If you are on the verge of launching a new online business, you must probably be grappling in setting up the best payment transaction modes. Payment aggregators and payment gateways are the two terms that are widely used in the online business landscape. Although they sound intrinsically similar, they differ on several grounds that we will reveal in this article. This write-up packs all the detail pertaining to Payment Aggregator and Payment Gateway.

What is the Payment Gateway?

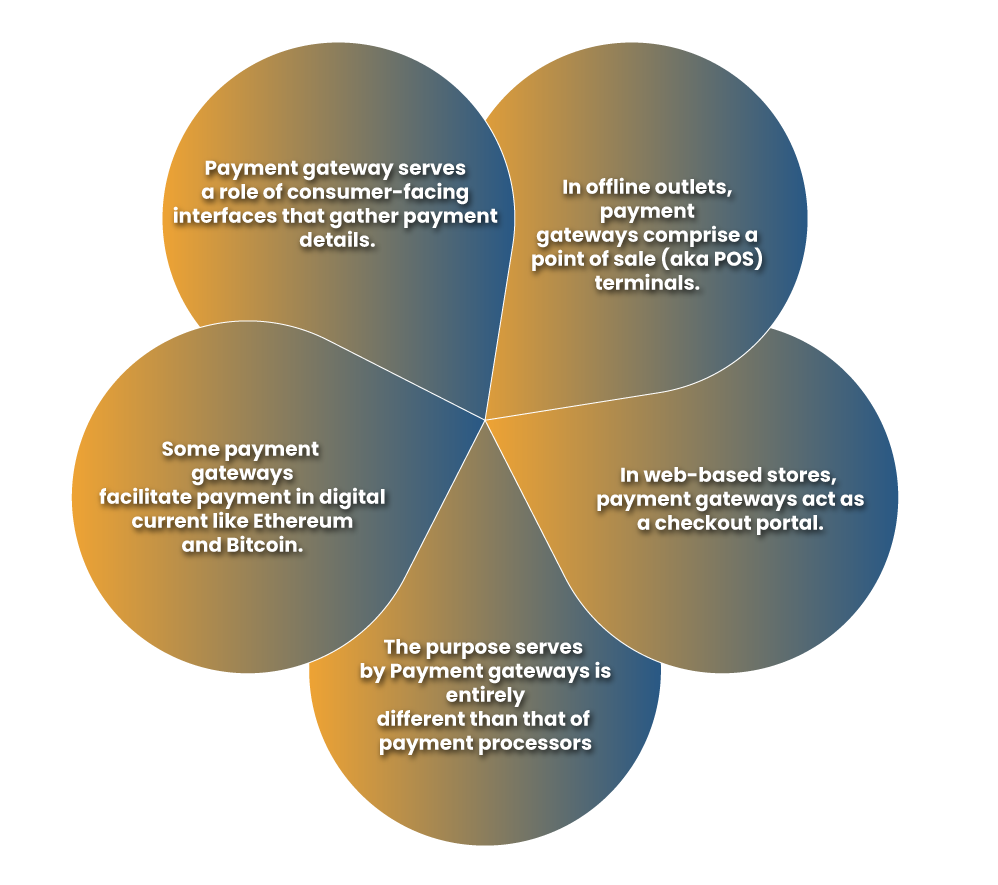

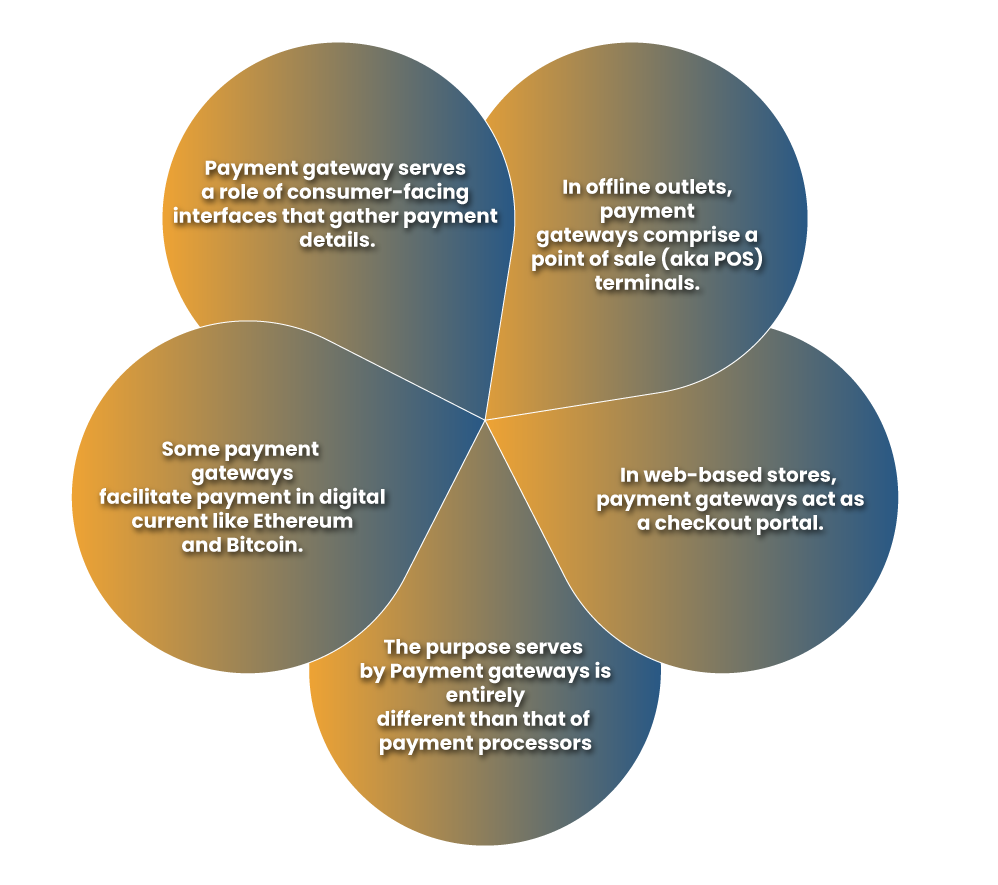

In general, the term “payment gateway” refers to a software service that enables web-based businesses to process payment transactions on their portal. They enable payment acceptance via several modes, including net banking, debit/credit cards, e-wallet and Unified Payment Interface, aka (UPI).

Read our article:RBI Issues New Guidelines for Payment Aggregators

Key Takeaways regarding Payment Gateway

What is the role of the Payment Aggregator?

A payment aggregator also referred as merchant aggregator, is a service provider that aggregate & facilitate payment acceptance services to the merchant. One primary difference between an aggregator and a gateway is that the latter is predominately used in the online business regime; meanwhile, the former digitizes online &/or offline payment touchpoints.

A payment aggregator provides end-users with any transaction, including digital payment modes & recording of cash and cheque or offline touchpoints (at billing store, kiosk, anywhere in-store, in-field and remote SMS-based payments). Further, it empowers merchants to accept all types of payment modes without arranging independent accounts with banks or with each card company or payment service provider.

Fundamentally, a payment aggregator performs the complex task of integrating with all payment providers to facilitate a single solution for all payment acceptances.

By utilizing the payment aggregator’s services, you can gain all forms of payment acceptance, including QR codes, credit/debit cards, Aadhaar pay, UPI, net banking, bank transfer, SMS payments, e-wallet, cash and cheque under one interface.

Key Differences between Payment Aggregator and Payment Gateway

The Payment Aggregator and Payment Gateway differ on several grounds, as explained in the table below:

| Parameter | Payment Gateway | Payment Aggregator |

| Role | Intermediary | Interface |

| Touchpoints Digitized | Online touch points including Mobile App/Website | Online &/ or offline touch-points |

| Payment Options | Limited | Numerous |

| Integrated Solution | Yes | Yes |

| Payment Success Rate (PSR) | Depends on managerial capabilities of payment gateway | Considerably higher payment success rate |

| Ownership | Owned by public & private banks, vendors, merchants, & payment aggregators | Owned by Fintech entities |

| Permissions | RBI validation under the Payment & Settlement Systems Act, 2007 (PSSA) | Payment aggregator is mandated to avail the requisite certification as per the Payment Card Industry Data Security Standard (PCI-DSS) |

The following section will dig deeper into a few more details that draw a line of distinction between Payment Aggregator and Payment Gateway.

Role/Function

A payment gateway serves as a transaction mediatory between merchants & consumers for the payment of goods/services being purchased online.

A payment aggregator act as an additional layer of an interface that enables any type of transaction across offline &/or online touchpoints.

How does Payment Aggregator and Payment Gateway operate?

A payment gateway is outfitted with an interface that administers data relating to payment transactions at the front end. Coming to the back end, the Payment Gateway syncs with a bank aiming to issue merchant accounts. Therefore, in such scenarios, authorizing banks are mandated to manage the underwriting & fund transfer process for various merchants intending to open accounts to process payments.

Payment aggregators possess the ability to dig down the underwriting process of the acquiring bank & process payments utilizing either the same MID (Merchant Identification Number) or different MIDs.

Payment Options

In India, a payment gateway enables merchants to utilize a few & limited payment alternatives hosted on the mobile app/website.

A payment aggregator facilitates various payment options encompassing, Unified Payment interface, debit/credit cards, net banking, SMS-based, biometric-enabled transactions, QR codes, SMS-based, cash and cheque.

Frequently Asked Questions regarding the Payment Aggregator and Payment Gateway

Here are some generalized queries often encountered by the end-users while comprehending the notion of web-based payments.

What is a payment gateway with example?

A payment gateway is broadly referred to as a web-based payment service that is synched with an e-commerce avenue as the platform to make & receive payments. The procedure for receiving payment includes the consumer needing to provide some information such a card no, CVV, and expiration date.

Is Visa a payment gateway?

Credit card networks operate in tandem with payment processors to provide coordination between merchant & issuing bank They are also liable to set interchange & assessment fees. American Express, Visa, Master Card are the widely known credit card networks.

What is the difference between a payment gateway and a payment processor?

The payment gateway usually serves its purpose at the beginning and end of the transaction, where end-users will provide their credit card[1] details & receive consent or rejection of the transaction. The payment processor keeps moving and processing the information between the consumer’s bank & the merchant acquirer until the transaction is completed.

What is a payment aggregator example?

In simple words, Payment Aggregator comprises a collection of different payment gateways. The service provider would sync with multiple options for electronic payments, i.e. different payment gateways & bringing them under one hood. Billdesk and Instamojo are the two popular examples of payment aggregator services.

Is UPI a payment aggregator?

The traditional payment channels through which a payment aggregator accepts payments could be debit, credit cards, wallet, UPI, etc. Payment aggregators serve the role of intermediary that bridges the gap between the payer (customer) and the payee (merchant).

Conclusion

It is clear that Payment Aggregator and Payment Gateway serve different purposes. The payment gateway largely works as an inlet for accepting online payment, and it has nothing to do with the processing part. Whereas the Payment aggregator seeks to club various payment gateway under one hood, enabling it to facilitate various payment options encompassing, Unified Payment interface, debit/credit cards, net banking, and so on.

Read our article:Overview of Payment Gateway License in India