In this article, we will provide comprehensive details regarding documents required for trust registration. As per the Indian Trust act 1982, a trust is a form of organisation where the owner transfers its property to the second person, aka trustee, so that the third person can benefit from it. The transfer of such property cannot take place without a legal process. It is essential to note that the public charitable trust is registered under the Bombay Public Charitable Trusts Act 1950 in Gujarat or Maharashtra. Apart from these states, it can be registered via trust deed.

On the contrary, the private Trust, whose beneficiaries are friends and relatives, are not eligible for tax exemptions. Suppose a person wants to utilise its property or income for the charitable purpose and wish to limit the control over the income to the recognisable individual. In that case, public charitable trust is the best option for them.

Read our article:New Registration Procedure under 12A (1) a/aa/ab: Trust 2020

Creation of Trust – Types

The creation of Trust depends on the three types of individuals:-

- The trustor who declares the confidence

- A trustee who accept the confidence

- The beneficiary is the individual who avails benefits from the Trust.

A trust is created when the property owner i.e. trustor, transfers property to a person (trustee) to benefit the beneficiaries. The settlor is a primary member of the trust who has more power at the disposal than trustees. The trustee cannot administer the trust for the sake of personal interest. It is subjected to specific regulations prescribed by state law[1].

Trust’s Classification

Public Trust

As the name suggests, public trust is formed for the benefit of the general public. In layman terms, the primary beneficiary is the general public instead of a specific individual. The public trust is further divided into two parts:

- Public Charitable Trust

- Public Religious Trust

Private Trust

Unlike a public trust, private trust is formed to benefit families or individuals. Moreover, such trust is categorised into two parts:

- Private Trusts whose heirs and their important offers both can be resolved

- Private Trusts who’s both or either the heirs and their critical offers can’t be resolved

Although public and private trusts sound identical entities on the surface, they bear some significant differences. The primary difference between the two is that the private trust works in the direction of the specific beneficiary/ beneficiaries. In contrast, the public trust works for the benefit of the general public at large. In addition to that, the public trust is administered by the board of trustees. Meanwhile, the private trust is handled by the appointed trustees.

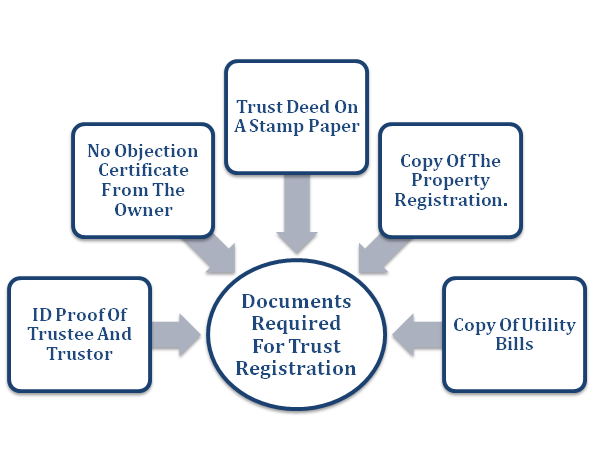

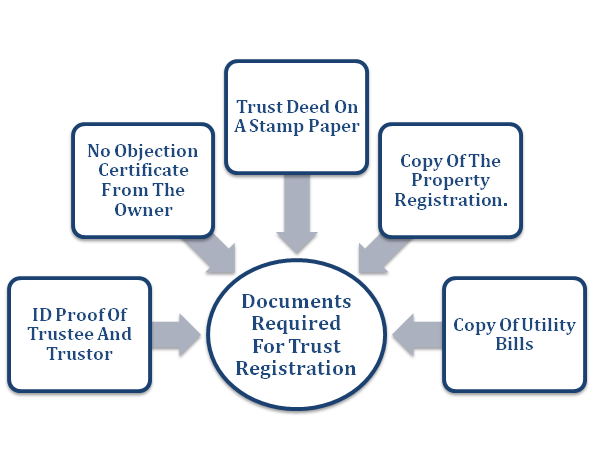

Now, let’s unfolds the topic further and find out what type of Documents required for trust registration. Below is the documentation list that one has to furnish to the relevant authority for the trust registration.

Documents Required For Trust Registration in India

- Copy of identification proof (Passport, Driving license, Voter ID, and Aadhaar card) of trustors and trustees. (Note: the documents should be self-attested)

- Copy of utility bills.

- Trust deed on a Stamp paper*

- Copy of the property registration.

- No objection certificate from the owner of a rented property.

Trust Deed Encloses the Following Details

- Trust’s Motive

- The trustee and settler’s basic details include name, occupational background, designation, age, contact information, etc.

- The total number of trustees.

- Address of the Trust’s registered office.

- Trust’s proposed name.

- Copy of the identification proof of trustee and settler.

- Photos (passport size) of trustees and settlers.

Documentation required for Trust Deed registration under Indian Trusts Act, 1882

- Schedule (registration application attest with a court fee INR 100)

- Trust deed of requisite value on a stamp paper.

- Declaration by all the trustees along with their signature.

- Letter of consent by the settlor attest with a court fee INR 10/.

- Identification proof of all the settlors and witnesses along with passport size photographs.

- Gas, electricity, or water bill of the registered address.

- No Objection Certificate (NOC) from the owner of the property (trustor).

- Settlor’s signatures on every page of the trust deed

Important Note on the foundation of Trust in India

It should be noted that the minimum of two persons can lay down the foundation of the Trust via trust deed. The trust deed is demonstrated on the non-judicial stamp paper that worth 4% of trust property valuation. Such documents seek the approval of the charities commissioner in the state of Gujarat and Maharastra. The individuals from the other states need to approach the registrar to serve this purpose. The trust deed demonstrates the trust’s intention, objective, and regulations. Well, that’s all about the Trust and Documents required for trust registration.

Conclusion

In general, you don’t need to arrange a large pile of documents to register a trust. The amount of documentation required in a trust registration is relatively lower than other forms of registration. Also, the process of trust registration is not stringent, either. The parties interested in setting up a trust should clearly define the role and responsibilities to avert future conflicts. CorpBiz shall be happy to serve you in case you need any assistance in the process of Trust Registration. Our professionals would ensure your seamless process at a minimum cost.

Read our article:Know the Advantage of Trust Registration in India