The contribution of Small and Medium Enterprises (SMEs) towards the nation’s growth is nothing short of monumental. Undeniably, it is one of the most vibrant & dynamic sectors of the Indian economy. But monetary constraint is a major deterrent to this sector and that’s why they often find themselves at financial avenues and NBFCs looking for fiscal aid. Credit score plays a vital role in determining their worth for obtaining a loan. Almost all financial institutions consider credit score as the key parameter for measuring an individual’s worth to repay the loan.

Banks and private lenders leverage several parameters for the calculation of business credit scores. These include credit utilization ratio, payment ratio, company size, length of credit history, public records, and industry risk. A higher score implies that the business is good at its finances and therefore fits enough to avail of the loan. Albeit maintain a good credit score is not easy, it will certainly aid you firm in the long run.

Why it is important to maintain a good credit score?

As an SME’s owner, if you have ever been rejected for a loan, the most likely reason is that you have a low credit score. Having a good credit score laid the foundation for credit facilitation. Unlike personal credit scores, the business credit report can be accessible to key consumers, partners, and even vendors. The credit score is the implication of your financial stability as well as credibility.

Read our article:How MSME Registration Can Ensure Business Growth?

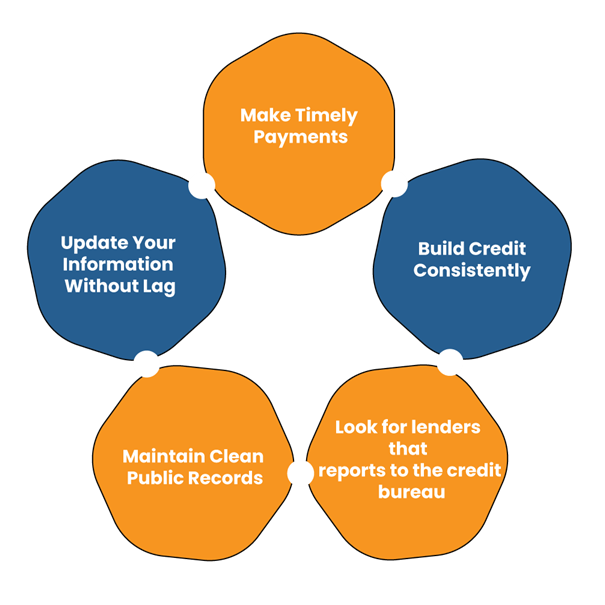

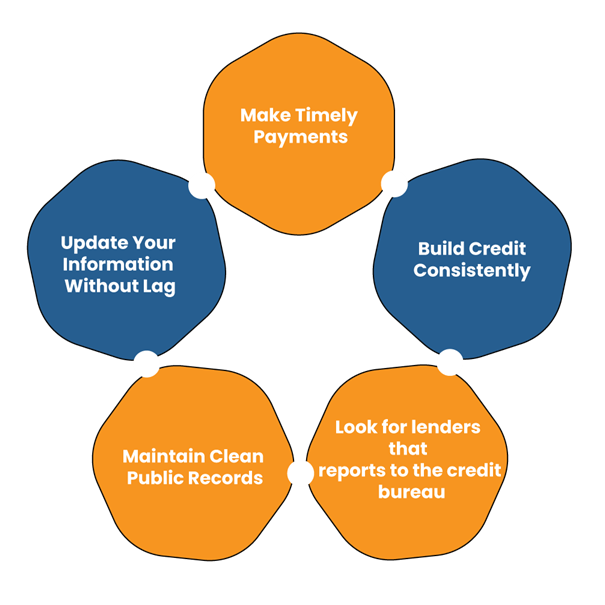

Tips for maintaining an ideal credit score

The following section entails some productive tips that will help you maintain an ideal credit score for your business.

Update Your Information Without Lag

At present, we have numerous credit bureaus present in our country that periodically access firm’s fiscal data to create credit reports. Every bureau leverage a different approach for computing a credit score. Therefore, the report may vary from bureau to bureau. Since it ispractically impossible to predict the identification protocol of these bureaus, it’s ideal to maintain optimal records across all bureaus.

You can update details such as the number of years in operation, financial statements, and workforce info from time to time. Updating the said parameters can help your firm avoid a bad credit score.

Make Timely Payments

Albeit untimely or late payment isn’t new for any organization, it has a lasting impact on the credit score. Every firm ought to keep its account payable on the positive side. That means companies must prevent holding due payment of their vendors or suppliers for long as it can undermine the quality of their credit score.

Build Credit Consistently

Brief and long credit history is a good indicator of a firm’s financial[1] prowess. That is the reason why it is considered an imperative ground by many bureaus for creating a credit report. Do take credit utilization ratio into account for building credit. Credit utilization is another important parameter that most bureaus considered; thus, it is a good idea to regularly use your credit cards up to their predetermined limit.

Look for lenders that reports to the credit bureau

Your payment history is something that could either make or break your credit report. But, if you avail credit from an institution that does not report to the credit bureau, it won’t have any positive impact on your credit score. If building credit is your ultimate goal behind any credit obtainment then make sure that your lender reports to the credit bureau.

Maintain Clean Public Records

In addition to the credit history, the business credit report shall also possess any public records filed in your business’s name. These records may entail liens, bankruptcies, & judgments. A court ruling judgment against you in a debt collection lawsuit will have a drastic impact on your credit score. Any negative impression on your rating could leave your business with reduced credit options.

Is there any solution exist to right these wrongs?

It’s a well-known fact that defaulting on a loan is not good from any aspect for the business. While building a good credit score takes a little time, here’s a listicle of solutions you can try to shift your finances on the positive side.

Reconcile with the Lender

If you have failed to repay certain installments due to an unexpected fiscal crisis, you can visit your lender and conclude an agreeable agreement. This could include reducing your payment in exchange for a higher interest rate over time or simply forgive some late payments. Some lenders may respond positively to such requests, while others may have some other perceptions. It’s better to seek professional advice on such matters from an experienced lawyer.

Deeds in Lieu

Rather than selling off specific assets, when physical properties are engaged, you can deed whatever interest you have in the said property over to the lender. In general, the lender shall already have a mortgage or a trust deed on the property. But, some bylaws enable borrowers to take back the property as soon as the outstanding loan is paid off, and many lenders may show no interest in accepting a deed instead of an agreement due to this.

Assignments for the Creditors’ benefits

If the negotiation falls apart then you can sign an assignment for the benefit of creditors”. This document enables the business owner to agree with the creditors, to offer some business-related assets to an unbiased third party. Once the said party is mutually agreed upon, they are liable for the asset’s liquidation and the division of the funds will find its way amongst the creditors.

Personal Guarantees

There is an ideal way to entirely bypass the intimidating foreclosure process. You can reach out tothe high-worth individual to support your business loan. Such an arrangement is generally preferred by creditors since it is less hectic and non-tedious, unlike the foreclosure process.

Conclusion

Improving your finances is the first step towards strengthening your credit report. It will take a significant amount of time to improve the credit score, but as long as you keep finances on the positive side, and avert credit default, or maxing out credit limit, your credit score will certainly improve. Once you attain an ideal credit score, you can maintain it with ease and improve your firm’s credibility in the market.

Read our article:Procedure to Avail MSME Registration Certificate in India