It’s almost impractical to identify a home that comes with an affordable rent amount. However, if you managed to find the best deal somehow, you cannot skip unseen elements such as tax deduction. Such elements make the entire process more perplexing & unnerving. The term “rent” is unsettling for many of us since it indicates nothing but expenses. The addition of words like TDS and its computation under section194-IB causes a bit of annoyance for the general masses. But not anymore! To ensure that you do not get confused or irritated with TDS next time, we have endeavoured to provide the best possible information on the same. This write-up will talk about the TDS on Rent.

Section 194I- TDS on Rent

Firstly, let’s dive into the fundamentals of TDS under the IT Act. As per the 194-I section of the IT Act, 1961[1], an individual (not being a person or HUF) entitled to paying rent is accountable for deducting 10% of the yearly rent as TDS if the annual rate surpasses INR 2.4 lakhs.

In the erstwhile regime, the TDS limit for a tax deduction on the rent was capped at Rs 1.8 lakhs. But, it was set out to Rs 2.4 lakhs in the financial year 2019-2020.

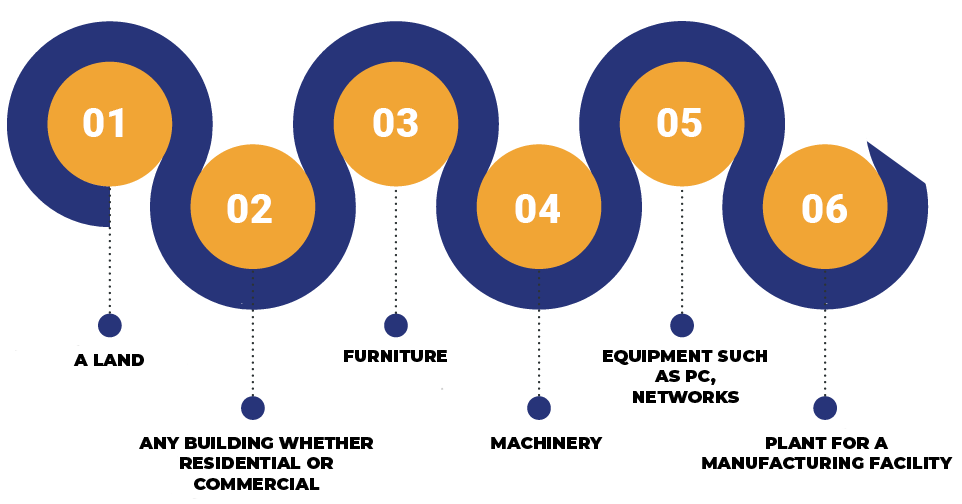

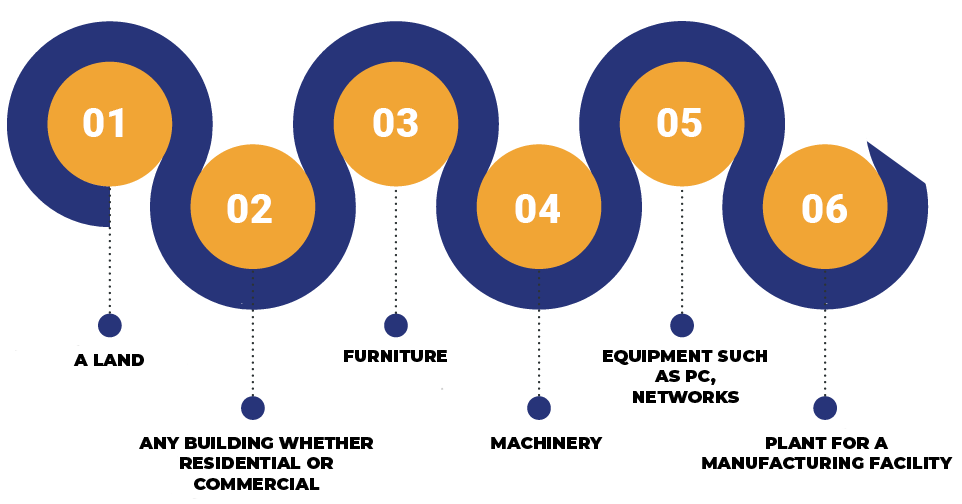

Definition of Rent under Income Tax Act

Many individuals often take only house rent into account when it comes to TDS deduction, which, in fact, is a wrong approach. Section 194-I provide a broad definition of rent as payment for the given things:

Do you require to Deduct TDS on Rent?

As per the ongoing tax regime, an individual who is not a person or a HUF is legally accountable to deduct TDS on rent of more than Rs 2.4 lakhs.

In case you fall under the Individual or HUF category, you can deduct TDS @ 5% if the rent that you are liable to furnish surpasses Rs. 50,000/month.

Read our article:TDS Returns Filing: Due Dates and Procedure for Filing

Deduction rate of TDS and Exceptions:

There are certain stipulates in which TDS is not deductible u/s 194-I. These include:

- When the yearly rent sum does not surpass Rs 2.4 lakhs.

- When the rent is made to the entities or government avenues whose income rejoices exemption under clauses (20) and (20A) of Sec.10 of the Income-tax Act.

- When the tenant is a person or HUF & the income from the profession does not surpass Rs 50 lakh. This also applies to the event if they operate the business having revenue of less than Rs 1 crore during the financial year.

- When there is a sharing of motion picture exhibition between the film exhibitor who owns the cinema halls and film distributor.

What is a legit way of computing TDS on Rent?

Let’s go through the following example to get a better understanding of TDS on rent.

Rakesh pays a rent of Rs 41,000 to his landlord per month. Now, in the purview of the revised rate, Rakesh will have to deduct 7.5% of the overall amount.

Here’s how much Rakesh will need to deduct:

- TDS on rent (Apr 2020 & May 2020): INR 8,000 (

- TDS on rent (April 2020 and May 2020): Rs. 8,200 (10% of the rent for the first two months)

- TDS on rent (June to March 2020): Rs. 30,750 (7.5% of the 10 month’s rent)

- Total TDS pertaining to the financial year 20-21 will be Rs. 38,950 (A + B) (You will need to deduct Rs. 38,950 from the rent of March 2020)

Effect of Tax Deduction on Sources on Tenant & Owner

TDS on rent simply reflects on the owner, income tax return, & a deduction on overall tax liability follows: Therefore, TDS deducted by tenant minimizes the total income tax liability.

As a tenant, you are supposed to be cautious with the deducted money & ensure that this money finds its way to the revenue department. This deduction does not append to the taxable income. Hence there is no alteration in your tax liability.

Tax Saving Options

TDS deduction does not affect the tax liability to a great extend. Hence, you have to look out for conventional modes of saving taxes. With legit tax planning, you can also minimize the quantum of taxes while boosting savings.

Here are the tax-saving instruments that ensure liquidity & improved returns.

Section 80C

It is one of the most widely assessed sections to save tax. It renders a wide array of investment options. The section aims to minimize the taxable income by up to Rs 1.5 lakhs. Some of the most effective tax-saving instruments include

Unit Linked Insurance Plans: Helps in creating long-term tax-free wealth, ensuring safety to your child education goals & maximize your retirement corpus

Sukanya Sammriddhi Yojana (SSY) & Public Provident Fund (PPF): Both schemes are quite popular, but serves different purposes.

National Pension Scheme (NPS): Mainly renders retirement benefits and render dynamic asset allocation & Equity exposure

Equity Linked Savings Scheme (ELSS): Pure equity mutual funds that come with three-year lock-in & tax-exemption.

Some more sections that enable taxpayers to save additional tax:

Section 24: Interest paid on a house loan up to INR 200,000. Enable taxpayer to minimize tax from house property. Hence this is a vital section if you own a let-out property.

Section 80E: You can spare tax on interest paid on a child education loan,

Section 80G: This section mitigates tax imposition on the amounts routed to charity houses or NGOs.

Conclusion

While TDS is merely an additional transaction in your rental deal, saving taxable income is a more compelling cause for your attention. Therefore, deduct TDS or receive rent but do not forget leveraging tax-saving investments to grow your wealth.

Read our article:How to File TDS Return Online?