Any running Private Limite company or existing unlisted public Limited Company can convert itself into LLP. Companies can wish to convert itself into Limited Liability Partnership due to various reasons like Ease of Conversion, Tax Benefits, and Less Statutory Compliances etc. After the enactment of the Limited Liability Partnership Act, 2008, existing companies can convert themselves into LLP.

Through this blog, we will discuss the aspects of conversion of the Company into LLP.

What is LLP?

Limited Liability Partnership is governed based on the Limited Liability Partnership Act, 2008[1], which came into existence on April 1, 2008. The Act came into force to promote MSME sector, with the advantage of self-governance and Less Compliance.

LLP is an alternative option for incorporating the corporate body, which comprises the benefit of both the Company and the Partnership. It contains the advantage of Limited liability to partner and Flexibility of Partnership.

- LLP is a corporate body having legal status same as that of Company.

- Unlike the Partnership in LLP, the liability of the partner is limited up to the contribution made by them.

What is the Eligibility Criteria for Conversion?

- The Company should not be carrying any collateral on any of its assets;

- There should be no pending E- Forms of a company;

- There should be no open charges for or against the Company;

- Company’s shareholder will become partners of the LLP;

- A company processing the conversion must have filed at least one balance sheet and annual returns.

What is the conversion process of Company into LLP?

Following mentioned way a private limited company can be converted into an LLP

Director Identification Number

There must be at least two designated partners in LLP, and one must be an Indian Citizen. While the incorporation of the LLP, partners are required to have their own DIN. DIN may also be allotted to a new person who is added as director/designated partner in LLP. Further, the very first step of converting the Company into LLP is the addition of a new designated partner to the Company, after this member can obtain it’s DIN. Besides this, a member can apply for the DSC, which is required during the process of DIN application.

Meeting of the Board of Directors

Boards of Directors of the Company are required to call for a meeting. In this meeting, a board of resolution shall be passed, allowing the conversion of the Company into LLP. Board of a resolution shall be passed with the majority and hence filed with the MCA along with the necessary forms and application.

Application for Name

In the next step, the Company must apply for a name reservation, and get a certificate of name approval from the Registrar of Companies.

Incorporation Form

Once the Company reserves its name, LLP must file its incorporation along with the below-mentioned documents;

- Proof of LLP Office address

- Sheets of subscription

- Partner’s consent Letter

- Partners Identity proof

- Resident proofs partners ;

- Details furnishing information of other companies in which the LLP’s partners work as partners.

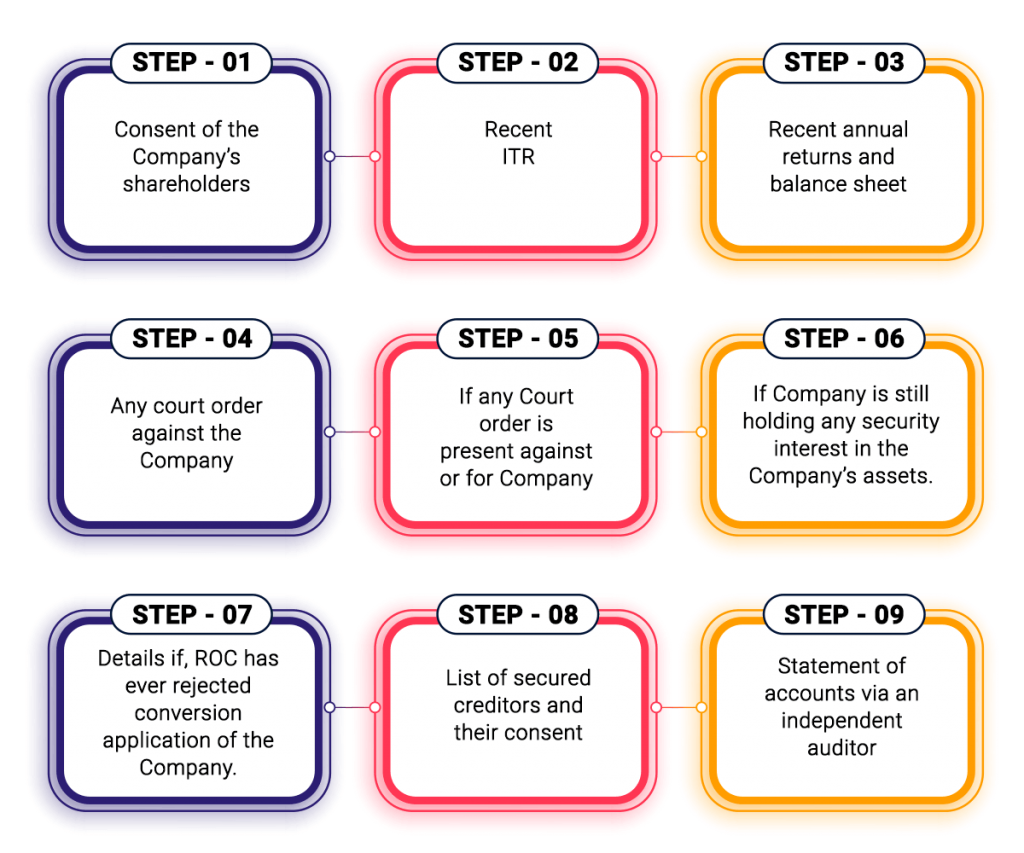

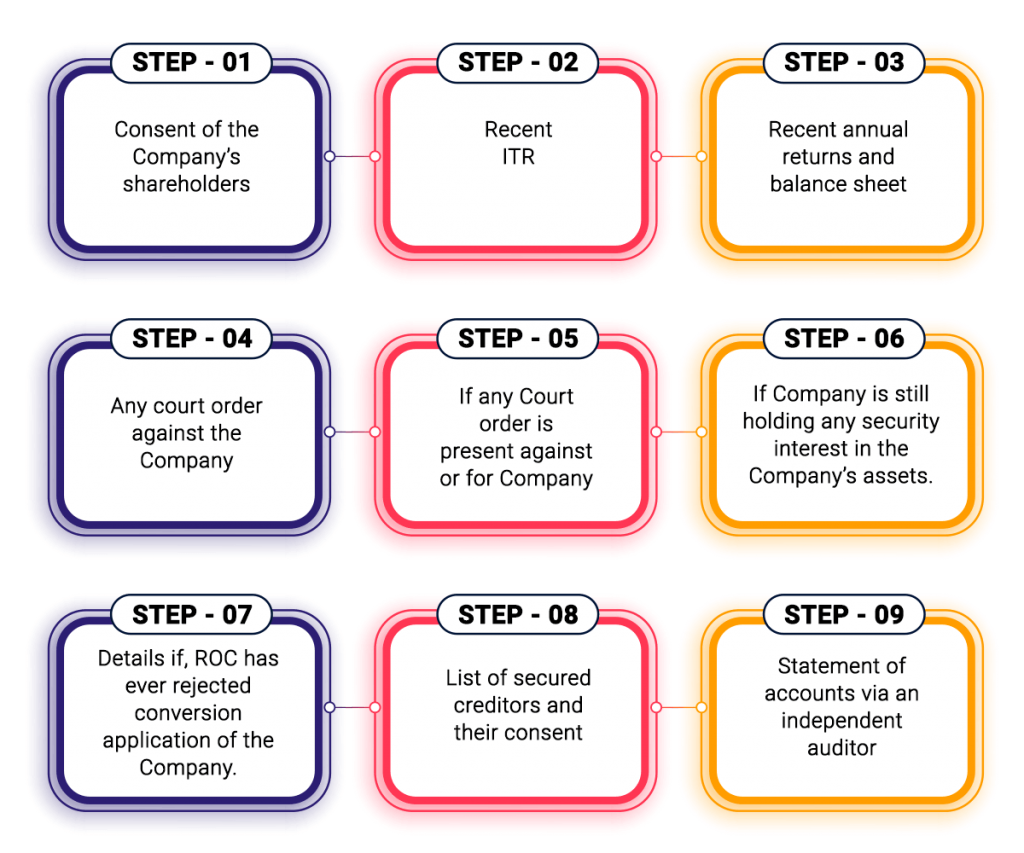

Application for Conversion into LLP

For converting the existing Company into LLP, Form 18 must be duly filled. the following information is required to be furnished along with the form;

- Consent of the Company’s shareholders;

- Recent ITR ;

- Recent annual returns and balance sheet ;

- Any court order against the Company;

- If any Court order is present against or for Company

- If Company is still holding any security interest in the Company’s assets.

- Details if, ROC has ever rejected conversion application of the Company.

- List of secured creditors and their consent

- Statement of accounts via an independent auditor

Incorporation Certificate

After completing all the formalities, ROC will further issue the Certificate of Incorporation to LLP. Hence, the Company shall be registered as LLP.

Drafting an LLP Agreement

After the incorporation, the designated partners must develop an LLP agreement, providing the following information:

- LLP’s Name

- Name of all Partners and Designated Partners

- Rules of governance

- Proposed Business

- Rights and Duties of Partners

- Form of contribution

- Profit-Sharing ratio

E-Form-3 and E-Form-14

Form -3 provides the information of LLP agreement. The form should be filed within a period of 30 days of such conversion, duly attached with the agreement. Further, form – 15 is required to be filed by the partners within 15 days of period of the conversion. Beside Form-14, following documents must be attached:

- Incorporation Certificate

- Copy of E-Form FiLLiP

Effect of Conversion

Some of the effects of conversion of Company into LLP is;

- The private Company gets dissolved after conversion.

- Registrar of Company will remove the name of the private limited Company from the register.

- Conversion does not affect employment, present liability, obligation, agreements and contracts.

Company must inform all the concerned authorities about the conversion. In addition to this, shall make necessary changes in all the registrations and licenses.

Benefits of Conversion

- On conversion of Company into LLP, assets of the Company will be converted into LLP. There is no requirement of instrument transfer. Hence, no stamp duty implication is required for such transfer.

- After conversion, no limit will be implied on partners.

- After conversion into LLP, no requirement on holding a minimum number of meeting and maintaining statutory records is required.

Conclusion

According to above discussions, LLP is considered to be a more convenient form of organization. For many entrepreneurs and professionals, LLP is eaten most suitable form for the incorporation, as it has less burden of compliances. Through conversion of existing Company into LLP, it can retain the advantages of Limited Liability and of less compliance.

Read our article: Functions of a Company Secretary as per the Companies Act, 2013