Employees Provident Fund is widely known as a saving scheme. Launched by the Indian government, it is entirely meant for the welfare of employees. The fund under the PF scheme accrued overtime with employees and employer’s monthly contribution. EPFO (Employees Provident Fund Organization) is a government-based institution that administers and regulates all the undertakings regarding the employees’ provident funds. The contribution made under the provident fund finds its way to the EPFO-managed account. Every employee who holds an EP account can check its status and detail via EPF passbook.

An Overview on EPFO member Passbook

EPF passbook is a web-based facility rendered by the EPFO or Employees Provident Fund Organization. The EPF passbook is more or less identical to the bank passbook. It enables the members to get aware of past transactions. EPF Passbook entails almost all required detail of the PF account such as;

- Employer contribution

- Employee contribution

- Withdrawals

- Interest earned

Furthermore, it allows the member to;

- Check account balance

- View Account Statement

- Download and Print the Account Statement

The EPF passbook is accessible via the EPFO mobile app. However, such a facility is available to those members who are registered on the UAN (Universal Account Number). UAN refers to 12 digit numbers that are used to identify the members under the EPFO scheme. Please note that once the UAN is created, it will continue to remain active and unchanged even if the employee changes his/her job.

Read our article:Procedure for EPF Registration – A Step by Step Guide

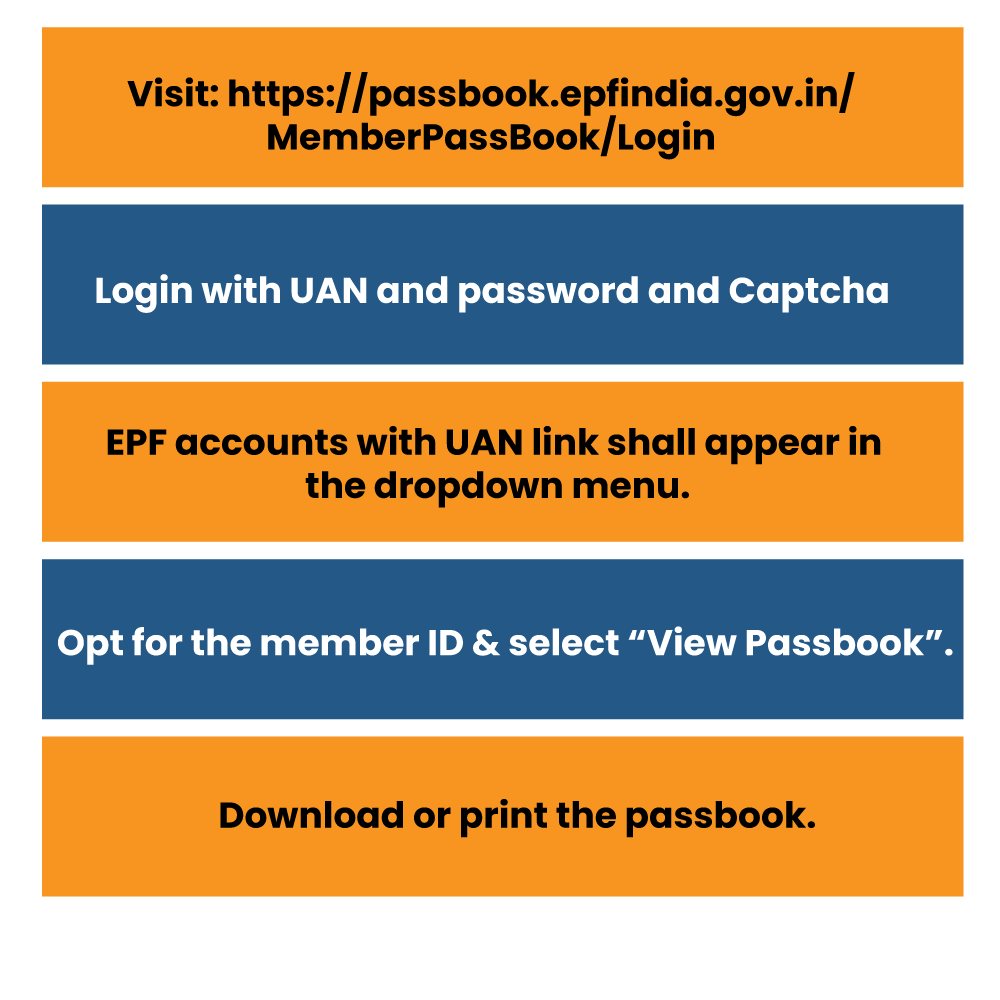

What is the online process of downloading the EPF Passbook?

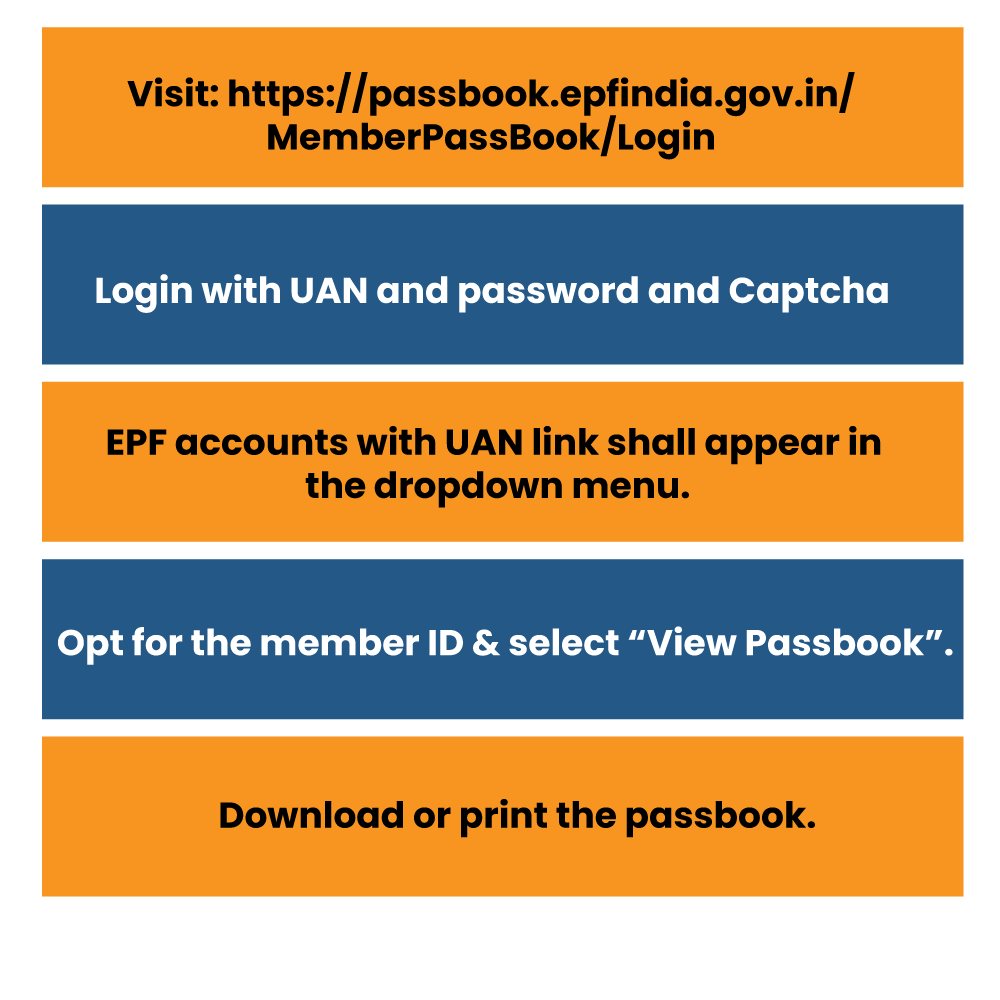

- Visit the URL as mentioned below https://passbook.epfindia.gov.in/MemberPassBook/Login

- Provide your credentials i.e. UAN and password.

- Enter Captcha for verification and then tap on the “Login” button.

- The member’s ID shall prompt on your display. Thus, all EPF accounts having a UAN link shall appear in the dropdown menu.

- Opt for the member ID & select “View Passbook”.

- The detailed passbook enclosing past transactions shall prompt on your display. You can download and print the same via a single command.

How to get EPF passbook on the system via EPFO App?

- Visit Play Store and search for the M-Sewa app via the search bar.

- Tap on the Install tab and wait until the app is ready for use.

- Once install, tap on the app icon to launch it on your device.

- Select the option, “Let’s Start.”

- Select EPF services>E-Passbook.

- Provide your login details such as UAN and password in the relevant fields.

- Select Member ID followed by View Passbook.

- Lastly, you can view the passbook, download or print the same.

How to get EPF passbook on the system via DOB & Contact Number?

- The members can visit the EPFO portal to download the EPF passbook via their contact number or Date of Birth.

- After registering on the EPFO portal for the e-passbook facility, the portal shall seek an identity card from the user for the registration process.

- The member will get a PIN on their contact number. The user is required to enter the same PIN on the EPFO portal to complete the registration process.

- With the help of contact number and document no, the user can log in to the portal.

- Select the ‘Download Passbook’ option.

- Enter name, PF code, and other requested detail appropriately.

- Finally, confirm the chosen transaction via a PIN

- As soon as the request for an EPF passbook is placed, it takes 3 days to process the user’s request.

An Overview Key Components of EPF passbook

The key components of EPF passbook include;

EPF account number

EPF account number usually exists in an alphanumeric format. In encloses the code related to state, establishment, member, and regional office. The following example will render the better understanding on the same

Sample PF number – AP HYD 0074560 000 0001234

Here;

- AP denotes Andhra Pradesh

- HYD denotes Hyderabad (location of the regional office)

- 7 numbers denote establishment ID ‘0074560’

- The subsequent 3 numbers denote the establishment extension ID.

- The remaining 7 numbers reflect member ID ‘0001234’

- The last 7 numbers represent member ID ‘0001234’

UAN

Universal Account Number[1] (UAN) is a unique member’s identification number allotted by the EPFO. Every member under the EPF scheme is eligible for this number. The PF member IDs are linked with this number.

Basic Details

The passbook entails key information like name & the address of business with establishment ID, DOB, member’s name, joining date, etc.

Opening Balance

The EPF passbook reflects the opening balance under the section of employer and employee. The opening balance refers to a total contribution to date along with interest reaped in the preceding fiscal year.

Monthly Contribution

The EPF passbook reflects the monthly contribution by both employees as well as the employer. But, contribution to EPS is shown independently.

Interest

The interest on EPF is calculated on running balance of every month. However, interest is credited at the end of financial year for employee and employer contributions. The rate of interest on which interest is calculated is mentioned in the passbook.

Closing Balance

The following expression reflects the exact computation of closing balance.

Closing balance = (employer contribution + interest) + (employee contribution + interest)

The closing balance is carried forward as an initial balance for the subsequent year.

Voluntary Provident Fund

As the name suggests, the voluntary provident fund is different from the basic PF contribution where the employee has to adhere to 12% contribution limit. In general, it refers to an excess contribution of the employee. Hence, it is reflected separately in the passbook.

Conclusion

EPF passbook keeps the employee on edge when it comes to familiarizing with the past transactions or contributions made to the PF account. It is easy to access and updates in real-time. Since the EPF passbook details exist on the EPFO’s database, the chance of getting them misplaced is next to negligible.

Read our article:How to Activate UAN for Your EPF Registration?