Insurance Brokers represent their clients and render advice to a potential customer having a keen interest in buying insurance services & products. These individuals are highly skilled and have a deep understanding of insurance-related products and services. After availing of the insurance broker license, they become eligible to sell multiple insurance products of different companies without the conflict of interest. IRDA is the governing authority that regulates and issues the insurance broker license in the country. Presently there are 400+ insurance brokers in India. In this article, we have compiled a list that illustrates the benefits of an insurance broker license in India. Before we get started with the main topic, let’s get familiar with the broker’s roles and responsibilities.

What an Insurance Broker do?

Brokers help customers to pick appropriate insurance policies. They support the customer with unbiased suggestion and chase any insurance claims for them. An insurance broker’s impartiality let them to match customer’s insurance needs with the right policies, the right organization, and the right premiums.

- Get accustomed to customer’s requirements for an insurance policy.

- Help in finding the right policy based on the customer’s[1] requirement.

- Help customers to understand the traits of the policy and make them aware of the possible limitation.

- Provides legit info regarding the policies including cost and hidden fees.

- Render aid to the prospective customer with the paperwork.

- Coordinate effectively with insurers and clients and perform required actions with diligence and care.

Read our article:Step by Step Procedure for Insurance Broker License

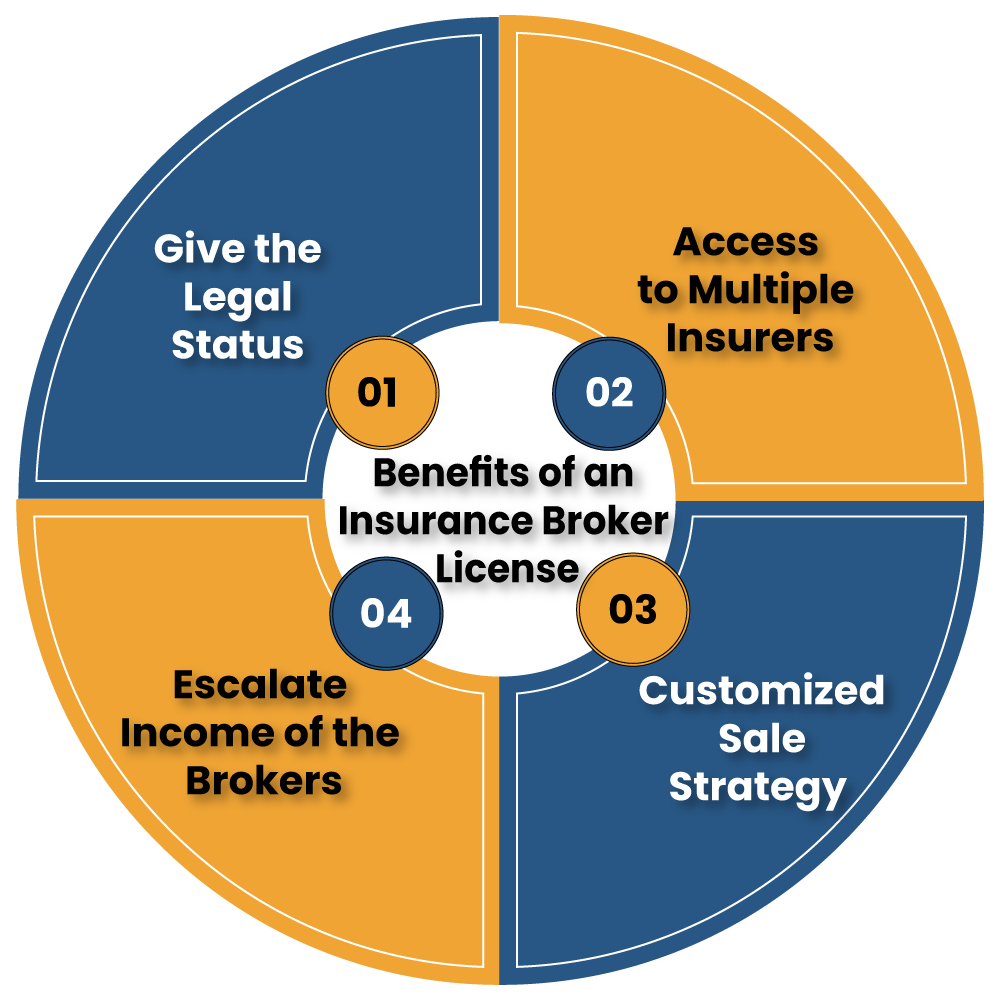

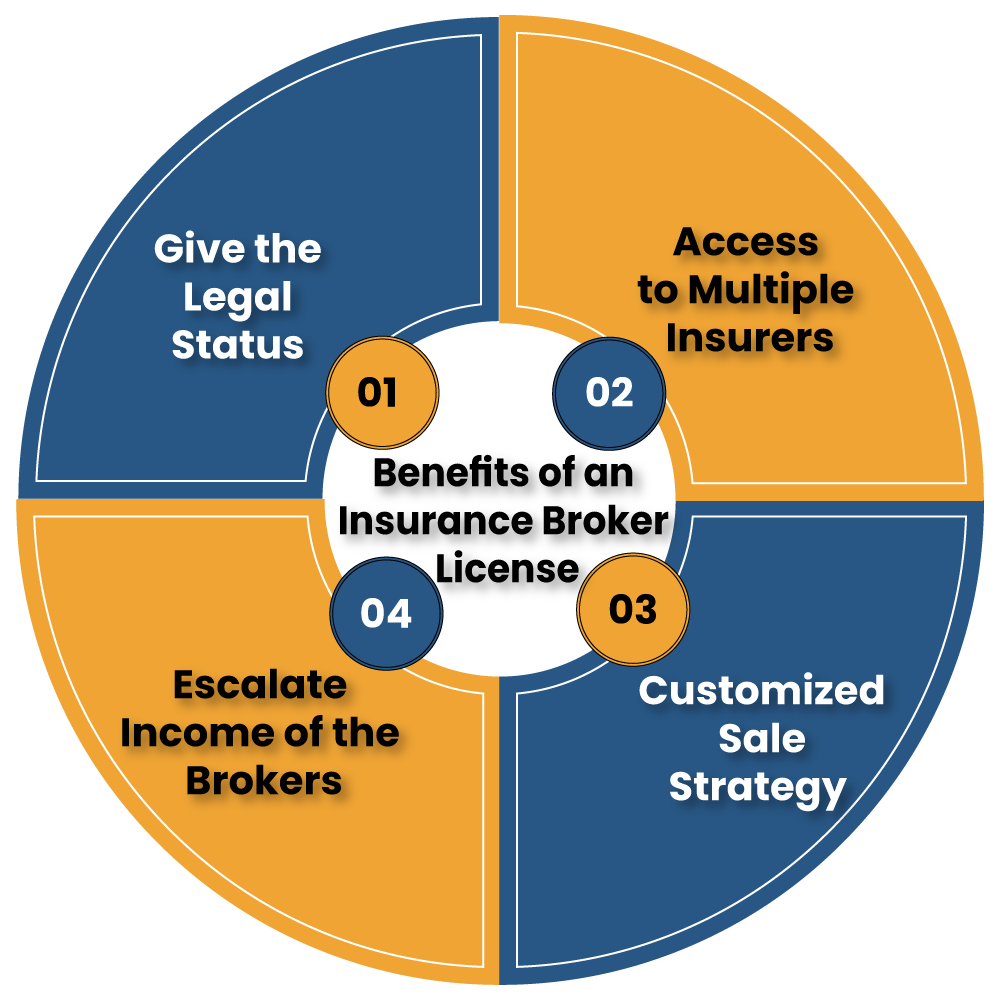

Top benefits of an insurance broker license

The given section will provide a briefing regarding the benefits of the insurance broker license in India.

Give the legal status

A firm with an insurance broker license would be deemed as an authorized entity that adheres to legality and is committed to impart transparency in its code of conduct. The legal status can help the broker to reap the benefit in the longer terms.

Escalate Income of the Brokers

According to the bylaws, the insurance brokers represent the prospective customers and are licensed to offer policies from many insurers. The insurance broker license helps the broker to set up multiple sale contracts with different companies thus; allowing them to extend their customer base and their income source.

With a wide portfolio of insurance products at disposal, they can interact with a wide pool of customers and hence maximize the earning through increased sales. Unlike the insurance agent, the insurance broker has the liberty to access a wide market. This is probably one of the best benefits of an insurance broker license.

Provide access to Multiple Insurers

The insurance broker license holders are liable to sell services and products of multiple clients. It means that they can approach numerous insurers, depending on their capabilities, and plead them to draw a sale contract. An insurance broker is much more versatile than an insurance agent in terms of customer interaction and sales portfolio.

Customized Sale Strategy

Yet another key benefit of an insurance broker license, the insurance broker can use a personalized sale strategy to sell the insurer’s product unless it doesn’t affect the integrity of the bylaws. Such relaxation can help the broker prepared customized sale blueprints for the different products to maximize the sale and the revenue. However, the broker under no circumstance can promote anything offensive or mislead in nature, or else it will deem as the contravention of the bylaws and contract.

There are numbers of online lender out there which provides a wide array of insurance policies to the end users. That shows how the license holder can adopt any technique including the online channel to sell the insurance product. But one has to keep in mind that licensed brokers are allowed to conduct any sale campaign that averts the statutory requirement under the law.

Act of Diligence with Utmost Faith and Integrity by Insurance Broker

Despite these apparent advantages, the broker needs to act with diligence and care. They must deal with clients with utmost faith and integrity and maintain the confidentiality of the document offered by them. The licensed broker adheres to many responsibilities, be it a matter of guiding a client or helping customers with tiresome paperwork.

Their job is to render the top of line service to a prospective client without any compromise. They carry a burden of the client’s reputation on their shoulder. One wrong decision or negligence could result in the closure of the sale contract. Broking is a work of delicacy that seeks the uncompromised conscience of the brokers.

Conclusion

The insurance broker act as a support for the clients who facilitates sale services to the prospective customer seeking the right policy. Insurance license comes with tons of obligations in terms of code of conduct and legal formalities mentioned under the bylaws. There is no way the broker can improvise the existing guidelines under the law for the sake of additional benefits.

From advertising to the sale of policies, the brokers are required to maintain the integrity of the bylaws no matter what the situation is. Despite these obligations, the license provides the liberty to the brokers to interact with multiple insurers to ensure growth.

Read our article:What type of Documents required for the Insurance Broker License?