Form 15G or 15H has to be submitted by fixed deposit holders at the start of a financial year to the relevant financial entity like a bank. This is done to avoid TDS (tax deducted at source) on the interest income earned. For FY2019-20, as there is no tax payable i.e. if taxable income does not exceed Rs 5 lakh, such individuals can submit the Form 15G/Form15H, as applicable. An individual is required to provide the estimate of total income where tax payable is zero. This total income on the form is the net taxable income after claiming all the deductions available to him. An individual with taxable income up to Rs 5 lakh in a financial year will be able to avail full tax rebate and thus, will not be required to pay any tax.

What is Form 15G and Form 15H?

Form 15G and Form 15H are forms that can submit to prevent TDS deduction on the interest income. For this, PAN card is compulsory. Some banks allow submitting these forms online through the bank’s website.

- Form 15G is for Individual resident India or trust or HUF or any other assessee with less than 60 years of age but shall not include a company or a firm; whereas Form 15H is for senior citizens i.e., those who are 60 years or older.

- Form 15G and Form 15H are valid for one financial year. So, submit these forms every year at the beginning of the financial year. This will ensure the bank does not deduct any TDS on the interest income.

Why to submit the Form 15G and 15H?

It is important to submit Form 15G and Form 15H to the financial institution (usually banks) to avoid the deduction of tax. Banks usually deduct TDS from the interest income on FDs if it crosses the threshold limit. Form 15G is submitted by a resident individual whose age is below 60 years of age during the year as mentioned in the form. On the other hand, Form 15H is submitted by a resident individual whose age is 60 years and above, that is, senior citizens and super senior citizens.

The wordings on Form15G and Form15H mention that an individual is required to declare the total income where tax payable is nil. The total income mentioned in the form is the net taxable income on which the taxpayer’s estimated total tax payable is nil. This form should only be submitted by an individual if tax-liability is zero. Gross total income is the income which is received by payer from all sources. Net taxable income refers to the income arrived at after subtracting all the tax-breaks, as applicable, from the gross total income.

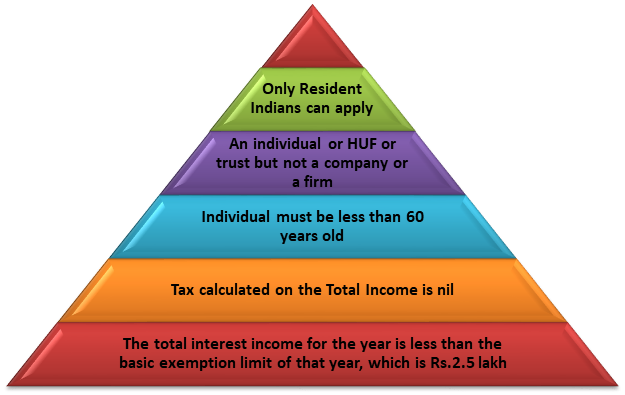

Eligibility Criteria for Form 15G

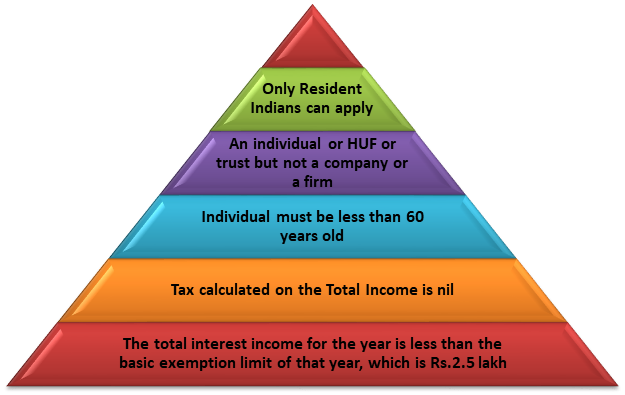

Form 15G is a declaration under sub-sections (1) and (1A) of section 197A of the Income Tax Act [1] of 1961, to be made by an individual (not being a company or firm) claiming certain receipts without the deduction of tax. The eligibility criteria to submit this form has been listed below:

- Form 15G can be submitted by individuals below the age of 60 years or by a Hindu Undivided Family (HUF).

- Form 15G should be submitted before the first payment of interest on a fixed deposit.

- The individual should submit this form to all deductors to whom a loan was advanced, i.e., this form will need to be submitted to each bank branch through which the individual is collecting interest.

- This form can only be submitted by individuals whose tax payable on their total income is zero.

- The individual should be a resident Indian.

- The total interest income is less than the minimum exemption amount for that year. The minimum exemption amount for the year is Rs.2,50,000.

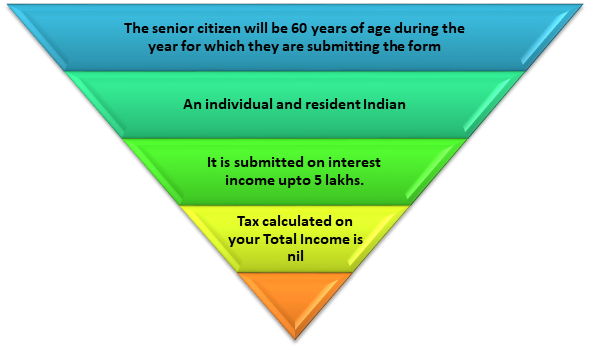

Eligibility Criteria for Form 15H

Form 15H is a declaration under sub-section (1C) of section 197A of the Income Tax Act, 1961, to be made by an individual of the age of 65 years or more to claim certain receipts without deduction of tax. The eligibility criteria to submit this declaration is listed below:

- Form 15H can only be submitted by individuals who have attained the age of 60 years at the time of submission.

- The estimated tax for the previous year should be zero. The individual should not have paid tax in the previous year because his/her income should be below the taxable amount.

- The individual should submit this form to all deductors to whom a loan was advanced, i.e., this form will need to be submitted to each bank branch through which the individual is collecting interest.

- Form 15H should be submitted to the bank before the payment of the first interest. This is not compulsory, but it will prevent the bank from deducting the TDS.

- Form 15H will require to be submitted if the interest income from any source other than a deposit, such as, interest on a loan, advance, debentures, bonds, etc. exceeds Rs.5,000 annually.

Read our article: TDS Return Filing Latest Amendment, Extensions and Rate Charts: 2020-21

For those who have taxable income above Rs 5 lakh

In case the gross total income of a person exceeds Rs 5 lakh and they intend to reduce it to Rs 5 lakh or little less by way of claiming eligible deductions, then the person is eligible to submit Form15G/Form15H. While submitting the form to avoid deduction of tax, the income of a person must not exceed the basic tax-exemption. For a resident individual whose age is below 60 years, the basic exemption limit is Rs 2.5 lakh.

This form can be submitted by the person only if his interest income does not exceed the tax-exemption level and the he can submit Form 15G for fixed deposit interest income earned from the bank. The aggregate interest income should not exceed Rs 2.5 lakh in a financial year. In case if person has total income from salary is Rs 4.5 lakh, and receive interest from FD with bank A is Rs 40,000 and also receive interest from FD with bank B is Rs 30,000. Then he can make PPF investment of Rs 50,000 which is eligible for tax break under section 80C.

For senior Citizens

For FY 2019-20, for senior citizens (aged 60 years and above but below 80 years), the basic tax-exempt income level is Rs 3 lakh. For super senior citizens (aged 80 years and above) the basic tax-exempt limit level is Rs 5 lakh. The condition of income not exceeding the basic exemption limit is applicable for individuals only are eligible for submitting Form15H.

The form applicable to senior citizens, i.e., Form15H is governed by Section 197A (1C) of the Income Tax Act. As per the notes, Form 15H can be filed by a senior citizen even if the income for which exemption is being claimed exceeds the basic exemption limit (i.e., Rs 3 lakh or Rs 5 lakh, as applicable). However, the net income after claiming all the deductions as applicable should be below the applicable exemption limit. The payer of income (usually banks) needs to verify that the tax liability on total income should be nil.

The Solution on forgetting to submit Form 15G or Form 15H

A lot of taxpayers forget to submit Form 15G and Form 15H on time. In such a situation, the bank might have already deducted the TDS. Based on this situation, one can do any of the following:

- File your income tax return to claim refund of TDS

The only way to seek a refund of excess TDS deducted is by filing on income tax return. Banks or other deductors cannot refund TDS, since they have already deposited it to the income tax department. Income tax department will refund excess TDS, after one will file income tax return.

- Submit Form 15G and Form 15H immediately

Most banks deduct TDS every quarter. If an individual forgets to submit Form 15G or Form 15H, then submit it at the earliest so that no TDS is deducted for the remaining financial year.

Where can you submit Form 15G or Form 15H apart from banks?

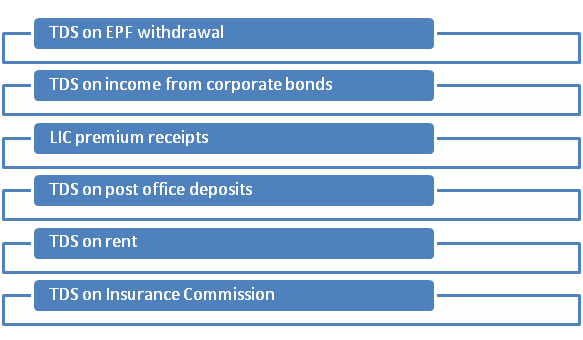

Though these forms have to be submitted to banks to ensure that the TDS is not deducted on interest, the given below are the other options where this form shall be submitted:

Important Information for Deductors

If a person is a TDS deductor, the Income-tax Act requires to allot a Unique Identification Number or UIN to everyone who submits a Form 15G or Form15H. One must file a statement on Form 15G or Form15H on a quarterly basis and must retain these forms for 7 years.

- TDS on EPF withdrawal – TDS is deducted on EPF balances if withdrawn before 5 years of continuous service. If a person have less than 5 years of service and plan to withdraw EPF balance of more than Rs 50,000 (Rs 50,000 effective 1 June 2016, Rs 30,000 prior to that), they can submit Form 15G or Form15H. However, the conditions must be fulfiled (listed above) to apply for these forms, i.e. tax on your total income including EPF balance withdrawn should be nil.

- TDS on income from corporate bonds –If a person holds corporate bonds, TDS is deducted on income from them exceeding Rs 5000. One can submit Form 15G or Form15H to the issuer requesting to not deduct any TDS.

- TDS on post office deposits – Digitized post offices can also deduct TDS and accept Form 15G or Form15H, if one meets the conditions applicable for submitting them.

- LIC premium receipts – Effective from October 2014, if the amount received from a policy exceeds Rs 1 lakh and it is taxable, 2% TDS shall be deducted by the insurer before paying. One can submit Form 15G or Form 15H to request that no TDS be deducted since tax on the total income is nil.

- TDS on rent – TDS is deducted on rent, if total rental payment in a year exceeds Rs 2.4 lakh. If tax on the total income is nil, one can submit Form 15G or Form15H to request the tenant to not deduct TDS (applicable from 1 April 2019).

- TDS on Insurance Commission – TDS is deducted on insurance commission, if it exceeds Rs 15,000 per financial year. However, insurance agents can submit Form 15G or Form 15H for non deduction of TDS if tax on their total income is nil, with effect from 1 June 2017.

Conclusion

The banks in India have to deduct TDS when the interest income of an individual is more than Rs.10,000 a year. The bank includes deposits held in all branches to determine this limit. In case an individual’s total income is below the taxable limit, he/she can submit a Form 15G and Form 15H to the bank to request them not to deduct TDS on the interest amount. In case there is change in circumstances and some tax is payable, taxpayers must immediately intimate the payer about it and withdraw their Form 15G and Form 15H. However, Form15-G and Form-15H cannot be submitted by non-resident Indians.

Read our article:TDS Returns Filing: Due Dates and Procedure for Filing