For years, banks and other financial institutions fight against the stringent force of terrorist financing and money laundering. Since such transactions mostly remain undercover and flow through unique patterns, it becomes hard for the NBFCs to detect them on the first attempt. And that’s where risk assessment comes into the picture.

A few months back, the reserve bank rolled out the notification regarding the amendment to the Master direction on KYC. This guides the existing NBFCs to perform a periodic assessment of risk related to terrorist financing and money laundering periodically. In this article, we will come across some crucial insights regarding the same.

Concept of Terrorist Financing Risk Assessment & Money Laundering

Financial Action Task Force, aka FATF, came with an idea of Terrorist Financing and money laundering risk assessment. The authority provides the detailed guidelines for the same and it is specially made for the existing NBFCs. Terrorist financing is a risk that operates via vulnerability and consequence. It is referred to as a non-legitimate method of fund raising for terrorist organizations.

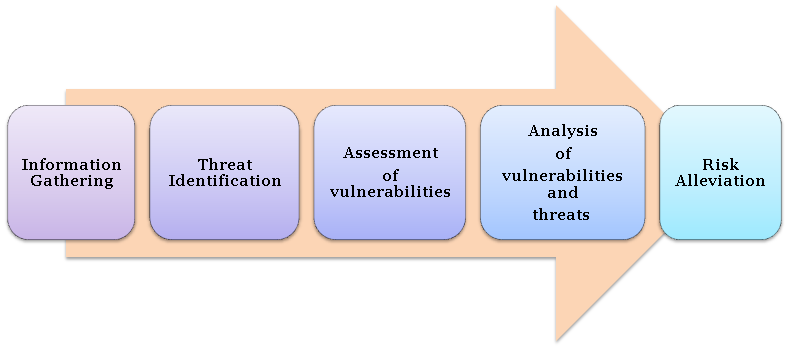

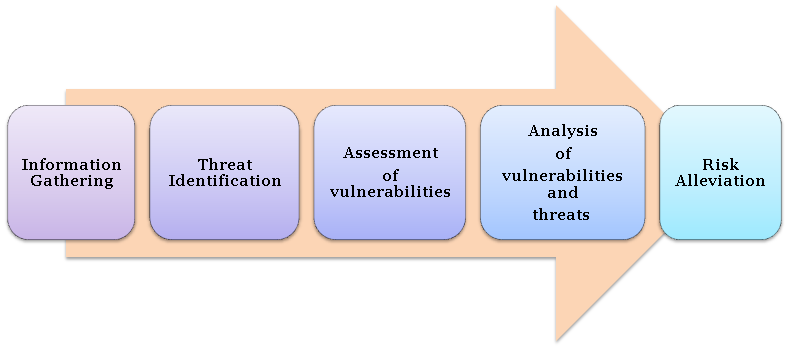

The Process of Risk Assessment by NBFCs

The risk assessment techniques adopted by NBFC should not be a complicated one. The process must encompass the nature and the size of the business for better results. A moderate risk assessment is sufficient for smaller and less intricate NBFCs.

Read our article:Guidance on NBFC compliances as specified by the RBI

The process of risk assessment by NBFCs may be categorized into the following stages. Those are as follows:-

Information Gathering

The process of risk assessment initiates with the accumulation of raw information by taking different variable into the account such as:

- General criminal environment

- Terror threats

- Terror financing

Such information can be gathered internally or externally. The Directorate of Enforcement looks into the matters of Terrorist Financing and Money laundering in India. They have access to a comprehensive database related to terrorists and their activities. Furthermore, the Central Bureau of Investigation[1] (CBI) can also contribute valuable information in this regard.

Threat Identification

After information gathering, the experts must pinpoint the sector-specific threats based on such information. Although the threat analysis must be conducted on the national level, it can be expanded further based on the severity of threats. The threat identification cannot be done without considering the nature and size of the business entity. The NBFCs must look into the preventive measures that are incorporated including the functioning of internal functions and risk management quality.

Assessment of Vulnerabilities related to Terrorist Financing & Money Laundering

In this step, the analytic team must measure the impact of the identified threats. During such assessment, the team must take scale, nature, and intricacy of their business into the account for a better outcome. In addition to that, the team should take advantage of transaction volume, internal audit, and regulatory authority to get a clear picture. The NBFCs must link such data with information received from external and internal sources.

Analysis of Vulnerabilities and Threats

Once vulnerabilities and threats are identified, it’s important to determine the root cause for them. Such analysis encompasses the consideration of how local and overseas financing threats utilized the identified vulnerabilities. The analysis also takes potential consequences into the account for a thorough assessment.

Risk Alleviation

After the completion of the above step, the NBFCs must develop and deploy policies related to the omission of risks linked with Terrorist Financing and Money Laundering. Customer Due Diligence processes must be laid down for the identification of the customers. This also includes the customer’s working background and their requirement for finance.

Customer Due Diligence Procedures

The customer due diligence is the first step towards the customer relationship. It is a process of collecting and examining customer’s data to curb the activities related to terrorist financing and money laundering.

Ongoing Monitoring

Ongoing monitoring is nothing but an investigation of the transactions. It is used to identify the intricate transactions that seemingly adhere to fraudulent patterns.

Reporting

The NBFCs must pinpoint the unusual fund movement for the analysis. Thereafter, the identified funds of suspicious nature must be addressed to the Financial Intelligence Unit (FIU) as per the authority’s guideline.

Internal control

For complete omission of risks, it is vital to have sufficient internal controls. Internal controls enclose governance arrangements where the accountability for Anti-money laundering and CFT is placed. It must also encompass the monitoring setup to examine the effectiveness of the policies and processes to pinpoint assess and potential risk.

Recruitment and Training

NBFCs must ensure that hired individuals must possess the abilities to perform their respective tasks with ease. The employees must be adequately trained to conduct a risk assessment for Money laundering and terrorist financing. NBFCs must incorporate suitable training modules to serve such a purpose.

Post Compliances

As soon as the analytic team is done with the assessment work, they must measure the identified risks against the scale of severity. The team must figure out the possible measures to omit these risks. The information laying the foundation of the risk assessment process must be updated regularly. The slightest of alternation in the information must be handled with due diligence and care.

Conclusion

The NBFC compliance officers must have enough authority at their disposal to perform their jobs without obstacles. This also encompasses due diligence of transaction patterns and verification of the suspicious account. By curbing such intricacies, NBFCs can uplift the quality of the services and productivity at the same time. Risk analysis seeks continual improvement with evolving data and technology. The experts take the initiative to deploy the updated version of technology within the system in order the maximize control over suspicious and fraudulent transactions.

Read our article:Are you running an NBFC? Get updated about the list of Annual Compliances Prescribed by the RBI