DVAT Act is made to consolidate and amend the law related to levy of tax on sale of goods, transfer of right to use goods, transfer of property involved in execution of works contracts, and entry of motor vehicles by way of introducing a value added tax regime and file revised returns under DVAT in the local areas of National Capital Territory of Delhi.

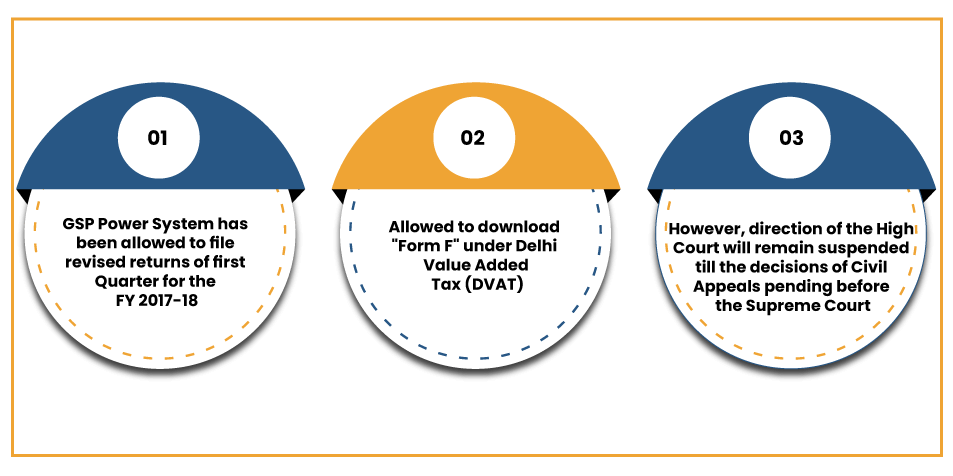

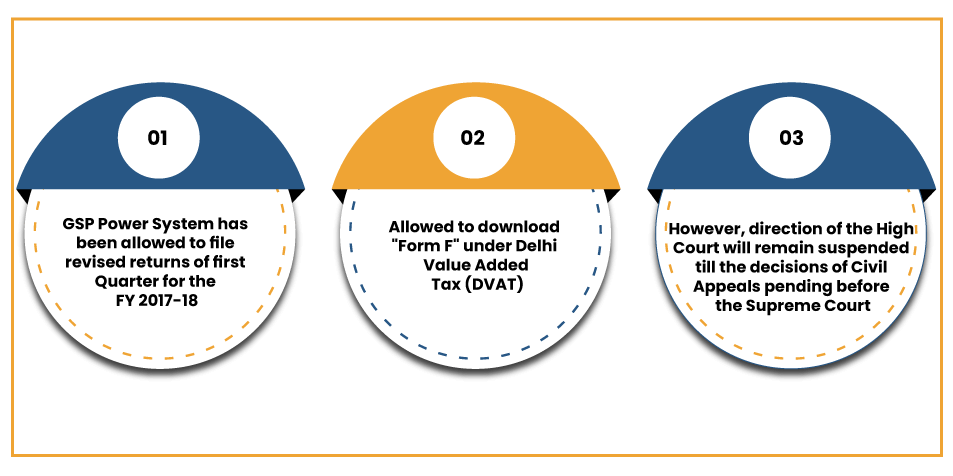

According to Section 26 of DVAT Act, every registered dealer is liable to pay tax under this Act has to furnish such returns to Commissioner for each tax period and by such dates as may be prescribed. However, the Delhi High Court has allowed the GSP Power System (petitioner) to file revised returns under DVAT and also to download “Form F” under Delhi Value Added Tax (DVAT). In the mention case the petitioner, GSP Power System has failed to mention the details of Inter-State branch transfers for a first quarter of Year 2017-18 in a Form 2A uploaded on Delhi Value Added Tax website while filing the returns.

The division judge bench of Justice Manmohan and Justice Sanjeev Narula has directed respondent authority for allowing an amendment which is sought by a petitioner in its return of first Quarter for the FY 2017-18. However, the court said that this direction will remain suspended till the decisions of Civil Appeals pending before the Hon’ble Supreme Court and this direction will abide by the decision that the Supreme Court renders.

Key Highlights of the Order Passed

GSP Power System Pvt. Ltd. Vs Commissioner Of Goods & Services Tax Department Of Trade And Taxes & Anr. (High Court of Delhi) W.P. (C) No 7411/2020

In this case, petitioner seeks the direction to respondent authorities for allowing the petitioner’s revision of returns for the financial year 2017-18 in accordnace with the provisions of DVAT Act and Rules. High Court has stated that no useful purpose would be served by keeping this petition pending. Consequently, the Court has directed a respondent to allow an amendment sought by a petitioner in its return of first Quarter for the FY 2017-18.

What contentions have been made in regards to File Revised Returns under DVAT?

The contentions made before the Delhi High court for revised returns under DVAT are as follows:

- This petition has been listed before the Bench by a Registry in view of the urgency expressed therein and the same has to be heard by way of video conferencing.

- The writ petition has been filed challenging the rejection made by respondent authorities of the petitioner’s request for correcting the return filed for first quarter of FY 2017-18 and for the refusal to give statutory forms under the Central Sales Tax[1] (Delhi) Rules.

- The petitioner seeks a direction to respondent authorities to allow the petitioner’s revision of returns for the FY 2017-18 in accordance the provisions of DVAT Act and Rules.

- The Learned counsel for a petitioner states that petitioner has failed to mention details of Inter-State branch transfers for first quarter of FY 2017-18 in a Form 2A uploaded on the Delhi Value Added Tax (DVAT) website while filing GST returns. Further he stated that the petitioner has requested the respondent to grant permission to revise the returns but the request was rejected by the respondent.

- The petitioner has stated that he requested the respondent authority for granting permission to revise returns under DVAT but they rejected the request. The petitioner has pointed out that an action of the respondent authority for not allowing revision of details of requirement in form ‘F’ is perverse in law, by adding further that it is contrary to provisions of the DVAT Act & Central Sales Tax (Delhi) Rules that permit issuance of forms.

- The petitioner has relying upon a judgment of this Court in WP(C) No.8709/2018 where the Court has directed a respondent to release the concerned Form ‘F’ within 2 weeks. It has been pointed out that SLP preferred against the said judgment has been admitted and also the matter is pending before the Hon’ble Supreme Court.

What are the Contentions have been made by the Respondent?

- On other hand the learned Additional Standing counsel for the respondents submits that a decision of this Court in the M/s. Ingram Micro India Pvt. Ltd. v Commissioner DT&T & Anr has been under challenge before the SC and the Supreme Court has granted leave in a said matter vide order dated 27th March, 2017. He has also pointed out that the Court rendered decisions in several similar cases, including, M/s. Indian Oil Corporation Ltd. v. Commissioner, VAT decided on 11th April, 2017, that have been appealed against in the SC and the Supreme Court has stayed the operation of the judgment of this Court.

- The counsel of the respondent has pointed out that in light of the interim orders passed by the SC, while deciding another writ petition i.e. Ingram Micro India Ltd. v. Commissioner, Department of Trade and Taxes and Anr., decided on 04th December, 2018, the Court issued directions for an issuance of segregated and separate Form C. However, directions issued by this Court were suspended till Civil Appeals before the Supreme Court were pending.

- The respondent contends that this Court has recently in similar matters been either adjourns the matter or allowing a petition but suspenda the relief till the civil appeals are pending in the Supreme Court are decided.

What High Court have Pronounced?

- After hearing both the sides, a High Court has the view that no useful purpose would be served by keeping a petition pending. Consequently, the Court directs the respondent to allow the amendment sought by a petitioner in its return of first Quarter for the FY 2017-18. However, this direction will remain suspended till the Civil Appeals pending before the Supreme Court are decided and this direction will abide by the decision that the Supreme Court renders.

- Exemptions are allowed in subject to all exceptions. With an aforesaid direction, present writ petition and pending application stands disposed of.

Conclusion

GSP Power System has been allowed to file revised returns under DVAT of first Quarter for the FY 2017-18 and to download “Form F” under Delhi Value Added Tax (DVAT). However, direction of the High Court will remain suspended till the decisions of Civil Appeals pending before the Supreme Court.

Read our article: GST Return Filing Procedure – Types of GST Returns, Due Date and Penalty