The Corporate Frauds happening all over India needs some stringent provisions to tackle with them. Corporate Frauds occur when a company or entity intentionally alter and conceals subtle information. The problem came with their rise in occurrence and sternness. This high frequency of Corporate Frauds demanded rigid penalties, ideal punishment, and efficient enforcement of the law with the correct strength.

What are the Different Types of Corporate Frauds?

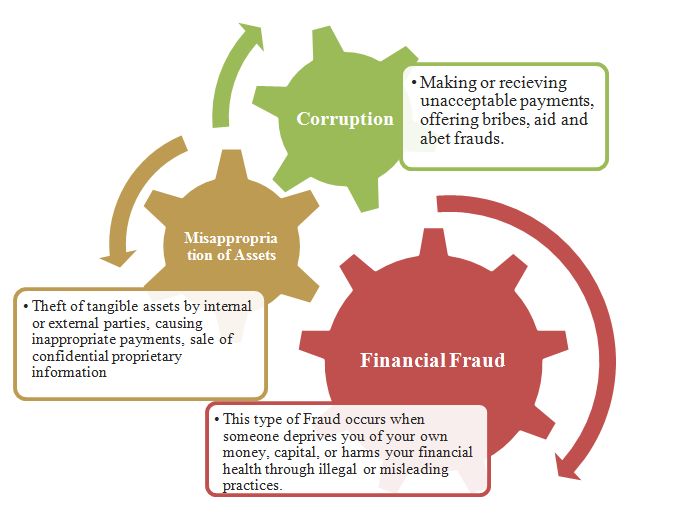

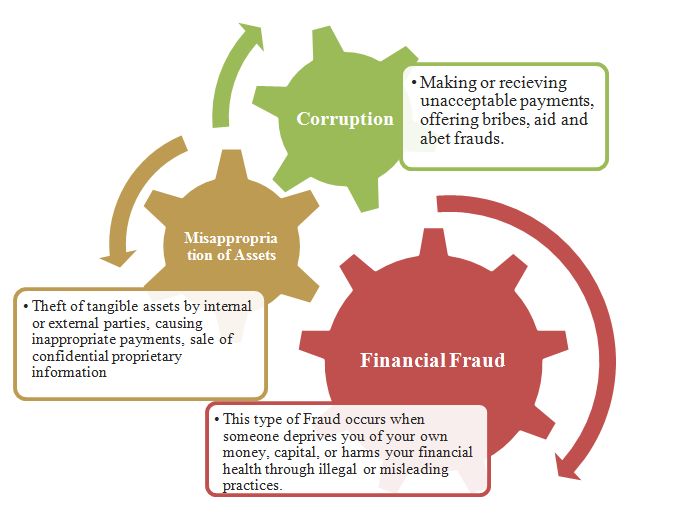

To commit a Fraud, an act should be committed by a party, who is a party to an agreement with a rationale to trick the other party. The person if intentionally commits any Corporate Frauds will be punished for his/her wrongful acts. There are many types of Corporate Frauds like False Fiscal Statements, Employee Fraud, Merchant Fraud, Consumer Fraud, Investment Scam, Insolvency Frauds, and many more. Some common types of Corporate Frauds are:

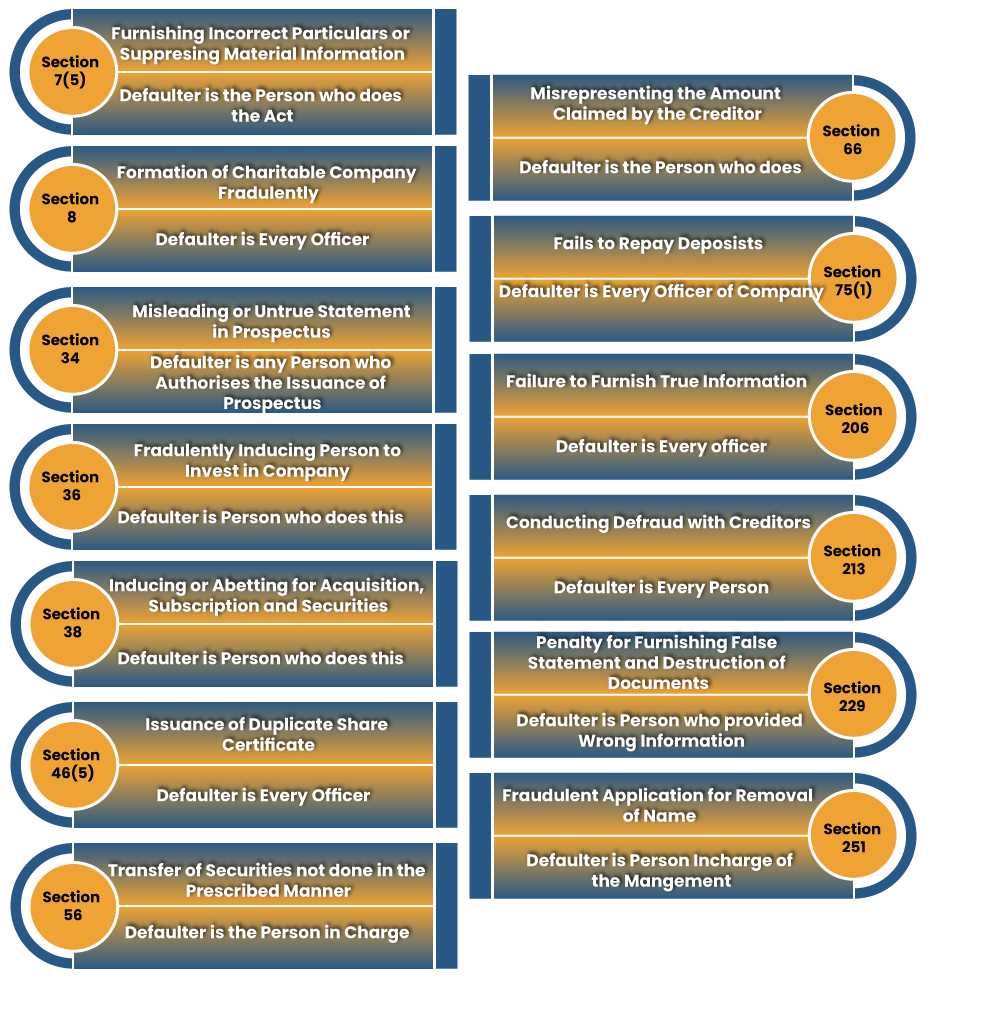

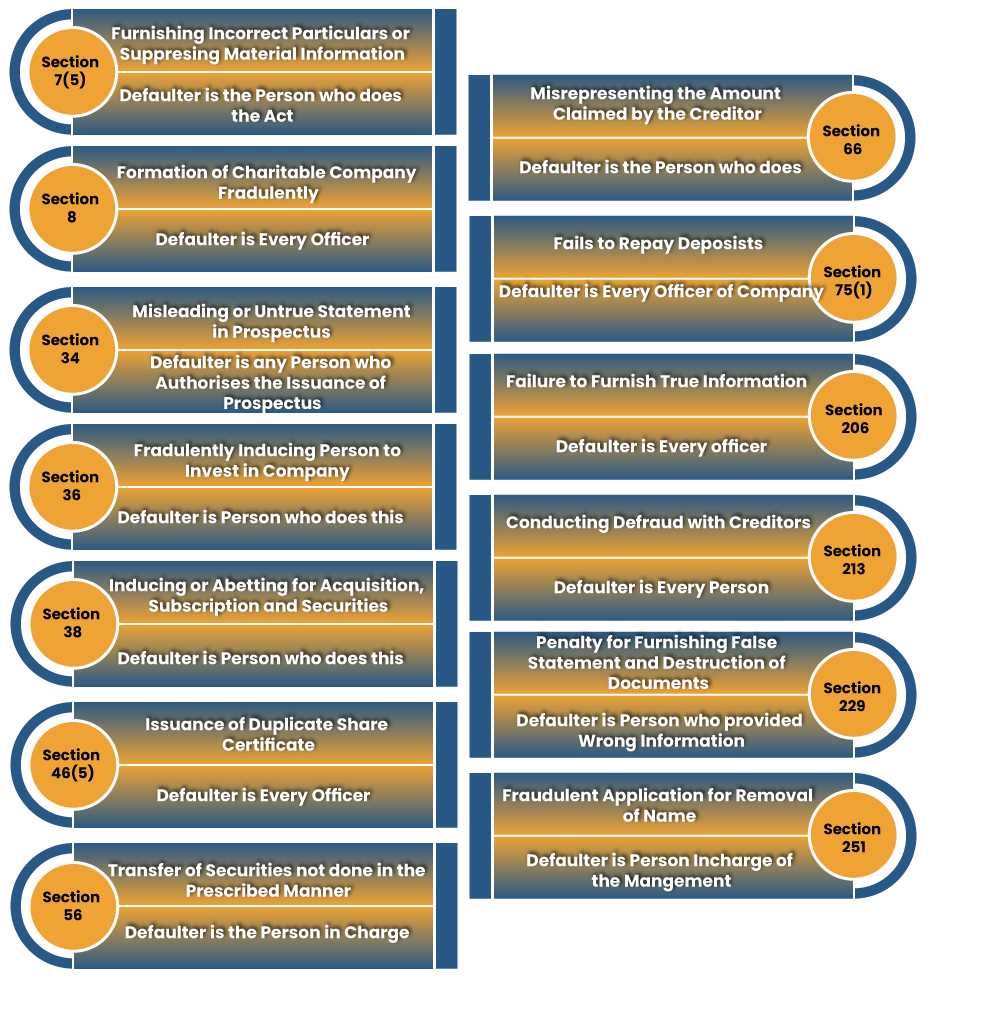

What are the Different Types of Corporate Frauds under the Companies Act, 2013?

Under the Companies Act, 2013, there are several Corporate Frauds which are dealt with in detail. Here is the list of the Corporate Frauds listed under the Companies Act, 2013:

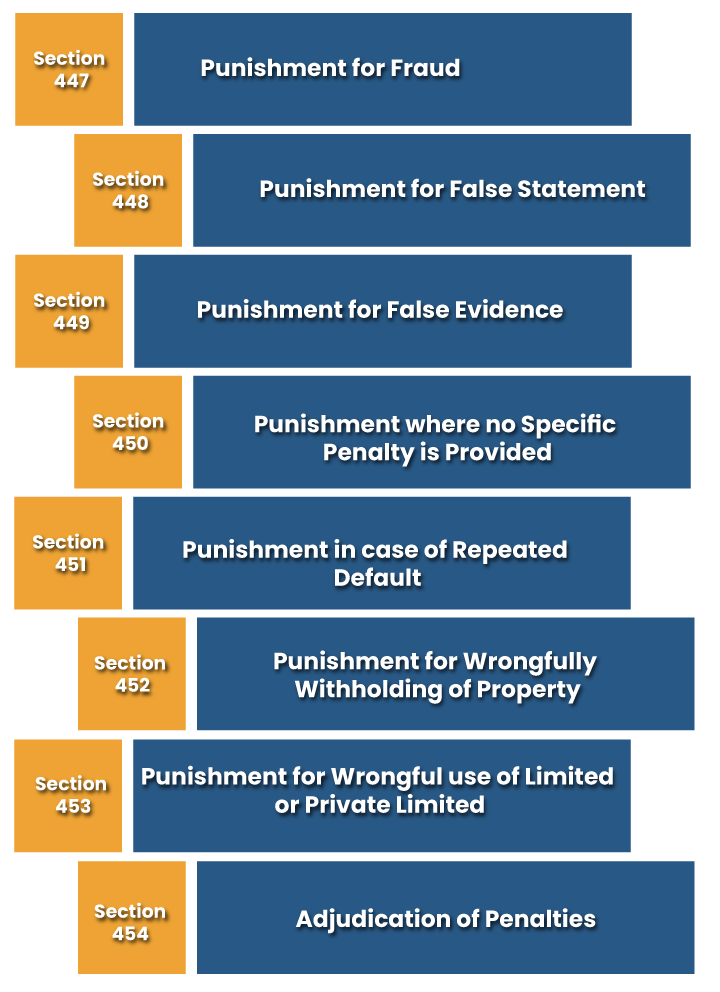

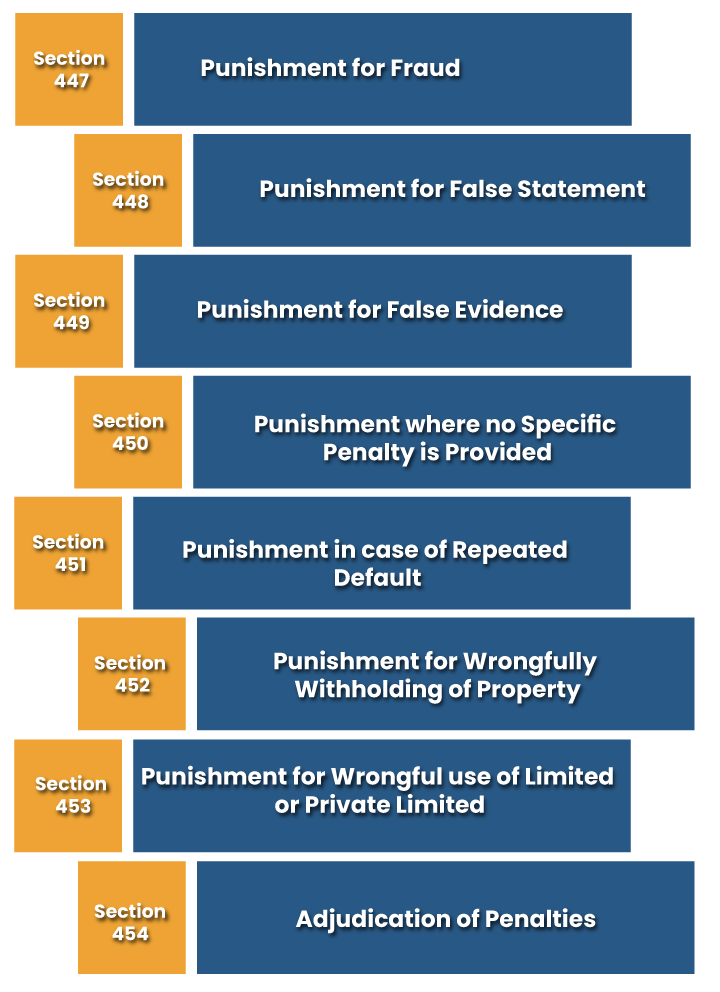

What is the Different Types of Punishment for Corporate Frauds under Companies Act, 2013?

Punishment for Fraud under Section 447

If any person or company is guilty of fraud involving an amount of at least 10 lakhs rupees or 1% of the turnover of the company, whichever is lower shall be punished with-

- Imprisonment which should not be less than 6 months which can be extended to 10 years and;

- A fine which should not be less than the amount of fraud and which may extend to 3 times the amount of fraud.

- Imprisonment of the term which can extend up to 5 years or,

- With fine which can be extended up to 50 lakhs of Rupees, or both

Punishment for False Statement under Section 448

If any person or company knowingly makes a false statement regarding the material facts and particulars of the company, then the person will be punished with under the provisions of Section 447.

Punishment for False Evidence under Section 449

If any person or company intentionally give any false evidence—

- Upon assessment on oath

- Of any Document Submitted during Winding up of Company

- Or any Matter Related to the company

Shall be punished with:

- Imprisonment of 3 years which can be extended to 7 years and;

- With fine which can be extended to 10 lakhs of Rupees

Punishment where No Specific Penalty is provided under Section 450

If any person or company contravenes with the provisions of the Companies Act, shall be punished with:

- A fine which can be extended to 10,000 Rupees

- If the contravention continues then further fine will be imposed of 1000 Rupees per day

Punishment in Case of Repeated Default under Section 451

If any person or company commits the same offence for the second, shall be punished with:

- Twice the amount of fine and;

- The imprisonment prescribed for that offence

Punishment for Wrongfully Withholding of Property under Section 452

If a person is having wrongful possession of the company’s property, shall be punished with:

- With fine of Rupees 1 lakh which can be extended to 5 lakhs of Rupees

Punishment for the Use of Limited or Private Limited under Section 453

If any person improperly uses the words ‘Limited’ or ‘Private Limited’, will be punished with:

- A fine, which should not be less than 500 rupees and can be extended up to 2000 rupees per day.

Adjudication of Penalties under Section 454

The Central Government by the order can publish in the Official Gazette about the appointment of the Adjudicating Officers. The Government should specify the jurisdiction of these Officers. The Adjudicating Officer can:

- Impose a penalty on the Company or the Officer of Company who is in default

- Can direct the Company or the Officer of Company to rectify the default

If the company fails to follow the order, shall be punished with:

- Fine which shall not be less than 25,000 Rupees and can be extended to 5 lakhs of Rupees

If a person fails to comply with the orders passed by the Adjudicating Officer, shall be punished with-

- Imprisonment, which may be extended to 6 months or;

- With fine which should not be less than 25,000 rupees but can be extended to 1 lakh Rupees.

What are Corporate Frauds Reporting under Companies Act, 2013?

Under Section 143 of the Companies Act, 2013, the provisions related to Fraud Reporting are explained. During his/her course of employment, if the Auditor thinks that there is fraud committed in the company, he/she shall immediately share this information to the Board of Directors of the Company. 3 Auditors have the responsibility to detect fraud and inform about this to the Board of Directors. The 3 Auditors who are responsible are as follows:

- Statutory Auditor (appointed as per Section 139 of the Companies Act, 2013)

- Cost Auditor (appointed as per Section 148 of the Companies Act, 2013)

- Secretarial Auditor (appointed as per Section 204 of the companies Act, 2013)

If the Auditor does not follow the rules prescribed under Section 143, then he/she will be punished with-

- A fine which should not be less than 1 lakh Rupees and can be extended to 25 lakhs Rupees.

Conclusion

There are stringent provisions in the Companies Act, 2013[1]; deal with the problem of Corporate Frauds indicates how serious the problem is in the corporate world. Corporate Frauds happens when the entities deliberately provide fraudulent information with the intention to gain an advantage. Corporate Frauds are very tiresome and long-lasting to be dealt with. We at Corpbiz have qualified and proficient professionals to help you with Corporate Frauds in your Company. Our professional will direct you and assist you in getting through the procedure to be followed. Our professionals will plan correctly and will assure the successful completion of your Matter.