The Insurance Brokerage companies work as advisors for insurance plans. You will often struggle with decisions such as choosing an investment plan or insurance. Such companies have qualified employees who partner with insurance companies and know about insurance and related laws.

Insurance brokers assist people with their insurance requirements. They act as intermediaries between the insurance company and the individual willing to purchase the insurance policy.

What does Insurance Brokerage Company do?

An insurance brokerage company has extensive experienced in controlling various types of insurance and managing insurance-related risks. Such company is required to obtain an insurance broker license. Now, getting a permit involves passing specific exams. Therefore, educational requirements ensure that insurance brokers have a significant level of expertise in the field.

The chief executives of such companies must be well informed about all types of insurance schemes and how they work. Unlike insurance agents, whose sole job is to sell an insurance policy to a customer, insurance brokers bear a high amount of responsibility. Clients can also sue a brokerage company if they fail to deliver the promised results.

Read our article:What type of Documents required for the Insurance Broker License?

What is the Types of Insurance Brokerage Company?

Listed below are the types of Insurance brokerage Company.

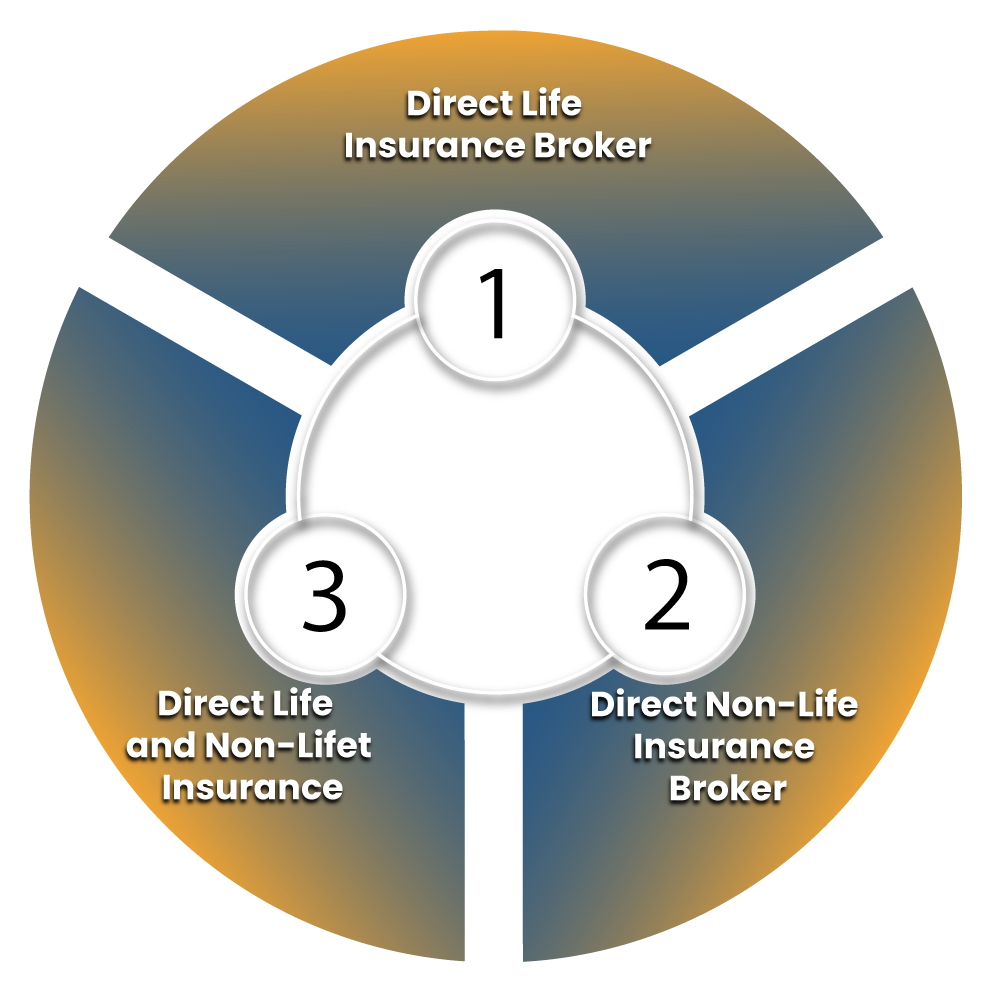

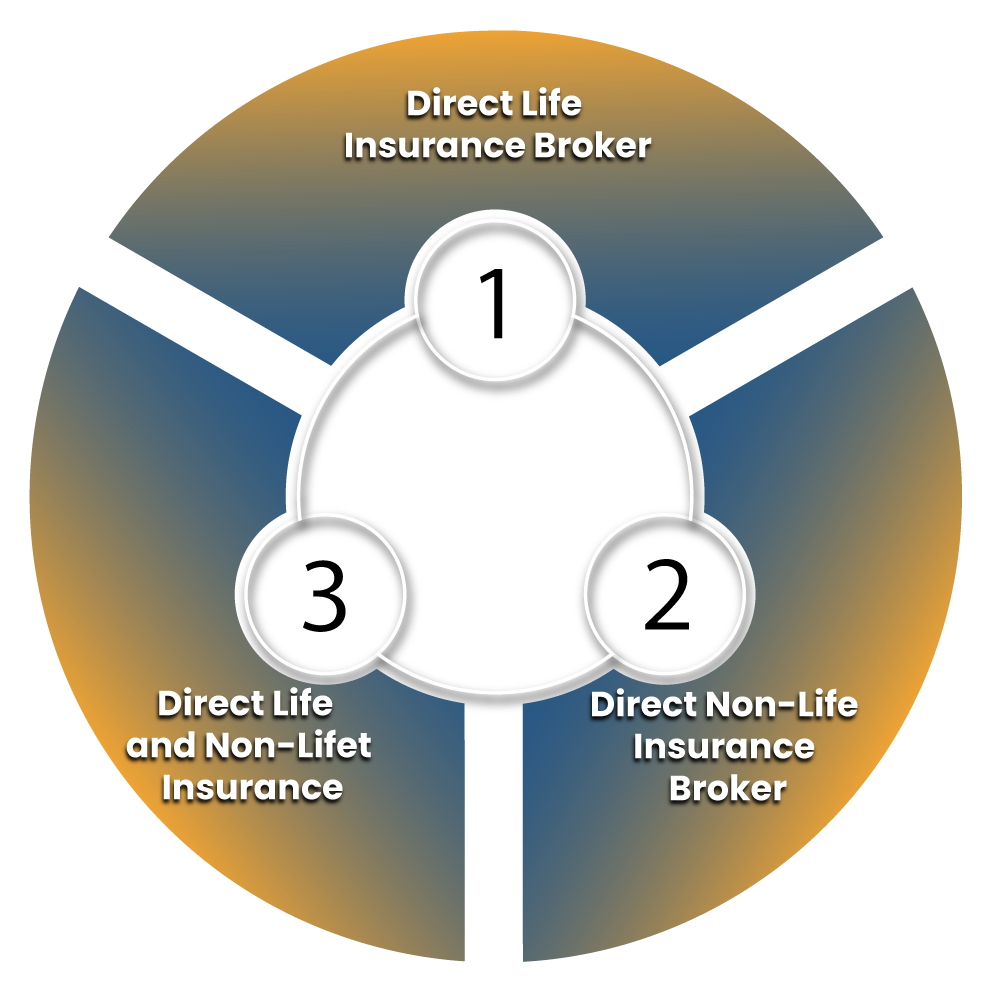

Direct Insurance Broker

A direct insurance broker tries to get insurance policies. They help their customers in purchasing the policy. They also help the customer choose a set of policies and earn a commission for selling a policy. Direct broker insurance companies also present market information about insurance. Following are the types of the direct insurance broker.

Reinsurance Broker

A reinsurance broker, as the name suggests, buys reinsurance for a firm. This process involves negotiating rates and finding the best policies in the benefit of the firm.

Composite Insurance Broker

Such insurance brokers have a license to serve insurance services. They can give both life and general insurance policies. Insurance companies or authorities selectively authorize licenses to such applicants.

Eligibility Criteria to Apply for Insurance Brokerage License

To obtain an insurance broker license, you must be registered with IRDAI. In addition, the government has put forward certain minimum criteria for obtaining insurance broker license. So, the applicant requires fulfilling the eligibility criteria to apply for an insurance brokerage license.

Who Can Apply for an Insurance Brokerage License?

Individuals listed below may be eligible to apply for an insurance broker license

- Companies incorporated under the Companies Act of 2013[1].

- LLPs (Limited Liability Partners) incorporated under the Limited Liability Partnership Act, 2008.

- Registered co-operative society incorporated under the Co-operative Societies Act, 1912 or any other version of it.

Particulars Required to Get an Insurance Broker License

- Schedule I- Form B

- Copies of MoA & AoA of the company

- Schedule I-Form G

- Schedule I-Form C

- Declaration that POs and directors, partners, etc. are not excluded according to the Section 42D of Insurance Act

- Details of partners, directors, promoters, advertisers, etc.

- Qualified agents list with their academic qualifications and professional experience

- Company’s bank account details

- Shareholders list (current + proposed)

- Details of Principal Bankers’ along with the details of the statutory auditors.

- Balance sheet of audited company

- Copy of the board resolution

- Particulars of business place infrastructure containing specifics like office space, work power, etc.

Process to Apply for an Insurance Brokerage License in India

Once the applicant has all the documents for an insurance brokerage application, he will eventually have to apply for an insurance broker license. It consists of two steps:

- The applicant has to apply for the grant of certificate of registration

- In next step, he can proceed with insurance broker license registration.

- The applicant must submit a duly filled insurance broker license application Form B of Schedule-I. Other required documents and the application fee, have to be forwarded to the Insurance Regulatory Development Authority of India (IRDAI).

- The documents submitted by the applicant will be thoroughly investigated by the authorities. They can also raise some questions if necessary and ask for additional documents in return, if needed.

- The authorities will verify the documents of the insurance broker company. And if the documentation and information provided seem satisfactory, the authority will issue an in-principle approval to the insurance brokerage firm. ‘In-principle’ acceptance means that the applicant has complied with all requirements for a certificate of registration.

- Upon obtaining in-principle approval, the company must comply with all additional requirements and also pay license fees. The payment of fees can be done through Demand Draft (DD) or electronically in favour of IRDAI, Hyderabad.

- If all the eligibility requirements & regulations prescribed by the IRDA Insurance Broker Regulations, 2018 are satisfied, the company is provided with a ‘Certificate of Registration’.

- If the required eligibility criteria are met, a license will be issued in the name of the applicant. This license will have a validity of 3 years from the date of issue.

Rejection of Insurance Brokerage Application

An insurance broker business application may be rejected if the authorities find that the applicant has not met the eligibility criteria. In that case, the authorities should inform the applicant within 30 days of the notice about the rejection.

Point to Remember

The applicant can apply again after one year of refusal of their insurance business application.

Concluding Remarks

Insurance companies convert accumulated capital into productive investment. Insurance loss enables financial stability to be reduced and promotes trade and commerce activities that result in sustainable economic growth and development.

Thus, insurance companies play a vital role in the sustainable growth of the national economy. Insurance brokers are licensed to offer the best policy from any insurance company. Insurance Brokerage Company can give you the expert advice on the appropriate insurance policies. You may kindly associate with the CorpBiz expert to know more about Insurance Brokerage Company.

Read our article:What are the Key Benefits of an Insurance Broker License?