Pvt Ltd Company registration is arguably one of the most efficient business forms in our country. The share of a private limited company remains inaccessible to outsiders; therefore, the probability of hostile takeover is next to negligible. Additionally, Ease of formation and no capital requirement make this business a perfect option for budget-conscious startups. In this write-up, you will learn how to open a current bank account for a Privately-held entity in India.

Introduction of Spice+ Web Form

Previously opening a current bank account was a tedious undertaking for the private limited companies owing to the abundance of requirements.

In Feb, 2020, the Indian government, in association with the Ministry of Corporate Affairs (MCA), came up with a revolutionary web-based form known as Spice+. This form aims to simplify the registration process for Private Limited Companies. The Spice+ form renders an array of services such as name reservation, the opening of current bank account post-incorporation, EPFO registration, Allotment of GSTIN, etc.

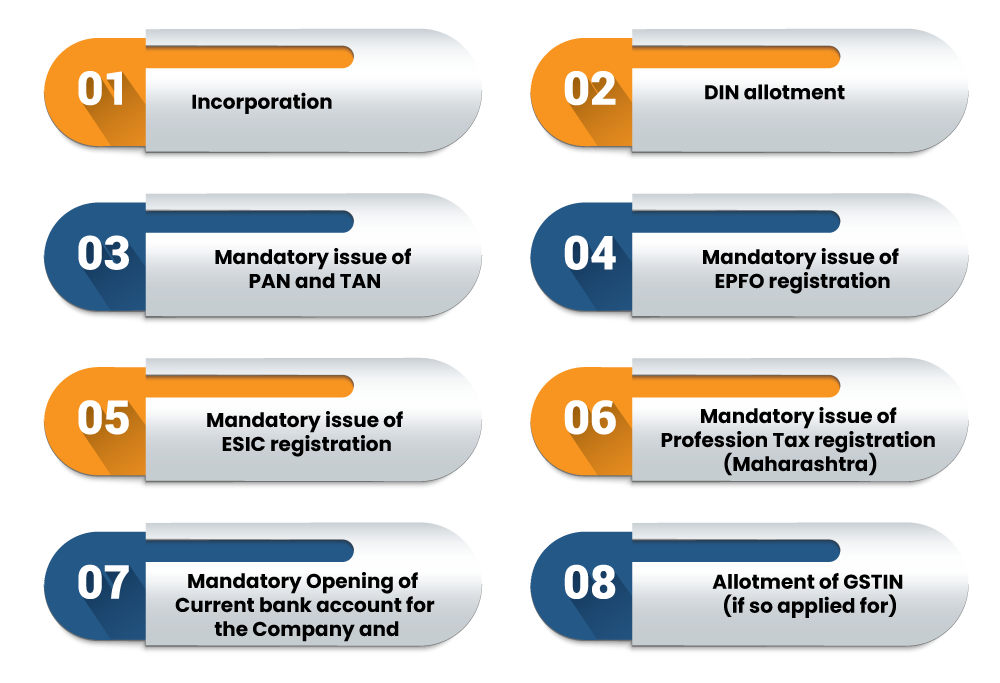

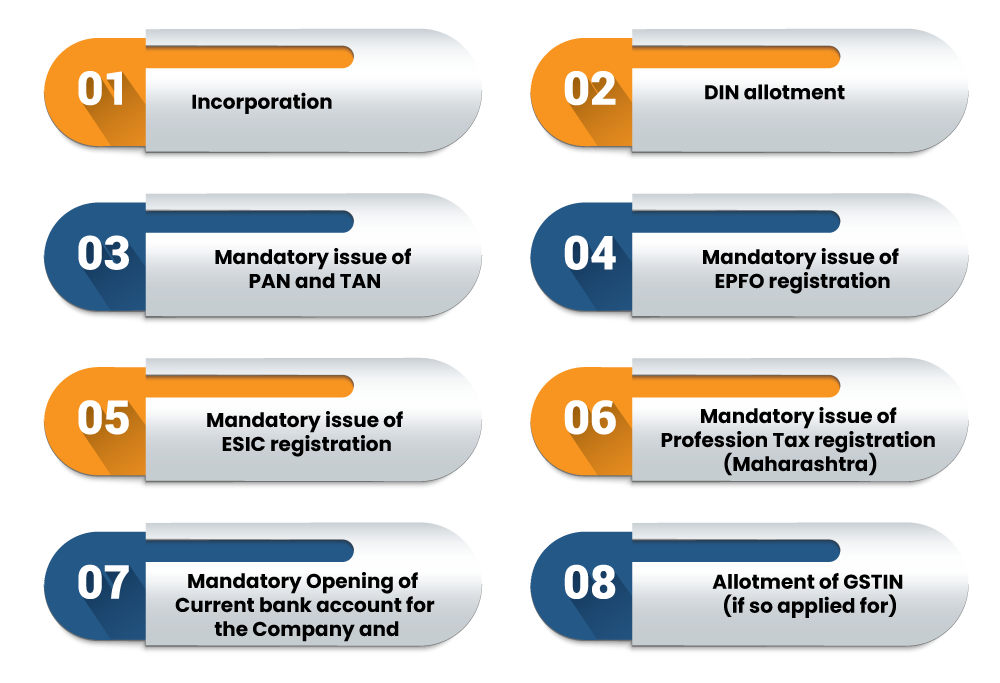

The Spice+ form is divided into two parts, i.e., Part A and Part B. Part A deals with the name reservation. Under Part B, the authority offers various incorporation services, including Incorporation, DIN allotment, GSTIN allotment, etc. This list below will give you a better understanding of the same.

- Part A: for Name reservation for new companies

- Part B: for Rendering Various Incorporation Services

After filling up the details in Part A, the applicant doesn’t require to manually fill the rest of the form viz; AGILE-PRO, eMoA, eAoA, URC-1, INC-9 because Spice+ is backed by automatic pre-fill support.

Opening of Current Bank Account via Agile Pro Form

All new entities incorporated via SPICe+ form (w.e.f 23rd February 2020) are mandated to apply for opening the Company’s Current bank account via AGILE-PRO web-based form.

At present, SBI Bank, Punjab National Bank[1], Kotak Mahindra Bank ICICI Bank, UBI, HDFC, Bank, and Bank of Baroda were integrated with SPICe+ for opening a current account for the Company. AGILE-PRO comprises online application for Profession Tax Registration, GSTIN/EPFO/ESIC/ and opening of Current bank account.

Read our article:How to Establish a New Company under Companies Act 2013 via SPICE+?

Law Governing the AGILE-PRO Web Form

AGILE-PRO web form is mandated to be filed under Rule 38(A) of the Companies (Incorporation) Rules, 2014. The application related to incorporation under rule 38 should be affixed with the AGILE-PRO (INC-35) form for the registration of the following,

- GSTIN

- EPFO

- ESIC

- Profession Tax Registration

- Opening of Current bank account

Purpose of the AGILE-PRO Web-form

Any applicant who wishes to incorporate a company via SPICe+ can also apply for the Opening of a current bank account/ Profession Tax/ GSTIN/ ESIC/ EPFO through AGILE-PRO (INC35) web-form. The applicant is mandated to file SPICe+ form for incorporation accompanying AGILE-PRO for, along with SPICe+ MOA (INC-33), form URC-1 and eForm SPICe+ AOA (INC34) as applicable for issuance of GSTN/ EPFO/ ESIC, etc.

This process will be accessible to those entities only which were incorporated by MCA via SPICe+ web form. Other applicants’ category such as Tax Collector, Tax Deductor, ISD, Casual Taxable person, etc. who wishes to apply for GSTIN is required to follow the existing registration process on the GST common portal.

Points to be Taken Care of While Filing Spice + Web Form

- The linked form will be pre-filled automatically by fetching data entered in Part A.

- While uploading a photo of an authorized signatory, make sure to take care of the image format and size. According to the form, the image should adhere to 100 KB size and. JPG format.

- Applicant can have access to those banks only that are integrated with SPICe+ form.

- It is mandatory to add the detail of the Proposed Director acting as an authorized signatory for the purpose of opening a current bank account or applying GSTIN / EPFO/ ESIC.

Mandatory Attachments for Opening Current Bank Account Agile Pro form

- Proof of Principal place of business

Following documents can be uploaded as Proof of Principal place of business. The particulars in the list are tagged along with admissible image size.

- Property Tax Receipt – 100 KB

- Municipal Khata copy – 100KB

- Electricity Bill – 100 KB

- Rent/ Lease Agreement – 2MB

- Consent Letter – 100KB

- Rent receipt with NOC (In case of no/expired agreement) – 1MB

- Legal ownership document – Image size- 1MB and image format- PDF.

- Identification proof of Authorized Signatory for opening Current bank account (.pdf)

- Address proof of Authorized Signatory for opening a current account in a bank (.pdf)

- Appointment proof of Authorized Signatory (.pdf)

- Copy of Resolution passed by BoD

- Letter of Authorisation – 100 KB

After uploading the aforesaid attachment, the applicant shall come across the declaration page. Before ticking the blank boxes, it is advisable to review the page thoroughly. Once you are satisfied with the page, tap on the “Pre-scrutiny” option followed by the Submit option.

What are the Salient Features of Spice + Web Form?

- Being on online application, the SPICe+ form would be filed via the front office dashboard along with other linked forms.

- The SPICe+ form provides the facility of On-screen filing along with real-time data validation for the error-free incorporation process.

- Information once provided can be altered and saved in the form.

- Once this form is filed with the requested details, the applicant can make covert the same into pdf format for affixing DSCs.

- Changes/modifications to the SPICe+ form are possible even after PDF conversion and affixing DSC.

- All Pre-scrutiny validations of details provided in the form will happen web form itself.

- DSC validations will happen at the upload level.

Conclusion

When contrasted with the previous method, opening a current bank account through the SPICe+ form is way easier and more seamless. The auto-fill feature certainly comes in handy in reducing manual errors. All in all, SPICe+ web-based is a novel medium through which the incorporation becomes incredibly more effortless.

Read our article:Registration Procedure of Small Business & Documents Required