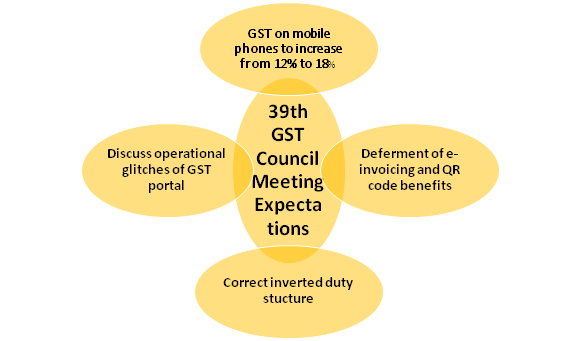

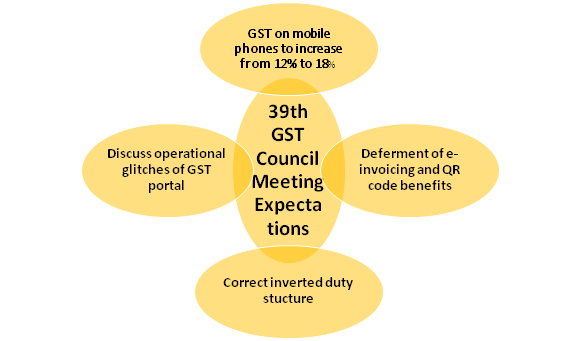

The 39th GST Council meeting is to be held on this coming Saturday, i.e. March 14, 2020, at Vigyan Bhawan New Delhi. The Union Finance Minister Nirmala Sitharaman will chair the meeting. The Council in its 38th meeting is expected to deliberate on crucial issues under Goods and services tax including rationalization of tax rates[1] on various sectors, deferment of implementation of the new return filing system and e-invoicing etc.

Issues to be Discussed in 39th GST Council Meeting

- The GST Council is expected to discuss operational glitches on the GST Network portal and seek a resolution plan from Infosys which had won the contract for managing back-end for GSTN in 2015.

- The Council would also be discussing ways to increase revenue collection.

- In it’s meeting the Council would also discuss the integration of the GST e-way bill system with the NHAI’s FASTag mechanism from April to keep track of the movement of goods and prevent tax evasion.

- The planned lottery scheme under GST, which is proposed to be launched from April 1, 2020, will also be discussed in the meeting. The Council will decide on lottery offers by conducting lucky draws every month for invoices of all business-to-customer (B2C) transactions.

- Inverted Duty Structure causes an annual revenue loss of Rs 20,000 crores. The GST Council in its meeting is expected to correct inverted Duty Structure to create a balance between the duty levied on the finished product and that on the raw material.

The inverted tax structure is a situation where tax rates are higher on inputs than on the finished product.

- The Council would discuss rationalization of GST rates in sectors which see duty inversion, leading to high input credit refund claims.

- Currently, mobile phones attract 12 per cent duty while mobile parts and batteries attract an 18% tax rate causing an inverted tax structure. Similarly, fabric attracts 5% GST rate while several categories of yarns are taxed at 12%. Likewise, the GST rate on chemical fertilizers is 5 per cent while inputs are taxed at 12 %. GST Council is expected to rationalize the tax rates of these sectors to increase revenue collections.

- The GST Council is also expected to discuss the deferment of e-invoicing and QR code benefits, along with exemption on certain sections of the industry from undertaking e-invoicing.

Take Away

GST Council in its 39th meeting is expected to correct the inverted duty structure and increase GST rates on mobile phones, footwear, fertilizer and textiles. Besides, GST Council will also deliberate upon the operational glitches on GST Network portal. All these expected moves of increasing GST rates would augment revenue collection. Moreover, the GST Council is also expected to discuss the measures to avoid tax evasion.

Read our article:Pragmatic Impact of GST Rate on Indian Economy