The Indian government has issued a scheme for the grant of ex-gratia payment to the borrower in a specified loan account from 1/3/2020 to 31/8/2020. The decision is taken in the view of the COVID 19 pandemic. The government of India has directed all the financial institutions including NBFCs to implement the scheme. Here the term “ex-gratia payment” refers to an amount that comes after subtracting the simple interest from the compound interest w.r.t to the given loan. The lender must roll out the amount to the borrower’s account on or before 05/11/2020, giving relaxation to potential borrowers ahead of Diwali. After successful disbursement of the credit, the lender can claim reimbursement from the government by 15/12/2020

About the Scheme: Ex-Gratia Payment

The Government has communicated the Scheme related to the grant of ex-gratia payment (compound interest -simple interest)borrowers in specified loan accounts from 1/03/2020, to 31/08/2020. The government directed the banks to convey that in view of the COVID-19 situation.

Eligibility Criteria for Ex-Gratia Payment

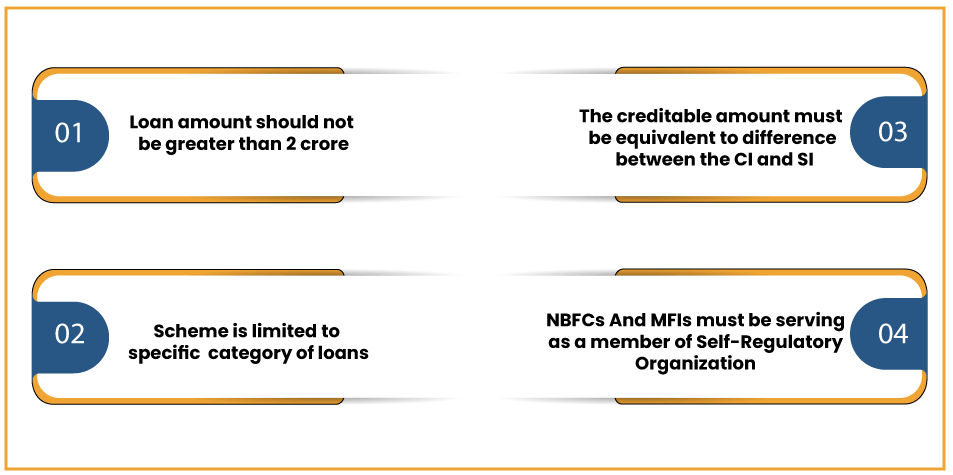

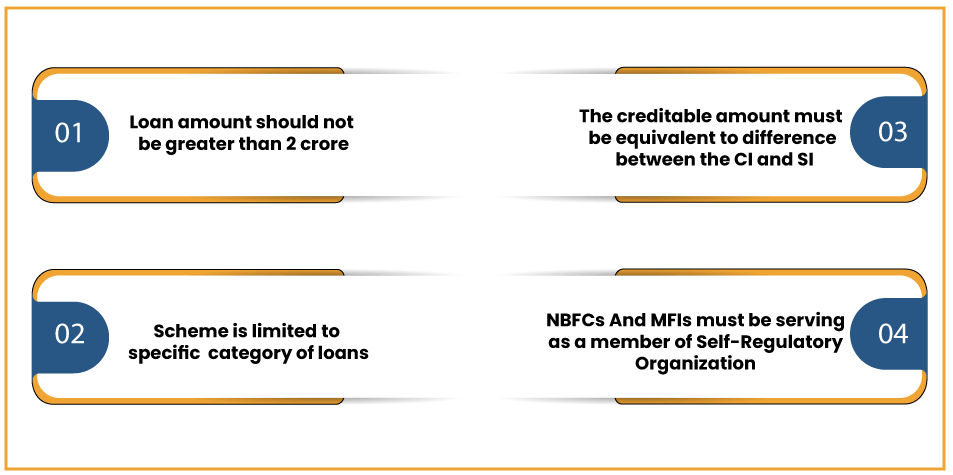

- MSME loan, consumer durable loans, personal loans, housing loans, education loans, automobile loans, consumer loans, and credit card dues eligible under the said scheme.

- The amount of the loan should not surpass Rs 2 crore- a total of all the facilities from the financial institutions.

- The loan account ought to be a standard account as of 29/02/2020. Meaning- the loan should not be tagged as a Non-Performing Asset as of the said date.

- The ex-gratia payment would be allowable regardless of whether the borrower has availed or not availed of the moratorium* w.r.t repayment declared by the Reserve Bank via notification DOR. No. BP.BC.47/21.04.048/ 2019-20, dated 27.3.2020. Thus, even in the absence of a moratorium period, the borrowers are eligible to avail of the scheme.

- The financial firm should not be the entity other than:-

1. Public sector Bank

2. All India Financial Institution

3. Regional bank

4. Non-Banking Financial Institutions (NBFCs)

- As per the scheme, the credit account will be equivalent to the difference between the compound interest and simple interest, which will be rendered to the borrowers between March 1, 2020, and August 31, 2020.

- Micro-Finance Institutions (MFIs[1]) and Non-Banking Financial Companies (NBFCs) MFIs must be serving as a member of SRO i.e. Self-Regulatory Organization accredited by Reserve Bank of India.

What is the Moratorium* Period?

A moratorium period is typically referred to as a timeline during which a borrower can enjoy a holiday from EMIs of home loan. This indicates that you start paying the credit as soon as you avail of the home loan. Rather you can enjoy an EMI holiday and start paying EMIs as soon as the break is over. A lender provides such relaxations so that borrower can plan their finances better.

Deployment of Grievance Redressal Mechanism

As per the government direction that problems related to claims furnished by the financial firms will be managed by the designated cell at State Bank of India in collaboration with GOI. Each financial institution must have a grievance redressal mechanism in place to resolve borrower’s issues related to the present scheme within 1 week from the date on which the scheme becomes effective. While deploying such a mechanism, the firm can take the notification released on 1.10.2020 released by the Indian Banks’ Association pursuant to the framework of COVID -19.

What is Ex-Gratia?

Ex-gratia is a term that is often used in the financial context which refers to a kind of grace or relaxation granted by the financial firm to the end-users. As per the above notification, government mandates the ex-gratia payment to a particular segment of the borrowers via crediting the difference between compound interest (CI) and Simple interest (SI) for a specific timeline i.e. between 1/03/2020 to 31/08/2020.

Conclusion

The government’s decision to disburse ex-gratia payment seems to be a generous step towards concerned borrowers. The scheme aims to undermine the repayment issues that borrowers were facing since the inception of this pandemic.

Read our article: RBI Included Cooperative Banks in Interest Subvention Scheme for MSMEs

Scheme-Letter