Death is inevitable, and there is no way one can avoid it. In legal purview, the transfer of property of the deceased is often carried out through legal instruments like Will. Legal heirs of the testator can accordingly opt for claims related to property as mentioned under Will. In the article, we will talk about the most popular legal instruments, i.e., succession certificate and Will probate existed in our legal framework.

Thus, ‘Will’ can be interpreted as a legal instrument that legalizes the transfer of property among the legal heirs. Giving the legal effect to property transfer is indeed a crucial step in the person’s life.

The Will can effortlessly overcome the potential disputes related to property that might trigger in future among the family members. A Will explicitly outlines how the testator’s property will be allocated among family members after his/her death.

Also, it ensures that the testator’s belongings do not devolve in light of the law of inheritance but as per the testator’s desire. So which legal instrument is suitable for seamless allocation of property among the legal heirs?

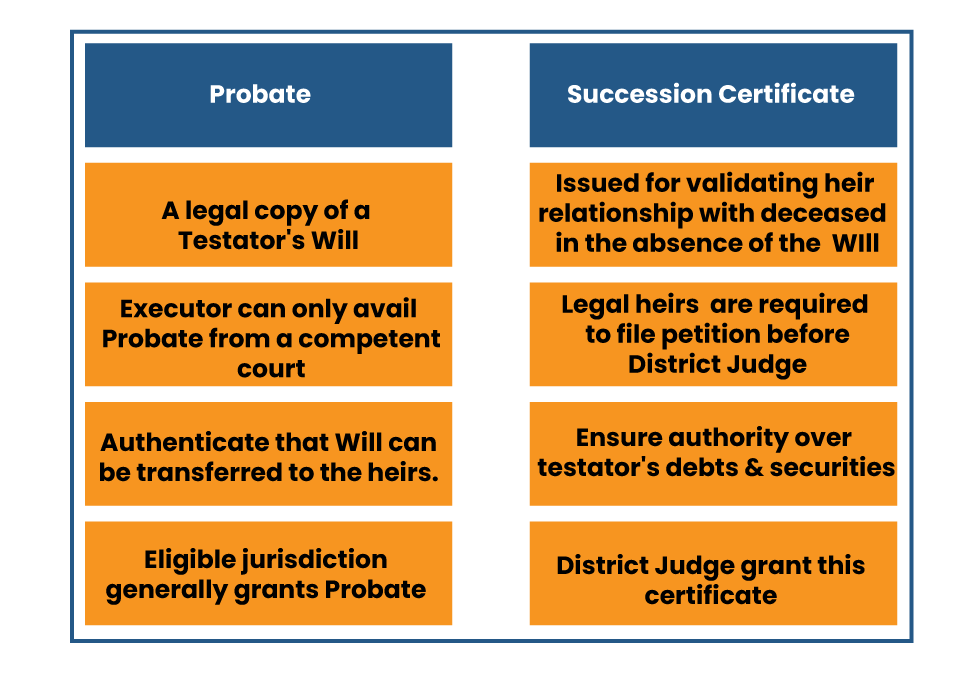

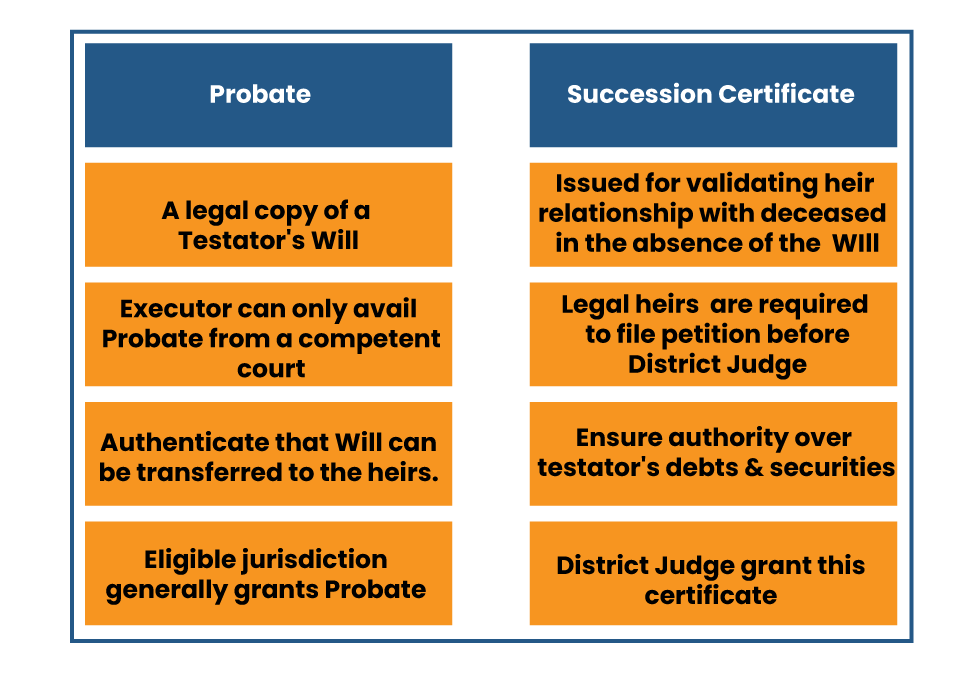

Probate: A Legal Process of Authenticating a Testator’s Will

In the legal purview, Probate refers to a legal procedure under which a competent court authorizes Will while giving effect to the testator’s intention or desire. In laymen’s terms, Probate acts as a legal document issued by the competent jurisdiction that ensures a Will which can be transferred to the beneficiary of the Will. It’s essential to note down that Probate and the succession certificate are two different things.

Probate is deemed as conclusive proof of the authenticity of a Will until it is revoked. Also, Probate largely remains unaffected from any evidence that questions its authenticity during the legal proceeding. Probate is usually required when a deceased owns the full estate or property, and it is compulsory in cases where there is a single owner of the property. As per prevailing law, Probate is mandatory for the deceased’s property to be transferred in the beneficiaries’ name.

It usually takes around 6-9 months for the entire process to reach completion, provided no objection is raised either from the deceased or public in the meantime. In cases of any objection, the court may extend the above timeline to two years based on the significance of the objection.

The Indian Succession Act, 1925 specifies the following conditions that mandate the presence of a Probate.

- Where a will has been made by a Hindu, Sikh, Jain, and Buddhist in the areas of Bengal, Orissa, Bihar, and Assam and within the local limits of the civil jurisdiction of the High Courts[1] of Madras and Bombay, then a probate is necessary.

- The recovery of a debt due to the estate of a Hindu is pending.

- The cost of obtaining Probate covers legal fees & stamp duty as per the estimated property’s value. The Stamp duty related to the Probate differs state-wise.

Succession Certificate: Required under Non-Availability of the Will

The civil court issues a succession certificate to the legal beneficiaries of a testator. It is issued by the court for the realization of the testator’s debts and securities if an individual dies without making a Will. It renders the confirmation regarding the legitimacy of the heirs & confers them the rights to have securities along with other assets assigned in their name and inherit debts.

It is granted in view of prevailing laws of inheritance on an application filed by an heir to a competent court in his/her respective jurisdiction. A succession certificate is important but not necessarily adequate to free the deceased’s assets. The common documents required for the issuance of succession certificate includes;

- A death certificate

- Letter of administration

- No-objection certificates

To avail this certificate, an applicant is required to file a petition before the District Judge located in the jurisdiction where the testator ordinarily lived at the time of his or her demise or, if at that time testator had no permanent place of residence, the District Judge under whose jurisdiction the property of the testator may be found.

The law has a different treatment for a person who either died after making the Will or without making the Will. In the presence of a Will, the same has to be submitted for Probate after the testator’s demise. In case of non-availability of the Will, the beneficiaries have to file a petition before the eligible jurisdiction for ‘Succession Certificate’ for the legal transfer of the testator’s assets.

Lock-in Points Related to Probate and Succession certificate

- A probate is a legal copy of the Will authenticated by the eligible court to the testator’s executor.

- The eligible jurisdiction generally grants Probate after the in-depth examination of the Will based on available facts.

- The individual appointed by the testator, aka executor, has the right to submit the petition regarding the Probate before the honorable court.

- The issuance of Probate is legally impossible in the absence of the testator’s executor. In case of non-availability of the executor, the court only issues the simple letter of administration.

- Generally, a succession certificate encloses information about the legal heirs chosen by the testator, the relation between the testator and the heir, debts, and assets of the testator, declaration of an intestate death, and death of the deceased.

- The presence of Will defies the applicability of the Succession Certificate.

Conclusion

The facts mentioned above explicitly manifest the Probate refers to legal process under which Will’s legitimacy is examined based on available facts. It is also used for the general administering of a testator’s Will or assets of the same individual without a will. Meanwhile, ‘Succession Certificate’ works on the concept of non-availability of the Will. It is usually conferred to the legal beneficiaries of a testator who has expired “interstate,” i.e., leaving no Will behind.

Read our article:Probate of a Will: Meaning, Significance, and Applicability