Have you ever dreamt of isolating your income from probable taxes? We bet you did, maybe countless times. But let face it- this is something you can’t refuse or overlooked. Well, most of us look at taxes as a financial burden. What could maximize our stress could be a lack of knowledge in regards to tax planning. The taxpayers spend their lot of time figuring out ways to maximize tax saving. If tax saving is our goal, then look no further. This guide will explain everything regarding how to save income tax and offers comprehensive viewpoint on profitable investments.

Tax-saving and the Income Tax Act

1961 was the year when the Income Tax Act came into effect. Everything concerning imposition, collection, and recovery of income tax comes under the radar of the Income Tax Act. As a taxpayer, you may have multiple channels to earn money during your life. As per income tax 1961, your profits or earnings attract taxes in a given financial year.

Whether you are a private employee or an entrepreneur or whether you mill out income from renting or investment, you are accountable for paying taxes to the government. To ease the complexity of tax saving, the Income Tax Act’s section 80C, 80D, and 80G suggest numerous ways to maximize your savings on taxes. If you were figuring out a solution for tax saving, here are some recommendations that you might be interested in.

High-risk appetite

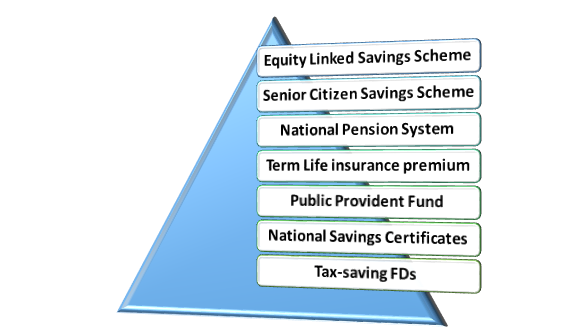

If you are a proactive investor and expecting high returns along with tax benefits under Section 80C, you can opt to invest ₹1.5 lakh per year in Equity Linked Saving Schemes (ELSS). It is nothing but a tax saving mutual fund that has the potency to double your return. In short, this is an effective way of availing short-term tax benefits and impressive long-term returns.

Moderate risk appetite:

If you are the one who has a moderate risk appetite, you can invest partial income in ELSS and the rest in tax-saving fixed deposits. This strategy helps you avail tax benefits under Section 80C and render a base to balance your risk and returns.

Low-risk appetite:

If you are a risk-averse, you can invest in Public Provident Fund (PPF) or saving fixed deposits. Adopting this strategy helps you make a tax deduction of ₹1.5 lakh under Section 80C and the minimum risk exposure. However, here you can’t expect a high rate of return on investment. It could turn into a severe issue if you take inflation into perspective.

Let understand this through an example – Let’s say you are availing long-term investment in Public Provident Fund (PPF) for your child’s education. And all you are doing this under the influence of education inflation, which lies somewhere around 10-12% every year. It means you are not going to make a good return. Precisely, you can save up to ₹46,800 on tax every year via these investments.

Additional benefits beyond Section 80C

If you are looking to maximize deductions beyond the scope of section 80C, then you can opt for the investment options like Atal Pension Yojana or National Pension Scheme. The Income Tax Act Section 80CCD (1B) allows deductions of up to ₹50,000 on these schemes. A saving of up to ₹15,600 is possible under this section.

In addition to that, you can rejoice tax benefits for paying premiums towards health insurance for family and terms insurance plan. Typically, Section 80D of the Income Tax Act offers this benefit.

A saving of ₹15,600/year is achievable through these health insurance payments. Henceforth, these offers collectively can render the saving up to ₹78,000/year.

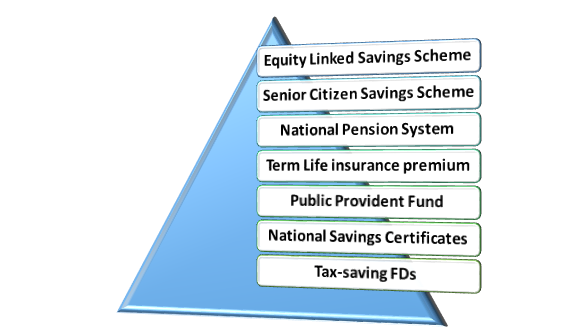

Investment schemes under Section 80C

Income Tax Act 1961-Section 80C allows deductions from taxable income for the significant reduction in your tax liabilities in a financial year.

Section 80C

This act allows taxpayers to claim deduction benefits on payment made towards financial products, contributions, or investment. Section 80C has been playing its part since April 1, 2006, as an alternative cum replacement to previous section 88. In the current scenario, this section allows the deduction up to ₹1,50,000 in a financial year, which is quite significant if we compare it with the previous limit, which was ₹1,00,000.

Read our article:New Income Tax Returns Forms: CBDT Notified FY 2019-20/ AY 2020-21

Equity Linked Savings Scheme:

Equity Linked Savings Schemes represent the family of mutual funds with three years of the lock-in period. The best part is that this category of mutual fund qualifies for a tax deduction in the context of Section 80(C) of the Income Tax Act.

Equity markets are a conducive platform for investment and making higher returns in the long run. Either you can opt for SIP (Systematic Investment Plan) or invest a lump sum amount. However, the withdrawal of money, in this case, is not possible until the three-year lock-in is over. Since mutual funds investment is made in the stock markets, they are subjected to high risk. However, the risk factor is not so significant if you consider long-run benefits. Hence, it is arguably the way to save income tax in the current time.

The amount of gain made from ELSS investments is subjected to tax deduction i.e., LTCG tax of 10%. However, this condition is only applicable when the gain exceeds ₹1 lakh in a financial year. ELSS investments could be the best option if you seek a decent return and looking for long term investment. When contrasted with all tax saving options, ELSS seems more profitable due to higher returns and shortest lock-in. And you can also override LTCG tax if you stay prudent and proactive.

Senior Citizen Savings Scheme:

Senior Citizen Savings Scheme is the best tax-saving investment for the retired citizens and those who have applied for voluntary retirement. This scheme comes with an assurance of Government arbitration and has flexible maturity periods. Moreover, the SCSS offers 8.6% of the rate of interest.

The provision for premature withdrawal under this scheme is applicable after one year of opening the account. Also, if you opt to close the account before two years, the penalty of 1.5% will be imposed on the total sum of a deposit.

Remember, the interest under this scheme is taxable, and TDS is also applicable if the interest surpasses ₹10,000 per annum. The SCSS account ensures a regular flow of income in post-retirement years. It is an old school way to save income tax.

National Pension System:

The National Pension System is a government authorized retirement benefit plan regulated by the Pension Regulatory Fund Authority of India. The one scheme allows you to save income tax in an easier way. If you already a subscriber of this scheme, then you probably know that your money is used for investment purposes, primarily in equity and debt instruments. The performance of these asset classes will eventually decide the value of your investment on maturity.

The equity exposure under this scheme ranges from 50% to 75%. Since this scheme supports the age-based asset allocation model, your exposure to portfolio risk will reduce as you grow older.

At the age of 60, you will become eligible to withdraw 60% of the maturity amount, and remaining will be utilized to purchase an annuity that will cover the pension part. And as far as premature withdrawal is concerned, a 25% withdrawal is permissible under this scheme but only after three years.

Term Life insurance premium

The premium concerning life insurance policies is subjected to tax deductions under Section 80C. The life insurance policies premium can render the benefit of tax deduction as per Section 80C. The eligible candidate for this scheme is the one who paid premiums to insure family, self, or represent the Hindu Undivided Family.

As per Income Tax Act Section 80C[1], the premium paid (up to the maximum limit of Rs.1,50,000) in the context of insurance policies is eligible for a tax deduction. The deductions are only applicable in the event when the amount of premium paid is 20% of the sum assured a total amount of the policy in a financial year. These provisions are applicable to the life insurance policies that have been issued before March 31, 2012.

Furthermore, the policies issued after April 1, 2012, the tax deductions are applicable to the premium paid in a financial year is 10% of the sum assured.

A life insurance policy is a must-have financial backup that everyone should opt for and its save income tax too. It comes really handy in case of the untimely death of the family member. This policy act as an added perk for those who are looking for tax benefits.

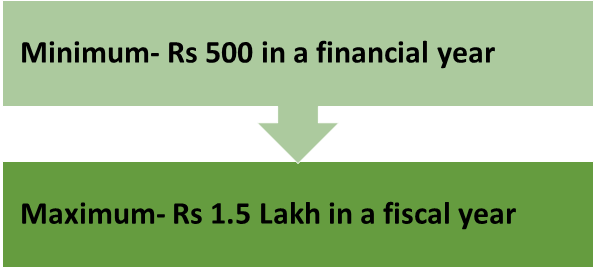

Public Provident Fund:

The Public Provident Fund (PPF) comes under the category of long-term investment scheme where tax benefits are more apparent. The PPF account renders 7.9% p.a. of interest rate, compounded annually, and comes with 15 years of the lock-in period. It means that there is no possibility of premature withdrawal for 15 years. However, partial withdrawal is allowed after the completion of six years.

The investment criteria under this scheme are as follows:-

If your investment surpasses the maximum limit, you will not be eligible to earn any sort of interest. PPF certainly offers a bit more stability in terms of risk, which is a safe investment option. The best part of PPF is that you were not entitled to pay any taxes at the time of withdrawal or deposit. The government allows the smooth transition of PPF corpus to NPS to ensure more flexibility and high returns.

National Savings Certificates:

The National Savings Certificate is a government-oriented investment option that is fixed by nature. To scheme is available at almost all the post office pan India. All you need to visit your nearby post office to initiate your investment. This scheme renders the five years of lock-in period and 7.9% per annum of the interest rate. You don’t need to invest a large sum of money to get started with this scheme. A Rs 100 will be sufficient to purchase an NSC certificate.

The NSC certificate is available in the following denominations.

- ₹10,000

- ₹5,000

- ₹1,000

- ₹500

- ₹100

Premature withdrawal under the NSC scheme is only possible in case of the certificate holder’s demise or loss of the certificate. Unlike most of the schemes, the NCS is backed by the Government of India that offers 100% assurance against the loss of capital.

Tax-saving FDs

You can opt the investment option like tax-saving fixed deposits to achieve maximum tax deductions of up to ₹1.5 lakh. The rate of interest of Tax-saving FDs is similar to 5 year FD rate, and it renders five years of the lock-in period. This implies that you are not eligible to withdraw any sort of money until this time span is over. This scheme allows the one-time lump sum deposit and imposes a complete restriction on premature withdrawals.

The investment criteria under this scheme differ from bank to bank. The only provision that remains common in this scheme is the limit of the maximum amount, which is capped at ₹150,000 as per section 80C.

Either you can opt for reinvestment of interest or go for quarterly or monthly payout, the choice is yours. Keep in mind that the TDS will be imposed on the interest that you earned on your FD. However, forms such as 15G or Form 15H can let you overcome that hurdle provided if you are a senior citizen.

Conclusion

Well, precisely, there are dozens of options out there that could save income tax easily. Smartly allocating the income in tax-averse schemes is the best way to maximize the tax saving. But you don’t have to rush through and blindly opt for any investment scheme to save income tax. An expert analysis might be the best option for those who aren’t familiar with investments that lead to tax benefits. However, we are confident that this information will deal with most of your tax-saving queries with ease. Kindly keep us informs if you need some assistance to clarify the doubts. To do so, all you need to scroll down and drop your queries in the comment section.

Read our article: ITAT: Capital Gain Deduction Claim if No Returns filed