Last year, CBDT, by way of Circular No 20-2020, released on 03.12.2020, has provides some clarification for the “TDS Deduction from Salaries for the Financial Year 2020 – 2021”.

Further, such a circular was authorized in continuance to Circular No: 4/2020, released on 16.01.2020, which talks about the rate of TDS deduction from salaries u/s 192 of the IT Act 1961.

In this write-up, we will come across the clarifications made by the said authority for new TDS deduction from salaries rates, which covered salaries from the FY 2020-21, together with other problems taken into account.

The paradigm of Tax Deducted at Source (TDS)

The term Tax Deducted at Source, aka TDS, implies the amount subtracted by the payer for paying Salary to the payee. It is a kind of Direct Tax & is imposed on incomes, dividends, rents, interest received from the bank, sale of assets, etc.

Moreover, the TDS provisions are overseen by the CBDT and governed under the ambit of the IT Act 1961. Section 194 IA, 194 IB, 194 IC of the IT Act 1961 governs the TDS applicable to the sale of goods. But, section 302 of the Act talks about the TDS imposed on dividends. Lastly, TDS is a kind of advance tax whose returns are filed every quarter.

Read our article:What are the Online Methods for Checking the TDS Status?

Underlining the Applicability of Circular No 20-2020

Every taxpayer who required to pay an amount as the income generated by the assessee can deduct Tax under the head “Salaries” on the aforesaid income for the FY 2020-21

How is TDS calculated on the Salary?

As per the provision of the IT Act 1961, TDS is estimated by taking the salary tax slab into account in which an employee falls. That means no tax will be chargeable if the computed Salary (inclusive of requirements) of an employees does not surpass the tax slab or the new tax domain u/s 115BAC.

Here’s the formula for computing salary for TDS deduction:

Salary = Basic Salary + Perquisites

But, if case an employee gets a salary from multiple employers, he/she needs to share the information of the present employee in written form, which shall be validated by him/her, together with other employers. Also, the current employer requires to deduct TDS on an aggregate basis.

Different Tax Slabs for Imposing Tax under the Salary Head

Following is the tabular form of rates at which Tax shall be imposed for the FY 2020-21 as per the provisions of the Finance Act, 2020[1].

| SI. No | Total Income Earned | Income Tax Rate | |

| 1 | Where the Total Income earned lies within the range of Rs 250000 | Nil | |

| 2 | Where the Total Income earned lies within the range of Rs 250000-500000 | 5% of the amount by which the gross income generate surpasses INR 250000 | |

| 3 | Where the Total Income lies within the range of Rs 500000-1000000 | Rs 12500 + 20% of the amount by which the gross income surpasses INR 500000 | |

| 4 | Where the Total Income is higher than Rs 1000000 | Rs 112500 + 30% of the amount by which the gross income surpasses the threshold of Rs 1000000 |

Normal Rates of Income Tax

When the Assessee is an Indian national, serving over 60 years of age but below 80 years

| SI No | Total Income Earned | Rate of Income Tax |

| 1 | Where the gross Income generated remain well below Rs 300000 | Nil |

| 2 | Where the gross Income generated Rs 300000 but does not surpassed Rs 500000 | 5% of the amount by which the gross Income generated exceeds Rs 300000 |

| 3 | Where the gross Income generated surpassed Rs 500000 but does not exceed INR 1000000 | INR 100001+ 20% of the amount by which the gross Income generated exceeds Rs 500000 |

| 4 | Where the gross Income generated exceeds Rs 1000000 | Rs 110000 + 30% of the total amount by which the gross Income generated surpassed Rs 1000000 |

When the Assessee is an Indian national, who is serving the age of 80 years or more

| SI No | Total Income Earned | Rate of Income Tax | |

| 1 | Where the gross Income generated does not exceed Rs 500000 | Nil | |

| 2 | Where the gross Income generated surpassed Rs 500000 but does not exceed Rs 1000000 | 20% of the total amount by which the gross Income generated exceeds Rs 500000 | |

| 3 | Where the gross Income generated exceeds Rs 1000000 | Rs 100000 plus 30% of the amount by which the gross Income generated exceeds Rs 1000000 | |

Clarifications for Arrears in Circular No: 20/2020

In terms of arrears, the employee can claim relief u/s 89 of the IT Act. Further, to serve such a purpose, the employer needs to furnish details in Form 10E, which further needs to be verified.

Clarifications on account of Losses Incurred Under Any Head

If in the event a loss came into existence under any head (other than the House Property), the same shall not be taken into account by DDO for the TDS calculation. In a case contrary to this, the DDO shall need to file declaration in addition to the computation of loss.

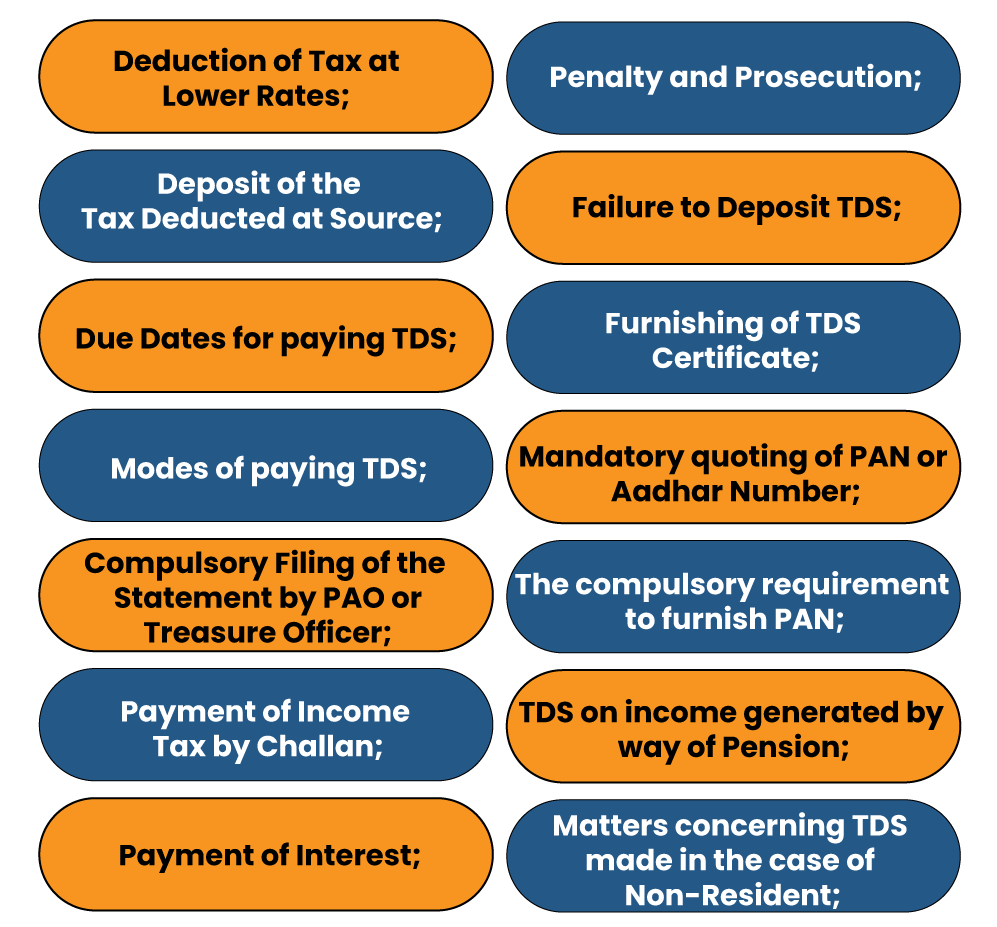

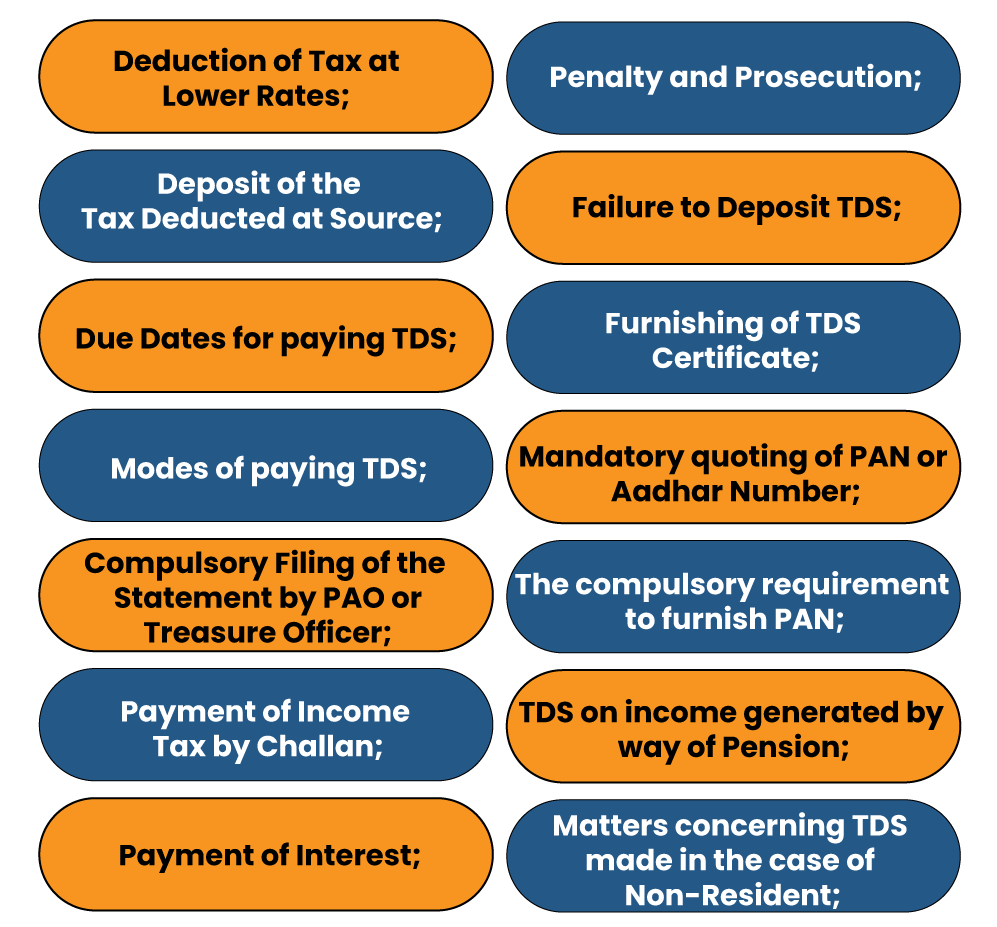

Other Clarifications mentioned in Circular No: 20/2020

With respect to a registered taxpayer eligible for TDS deduction, CBDT has rolled out some clarification for provisions related to the following;

Conclusion

The CBDT’s Circular No 20-2020 has provided clarification for new TDS deduction from salaries rates, which covered salaries from the FY 2020-21. Also, all the clarification mentioned in Circular No 20-2020 was in line with the provisions of IT Act 1961 & IT rules 1962.

Read our article:What is TDS Payment Due Date through Challan?