GSTR 1 refers to a document that encloses the information regarding the sales made by the seller to the buyer. GSTR-1 is the primary document on which the compliance framework of GST is based. In the article, you will learn everything regarding GSTR-1 and its aspects from the taxpayer’s viewpoint.

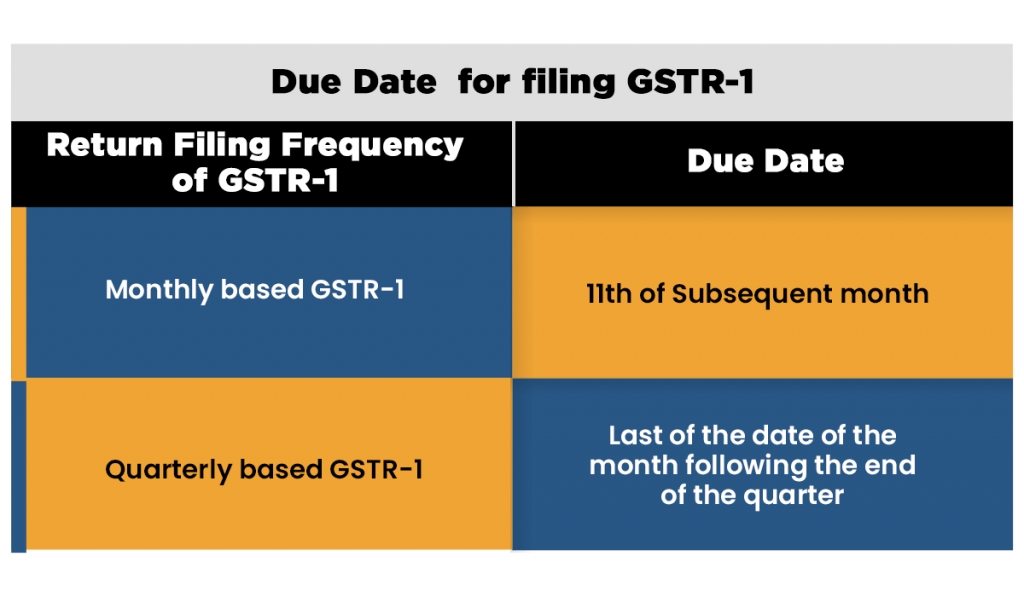

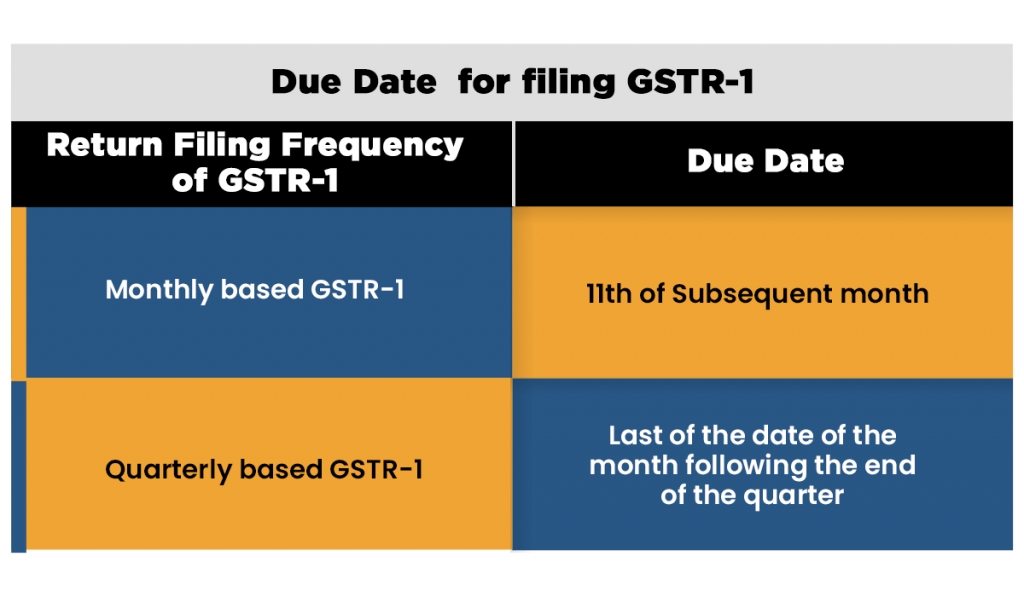

What is the Due date for filing GSTR 1?

The due date for GSTR 1 depends on the turnover. On account of business turnover, taxpayers need to file GSTR 1 return either on a monthly or quarterly basis. Businesses with an annual turnover of up to one and a half crore is permitted to file the quarterly based return. Meanwhile, a business whose yearly income which is greater than the said limit is requires monthly based returns.

The given Tabular Representation Shows the Due Dates to File GSTR 1

Who is Liable to file GSTR 1?

Every taxpayer has to file GSTR-1 regardless of the number of transactions. However, the following individuals are not required to file GSTR-1.

- Composition Dealers

- Input Service Distributors

- Suppliers of OIDAR, who have address tax liability as per section 14 of the IGST Act.

- Non-resident individuals

- Taxpayer collecting TCS

- Taxpayer deducting TDS

What if Suppliers fail to submit GSTR 1 on the said date?

In case of the failure to submission, the supplier will not be able to file the GSTR-1 between the 11th to 15th of the subsequent month. The law has imposed a limitation on such a way of filing.

What Details are to be Mentioned in GSTR 1?

The filing of GSTR-1 is done in Form GSTR-1. Following are the list of the particular included in GSTR 1:-

- Invoice related info Intra-state and inter-state supplies made to registered taxpayers and inter-state supplies with invoice value higher than 2.5 lakh made to unregistered individuals.

- Consolidated information of Intra-State supplies made to non-registered individuals for each tax rate and State wise inter-state supplies with invoice accounting for 2.5 lakh rupees made to the non-registered individuals for each rate of tax.

- Credit and debit notes issued during the period for invoices issued previously.

Conditions for Omitting Any Error or Detail Included By the Supplier in GSTR-1

- The Registered individual has successfully filed GSTR 1

- Information provided by the registered taxpayer should remain unmatched.

Suitable Timeline for Making Rectification of Error

The omission of error can be made in the return to be provided for the given month for which error is noticed.

What If The Tax Payable Increases After The Omission Of The Error?

The registered taxpayers[1] are liable to pay tax as well as the interest if any. The tax + interest must be deposited with the return to be provided for the tax period in which the said error is rectified.

Conditions under Which Omission of Error is Not Possible

Rectification of error according to the information provided is not permitted after happening of the given events:-

- Filing of return for the September month following the end of the year to which such information pertain,

- Filing of the yearly return.

What Process should be followed in Case if Detail of Supplies were Modified or Omitted by the Recipient?

The supplier will be notified for the same via Form GSTR 1A

- Supplies that have been modified or omitted by the recipient or, Supplies that remain undeclared from the supplier’s end but have been incorporated in the return by the recipient.

- The taxpayer i.e. outward supplier who has been notified regarding the said matter would have to take actions accordingly as per the bylaws.

- The action of accepting or rejecting the notification provided to the outward suppliers shall be done on or before the 17th day but after the 15th day of the month following the tax period.

- On accepting or rejecting the details, the details as submitted by the outward supplier shall stand amended accordingly.

How the Return Filing System Under GST Monitors Tax Evasion and Advocates Voluntary Compliance?

If the supplier fails to render the legitimate information of outward supplies in GSTR 1 and the recipient successfully avail the credit on paid tax then a trail would be created for the supply. Also, GSTR-1 of suppliers will show variation concerning details of inward supplies provided by the recipient in the GSRT-2. Therefore, the supplier would have to make changes in the details file by him.

Late Fees and Penalty

The late fee for non-filing of GSTR 1 is two hundred rupees per day (Rs 100 as per the CGST and SGCT Act respectively). The late fees will be imposed from the day after the due date. Given the latest update, the late fees for nit return have been reduced to Rs 50/day and Rs 20/day.

What are the Details that cannot be modified?

Following are the particulars that are not open to changes:-

- GSTIN of the customer.

- Modifying tax invoice into the bill of supply

- Bill of export date & shipping bill date.

- Type of export

- Place of supply

- Reverse charge applicable

Conclusion

Generally, details needed to be mentioned in the GSTR 1 format are either state-wise, rate wise or invoice wise details of outward supplies completed during the month. The credibility of a business could be compromised on account of non-compliance with the filing requirement. Also, it will affect the customers since input tax credit depends on the supplier compliance.

Read our article: Overall Guide on Section 7 Schedule 1 of the CGST Act