Small businesses can be considered as the backbone of India’s growing economy. There are 50 to 60 million micro small and medium enterprises (MSMEs) over there in India. MSMEs are employing around 110 million individuals where its significant subsidising GDP, exports, and employment, digital lending under MSMEs played a vital role in the nation’s growth.

Digital Lending under MSMEs is a process in which the loan can grant to the borrowers by using electronic media. In other words, it can be considered as all mechanism of lending is to be done by the digital medium. It involves the use of online technology to provide a loan to customers. Digital lending under MSME can be an online loan application offered by banks or credit unions on their website to better of their customer satisfaction.

Crisis of Restraining the Covid 19 Spread & Economic Instability

MSMEs mean for Micro Small and Medium Enterprises, The ministry of MSMEs regulated by the Government of India and the Micro, Small and Medium Enterprises Development (MSMED) Act[1], enacted by the Government of India on dated 16th June 2006. The Definition of MSMEs is further divided into two broad categories. As the world under the reels of the Covid 19 pandemic situation, India is facing with twin crisis of restraining the Covid 19 spread & economic instability.

In 2019 MSMEs have devoted its 29 % income for the national GDP and the Indian Government has the determination to increase the MSMEs sector subsidizing up to 50 percent income in the next coming years. While the MSMEs were considered production drivers of the Indian economy, the worldwide pandemic effect of Covid 19 & consequent stoppage of economic activities triggered concern across the nation.

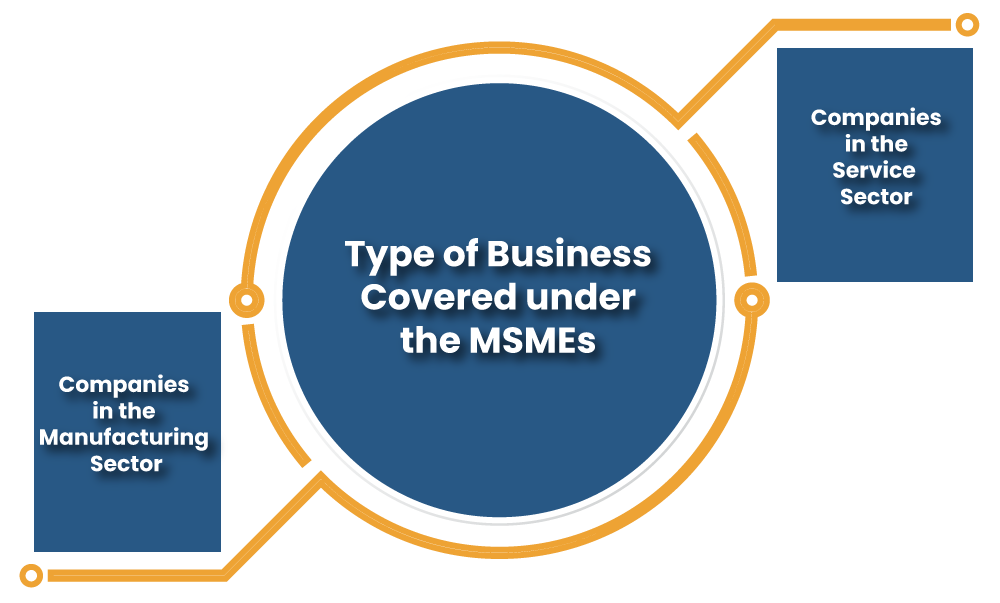

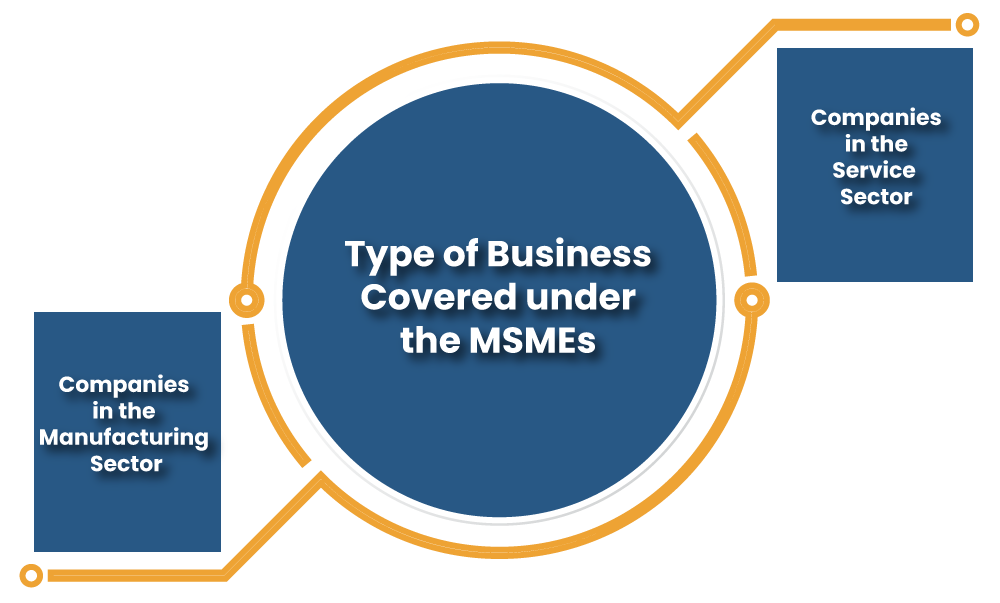

What Type of Business Cover under the MSMEs?

The broad categorization of business cover under the MSMEs is as follows:

Companies in the Manufacturing Sector

Industries involved in the manufacturing of goods or production of goods industries mentioned in the first schedule of Industries (Development & Regulation Act) 1951 are included within the purview of the MSMEs.

Also, enterprises employing plant & machinery to increase the worth of finished product that comes out with a distinct name, use or character covers under the scope of micro small & medium enterprises meaning. As per their annual turnover, the enterprises are classified under the subcategories are as follows.

- Micro enterprises – Companies whose annual turnover does not exceed more than Rs.5 crore.

- Small enterprises – Companies whose annual turnover remains between Rs.5 crore and Rs.50 crore.

- Medium enterprises – Companies whose annual turnover remains between 50 crore and Rs.100 crores.

Companies in the Service Sector

The effect of MSMEs also extends to enterprises in the service sector. The sub-categorizationof MSMEs in the service sector basis on their annual turnover are as follows:

- Micro Enterprises – Companies whose annual turnover under Rs.5 crore.

- Small Enterprises – Companies whose annual turnover remains from Rs.5 crore and Rs.50 crore.

- Medium Enterprises – Companies whose annual turnover remains from Rs.50 crore and Rs.100 crore.

Overview on Digital Lending In MSME in Consonance with Transforming Fintech

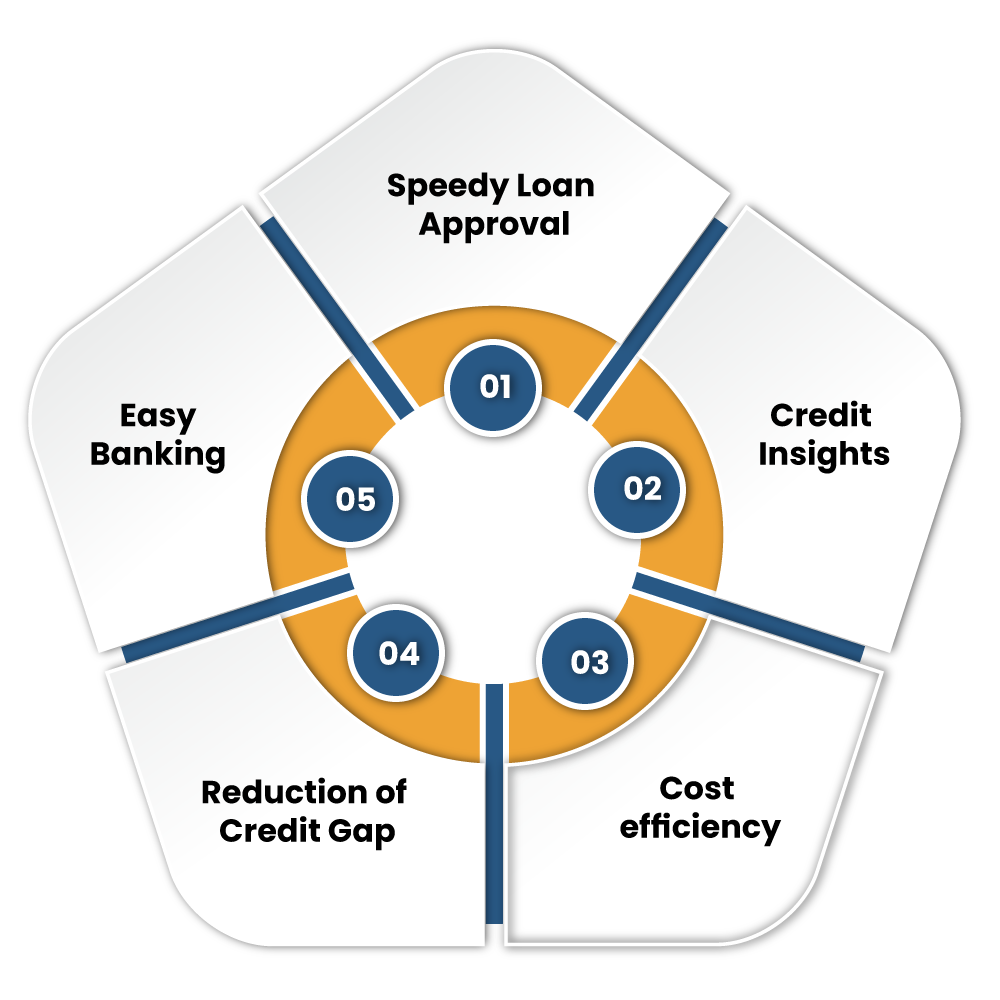

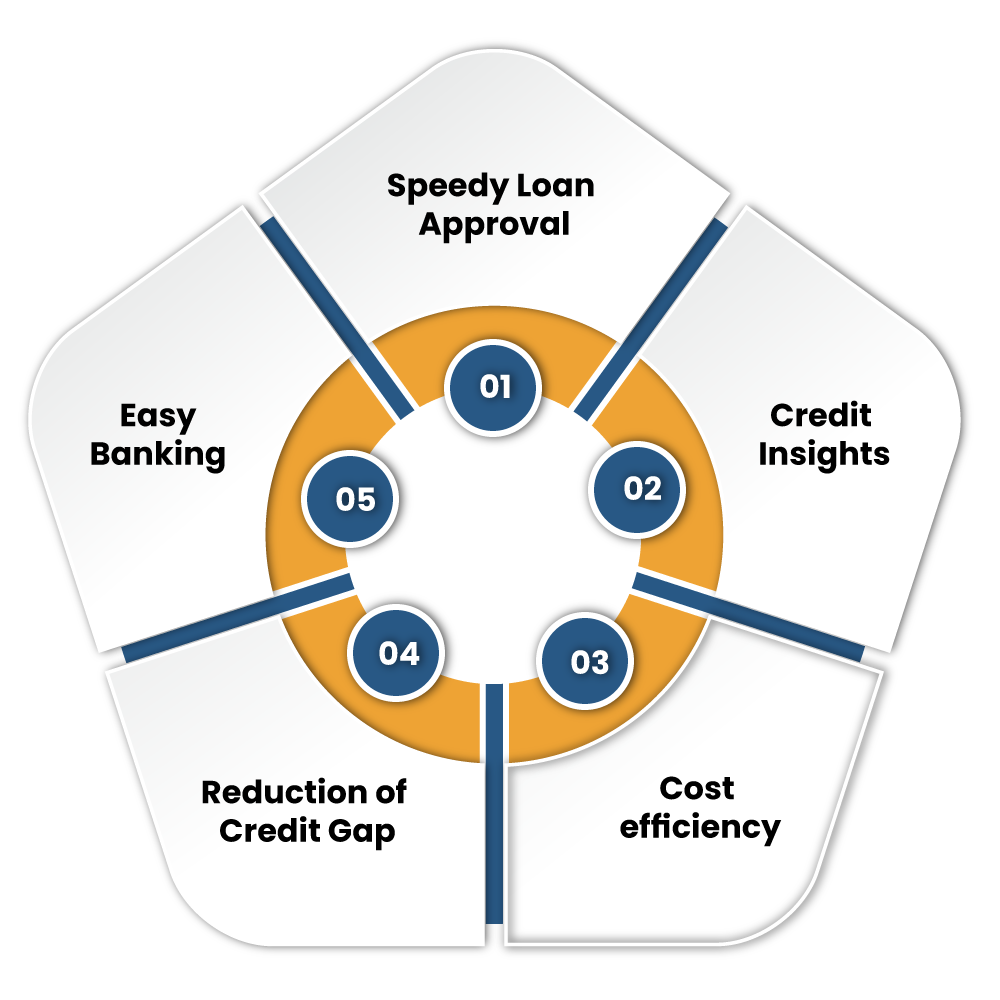

Digital lending and fintech are transforming the structure of the MSMEs in India. Banks have started to move fast to ratify the digital ecosystem and automate the backend process to reap the short-term and long-term benefits. The end-to-end digitization will reinforce the bank in compressing turnaround time for decisions and diminish the processing cost involved in these units. This shall give not only timely access to funds but also decrease the cost of the loans.

Given the ongoing challenge & restrictions of physical loan disbursements due to the spread of coronavirus, Digital lending under MSME will convince the safety of staff & customers from the Covid-19.

The Potential of Digital Lending Under MSMES Rejuvenation

The Indian Government announced the various steps for the revitalization of the MSMEs sector, In May 2020; Finance Minister Nirmala Sitharaman publicized six COVID-19 relief measures to make MSMEs ‘Aatmanirbhar’ (self-dependent).

Why Digital Lending Is Considered As A Game Changer For MSMEs?

The Government standardized the bank to support the government’s schemes for the betterment of stress MSMEs such as Credit Line Guarantee (ECLG). The Government has supervised the public & private sectors to offer help and to precipitate the volume of financial support required to stretch out the businesses from facing a huge economic crisis. The whole lending & financial ecosystem needs to uphold the MSMEs with agile credit solutions for a macroeconomic impact.

In the present scenario, digital lending by fintech players can undoubtedly benefit MSMEs to emerge out of the crisis & aid in India from the recovery of pandemic Covid 19 situation. A line of credit will aid MSMEs to get access to agile capital, especially as the fund cycle rattled either by supply-chain wreckage, labour issues, or adverse cash due to the movement of national lockdown imposed by the Indian Government.

Why Is Digital Lending Growing Fast Among The MSMEs?

The Indian government has given the serenity access and a smooth process of securing loans due to this Digital Lending under the MSME growing fast compared to the traditional source of lending.

There was a time when the loan application was determined traditionally based on several financial information and documentation like tax returns, credit report, bill payment, etc. Still, after the digital lending, the digital lender can quickly analyze the loan & the interest rate for which the borrower is eligible or not.

As compared to the precise sources of data like bank statements, ID cards, the lender can calculate the borrower’s financial history by evaluating the person’s habits. Moreover, with the help of “Artificial Intelligence,” digital lenders can investigate the borrower’s economic history more efficiently.

What Are The Devoting Aspects Of Digital Lending Under MSMEs?

The devoting factors for digital lending under MSMEs are that have used for reiterate are as follows:-

- MSMEs are digitizing their operations and their credit acquisitions quickly;

- 75% of MSMEs allocating data digitally and;

- 47% of MSMEs handling digital tools for accounting, payment, or sales purposes.

- Credit chain value is digitizing; therefore, MSMEs can have access to funding.

Conclusion

Every coin has two sides like that every process has its merits as well demerits. It depends on how we are using it. Indian economy is supposed to reach on giant stalked leading within the coming years, and MSMEs are ready to create a symbolic mark towards accomplishing that.

Digital lending can be profitable for MSMEs in both sectors as well as for customers. It is expected from a traditional money lender to adopt the digital lending process efficiently and use the new technology to decrease the rate of interest. Digital lending requires less expense, and establishes the documentation in an automated and modernizes the way follow-ups are conducted with the borrowers. You may kindly associate with a Corpbiz expert, if you want to learn and get assistance on Digital Lending under MSMEs.

Read our article: An Outline on the Prominent Challenges faced by the MSME in Our Country