Salaried individual is an individual or the taxpayer that comes under the head of income from salary according to the Income Tax act. Any Individual or businessman that comes under the purview of tax submits their Income Declarations form and submit the requisite documents. Although, it seems very easy but submitting income tax forms requires professional guidance and expertise. Therefore, a personal income that exceeds the maximum limit of the income prescribed by the Income-tax Department as a taxable income is known as taxable income. The Income-tax department brings revenue to the government.

According to the Income-tax Act[1], the amount of money we pay from your income is an income tax. Income tax is levied on a person who was in India for about 182 days during any previous year or the person who was in India for at least 60 days during the previous tax year and for at least 365 days during the preceding 4 years will be charged to tax.

Changes in calculation of Income Tax 2020-21

The new income tax regime came into effect from April 1, 2020. This gives an individual taxpayer the option to either continue with the existing tax regime (with tax-exemptions and deductions) or opt for new tax regime (without 70 tax-exemptions and deductions). Salaried individual, who have no business income, will have to choose between the existing and new tax regimes every financial year, as per their convenience.

Important points in 2020-21 Income Tax

- The surcharge is levied on income above Rs 50 lakh. Health and Education cess at the rate of 4 percent will be added to the income tax liability in all cases. Individuals having taxable income of up to Rs 5 lakh will be eligible for tax rebate under section 87A up to Rs 12,500, thereby making zero tax payable in the new tax regime.

- Under the new tax regime, the new income tax regime allows a deduction under section 80CCD(2) of the Income-tax Act, 1961. This deduction is available if an employer contributes to an employee’s NPS account. An employee can claim a maximum deduction of 10 percent of salary (salary means basic plus dearness allowance).

- Other commonly availed deductions such as those under sections 80C, 80D, etc., and tax exemptions such as HRA, LTA, etc. are not available in the new tax structure.

- Unlike existing tax regime which offers higher tax-exemption limit for senior citizens (age 60 years and above but less than 80 years) and super senior citizens (age 80 years and above), the new tax regime does not offer a higher tax-exemption limit on income.

- The new income tax regime also offers a maximum tax rebate of Rs 12,500 under section 87A of the Income-tax Act. Therefore, an individual is not required to pay any tax on income up to Rs 5 lakh in FY 2020-21 under the new tax regime.

- To arrive at net taxable income, for a financial year, an individual first needs to calculate the total of incomes that are taxable. Then, one needs to total the number of deductions that an individual is eligible to claim in a financial year. To arrive at net taxable income, one needs to deduct the total amount deductions from the total taxable income.

What is the difference between Exemption and Deductions?

Both exemption and deduction help reduce your tax liability, but these are availed under different sections of the Income Tax Act.

- Deduction is a reduction in the total taxable income based on Section 80 and Chapter VI-A. Specific kinds of spending, such as investment in life insurance policies and payment of children’s tuition fees, help you avail of a tax deduction.

- Exemption is a specific amount that is excluded from the total gross income before calculating tax. Exemptions are available under Sections 10 and 54. Interest earned from tax-free bonds and salary components like LTA are examples of exemptions.

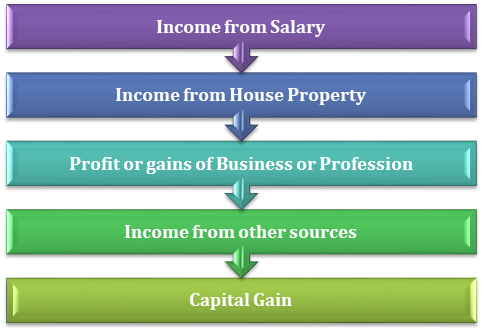

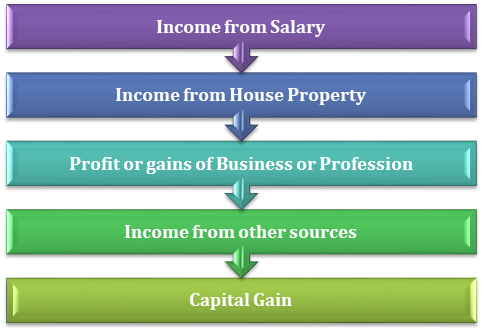

Heads under the Income Tax Act

A total personal income is divided into 5 heads of income which are as follows-

“Salaried Income” As Per Income Tax Act 1961

The dictionary meaning of the Salaried Income is a form of earning or profit that is provided by an employer to his or her employee for the service rendered. So, the amount of money which is calculated as the salary is the right of the employee, which he or she received from the employer as a service rendered. And as a result of the income from salary, it comes under Income tax for Salaried Individual.

As per the Income-tax department, section 17 (2) of the Income-tax Act, 1961 defines the salary as the worth of an accommodation that is free of rent from an employer to an employee.

What is Salaried Income?

The term Salary includes wages, pension, gratuity, fees, commission, provident fund contribution, perquisites, and leaves encashment; the central government contributed to pension and compensation received for a service.

Salary is the remuneration paid by the employer to the employee for the services rendered for a certain period of time. The person who gets the salary income is the salaried individual. It is paid in fixed intervals like monthly one-twelfth of the annual salary. The following items are included in salary-

- Basic salary or the fixed component of salary as per the employment terms

- Fees, commission, and bonus received by an employee from employer end

- Allowances are paid by the employer to an employee to meet the personal expenses.

- Allowances are taxed either partially, fully, or exempt sometimes.

Following are Some Fully Taxable Allowance-

- Dearness allowance is paid to the employee to meet its expenses caused due to inflation

- City Compensatory Allowance is paid to those who move to metropolitan cities like Mumbai, Delhi, and Chennai where the standard of living is higher,

- Overtime allowance is paid to the employee who works apart from working hour

- Deputation allowance and servant allowance

Following are Some Partially Taxable Allowance –

House Rent Allowance is given to the employee who stays in a rented property and unlikely a person who stays in its own house; then, it is fully taxable. The allowance exemption is the least of the actual house rent allowance or additional rent above 10% of the salary, or the rent is equal to 50% of the salary in metro or 40% in another area

- Entertainment allowances are given to the employee excluding Central or State Government

- Special allowances are like uniform, travel or research allowance, etc.

- Special allowance to meet personal expenses like children education allowance, children hostel allowance, etc

Read our article: ITR Rectification – A Complete Guide on How To Rectify ITR Online

Following are Fully Exempt Allowances –

- Foreign allowance given to the employee posted abroad

- Allowance of high court and Supreme Court Judges

- United Nations Organization employee allowances.

- Perquisites are the Incentives that are paid to the employee Over Their Salaries. They are Not Reimbursement of Expenses.

Some perquisites are taxable for all employees irrespective of salaried individual which are as discussed-

Some perquisites are those who are only for directors or those who have some substantial interest in the organization –

Some Exempt from the Tax like Fringe Benefits are Exempt from Tax –

Exemption on receipts at the time of voluntary retirement

Under section 10 C, any compensation received upon voluntary retirement or separation. This exemption can be claimed in the assessment year in which compensation is received.

It is not taxable if they meet the following conditions:

- Compensation is received against voluntary retirement or separation.

- The maximum amount must not exceed Rs.5,00,000.

- The employee must be working with an authority established under the Central or State Act, state government or central government, university, local authority, notified institute of management, IIT, or notified institute of importance throughout India or any state, company, PSU or a cooperative society.

- The receipts must comply with Rule 2BA

Under this section, no exemption can be claimed for the same AY. Also, this exemption cannot be claimed if the employee has already taken exemption under Section 89for compensation of voluntary retirement or separation or termination of services.

The Retirement Benefits are given to The Employee during Their Period of Service or Retirement –

- A pension is given either on a monthly basis or in a lump sum, and the tax is charged depending on the category of the employee.

- Gratuity is given as the appreciation of the going performance, which is received at the time of retirement and is exempt to a certain limit.

- Leave salaries tax depends on the category of the employee. The employee has the discretion to make use of the leave or encash it.

- Provident fund is contributed by both employee and employer on a monthly basis. At the time of retirement, the employee gets the amount along with interest.

Calculate Taxable Income on Salary

To calculate the taxable income for a salaried individual, one needs to gather all the details that are required to file income tax returns before computing the total taxable income on salary. After that, they will calculate the total taxable income along with the tax deduction or tax refundable in case.

Procedure for calculating taxable income on salary is as follows-

- Firstly, collect your salary slips along with the Form 16 of the current fiscal year and ass every emolument like basic salary, House Rent Allowance, Travel allowance, Dearness Allowance and other reimbursement and allowances that are mentioned in Form 16 (Part B) and salary slips.

- Secondly, add the bonus or benefit received during the year.

- The total gross salary you have to deduct from the exempted part of house rent allowance, transport allowance or medical reimbursement, and all other reimbursement provided the actual bills are in respect of the expenses incurred.

- As a result, the net income from salary is calculated.

What is included or excluded in the taxable income?

Basic Salary– It is the largest portion of salary, and it is a fixed component which forms other components of the total salary.

House Rent Allowance– This amount is exempted from tax if the salaried individual lives in a rented house or apartment. For those who have own house in the same city as their job is, then this amount is taxable.

Medical Reimbursement– If the company offers a medical reimbursement, then it can be claimed only by submitting the medical bills. This bill can be reimbursed for doctor consultation, medical tests, and medicinal expenses. This bill can also be claimed against medical expenses of dependents, but this is subject to company rules.

Conveyance Allowance– This allowance is given to employees to cover their travel expenses from home to work. It is exempted from tax.

Leave Travel Allowance– Salaried employees can avail exemption under Leave Travel Allowance for a trip within India and it can be claimed only for travel done with the family members. To claim the exemption, one needs to submit the bills, and thus it is not possible to claim it unless one has actually been travelling.

Special Allowance– Special allowances are fully taxable, and this covers other left out allowances.

Bonus– This allowance is paid once or twice a year, and it is 100% taxable.

Employee Contribution to PF– Employee and the employer are both supposed to contribute 12% of the basic salary into the employee’s Provident Fund, and it should be done on a monthly basis.

Professional Tax– This tax is levied by the state, and the maximum amount can be levied. The employers deduct it and deposit it to the state government.

Deduction for Loan for Higher Studies (Section 80E)

Income Tax Act has a provision for deduction of interest on loans for education. The important conditions that should be satisfied before claiming such deduction are that for pursuing higher studies the loan should have been taken from a financial institution or a bank in India or abroad by the person himself or for his spouse or children.

Interest on Home Loan (Section 80C and Section 24)

Another significant tool for saving tax is the home loan interest that is paid. These homeowners have the choice to claim deduction for interest on home loan which can be up to Rs. 2 lakh as a for self-occupied property.

Conclusion

The total tax liability is calculated on the basis of your net taxable income, falling into a particular tax slab. As your income increases, income at different levels will be taxed at different tax slab rates. From the financial year (FY) 2020-21, a salaried individual taxpayer has to choose between the new tax regime ( tax-exemption and deductions) and the existing tax regime (continue with existing deductions and exemptions).

Read our article: Taxability for Co-operative Societies: A Complete Outlook on Annual Returns