On 1st April, 2020, the Central Board of Direct Taxes (CBDT Notice) has disclosed the fact that they have released/issued tax refunds worth₹26,242 Cr. to assessees. It got applicable from 1st April 2020 to 21st May 2020.

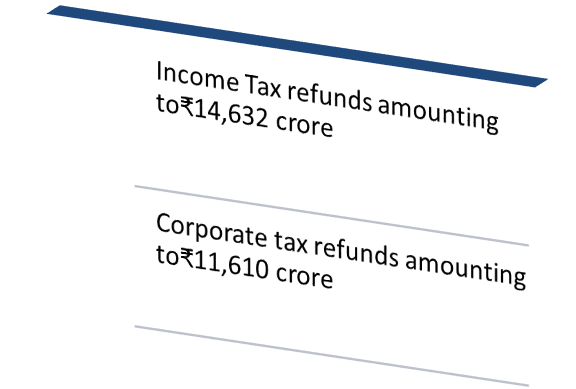

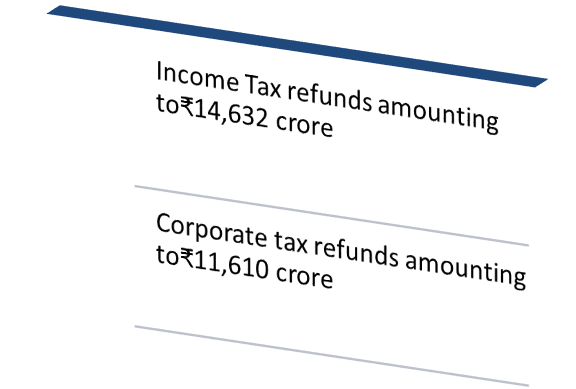

Income Tax and Corporate Tax Refunds:-

- CBDT Notice has opined to release the Income Tax refunds amounting to₹14,632 crore. It has been allotted/issued to 15, 81,906 assessees concerning the same due dates as mentioned.

- CBDT Notice has also released Corporate tax refunds amounting to₹11,610 crore, which have been issued to 1, 02,392 assessees for the duration of this period-mentioned above.

Footsteps for “Aatma Nirbhar Bharat Abhiyan”

- It has propounded that the refund process will get accelerated, and as per the statements, the refunds are being issued at a larger pace. It is because of the drawn footsteps by the Union Finance Minister Smt. Nirmala Sitharaman’s announcement furnished in the Aatma Nirbhar Bharat Abhiyan.

Statistics evaluated for issues of refunds:-

- Complying with the refunds, the statistics say that CBDT Notice has released a sum of ₹ 2050.61 crore in the earlier week ended on 16th May.

- They have released in between 9th to 16th May 2020, to 37,531 income tax assessees. Moreover, a sum of ₹ 867.62 crore to 2878 has been released to corporate tax assessees.

- In between 17th to 21st May 2020, for the duration of this week, another 1,22,764 income tax assessees were reimbursed/refunded ₹ 2672.97 crore and 33,774 corporate tax assessees.

- It included all trusts, MSMEs, proprietorships, partnerships, etc. which got issues of refunds worth₹6714.34 crore, considering the total amount refunded to₹9387.31 crore in the case of 1, 56,538 assessees.

Read our article:Income Tax Slab and Rate for financial year 2020-21

Welfare Fund Board & Kerala Cooperative Development: CBDT Notice

As per the CBDT Notification No. 26/2020– The Kerala Cooperative Board and Welfare Fund Board are eligible for Income Tax Exemption.

- Hereby, the Central Government informs ‘Kerala Cooperative Development and Welfare Fund Board’, a Board constituted by the Government of Kerala, in respect of the detailed income rising under ‘section 10(46)’ of Income Tax Act, 1961.

- The Central Board of Direct Taxes (CBDT) has notified them on Thursday about the eligible for Income Tax exemption under Section 10(46) of the Income Tax Act, 1961[1] for five Assessment Years 2019-20 to 2023-24

Membership Constitution:

- It was constituted by the Government of Kerala, in terms of the Membership Fees; Risk Fund Contribution; Annual Renewal Fees; Membership Fees, Annual Renewal Fees, and Contribution/Assistance detailed income arising to the Board.

- The CBDT Notice shall be operational on subject to the conditions that ‘Kerala Cooperative Development’ and ‘Welfare Fund Board’ only when they shall not be engaged in few specified categorical activities.

Those activities are as follows:-

- Commercial activity;

- Nature of activity with specified income, which shall remain unchanged during the course of financial years;

- They shall file Income tax return in accordance with the provision of ‘clause (g) of sub-section (4C)’ of ‘section 139’ of the Income-tax Act, 1961;

- They shall file the ‘audit report’ as well as with Annual Return. They should be duly substantiated by the accountant as provided an explanation to ‘Section 288(2)’ of the Income Tax Act, 1961. It should adhere to the rules and provide a certificate from the chartered accountant, that the above circumstances are fulfilled.

Conclusion

It must be noted that the CBDT Notice shall apply with respect to the assessment years, starting from 2019-2020, 2020-2021, 2021-2022, 2022-2023, and 2023-2024 as per the given notification. Our Corpbiz group is ready to help you if you want expert advice related to Income Tax and Fund management. We will help you to ensure complete procedure as per your desired activities, ensuring the successful and well-timed achievement of your work.

Read our article: What is the Difference Between Direct Tax and Indirect Tax