The amount of gain or profit generated from the sale of the capital asset is known as a capital gain. This profit or gain, in general, is treated as income; therefore, it is exposed to tax deductions that need to be paid out in the year in which transfer of the capital took place. It is known as capital gain tax, which can be LTCG and STCG.

Capital gain tax cannot be applied to the inherited property as there is no sale, only a shift of ownership. The Income Tax Act[1] has tax exemption for assets received as gifts via inheritance or will. However, if the person decides to sell that asset, the capital gain tax on the will be applied.

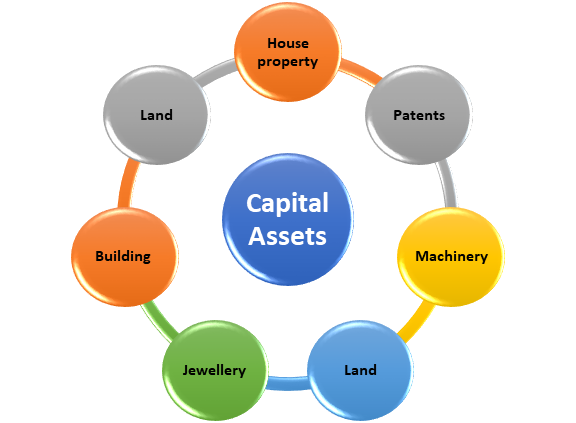

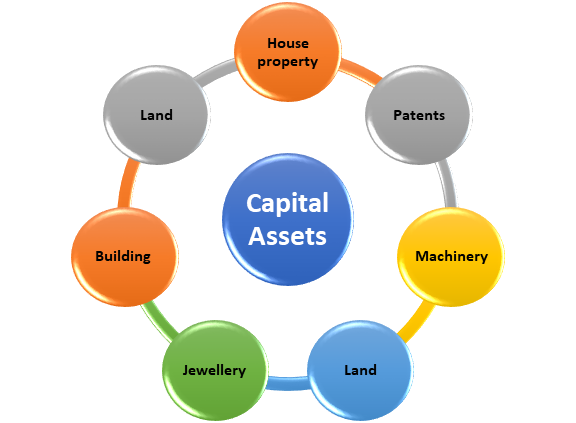

Defining Capital Assets

The following entities represent the family of capital assets. Those are as follows:-

It includes the possession of rights concerning an Indian company. It also covers the control, rights of management, or other legal rights.

The following entities are not part of a capital asset.

- Any stock, or raw material, held for profession or business.

- Personal goods like furniture or consumable electronics.

- Land used for agriculture.

- The central government issued bonds such as 6½% gold bonds or national defense gold bonds (1980).

- Special bearer bonds (1991)

- Gold deposit bond or deposit certificates authorized by Gold Monetisation Scheme, 2015

What are the Types of Capital Assets?

Short-term capital asset

An asset held under the possession of a person for 36 months or less is called a short-term capital asset. It’s worth noting that the immovable properties such as building, land, and house property don’t serve this period. A time span of 24 months applies to such properties.

For example, if you sell your house after possession of 24 months, the gain from this property will be treated as LTCG, provided the selling has been done after March 31, 2017.

Long-term capital asset

If the possession of the asset surpassed the timespan of 36 months, then it will be treated as a long-term capital asset. The period of 24 months cannot apply to movable property, such as debt-oriented mutual funds or jewelry. They will come under the classification of a long-term capital asset if the possession period surpasses 36 months.

Some assets deem as short-term capital assets provided their ownership pursued for 12 months or less. This provision comes into effect if the date of transfer falls after July 10, 2014, regardless of the date of purchase.

The assets are as follows:-

- Company’s shares or equity listed on the stock exchange.

- Securities such as bonds and debentures listed on a stock exchange in India.

- Units of UTI, equity-oriented mutual fund, or Zero-coupon bonds

When the possession of these assets pursued for more than 12 months, they trickled down to the category of a long-term capital asset. In case an asset is acquired by will, gift, succession, or inheritance, the time span for which the previous owner held the asset must be taken into the account while determining whether it’s a short term or a long-term capital asset. In the case of bonus or rights shares, these assets’ allotment periods will use for the holding period’s estimation.

Calculating Capital Gains

Since the Capital profit estimation depends on the possession period of the asset, you must keep in mind a few things.

Full value consideration

Capital profits lure capital gain taxes and are only applicable in the year when the transfer took place even if it didn’t expose to any sort of consideration.

Cost of acquisition

The acquisition cost of the capital asset bear by the seller.

Cost of improvement

Any changes or addition to the capital asset made could lead to expenses is known as the cost of improvement. The improvement before April 1, 2001, is subjected to non-consideration.

How to Calculate Short-Term Capital Gains?

Step 1: Commence the estimation with the full value of consideration.

Step 2: Make sure to deduct the following:-

- Expenditure occurred with such transfer, whether it incurred wholly and exclusively.

- Cost of acquisition

- Cost of improvement

Step 3: This amount is referred to as short-term capital gain

Short term capital profit = Full value consideration.

Read our article:What Is A Tax Residency Certificate, And How To Get It? How!

How to Calculate Long-Term Capital Gains?

Step 1: Commence the estimation with the full value of consideration.

Step 2: Make sure to deduct the following:

- Expenditure occurred with such transfer, whether it incurred wholly and exclusively.

- Indexed cost of acquisition

- Indexed cost of improvement

Step 3: Deduct the resulting number by the tax exemptions provided under sections 54, 54EC, 54F, and 54B.

Long-term capital profit= Full value consideration.

Less: Expenses incurred concerning such transfer

Less: Indexed Cost of acquisition

Less: Indexed Cost of improvement

Less: Expenses that are eligible for a deduction from full value for consideration*

Note: *Expenses in context of sale gains made a capital asset are deductible from the full value of consideration. These expenses are imperative for the successful transfer of assets.

As per Budget 2018, long-term capital profit in the context of equity shares obtained after March 31, 2018, will come under capital gain tax exemption from Rs. 1 lakh per annum. Furthermore, 10% of tax will be imposed on LTCG on equity-based funds surpassing Rs 1 Lakh in one financial year in the absence of indexation’s benefit.

In the case of sale of house property

Following expenses which need to be deducted from total sale price:

- Amount paid in terms of Brokerage to secure a purchaser.

- Expenses in context to Stamp papers

- Traveling expenses in the context of transfer. These expenses might occur after the transfer has been affected.

- In the case of “inheritance of assets,” expenditure concerning obtaining a succession certificate and executor’s cost may be permissible in some cases.

In the case of sale of shares

The deductions of the following expenses come under this category.

- Broker’s commission raised by the selling of the shares

- STT or securities transaction tax not come under deductible expenses.

In case of sale of jewelry

Here, a broker’s services shall be considered as deductible expenses used to secure a buyer. Note that expenses that were subtracted from the asset’s selling price for the estimation capital profit shall not be deemed as a deduction under income tax return.

Indexed Cost of Acquisition/Improvement

The indexation of the cost of improvement and acquisition is achieved by applying CII (Cost Inflation Cost). In general, CII is applied when there is a need for inflation adjustment concerning the value of the asset. This may lower capital gains to a considerable amount and crank up cost base.

Indexed cost of acquisition = cost of acquisition/Cost inflation index (CII)

Keep in mind that the estimation of the Cost inflation index (CII) depends on the year in which the owner claims the possession of the asset for the first time, or 2001-02.

Exemption on Capital Gains

Example: Kalsi bought a brand new house in July 2004 for the sum of Rs 50 lakh, and the sum of 1.8 crore is obtained as the full value of the consideration in FY 2016-17. Since this property has under the possession for over three years, this would refer to a long-term capital asset. The inflation cost and indexed cost has already been taken into account.

As per the formula of indexed cost of acquisition, the adjusted cost of this particular property is Rs 1.17 crore. Apparently, the net capital gain, in this case, came out to be Rs 63, 00,000. The long-term capital gains are prone to a capital gain tax, which is 20%. So, the tax expenditure on these net capital gains will be Rs 12, 97,800, which is a great amount of money that will eventually result in tax pay-out. Fortunately, one could short down this huge figure through various tax exemptions on capital gains, provided the sale gain is used to acquire another asset.

Section 54: Exemption on Sale of House Property on Purchase of another House Property

One can take benefit of exemption under section 54 if the sales profit is used for investment for acquiring another two houses property. Earlier, this provision prior amendment was limited to only one house property.

The exemption on two house properties is permissible for once in a taxpayer’s lifetime, provided the capital profit do not surpass the figure Rs. 2 crores The taxpayer is only eligible to manage an investment of the capital gains and not the entire sale proceeds. If the new property purchase price exceeds the capital gain amount. The exemption will only apply to the total capital gain on the sale.

Conditions for availing this benefit

1. The purchasing of the newer property can be done only in two of the given conditions

- One year before the sale

- Two years after selling the property.

2. The sale gains made from assets could be further utilized for construction purposes. However, there is a time-constrained of three years with this provision. It means that if the person isn’t sure of completing the constructions in the given time frame, he/she must allocate the gain somewhere else to ensure 100% compliance with tax provisions.

3. The Budget of 2014-15 already clarified that the purchasing of only one house property is possible via sale profit of assets to claim this exemption.

4. Please note that this exemption is exposed to dissolution if its owner sells this newer property within three years of its purchase.

Let us summarise what we have learned so far.

- Capital gain tax is nothing but a tax imposed on profit that was obtained by selling capital assets.

- Based on the holding duration, capital profit could be classified into Long term Capital Gain Tax, or Short term Capital Gain Tax.

- LTCG is 10% for equity-based mutual funds and 20% for real estate’s indexation, mutual funds, and other crucial assets.

- LTCG is free from any sort of indexation benefits concerning equities/equity mutual funds.

- STCG, on the other hand, is levied as per the slab rate.

- The holding duration in the context of LTCG or STCG varies from asset to asset.

- LTCG can be applied to real estate in the event when the holding period exceeds two years.

- LTCG can be applied to debt fund in the event when the holding period exceeds two years.

- LTCG can be used to stocks/equity mutual funds in the event when the holding period exceeds one year.

Conclusion

So, it is clear that the estimation of the Capital-gains tax is done when the asset is sold for monetary gains. Many investors adopt proactive methods to get access to capital gain based on their tax needs. Well, to be frank, capital-gains renders both pros and cons, based on the taxpayer’s tax situation. Nearly everything you got at your disposal in the form of a tangible entity is treated as a capital asset. One of the biggest drawbacks of having a capital asset is that if they are sold for great profit, the tax authorities require that you report a profit as income. The amount of taxes that you are entitled to pay-out depends on the holding period of the asset prior to selling that can either cause loss or benefit to the taxpayer.

Read our article: Is Capital Gain Tax incapable of levying upon Registration of Sale Deed? Know-How!