GST Certificate is a must-have requirement for every taxpayer that comes under the provisions of the GST Act. As soon as the GST registration is availed, the taxpayer needs to display it on their office premises from where he/she is conducting its business activities. Downloading a GST certificate isn’t a tedious task at all. In this blog, you will .

The GST law states that a business entity whose turnover exceeds Rs 40 Lakhs should compulsorily opt for the GST registration. Meanwhile, the suppliers in the Special Category States have to comply with GST provision if their annual turnover falls in the bandwidth of Rs 20 lacs. Furthermore, the suppliers generating more than 1.5 cr of yearly turnover have to register under the composition scheme. Therefore, once the supplier successfully avails the GST registration, the same certification can be downloaded from the GSTIN portal.

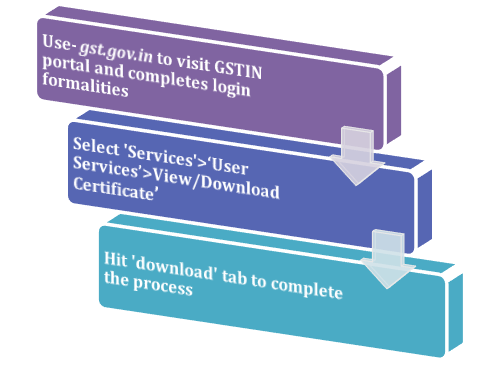

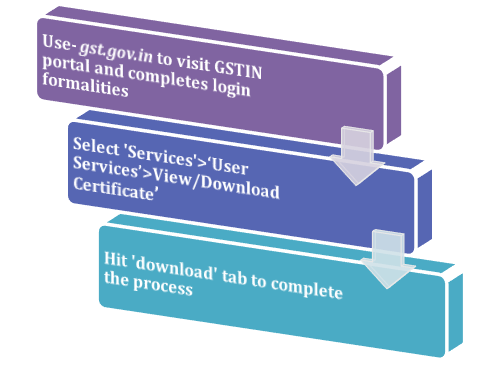

Steps to Download GST Registration Certificate

- Use this URL- gst.gov.in. To visit the GSTIN portal.

- Now, login to this portal by entering your account details.

- On the main menu, click the ‘Services’ tab and select ‘User Services.’

- Next, opt for the ‘View/Download Certificate’ located in the drop-down menu.

- Hit the ‘Download’ tab to complete the downloading process of the GST Registration Certificate.

Format of GST Registration Certificate

GST Registration Certificate is a three-page document displayed in a GST REG-06 form. The first page exhibits the info regarding the principal place of business, along with some following attributes.

Info in Page 1

- GSTIN of the business entity or the individual.

- Legal or trade name, if any.

- Business Constitution

- Legal Business Address.

- Address of Principal Place of Business

- Date related to Liability

- The validity period for the casual or non-resident taxable person.

- Registration Category

- Issuing date of the certificate

- Detail of the authority responsible for approving the certificate.

Info on Page 2

Page 2 illustrates the detail regarding Annexure-A. Here’s what you will find in this section of the certificate.

- GSTIN of the business entity or the individual.

- Legal as well as the trade name.

- All branches of the business operating in the state

Info in Page 3

Page 3 subsume Annexure-B that renders the information of the business owner such as Partners, Karta, Sole proprietor, MD, the board of trustees, or whole time managers, etc. This page illustrates the following details.

- GSTIN of the business entity or the individual.

- Name

- Photograph

- Designation of the in-charge

- Resident of State

Read our article:Revocation of Cancellation of GST Registration

Showcasing GST Registration Certificate in the office premises

Rule 18 of the CGST Act, 2017, states that every GST registered entity is liable to display a copy of the GST registration certificate and GSTIN at the principal place of business and associated branches.

Validity associated with GST Registration Certificate

The provision of adding the validity section in the GST Registration Certificate is limited to a casual or non-taxable person as per GST provisions.

GST Registration Certificate discourages the provision for expiration in the case of Normal taxpayers unless the concerned entity drops the cancellation request at the GSTIN portal, or the authority cancels its registration due to violation of the act.

Verification of GST Certificate

Any taxpayer seeking GST verification of another entity can visit the GST portal and use the features as GSTIN Search and Verification Tool located under the ‘Search by Taxpayer’ tab. The verification tool offers instant details of the concerned entity on entering GSTIN detail in the search bar.

Verification tool renders the following details.

- Legal name

- Date of registration

- Center and state jurisdiction

- Business constitution

- GST category

- GSTIN/UIN

The verification tool allows users to determine whether the business entity is following GST compliances or not.

Understanding GST Registration Number

It’s worth noting that the GST Registration number is state-specific, and it is outlined based on the PAN provided by the applicant. GSTIN is a 15 digit alpha-numeric code issued to the taxpayer by the tax authority after approval of the application.

- First two characters of GSTIN indicate State code.

- The following ten characters show the taxpayer’s PAN details.

- The thirteenth character provides info about the number of registrations serving a single PAN.

- The fourteenth character indicates the nature of the business.

- The last digit is the check code.

Type of amendments feasible in GST Registration

After acquiring GST registration, there could be instances where an entity may seek changes in the registration details on account of contact number, address, or business details, etc.

To ease out the process of such amendments, tax authority provides an application form called GST REG-14 on the GSTIN portal to the taxpayers. The amendment in the GST registration is limited to specific fields given below:

Alteration of the core field

Any changes in the core field need approval from the proper tax officer.

- Business Name

- Address of the main Business

- Associate branches of the business

- Details of the entities accountable for running the business

Alteration of Non-Core Fields

Alteration of Non-Core Fields discourages any approval from concerned authority and is subject to automatic updates.

- Change on account of authorized signatory

- Modification in the business owner details.

- Inclusion of new bank account details.

GST Registration Amendment process

- Visit the GSTIN portal and complete the login formalities.

- Go to the ‘Services’ tab and select ‘Registration’>Amendment of Registration Core Fields.’

- Once you get access to Form GST REG-14, initiate the filling process, and attach the supporting documents.

Conclusion

GST registration is the utmost necessity for the majority of businesses operating in India. If you ever encounter any obstacle on account of GST registration or filling, then go ahead; share your doubts with CorpBiz’s experts. With years of expertise under the belts, our experts offer unprecedented support to the taxpayers seeking help on tax-related issues.

Read our article:Step by step guide on how to check GST Registration Status