegetarian/non-vegetarian

- FSSAI Logo along with the registration number.

- The present of colouring agent

In addition to that, the FSSAI has some norms regarding the design and lettering of labels:

- Product information ought to be clear, legible and in a readable format.

- The colour of the logo available on the label must be in contrast with a label colour & should display the logo and the license number.

- The height of the letters on the label should not be less than 1mm. At the same time, the width should not be less than 1/3 of the height.

- Falsified Statements & pictorial representation relating to the product’s nature, composition, and origin aren’t allowed.

- Statements specifying recommendations by a medical expert is prohibited.

The labelling on Items other than food must carry the following information

- Name of product

- Month and year of manufacturing, packaging & import

- Net quantity

- Name and address of the importer

- MRP, i.e. Maximum retail price

Environmental Obligations to be followed by importer seeking import from China

Environmental obligations have an essential role to play in EXIM activities. India has underpinned Electronic Wastes (Management and Handling) Rules, which specifies the responsibilities of importers of electronic equipment and gears.

It aims to mitigate risks that jeopardize human life and mediocre management of e-waste.

The e-waste rules in India consolidate the best approaches of two European laws mentioned below;

- Waste from Electrical and Electronic Equipment (WEEE) Directive.

- Restriction of Hazardous Substances (RoHS) Directive

ROHS Directive

It limits the utilization of 10 dangerous substances (mentioned below) beyond permissible threshold;

- Lead,

- Cadmium,

- Mercury,

- Polybrominated biphenyls,

- Hexavalent chromium,

- Bis(2-Ethylhexyl) phthalate,

- Polybrominated diphenyl ether,

- Butyl benzyl phthalate,

- Dibutyl phthalate

- diisobutyl phthalate

Only a few items that lack viable alternatives to the prohibited substances are exempt. Like India, any other nation has underpinned a different version of the ROHS directive. India’s waste norms sought for minimal use of dangerous substances as per the ROHS Directive.

WEEE Directive

It seeks to mitigate the production of e-waste coming from electrical items. Where such waste is produced, it sets out norms for their effective handling, recovery & re-use.

Under India’s e-waste norms, the importation of electronic gear is permitted only with the Permission of the State Pollution Control Board.

The norms also specify a threshold for e-waste collection- 30% of anticipated sales on a self-computed basis by 2018 & 70% by 2023. Non-adherence to such requirements would invoke penalties for the defaulters.

The norms specify the following obligations for the importers:

- Gathering electronic waste during the manufacturing process or after the completion of the service life of the product and ensuring their recycling or disposal via legalized agencies and registered dismantlers & recyclers

- Establishing collection avenues and rendering customers with their contact info

- Publishing ads, booklets and posters about dangerous content in the product, detail about the handling of the same and possible repercussions of improper handling

- Keeping a legit record of electronic waste and ensure its access to regulators like State Pollution Control Board

ECO Mark Scheme

While affixing the ECO mark is not mandatory, the BIS has a scheme for the labelling & certification of environment-friendly items, including all types of electronic goods, plastics, food items, textiles, paints and cosmetics, etc. The product that fulfils the underlying BIS norms and the environmental criteria can affix the ECO mark and ISI mark for a specific timeline.

Conclusion

So it is evident from this write-up that businesses seeking import from China has to fulfil a heap of legal requirements. From IEC registration to BIS certificate, importers in India are bound to secure a dozen government registrations and licenses before making actual imports from any nation.

Read our article:How to obtain IEC Code in India