The Indian Government has decided to extend the credit allotment tenure under the emergency credit line guarantee scheme, aka ECLG scheme. The decision comes as a huge relief for the credit seeker dealing with a financial crunch due to the ongoing pandemic. It would also attract more borrowers to obtain credits during the festive season.

According to the Finance Ministry, the ECLG scheme will now remain accessible till Nov. 30 or until the entire disbursement of the 3 lakh crore stimulus package. The ministry also added that as of now, Rs 2.03 lakh crore has been approved by the financial institutions to 60.67 lakh borrowers. Out of the aforesaid figure, only 50% of the amount has been disbursed to the credit seekers to date.

About the Emergency Credit Line Guarantee Scheme (ECLG)

ECLG scheme was deployed by the government in wake of COVID 19 as a relief package for small companies under the Aatmanirbhar Bharat Mission. The scheme aims to render a fiscal cushion to the MSMEs affected by the Covid-19 pandemic. As per the RBI’s[1]statistics between the period of March and Sep 2020, a considerable number of entities took benefits of the scheme resulting 13.85% hike in credit.

Who all are the Major Beneficiary of the Scheme?

Accessibility of the scheme was limited to the entities with credit outstanding up fifty crores, as of February 29, 2020, & yearly revenue of up to Rs 250 crores. At the time of the launch of the scheme, the interest rate was stood at 9.25% for banks and 14% for private lenders. The maximum tenure per loan was capped at 4 years including the one year moratorium period.

What is the Government’s Takes On the Decision

According to the ministry – As the various sectors are gradually coming back on track and the festive season is around the corner, the extension of the loan guarantee scheme will help the sector to meet the sudden spike in and attract more borrowers. As per the report of the National Institute of Bank Management, the ECLG scheme has provided immense relief to the affected entities by rendering timely funding support to initiates the recovery phase. The scheme also helped the entities to addresses the urgent financial obligations that seek prompt attention. But on the flip side, the scheme has been bashed for its obvious disparities like cramped loan amounts and excessive documentation.

How’s the ELGS Scheme Performed Until Now?

While 72% of respondents getting 59% share of the ECLGS belong to micro-units, 9% of respondents with 21 % share of the disbursed credit were from the small entities, meanwhile, only 2% of respondents with 6% share of the disbursed amount were from medium scale enterprises.

Furthermore, in terms of disbursed amount, only one percent of applicants avail over ten lakh rupees amount which was 16.2 % of the 100% disbursed amount. Similarly, 4% of applicants obtained loan between Rs 5 lakh and Rs 10 Lakh – 20.2 % of the disbursed amount, 27% of the applicant availed credit between Rs 1 lakh and Rs 5 Lakh- 47.9% of the disbursed credit, 18% obtained loan between Rs 50,000 and Rs 1 Lakh which was 10.4% of the total amount.

According to the Finance Ministry, banks have approved Rs 1,87,579 crore loans to 50.7 lakh MSMEs out of which around 26 lakhs businesses were disbursed with Rs 1,36,140 crore loans in October.

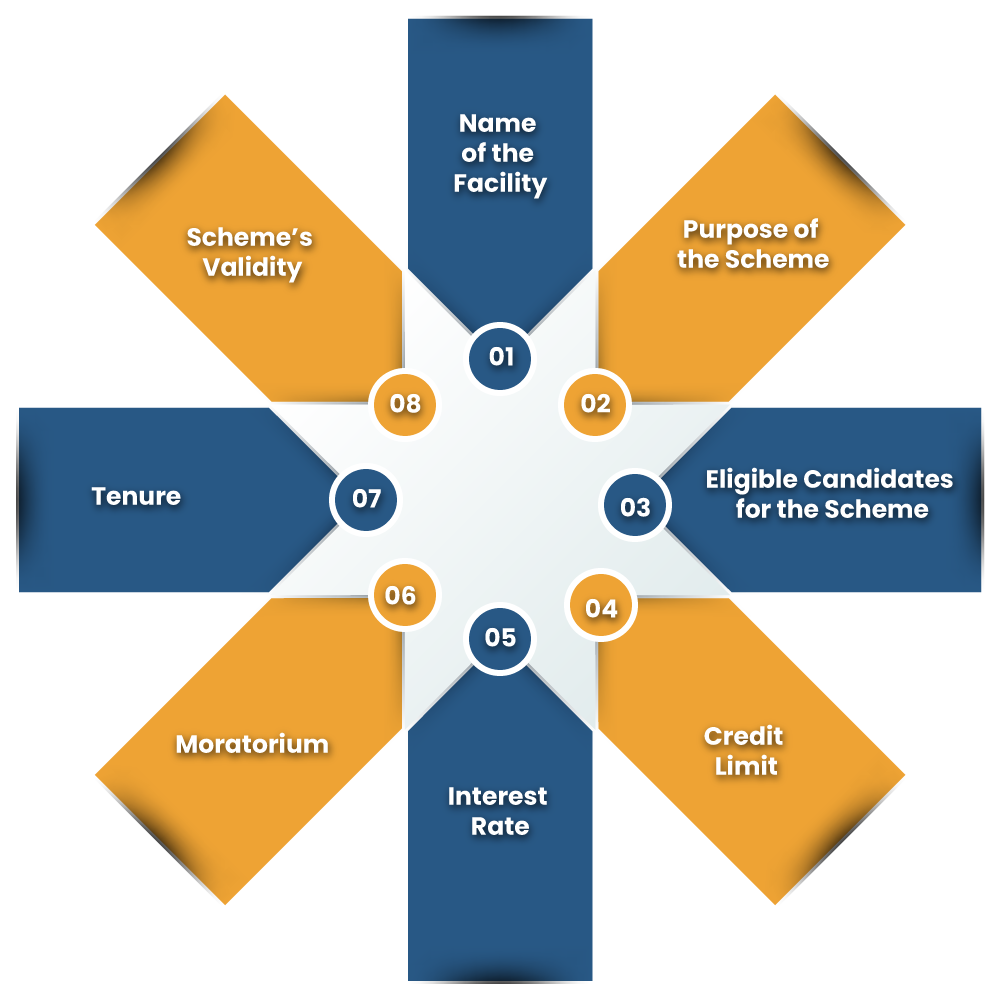

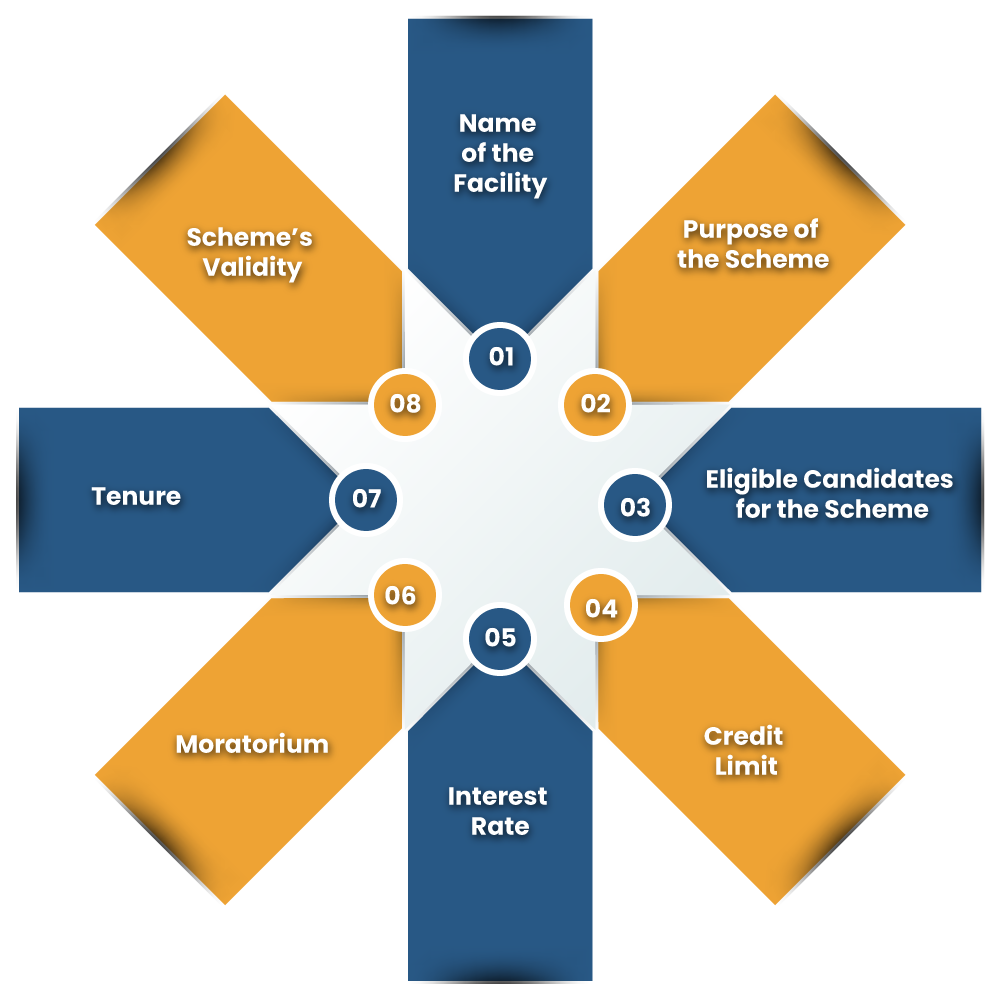

What are the Key Attributes of the ECLG Scheme?

Following are the core features of the Emergency Credit Line Guarantee Scheme (ECLGS). The scheme was launched in May to overcome the economic distress created by the COVID 19.

Name of the Facility

Emergency Credit Line Guarantee Scheme (ECLGS) is referred to as a credit product for which a guarantee is being rendered under the scheme.

Purpose of the Scheme

The Scheme aims to diminish financial adversity created by the COVID 19 pandemic. It seeks to render additional fiscal aid, thereby allowing MSMEs to address the operational liabilities.

Eligible Candidates for the Scheme

MSMEs which are constituted as Partnership, Limited Liability Partnership, Proprietorship, and Registered Companies were eligible to avail of the scheme.

Credit Limit

The credit limit stands at 20% of the borrower’s total outstanding amount.

Interest Rate

The rate of interest has been capped at 14% during the entire tenure.

Moratorium

A moratorium period of one year has been provided on the principal amount.

Tenure

4 years from the disbursement date.

Scheme’s Validity

The scheme is applied on all loans approved under the Guaranteed Emergency Credit Line.

Conclusion

The ECLG scheme was launched at the time when the majority of the sector was left overwhelmed due to the COVID 19 pandemic. The nationwide lockdown has even forced many entities to close down their establishment for months. The government tried to curb the aftereffect of the pandemic by releasing a loan guarantee scheme for the MSMEs. The way government handles the financial turbulence created by the COVID 19 pandemic is nothing short of an outstanding accomplishment. The recent announcement indicates that government is proactive enough to encounter ongoing economic adversity.

Read our article: What are the Positive and Negative Factors of the Implication of GST under MSMEs?