Import Export Code (IEC) is a ten-digit identification number which is granted by the Director-General of Foreign Trade. Every organization and business owner must get this code to conduct a business of import and export in the country. Without IEC registration, companies would come across legal constraints while trading their product outside the nation.

Conducting business globally isn’t a simple errand. Before commencing international trade, one has to deal with various procedures and legal obligations to obtain different licenses and registrations. The IEC code is a must-have requirement for businesses who wish to trade their product globally. There are various stipulation and processes one has to address to get the IEC code. Additionally, there are specific conditions that you have to adhere to without exception.

Why IEC Modification is Essential?

The outdated data of the company could lead to mismatching of details with DGFT & customs. Therefore; it is important to update the data every now and then to avert conflicts. The applicant can make the IEC modification from the ground up, be it a question of changing PAN card number or adding new detail for the new branch office.

Online Procedure for IEC modification

The IEC modification web-based procedure includes the given instructions. Those are as follows:-

Documents Arrangement

This stage will get rid of the confusion related to the modification of the IEC code. All you need to gather the required documents for drafting an application. Documents required for IEC modification are given below:-

- PAN card of the company or individual

- Passport size photo

- current/savings account cancellation cheque

- Aadhar card of all the partners and directors

- ANF – 2A application form

- Class 2 or class 3 digital signatures.

Application Filing

Your application shall be drafted based on the documents provided and will send back to you for confirmation. Post-approval, the final submission of the application shall be done.

IEC Modification Charges

Factually, the application under the process attracts no fees whatsoever, But in case of modification, the authority might charges Rs 200/application from the applicants.

Modified IEC Certificate

After the successful submission of the application, the applicant shall receive a soft copy of the modification from the DGFT portal[1] via email within the next 2 to 5 working days.

Various Features of IEC modification in India

In the given section you would come across some prominent features of IEC modification. We have strived to explain each and every feature in brief for better understanding.

Hassle-Free Import-Export

As soon as you are done with the modification works, all the data get synced with the customs and DGFT. This updated information would come handy for the exporter when it comes to the clearance of shipment from the port. In the presence of the updated data, the custom and other authorities would find it easy to scan the shipping document and credential; thus; ensuring the prompt and hassle-free shipping.

Validity of IEC

The IEC comes with a life-time validity, which means the business owners do not have to renew it on a reoccurring basis. The code will continue to serve its purpose even after the modification in the key business details. That means it remains independent of the changes.

Incentives

With the IEC code at the disposal, the business owner can avail of a host of government-driven schemes and incentives to maximize their profit. Some schemes allow the exporters to avail 5% of the refund on the invoice for the particular value of the shipment. Such relaxation would encourage more and more business owners to boost the export volume.

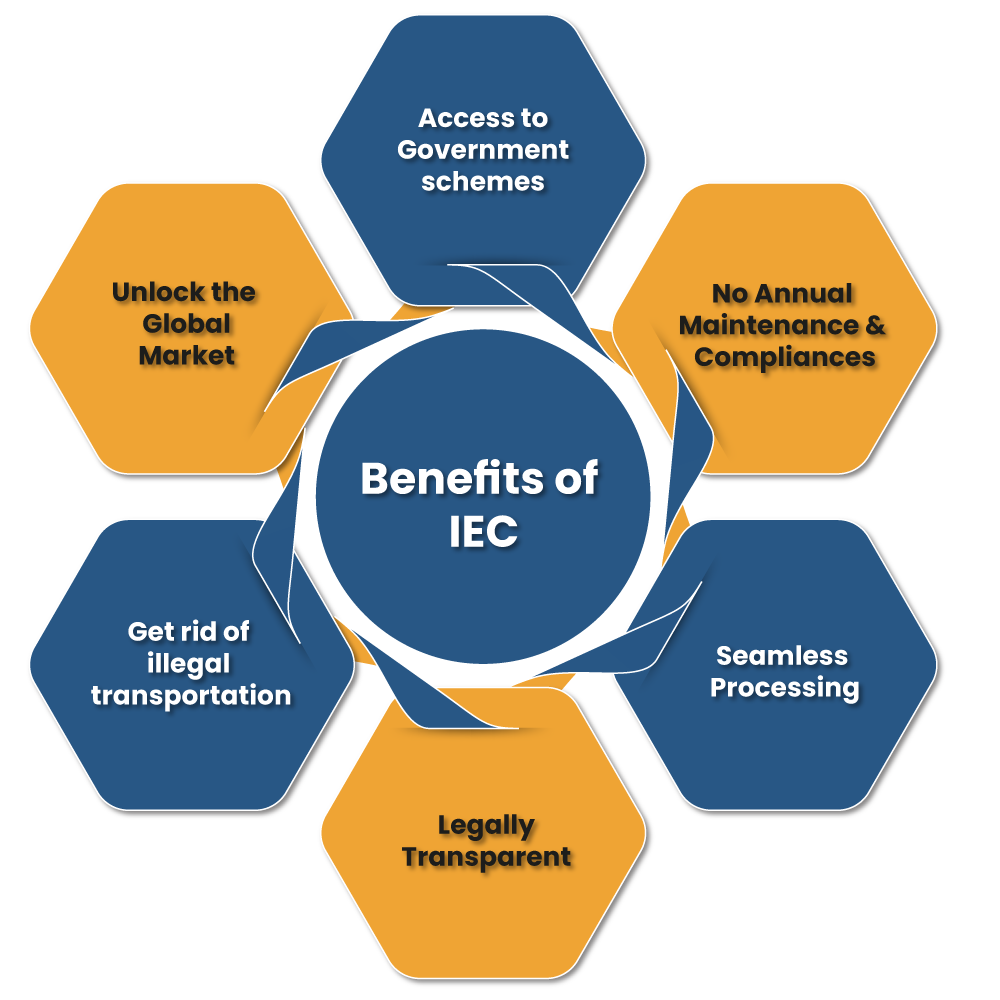

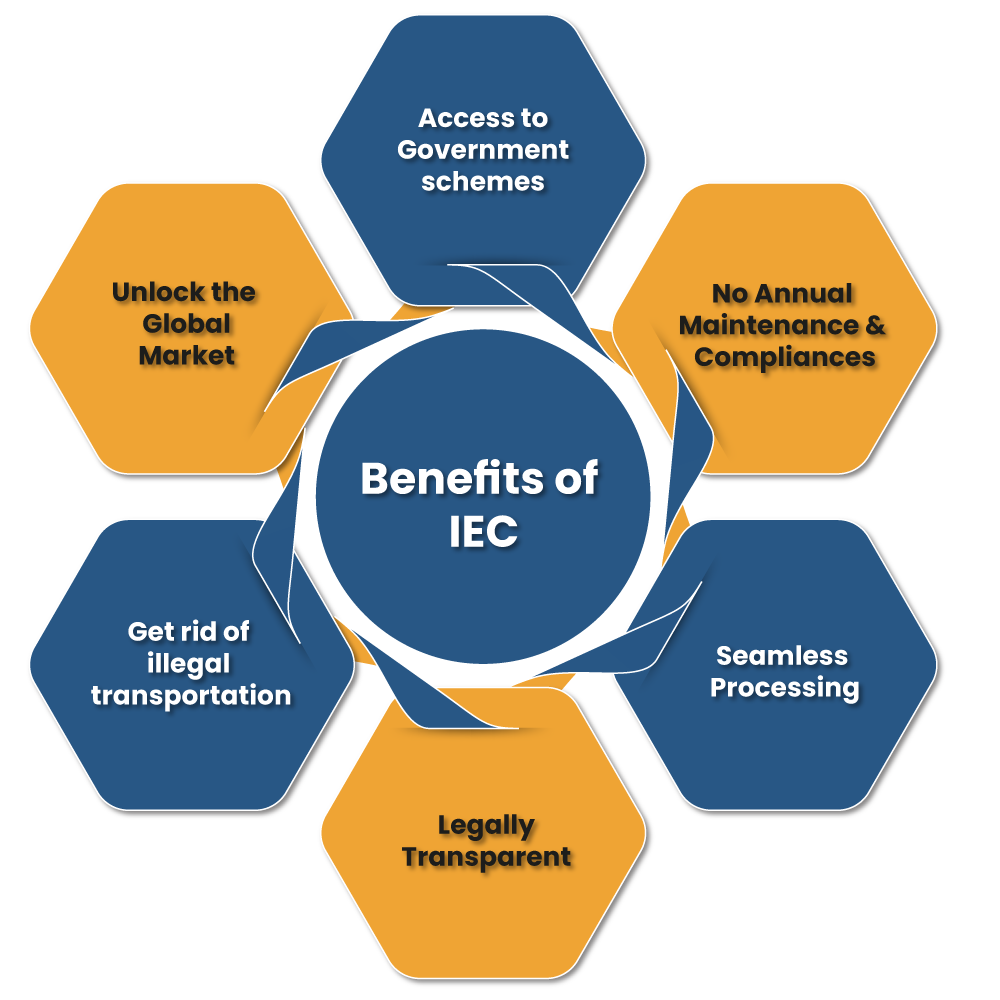

What are the Benefits arises out of IEC Modification?

Aggressive market strategies might not work at times when it comes to profit maximization. One has to go beyond the existing market to reap additional revenue, and that’s where international trading comes into the picture. In India, cross-border trading can be conducted with the IEC code in hand. The section below would explain the viable benefits of the IEC in brief.

Unlock the Global Market

It’s a well-known fact that IEC is a primary requirement for businesses willing to engage with international trading. It enables businesses to transform their existing product into a global brand by setting up trade with different countries. Also, it would improve the chances of accelerating the obstinate sale figures.

Benefits of Schemes

IEC code imparts a host of benefits to exporters as well as importers. The registered entities are eligible to reap benefits with regards to subsidies declared by the concerned authorities. After filing a Letter of Undertaking (LUT) under GST, the exporter becomes eligible to export goods or services without paying IGST subjected to certain conditions. If the tax is imposed on the export then the exporter can claim refund on the same.

No Annual Maintenance & Compliances

Unlike other tax obligations, the trader does not require to address any compliance requirements such as return filling or annual fillings. Additionally, the IEC code does not encounter any compliance post-registration. Since there is no compliance listed, business owners are not required to pay an annual maintenance fee after obtaining the code.

Seamless Processing

To be precise, availing of IEC is not a complicated process. All users are required to make the relevant application and the DGFT will grant the code within 10-15 days. Furthermore, the authority would not demand any proof regarding the export and import from the applicant for the issuance of the IEC code.

Legally Transparent

IEC legalize the cross-border trading and enables exporters and importers to clear their shipment from custom and various authorities with ease.

Get rid of Illegal Transportation

The import-export code gets rid of illegal shipping practices through definite controls and clear policies. The centralized registration also empowers the officials to keep track of all the transactions that take place as a part of International Trading.

Conclusion

Obtaining the Import-export code is mandatory before kick-starting the business of international trade. Furthermore, the applicant who involves cross-border trading ought to obtain registration under GST as per the law. Connect with CorpBiz to avail professional-grade help on IEC Modification Online.

Read our article: Advantages of Obtaining IEC (Import Export Code) Registration in India