There are two very new concepts in the changing scenario of corporate law in India. The first is OPC which stands for One Person Company, and other is LLP which stands for Limited Liability Partnership. The concept of LLP is a modern form of Partnership firm with the advanced features of the company. The Limited Liability Partnership is governed by the Limited Liability Partnership Act 2008, which state any corporate and incorporate body establishes under this act is limited liability partnership.

On the other hand, the One Person Company is a new concept introduced under the Companies Act 2013[1]. According to section 2(62) of the act states when one person is a member, it will be one person company. The advantage of OPC is it’s a company run by a single person. The key differences between OPC and LLP are shown below:

Difference between OPC and LLP

|

Points of Difference |

One Person Company |

Limited Liability Partnership |

|

Applicability |

The One Person Company is incorporated by the provisions of the Companies Act 2013. |

The Limited Liablity Partnership is incorporated by the provisions of the Limited Liability Partnership Act 2008. |

|

Registering Authority |

The registrar of the company (ROC) is the registering authority for the company. |

The registrar of the LLP is the registering authority for the LLP |

|

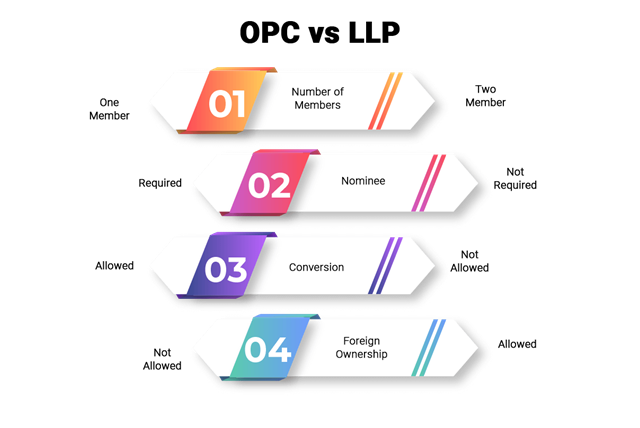

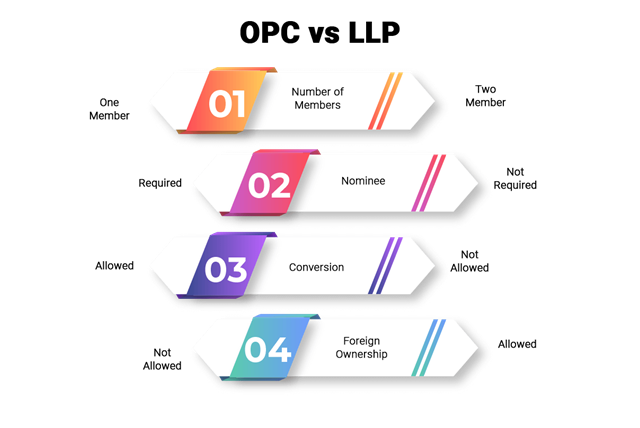

Number of members |

The numbers of members to start a One Person Company is only one. It is necessary to appoint a nominee in case of OPC. |

The number of members required is two for the incorporation of the LLP, but there is no maximum limit in LLP. |

|

Minimum Capital |

Earlier minimum paid-up capital requires Rs 1Lakh to start a Company. After the amendment in 2015, there is no minimum capital required for incorporation of OPC. |

In the case of LLP, no specific minimum paid-up capital required. |

|

Compliances |

In OPC, the statutory compliances costs are more. It required to maintain compliance as per the Income Tax Act and the Companies Act. |

In LLP, the statutory compliances costs are less. |

|

Penalty on non-compliance |

Up to 1 lakh |

Up to 5 lakhs |

|

Audit Requirements |

For the One Person Company, auditing is must irrespective of the amount of the share capital. |

When turnover exceeds Rs 40 Lakhs in LLP, the auditing is required or in the case when a capital contribution is above Rs 25 Lakhs. |

|

Conversion |

The conversion of OPC is allowed to a Private Limited Company after 2 years of incorporation. |

The conversion of LLP is not allowed in this case. |

|

Inheritance of Entity |

The OPC also has the separate legal entity but requires the nominee at the time of incorporation. |

The LLP has the separate legal entity as well as perpetual succession. |

|

Taxation Benefit |

1.Wealth tax is charged at 1%, and the surcharge is applicable. 2.A loan to the director is taxable. 3.No uniformity in the rates of minimum alternative tax. |

1.Surcharge and the Wealth-tax are not applicable . 2.A loan to partners is not taxable. 3.There is uniformity in the rate of minimum alternative tax. |

|

Transferability |

There is only one shareholder In OPC; therefore, shares are not transferable. However, the transfer of shares can be done after an amendment in AOA. |

By making a written agreement before the notary public in the case of LLP, the shares can be transferred. |

|

Dissolution |

The closure is done when the individual company shareholder is not active. NOC is obtained from the creditors before winding up of OPC. |

The LLP liquidator is appointed to file the copy of the order to Tribunal with the registrar for LLP’s winding up. |

Read our article:One Person Company Vs. Sole Proprietorship: What is the difference between Sole Proprietorship and OPC

Advantage of OPC

In the Companies Act 1956, there were two types of companies incorporation one was a public limited company, and the other one was a private limited company. The major hurdle was to incorporate a private company, there was a requirement of a minimum of two members, and for the incorporation of a public company, there was of a minimum of seven members required.

To overcome the problem, the private companies started appointed two-person in which one was a nominal director, which was made in the namesake and doest not take part in the business of the company. In this manner, the law was bent according to the needs of the business person. This practice was being monitored and a proposal for the One Person Company.

The legislature placed the incorporation of OPC in the Companies Act 2013, under section 3 there is the formation of One Person Company. The advantage of OPC is the individual can monitor the check and balances of the company. The advantage of OPC is also now a new entrepreneur can start his own choice of business, trade and commerce. The OPC is a modern concept of the Sole Proprietorship, and the features of a private company and hence the advantages of OPC are more.

Similarities between LLP and OPC

Despite many differences, there are also some similarities between the Limited Liability Partnership and the OPC to some extent. Both the Limited Liability Partnership and OPC have the separate legal entity than of its members and partners. Also, both LLP and OPC have perpetual succession, which means it does not affect the existence of LLP and company in case of death, bankruptcy, exit, transfer, etc. of the partners or members.

The capital is raised privately from shareholders or partners in OPC and LLP as it cannot be raised or borrowed from the general public. In the OPC and LLP both, a member or a partner is liable for his actions only to the liability extent of his contribution to the capital.

Takeaway

LLP registration & OPC registration have their benefits. However, one can start its business through OPC registration, as there are many advantages of OPC. Later, one can convert their OPC into a private company as in long run company registration is more beneficial. The LLP registration also has its benefits as two-person together start the LLP. We at Corpbiz help you in OPC registration and LLP registration, as well as post incorporation compliance services.

Read our article:Advantages of LLP (Limited Liability Partnership) over Private Limited Company