The marketing and advertising sector plays an important role in the success of any business. In a normal course of business marketing and advertising is the promotional activity generally using mediums to increase the reach for a growing business. There were many changes done in this industry in the previous decade with an increase in concurrent competition, halting lower-priced brands and also an increase in the expenditure related to digital ads. Lets us understand the impact of GST on marketing and advertising industries.

Marketing services generally include both audio and visual activities that include television, digital marketing, radio, social media marketing etc. On the other hand, advertisement services include ads in newspapers, magazines, radio, television, direct mail, catalogues etc.

Situation prior to implementation of GST on Marketing and Advertising

The service tax was imposed prior to the implementation of GST and it was applicable to the marketing and advertising services.

Marketing

Before GST, a service tax was imposed on the promoting and marketing services of ‘brand of goods’, business entity and services events. The following activities were taxable previously under the finance act.

- Any brand promotion services which could be provided by any individual to any other person.

- The services could be provided directly or indirectly through any entity of business or otherwise.

- Any services provided under a contractual obligation for the promotion of the brand.

- All the services related to marketing or a promotion of brand.

- The brand must be an endorsement of name, services or goods.

- Any services appear in the promotional or advertising events which are carrying out any promotional activity of such services, event or goods.

Advertising

The service taxes were applicable to all aspects of the advertising services except time or space for advertisement. Similarly, sale of time slots which exist between programs on the television, and the sale of the hoarding space, such were not taxable. But after October 1, 2014, a list was amended to put a limit on non-taxability of the sale of space especially in print media and with that, all time and space arrangements were brought under an ambit of service tax.

Read our article:GSTR-1 – Everything you need to know about Filings and Voluntary Compliance

Post Implementation of GST on Marketing and Advertising Sector

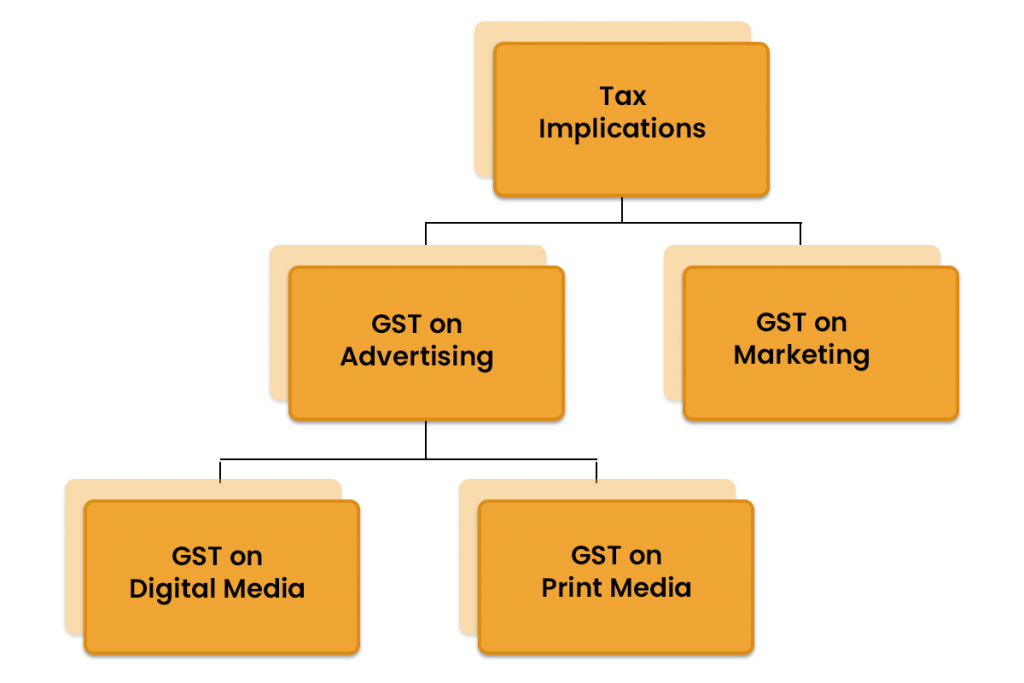

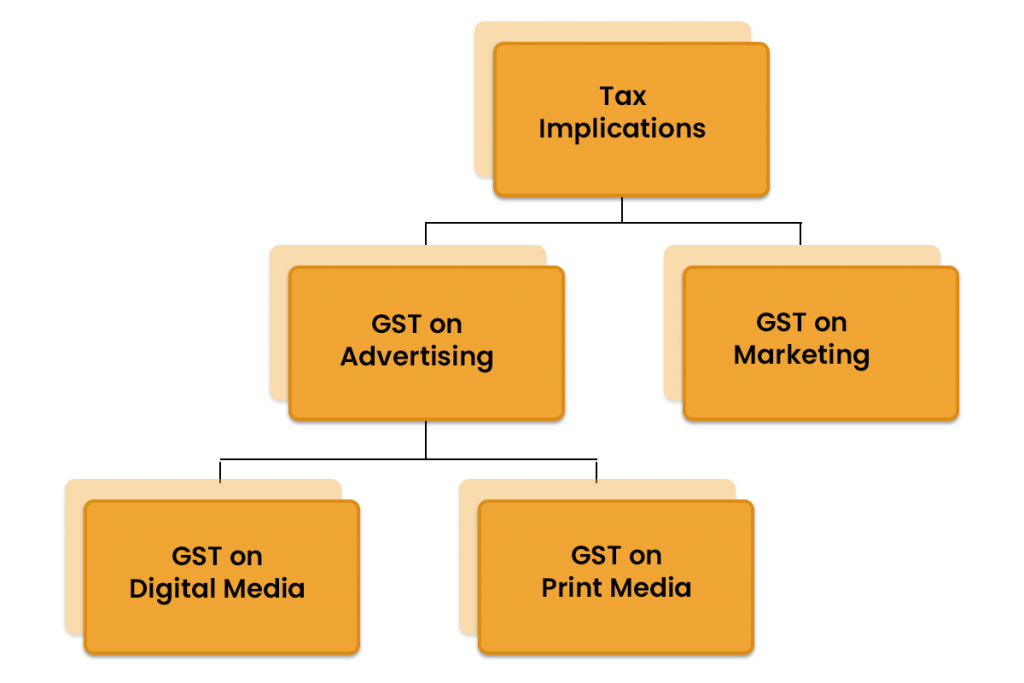

The following are the effects of GST on marketing and advertising sector:

GST on Advertising

GST is levied in all the modes of advertisement such as sale for space in the print media. Though it will lead to a rise in the cash outflow, the free flow of the credits of acquirement side leads to the overall cut in a value of advertising.

The following are of two types of advertising medium:

GST on Digital Media

In transaction related to digital media generally, there are two parties involved- the publisher & the advertiser. An advertiser is a person who wants to advertise about the product or idea, and on the other hand, a publisher is one who publishes these all advertisements. A particular advertisement on digital media is liable to GST at an 18% rate.

GST on Print Media

The advertisement made in print media are newspapers, a particular advertisement on print media is liable to GST at an 18% rate. A person who wants to advertise about the product contact to publisher of print media for the same (a publisher is one who publishes these all advertisements).

GST on Marketing

Every person who gets involved in the supply of goods or rendering of services is liable to be registered under GST registration if the turnover in the financial year of taxable service or supply of goods is above Rs 20 Lakh. Hence the GST would be applicable to all marketing services.

The following are rates of GST on marketing services:-

- Rate of GST on marketing services is 18%

- Rate of GST on Digital Media Advertising is 18%

The Input Tax Credit on GST on Marketing and Advertising

The supplier of marketing and advertising services invests the huge amount of resources in the purchase of high-end electronic goods and also equipment which is necessary for the business to run, but they were not permitted to claim the credit for same. However, under GST, they are allowed to claim the credit of the taxes paid on such those electronic goods and equipment.

SAC Code for Marketing Services

| SAS Code | Market Services |

| 998371 | Market Research Activities |

| 998372 | Public opinion polling service |

| 998311 | Management services such as financial strategic, human resources, supply chain management and management consulting. |

SAS Code for Advertising Services

| SAS Code | Advertising services |

| 998361 | Provisionof advertising time & space and advertising services |

| 998362 | Sale or purchase of the advertising time or space on commission |

| 998363 | Sale of advertisement space in print media |

| 998364 | Sale of radio and TV advertising time |

| 998365 | Internet advertising space on sale |

| 998366 | Sale of other advertising item or space |

Conclusion

It is evident that advertising and marketing are the biggest emerging industries, and the government[1] is willing to take gain from it. The Ads and marketing industry space were previously roamed with negligible tax rates for many years as it was unavailable on the scale. Now the GST is levied in all modes of advertisement such as the sale of the space in the print media.

Though, it will lead to rising is the cash outflow, the free flow of credits of acquirement side leads to the overall cut in the value of advertising. On the other hand, a person who gets involved in the rendering of services of marketing is liable to pay the GST if its turnover in the financial year of taxable service is above Rs 20 Lakh.

Read our article:Everything you Need to Know about Benefits of GST Registration