In a simple sense, the Conversion of Debentures into Equity Shares means to change the loan liability into a capital liability. After the Conversion of Debentures into Equity Shares, the Debenture Holder becomes Shareholder. The shareholders will get the right to vote. After Conversion, until Liquidation occurs in the Company, the money invested by shareholders will not be refunded back to the shareholders. In this article, we will discuss Procedure followed for Conversion of Debentures into Equity Shares.

What are Debentures and Equity Shares?

Debentures

The long term loans of a Company are known as Debentures. It is a loan which should be repaid on a specified date. The rate of interest of the Debentures is fixed. Section 2(3) of the Companies Act, 2013 defines Debentures. The definition states that the Debenture includes stocks and bonds or any other instrument of a company evidencing the debt, whether constituting a charge on the assets of the Company or not. The benefit of having Debentures in the Company is that they have lower interest rates than other types of loans. There are two types of Debentures:

Convertible Debentures

These instruments can be converted into equity shares of the Company who issued them. The Conversion can be done after a predetermined period. These instruments are always favourable to the investors as they can at any time; convert these convertible bonds into equity shares. The lower interest rates are also one of the reasons for their preference by the investors.

Non-Convertible Debentures

These instruments always retain the character of debt and cannot be changed into equity shares. As they cannot be converted to equity shares, the interest rates of these instruments are usually higher than other convertible instruments.

Equity Shares

The Equity Shares are the primary source of finance for the Company. The Equity Shares give investors the right to vote, profit sharing, and claim on the assets.

They are also called the Ordinary Shares in the Company. No preference is given to these shares regarding the payment of Dividend and while repayment of Capital. The Equity Shareholders are real owners of the Company. Section 43 (a) of Companies Act, 2013[1], talks about Equity Shares and states:

- With voting rights; or

- With the right to Dividend, as prescribed by the rules of the Act.

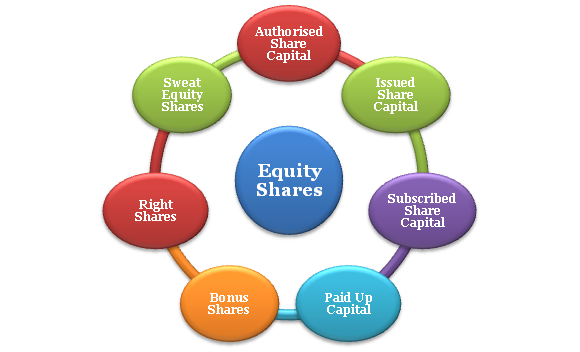

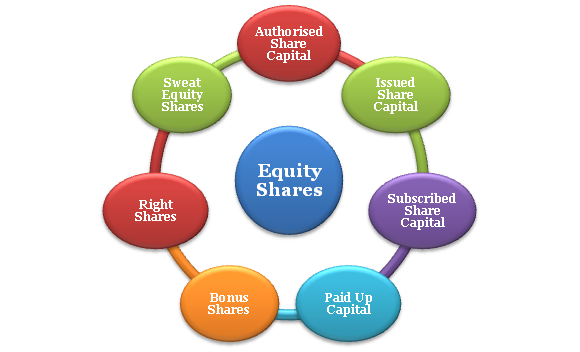

There are different types of Equity Shares in a Company which are:

Authorized Share Capital

The maximum amount of Capital that Company can issue. Limit of authorized Capital can be increased with the permission of the respective authorities.

Issued Share Capital

The amount of Capital which Company offers to investors out of authorized Capital of Company is the Issued Share Capital.

Subscribed Share Capital

It is part of the Issued Capital which the investors accept and agree.

Paid Up Capital

The paid-up capital is the amount which registered Company invests in the business. It is part of the Subscribed Capital which the investors pay to the Company.

Right Shares

These shares are issued to protect the ownership of the existing owners of the Company. When someone invests in the Equity Shares of Company, the Company will issue further shares to you, theses new shares issued are the Right Shares.

Bonus Shares

The Dividend when issued to the investors of Company is issued in the form of Bonus Shares.

Sweat Equity Shares

The Sweat Equity Shares are issued to the employees and Directors of the Company when they perform their job correctly.

What is the Procedure for the Conversion of Debentures into Equity Shares?

Under Companies Act, 2013, Section 71(1) authorizes the Company to issue Debentures with an option for Conversion of Debentures into Equity Shares. The above option of Conversion of Debentures into Equity Shares shall be approved by a special resolution passed by the Board in the General Meeting.

Hold Board Meeting

The resolution for Conversion of Debentures into Equity Shares should be approved in the Board Meeting. The approval of shareholders, as well as Debentures Holders, is taken for the Conversion. After passing of the Board Resolution, the notice for General Meeting should be passed.

Hold General Meeting

After passing of the Board Resolution, General Meeting is held. A Special Resolution for the Conversion of Debentures into Equity Shares is passed. The Special Resolution cannot be passed by the shareholders until and unless the Articles of Association (AoA) authorizes for the Conversion of Debentures into Equity Shares.

File Form MGT-14

The Special Resolution passed by the members should be filed with the Registrar of Companies (RoC). The passed Special Resolution should be filed within 30 days from the date of the passing of the Special Resolution for Conversion of Debentures into Equity Shares. This Special Resolution is passed with Form MGT-14.

Letter of Option

Letter of Option is sent to Debenture Holders, and one copy of Letter is also sent to SEBI (Securities and Exchange Board of India). The Letter is sent for verifying the consent of all Debenture Holders for Conversion of Debentures into Equity Shares. The Secretary verifies the Letter of Option.

Allotment of Shares

Conversion of Debentures into Equity Shares is done. The Debenture Holders are then asked to return there Debenture Certificates. The Secretary carries out the Allotment of Shares to Debenture holders in meanwhile.

Issue of Share Certificate

The Share Certificates are prepared and then issued as prescribed in the Form SH-1.

Change in Register of Charges

The Company has to cancel the charges against assets which were created at the time of issue of Debentures. After the Allotment of shares, the necessary changes are made in the Register of Charges.

Entry in Register of Members

After issuing of Share Certificate to the Shareholders, their names are entered in the Register of Members.

Filing of Return Allotment

A Return of Allotment should be filed with the Registrar of Companies (RoC) within 30 days of Allotment of Shares. The Return of Allotment should be filed in Form PAS-3 with the fee prescribed under Companies (Registration and Offices and Fees) Rules, 2014. The following attachments are required to be filed with Form PAS-3:

- Complete list of Allottees

- Copy of Board Resolution passed

- Copy of Special Resolution passed

- The Valuation Report

Conclusion

The Companies Act, 2013 authorizes for the Conversion of Debentures into Equity Shares. The Company does this type of Conversion for economic benefit to shareholders. The Procedure of Conversion of Debentures into Equity Shares is long-lasting and time-consuming. We at Corpbiz have experienced and qualified professionals to help you with the Procedure of Conversion. Our experts will assist you in getting through the Procedure of Conversion of Debentures into Equity Shares. Our experts will plan ideally and make certain the successful completion of your work.

Read our article:How does a Company Issue Debentures to the Public?