The Finance Minister, Mrs. Nirmala Sitaraman, in her Budget Speech 2020 implements CAROTAR 2020 The Customs Administration of Rules of Origin under Trade Agreements Rules,2020 and mentioned regarding the need to protect the domestic industry from the misuse of free trade agreements. Finance Minister said that “Undue claims of FTA benefits have posed a threat to a domestic industry. Such imports need stringent checks. In this context, appropriate provisions are being incorporated in the Customs Act, 1962.”

CAROTAR 2020, read with CBIC (Central Board of Indirect Tax) Circular No. 38/2020-Cus, notified on 21st August 2020, came into force from 21st September 2020 upon completion of the 30 day period that was provided to importers as well as other stakeholders to familiarize themselves with new provisions.

Introduction of CAROTAR 2020

The Customs are equipped with the new mechanism of verification that started from 21st September. Now, the customs officers have the full authority to strictly scrutinize all the products that fall under Free-trade Agreements and documents provided by importers claiming duty benefits under FTA. Electronic products, refrigerators, air-conditioner, camera, mobiles and telecom equipment and other products that fall under FTA will come under the lens of authorities. It is a move aimed at curbing severe misuse of the concessions under FTA.

Post-Amendment Rules For CAROTAR 2020

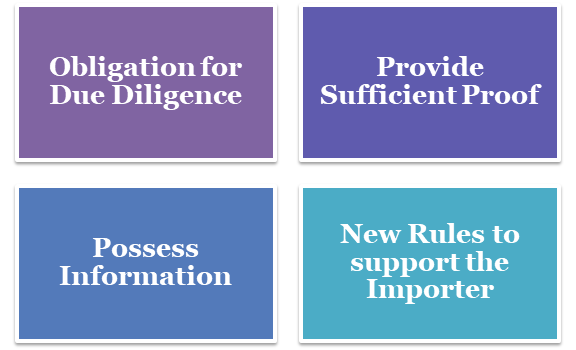

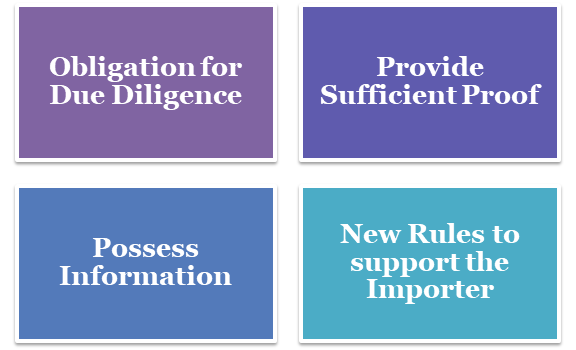

After that the amendments incorporated in the customs law in the Budget session, the following are the new rules that the government issued last month as a measure in order to curb the severe misuse of custom duty concessions under FTAs:-

- An importer is now obliged to do due diligence before importing the goods to make sure that they met the prescribed criteria. A list of basic information which the importer is necessary to possess has also been provided in the rules along with general guidance.

- Importers are required to provide sufficient proof to the domestic customs authorities regarding the goods that are being imported have a minimum 35 % value addition in the country from where it is being exported to India.

- The importer shall possess information to demonstrate how the origin criteria are being satisfied and maintain all supporting documents for 5 years from the date of filing of the entry bill.

- The new rules support the importer in order to ascertain the country of origin correctly and properly claim the concessional duty and assist the customs authorities for the smooth clearance of legitimate imports under FTAs.

- The new Rules has strengthened the hands of the Customs in order to check any attempted misuse of the duty concessions under FTA.

In case, It is found that benefit has been wrongly aimed in respect of a consignment, the FTA benefit shall be denied in subsequent consignments of identical goods, and the importer will have to pay full applicable duty. The domestic industry claimed severe damage on accounts of the imports, that have been urged to the government to take strict action in order to curb such irregular imports done by flouting FTA provisions.

Regulation for Asean Countries

This move assumes a significant backdrop of concerns being raised by certain quarters of the domestic industry about the misuse of the free trade agreement (FTA) benefits from 10-member ASEAN (Association of Southeast Asian Nations) countries.

Benefit for Concessional Customs Duty Rate

Significant imports to India are coming from five ASEAN countries — Indonesia, Malaysia, Thailand, Singapore and Vietnam. The benefit for concessional customs duty rate applies only in case if ASEAN member country is the country of origin of goods. It means that the goods originating from China and routed through these countries will not be eligible for concessions of customs duty under ASEAN FTA[1].

Further, the investigation into FTA imports in the past few years has disclosed that the rules of origin, under FTA were not being followed in the right spirit. In several situations, it was discovered that items from non-ASEAN countries are being diverted into India via ASEAN countries with mere packing or repacking, assembly or any minor procedure and declaring 35% of value addition or wrongly claiming the significant transformation in ASEAN member country.

Conclusion

This practice has been rampant in case of electronic items. Under such FTA agreements, two trading partners significantly reduce or eliminate import/customs duties on the maximum number of goods traded between them. FTAs have been widely misused to export goods to India in utter disregard to the ‘rules of origin’. The Government of India has taken an efficient step with the introduction of CAROTAR 2020 to curb the misuse of Law.

Read our article: Lok Sabha Passed the Foreign Contribution (Regulation) Amendment Bill, 2020