Setting up a business in India is considered a challenge, but when you know the right facts, it is not difficult to keep the necessary documents and work according to the defined procedures. In this article, we will cover the details of alcohol export compliance for setting up business in India in the context of alcohol beverage export and trade. We will give details of the treatment of excise duty for export and trade of alcoholic beverages in India.

Profitable Alcohol Export Business Plan

India has a good picture at the market for international trade. And this is why many F&B International brands are interested in understanding alcohol import compliance to set up a business in India. Export/Import business, also known as international trade, which is the exchange of capital, goods, or services across international borders or territories. The Government of India periodically amends the formalities and procedures for establishing an export/import business in India.

Read our article:Advantages of Obtaining IEC (Import Export Code) Registration in India

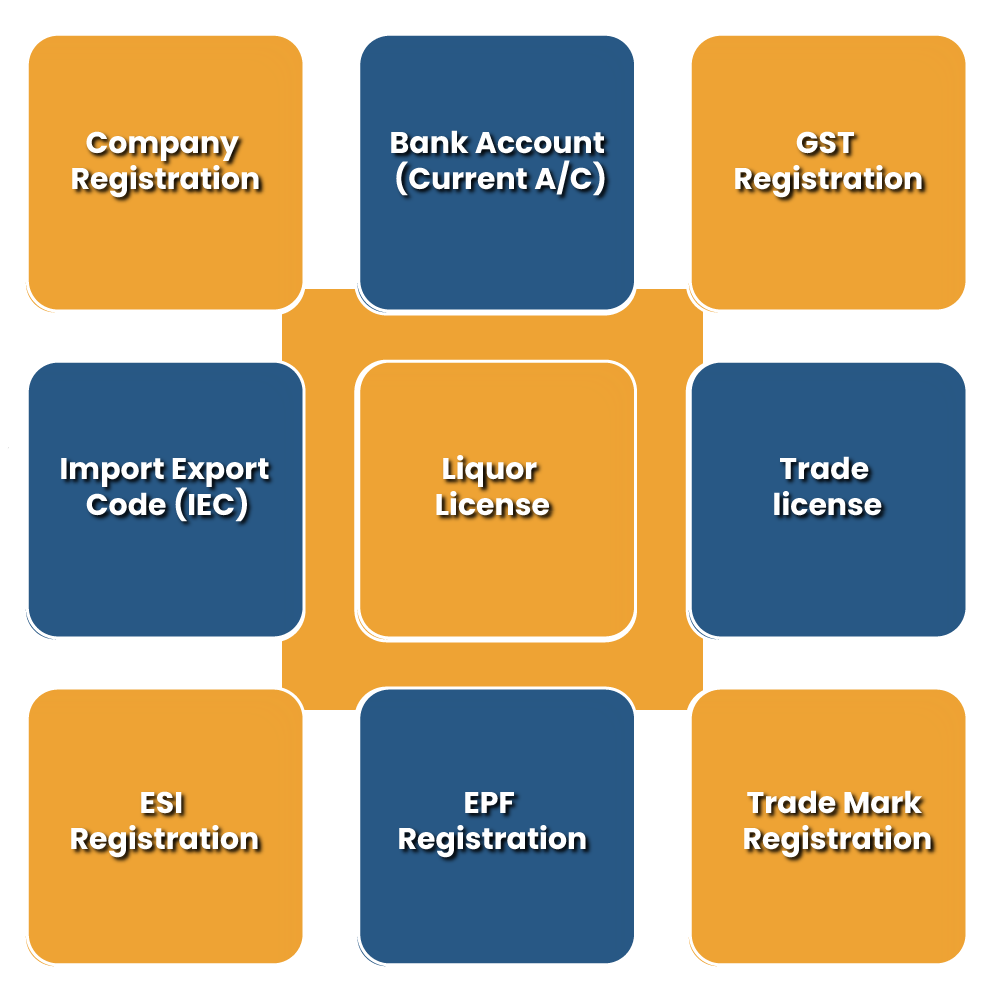

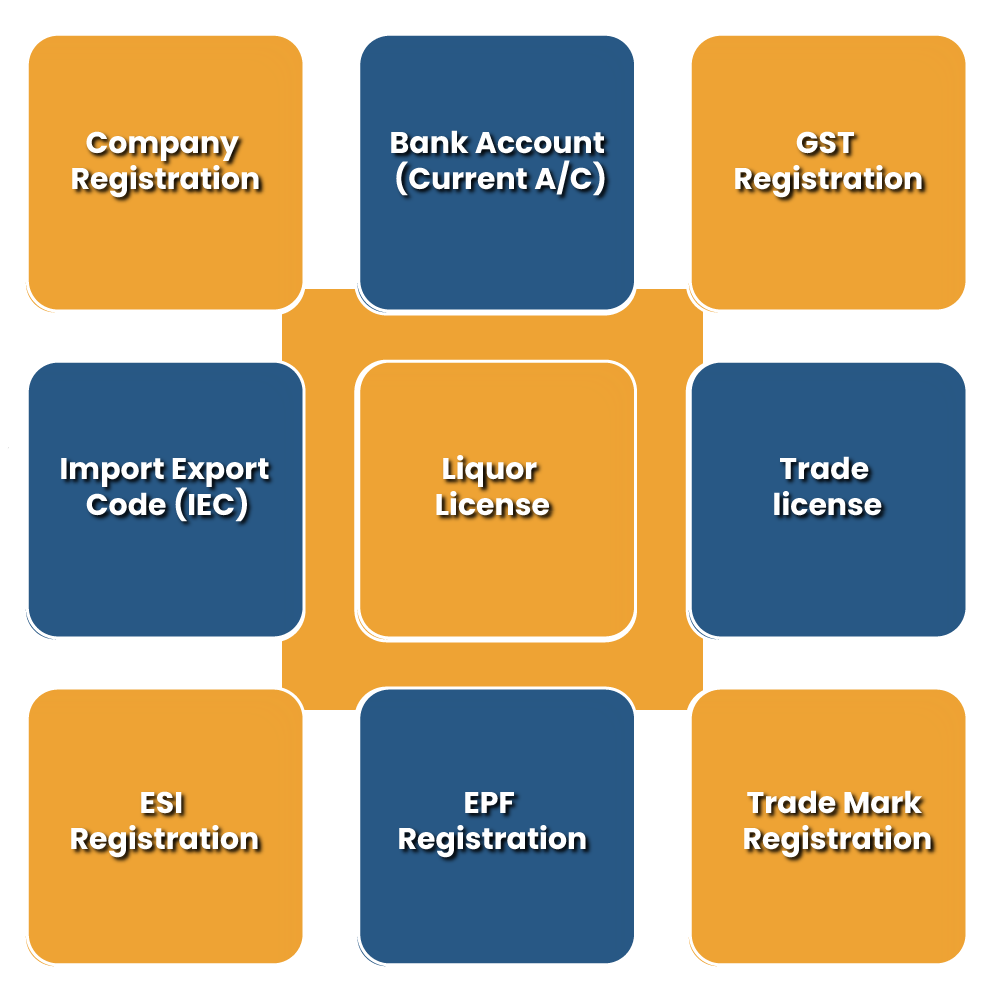

Particulars Required to Register Alcohol Export Business

Company Registration

To start a profitable alcohol export business in India, first of all, you have to proof your ownership by registering a company.

- If you have decided to start alcohol export business as a one-Person company, you must register your company as a one person company.

- For partnership business, you must register as a LLP or Partnership Firm. Ltd. company.

- Once you register a company, you have to open a current bank account on your company name

GST Registration

After the company registration you must apply for GST registration and obtain a GST no. to perform the business activities.

Import Export Code (IEC)

To alcohol export in other countries you have to obtain Import Export Code (IEC) from the concerned department.

How to Get an IEC with DGFT with Branch Code?

Import Export Code is mandatory for the movements of goods from outside the India. No person or company shall do any import or export without the IEC code, which can be obtained from the Director-General of Foreign Trade within the jurisdiction office of the company. Without IEC code, movement of goods from the country is not permitted.

Listed below documents are required to Get IEC code, which are as follows:-

- Bank receipt/demand draft against application fee

- Application form in prescribed format issued by DGFT for issue of Import Export Code number

- Please attest the application for IEC with the bank records where you have opened current account in the name of firm to operate export import activities.

- Self attested copy of Permanent Account Number-PAN issued by income tax authorities.

- Passport size photographs of the applicant.

- If any partner or partners are non-resident interest or holding in the firm or company exists with repatriation benefits, you need to attach a self certified copy of Reserve Bank of India[1] approval on the same.

Liquor License

To start alcohol export business in India, individual must obtain the Liquor license.

Particulars Required for Liquor License

- Identity proof of applicant’s

- Resident proof of applicant

- Proof of address of principle place of business

- No Objection Certificate from the concerned State fire department and Municipal Corporation

- Filled Application form

- MoA and AoA of companies, if applicable

- Latest ITR copy

- Passport size photograph of applicant

- Affidavit declaring that applicant has no criminal history.

Trade license

Get a Trade license from the local authorities to perform the business activities

ESI Registration

Employees State Insurance which is an insurance scheme for workers working under your manufacturing unit. If you are manufacturing alcohol, in that case it is mandatory to obtain ESI registration.

EPF Registration

Employee’s provident fund is compulsory for business where more than 20 employees are working.

Trademark Registration

Register your brand name with a trademark that will protect your brand globally

Procedure to Start Alcohol Export Business

The export regulations prescribe the groundwork related to duties, permissions and other laws governing export transactions. Since alcohol is a subject in the state list under the 7th Schedule of the Indian Constitution, export regulations, especially duties & tariffs may vary from state to state. Listed below are the steps to be followed to export alcohol outside the country.

Application to the Commissioner

Any producer or dealer who wishes to export alcohol must submit an application to the Commissioner. This application should specify the following items, which are as follows:-

- Name of consignor

- Consignee name

- Description, quantity and potency of each type of alcohol exported

- Export route and check post on exit from state or country.

A license or permit from the appropriate excise duty of the state or union territory in which the alcohol is to be exported, which authorizes the import of alcohol outside the country.

- A reference to a duly executed special bond or general bond in force or a document providing payment of duty information, or

- Receipt or challan for payment of duty in respect of alcohol exported to the Government treasury.

Authorization to Export

- In case the application is found to be in order, the commissioner will issue permission to specify the name, quantity and strength of each type of alcohol.

- A copy of this permit will be sent to the appropriate excise officer of the exporter, state or union territory for which the alcohol is to be exported.

Time Limit

- Within a reasonable time period specified by the Commissioner on the permit, the exporter must produce a copy of the import permit imported with a certificate signed by the Excise Officer of the State or Union Territory in which the alcohol is exported before the Assistant Excise Commissioner of State to certify the scheduled arrival or otherwise of alcohol at its destination.

- The Commissioner may extend this time period on a written application if valid and sufficient reasons are cited.

Bond Discharge

- In the case of alcohol exported under a special bond, the commissioner shall discharge the bond upon receipt of the certificate, provided that none of the terms of the bond has been violated.

- In case the certificate is not received within the time period mentioned in the bond or permit, or if any of the conditions on the bond or permit appear to be in violation, the commissioner will take the necessary steps to recover the penalty from the executor.

Particulars to be Mentioned on the Container

- Name & mark of the distillery of the concerned state

- Capacity of the bottle

- Quantity of ingredients

- Batch number and date of manufacturing

- Price

Concluding Remarks

The Indian alcohol Industry is one of the most vibrant in the world. The alcohol sold in India is dazzling and its demand among affluent Indians is increasing by the period of time. India is one of the top markets to grow at a high and healthy rate; however, to establish an alcohol export business in India is not an easy task.

Therefore, it is recommended that you should look into how to establish alcohol export business in India. This business will give you more profit if you go through with the process as mentioned above. The Indian alcohol industry is one of the most vibrant in the world. Kindly associate with the Corpbiz expert to know more about how to establish alcohol export business in India.

Read our article:What is the IEC Registration Process in India?