As Government of India has released several measures granting relaxation to businesses to combat COVID-19 Outbreak, the Ministry of Corporate Affairs (MCA) has also come up with specific measures for Companies and LLP’s.

Ministry of Corporate Affairs (MCA) has recently introduced “Companies Fresh Start Scheme 2020 (CFSS 2020), notified vide circular 12/2020 dated 30th March 2020

Many Entrepreneurs who set up companies for business ventures, and did not commence operations because of their various genuine economic reasons and fail to ensure the necessary statutory filings, resulted in huge penalties, which created a heavy burden for the stakeholders and were added to the number of defaulting companies. This is a very good opportunity for such companies; Stakeholders can take advantage and can do a fresh start and make it a Compliant Company.

What was the Purpose of Companies Fresh Start Scheme 2020?

- This Scheme will enable companies to make good of any filing-related defaults, irrespective of their duration of the default, and to make a fresh start as a fully compliant entity.

- This Scheme will help to incentivize compliance and reduce compliance burden during the unprecedented public health situation caused by COVID-19.”

- “The schemes, apart from giving longer timelines for corporates to comply with various filing requirements under the Companies Act 2013, significantly reduce the related financial burden on them, especially for those with long-standing defaults, thereby allowing them to make a “fresh start.”

- This Scheme was introduced by the request of various stakeholders.

This move is now Aimed to Bring Non-Compliant Companies and LLPs to the Legal fold

- This Scheme will provide a one-time relaxation in an additional fee for the defaulting Companies and LLPs.

- Companies and LLPs are now given 6 months to complete filings that were due.

- It shall start from 01st April 2020 till 30th September 2020,

- This window provides an opportunity for firms to complete long-standing compliances, besides providing them additional time to complete filings that are falling due.

- In the case of businesses with long-standing defaults, the schemes are likely to be a significant relief.

- It will allow companies to make a fresh start, to lower compliance burden.

- After compliance, ROC will issue an immunity certificate.

- the immunity is only with delayed filings on MCA 21 (the online portal for making statutory filings) and not across any substantive violation of the law,

Applicability of Companies Fresh Start Scheme, 2020

CFSS 2020 is applicable to defaulting Companies.

Any “defaulting Company” is permitted to the belated file documents, which were due for filing on a given date in accordance with the provisions of the Scheme.

The scheme SCFSS, 2020 (Scheme fresh start scheme) will apply with filing only with the following Specified Forms;

- Annual Return (MGT-7)

- Financial Statement (AOC-4)

- PAS-3(Return of Allotment)

- MGT-14(Filing Resolutions and Agreements with the Registrar)

- ADT-1(Appointment of Auditor)

- INC-20A (Declaration for the commencement of business)

- INC-22A (Active Company)

Non- Applicability Companies Fresh Start Scheme, 2020

CFSS,2020 (Scheme fresh start scheme, 2020) shall not apply;

- To the companies against which the Designated Authority has already initiated the action with final notice for striking off for the name u/s 248 of the Act;

- Where the companies have already applied to the operation of striking off the name of the Company from the registrar of companies;

- to companies which have amalgamated under a scheme of arrangement or compromise under the Act;

- Where the applications have already been filed for obtaining Dormant Status under Section 455 of the Act before this Scheme;

- to vanishing companies;

- Where there is an Increase in Authorized Capital (Form SH-7)

- Charge related documents (CH-1, CH-4, CH-8, and CH-9)

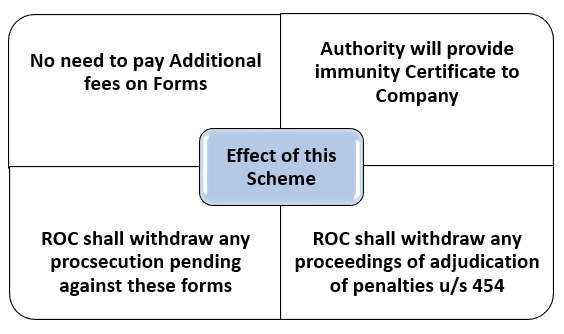

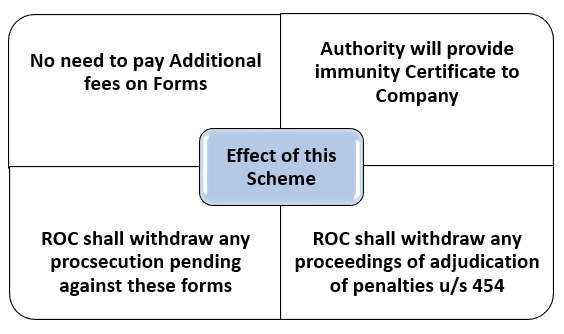

What will be the effect of this Scheme?

Manner of Payment of Fees

Every defaulting Company will be required to pay normal fees as prescribed under the Companies (Registration offices and fees) Rule,2014, on the date of filing of each belated documents, no additional fees shall be payable.

Application for the issue of immunity in respect of documents filed under the Scheme

Application for the issue of immunity shall be made electronically in FORM CFSS-2020. Documents will be taken into the record by the Designated authority as the case may be.

- No fee shall be payable for this form.

- Immunity will not be applicable in the matter of pending appeal before the court of law.

Order by the designated authority granting immunity from penalty and Prosecution

- Based on the declaration made in form CFSS, 2020 immunity certificate in respect of documents Based on the filed under this Scheme shall be issued by the designated authority.

Scheme for the Inactive Companies

The defaulting inactive companies while filing the due documents under this Scheme can also;

- Apply to get themselves to be declared as Dormant Company by filing form MSC-1 under section 455 of the Companies Act, 2013[1] at a normal fee on the said form; or

- Apply for Striking off the name of the Company by filing form STK-2, by a paying fee as applicable on Form STK-2

After the Conclusion of this Scheme

After the Conclusion of this Scheme, the Designated Authority shall take necessary action for the Companies who have not availed the benefit of this Scheme and are default in filing the documents on time.

Take Away

The move was an excellent step for the Companies Act and the LLP Act, with one time wavier of additional fees on specified forms, adding that the length of time given under the Scheme implies that firms would have “time even after the lockdown opens, to look at it comprehensively and apply for the fresh start scheme.”

Read our article:Covid-19 Outbreak: SEBI Relaxes Compliance Requirements for Companies