An insurance broker refers to an entity or individual that secures policies for the consumers. Insurance brokers would avail commission from the insurance company against the insurance products delivered to the customers. A company or individual seeking to serve as an insurance broker is required to avail of the insurance broker license from the IRDAI (Insurance Regulatory Development Authority of India).

What are the types of Insurance Brokers?

The section below entails the different types of insurance brokers that serve different purposes.

Direct Brokers

A direct broker refers to an entity that availed the brief information about the clients for an insurance business. Apart from this, a direct broker facilitates professional advice about the different insurance policies available. The direct broker also digs down the market to avail valuable information on the insurance business. Further, such entities help in bridging the gap between the insurance companies and target consumers. The fundamental obligations of a direct broker include assisting clients on matters related to the insurance products, opening an e-insurance account, and aiding clients to make a timely premium.

Re-insurance Broker

A re-insurance broker closely resembles the duties performed by the direct broker. Re-insurance broker, as the name suggests, manages the affairs related to the re-insurance business. The typical duties performed by re-insurance brokers include;

- Selling re-insurance based products such as international insurance.

- Maintaining the market statistics of re-insurance markets

- Negotiating with the concerned customers on behalf of the client

Composite Broker

A composite broker serves as a platform that performs all the undertakings of a direct broker & a re-insurance broker.

Read our article:What type of Documents required for the Insurance Broker License?

Who Governs the Insurance Broker License in India?

The Insurance Regulatory and Development Authority of India (aka IRDAI) is the prime regulator of insurance broker license in India. The Insurance Regulatory and Development Act 1999 & Insurance Act 1938 are regulations behind the insurance law. Apart from this, insurance broker license also comes under the ambit of Insurance Regulatory and Development Authority of India (Insurance Brokers) Regulations, 2018

Underlining eligibility guidelines for obtaining Insurance Broker License in India

The Indian government has underpinned minimum requisites for the grant of an insurance broker license. Apart from this, the applicant needs to get certified by the IRDAI through a standard procedure.

Corporate Structure

The following can serve as an IRDAI-registered Insurance Broker in India

- A company that comes under the ambit of the Companies Act, 2013 or the preceding Act, such as Company Act 1956;

- An entity functioning under the regime of the Limited Liability Partnership Act, 2008;

- A cooperative society which comes under the ambit of Cooperative society act 1912; and

- Any other person or entity that is permitted to run a business of Insurance Broker

Capital Requirements

The applicant must fulfil the capital requisites for availing Insurance broker license in India:

- Direct Broker : INR 75 lakhs

- Re-insurance: INR 4 crore

- Composite Broker: INR 5 crore

Net Worth Requisites

The applicant must fulfil the net worth requisites for getting an Insurance broker license in India:

Net worth pertaining to the insurance broker must not fall below;

- 50 lakh Rupees (Direct broker); &

- 50% of the mini. capital requirements or contribution or equivalent for composite broker & re-insurance broker.

Deposit Requirements

Before initiating an insurance broker business, every insurer must deposit the following sum of capital in the scheduled bank.

- Rs 10 Lakh (Direct Broker); and

- 10% of the mini capital/ contribution is needed for composite broker/re-insurance. Fixed deposit (FD) shall not be released to them in the absence of written consent of the authority.

Office Space/ Facilities

The applicant seeking an insurance broker license in India must have the necessary infrastructure in place, such as trained workforce, adequate office space, and IT infrastructure or equipment.

Qualification

The license seeker must have at least two qualified persons at the backup who have adequate training to serve as insurance brokers. This requirement encompasses all kinds of insurance products, including life and general insurance.

The principal officers of business should possess the specialization in the insurance broker business. He must have the necessary certificates in place to carry out such activities.

The Principal Officer should be a part of key management executive of the organization and must be serving as a key position such as partner and whole-time director.

Purpose of the Business

The applicant must outline the primary objects of the insurance broker business. Such objects must find their way to the object clause of the Company’s charter documents such as MOA and AOA.

- Overseas investors are also permitted to make an investment in businesses dealing with insurance brokers.

Step by Step process for availing Insurance Broker License in India

Application for Grant of Registration Certificate

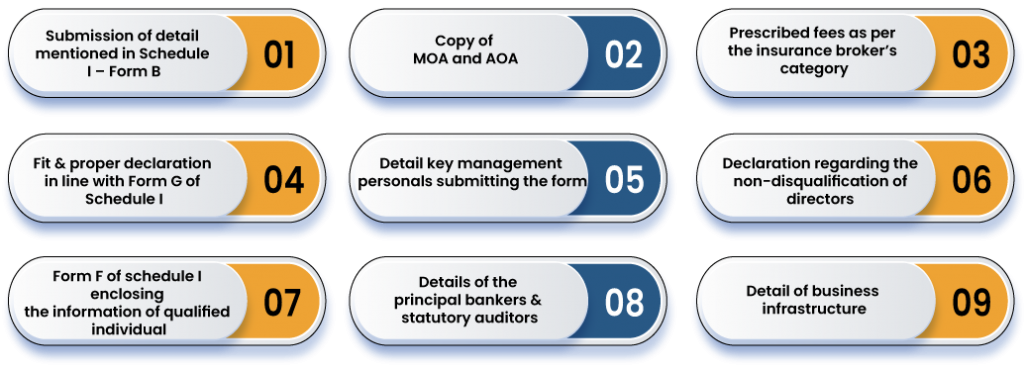

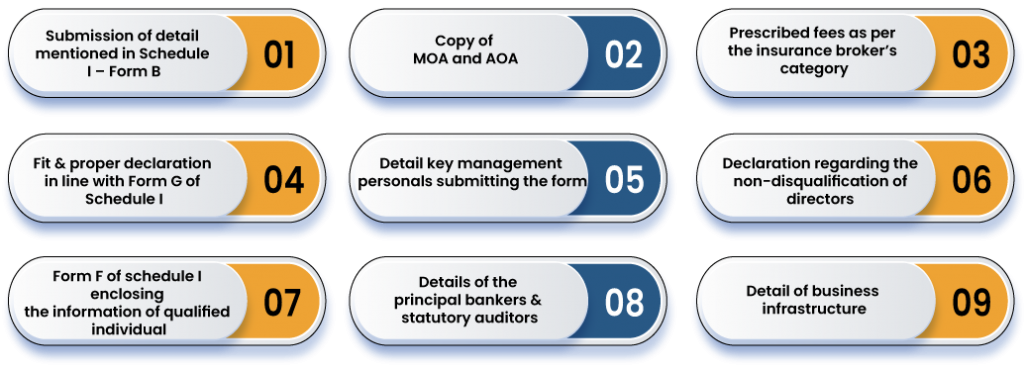

- The applicant should file an application, viz FORM B- Schedule I, to obtain an insurance broker license in India.

- The application should be accompanied by a document cited in the FORM-C Schedule I of the regulations.

- The application should be furnished along with the fees cited in the FORM D- Schedule I for granting the certification. Make sure to refer to the following fee structure before applying for an insurance broker license.

- Direct broker Rs.25,000.

- Re-insurance broker Rs.50,000.

- Composite broker Rs.75,000.

Apart from this, there are compulsory fees that have been paid for obtaining the certification of registration.

- Direct Broker- INR. 50,000/- after conferring the in-principal consent where the applicant is new. In case of renewal, the authority will charge the fees of Rs 1, 00,000/- for a period of 3 years.

- Re-insurance Broker- INR. 1, 50,000/- after conferring an in-principal consent where the application is new. The fees for the registration renewal has been capped at Rs 3,00,000/- for three years.

- Composite Broker- Rs.2, 50,000/- for a new application, after granting of an in-principal approval. In case of registration renewal, the authority will charge Rs 5,00,000/- for three years as a standard fee.

- The fee payable as the compulsory fee would be for the validity timeline of the registration certificate.

- Fees must be submitted via online mode or Demand draft payable in favour of IRDAI, Hyderabad.

Clarification/ Further Information

- The applicant may be prompted to provide information by the authority

- If needed, the applicant has to furnish such documents within thirty days from the date of the notification.

Procedure for Issuing Insurance Broker License (registration)

- After scrutinizing the requisite conditions for an Insurance broker license, the authority will grant the in-principal approval to the applicant related to the certificate of registration.

- The authority shall award the certificate if the applicant has complied with the underlying regulations.

- The certificate of registration would be accorded to the applicant after meeting the code of conduct recommended by the bylaws.

- The broker seeking a certificate of registration can also opt for other registrations under the IRDAI. Such registrations would be accorded after the issuance of the certificate of registration.

- An applicant can re-apply for the certificate of registration after confronting rejection from the authority owing to the change in law or held by a Securities Appellate Tribunal[1]. An application under such a scenario can only be made after one year to the authority.

Rejection of application for Insurance Broker License

- An application for obtaining an insurance broker license in India could confront rejection if it is not found in line with underlying conditions.

- In case of rejection, the authority shall intimate the applicant via notice stating the reason for the same within 30 days of notification of the rejection.

- An applicant can re-apply for an insurance broker license in India after one year of rejection.

Documentation for availing Insurance Broker License in India

Conclusion

The grant of insurance broker license in India is subjected to plenty of legal implications, and there is no way to bypass them. Hence, strive to stay in line with the aforesaid requisites while applying for this license. For any query, kindly prompt us by dropping the message in the comment box.

Read our article:Step by Step Procedure for Insurance Broker License