The order has been issued by CBDT (Central Board of Direct Taxes) in F.No. 225/136/2020/ITA.II dated 31.08.2020

in relation to exercise of powers conferred under section 138(1) (a) of Income Tax Act, 1961, related to ITR filing status for compliance check for scheduled commercial banks.

Reasons for Compliance Check

The data related to cash withdrawal specified that a huge amount of cash is being withdrawn by the persons who have never filed ITR. It is to make sure that ITR is filed by these persons and to keep trace of the cash withdrawals by the non-filers of ITR, and to control black money, the Finance Act, 2020.

With the effect from July 1st, 2020 the Income Tax Act, 1961 was further amended to limit the cash withdrawal to INR 20 lakh for the applicability of TDS for the non-filers of ITR. It also mandates TDS at a higher rate of interest 5% on cash withdrawal if the amount exceeds INR 1 crore by the non-filers of ITR.

Read our article:ITR Rectification – A Complete Guide on How To Rectify ITR Online

Steps taken by the Income Tax Department for Compliance Check

The Income Tax Department has already provided functionality “Verification of applicability under section 194N” on the official website of Income Tax that is www.incometaxindiaefiling.gov.in for Banks and Post offices since July 1st, 2020. Through this functionality, Bank as well as Post Offices can get the applicable TDS rate as per section 194N of the Income-tax Act, 1961 by simply entering the PAN details of the person who is withdrawing cash.

The Income Tax Department has now released a new function “ITR Filing Compliance Check” which will be accessible to Scheduled Commercial Banks (SCBs) to check the ITR filing status of PANs in bulk. It can be done via Principal Director General of Income tax associated to the Scheduled Commercial Banks. The Salient Features of the Functionality

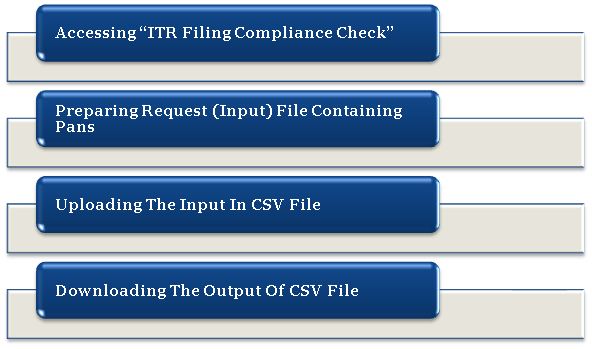

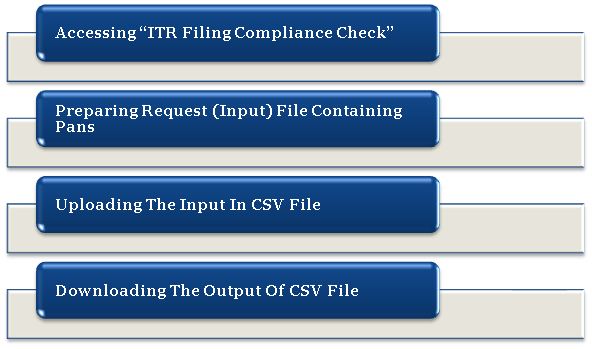

Accessing “ITR Filing Compliance Check”

The principal officer and designated director of Scheduled Commercial Banks are required to be registered in the reporting portal of Income Tax Department. They should be able to use the function after logging into portal using their credentials provided by the department. After successfully logging in, a link to “ITR Filing Compliance Check” will appear on the home page of the reporting portal.

Preparing Request (Input) File Containing Pans

The CSV file will appear to enter PAN details by clicking on the “Download CSV file” button on the “ITR Filing Compliance Check”. PAN details are required for ITR filing to be entered in the downloaded CSV file. The current number of PAN in one file is limited to 10,000 for search and verification.

Uploading the input in CSV file

Input in CSV file can be uploaded by clicking on Upload CSV button. While uploading, “Reference Financial Year” is necessary to be preferred. Reference Financial Year is the year for which results are required for ITR Filing Compliance Check. If selected Reference Financial Year is 2020-21 then results will be AY 2017-18, 2018-19 & 2019-20. The uploaded file will be reflected with uploaded status as per your selection.

Downloading the Output of CSV file

After processing the above, you can check the status of your CSV file containing ITR Filing by entering the PAN details and related documents. After doing so, the output available for ‘download’ and “Status” will change to ‘Available’ automatically. Output of CSV file will have PAN details that are name of the PAN card holder (masked) and show the ITR Filing status for last 3 AY.

After downloading file, the status will change to downloaded. After 24 hours of file applicability, the download link will expire and status will change to Expired.

Scheduled Commercial Banks can also use “Application Programming Interface[1]” based exchange to computerize and integrate the process with the bank’s core banking solution. Scheduled Commercial Banks are required to apply document, appropriate information security policies and procedures with clearly defined role and responsibility to make sure that the information is secure.

Conclusion

The decision taken by Income Tax Department for compliance check was due to data related to cash withdrawal, which specified that a huge amount of cash is being withdrawn by the persons who have never filed ITR. Therefore, it is to make sure that ITR is filed by these persons and to keep trace of the cash withdrawals by the non-filers of ITR.

Read our article:CBDT extended the Filing of ITR deadline till 30th September