The Asset Reconstruction Company is acknowledged by Reserve bank of India as NBFC, whose primary goal is to handle banks’ NPA. AFC’s role is very crucial on account of the re-organization of the bank debt. RBI has some strict norms for ARCs operating across the country.

What is Asset Reconstruction Company (ARCs)?

An Asset Reconstruction Company refers to a financial institution that buys the bad assets or NPA (non-performing asset) from banks and cleans up their balance sheets. In simple terms, ARCs engaged in the business of purchasing bad loans from banks. This allows the banks to shift their entire focus on the core competency. ARCs enable the banks to mitigate the requirement of following up with the clients to recover the debt.

SARFAESI Act 2002- The Derivation of ARCs

The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002 provides the legal grounds for establishing ARCs in India. Section 2 (1) of the Act provides meaningful description of Asset Securitization. Likewise, ARCs are also defined as u/s 3 of the Act.

The SARFAESI Act provides service regarding the reconstruction of bad assets with the interference of courts. As of now, an ample number of ARCs were operating pan India under the RBI’s regulation.

What are the Roles of Asset Reconstruction Company?

RBI Guidelines Regarding Securitization & Asset Reconstruction Company

The Reserve Bank of India[1] (RBI) introduced some norms related to the securitization and Asset Reconstruction Companies (ARCs). Given SARFAESI Act, the Reserve Bank has introduced the Guidelines & Directions, 2003 for these companies.

The exception of the directors’ scope is that most of the functional part of the guidelines apply to the asset acquisition by a SARC but does not become active if such assets are held as trustee. The SARC has to be a trustee to such trust and acquire assets as trustees to fall beyond the scope of the guidelines.

SCs/RCs shall obtain memberships of JLF (Joint lender’s forum) as mentioned on ‘Framework for Revitalized Distressed Assets in the Economy- Directions related to Corrective Action Plan (CAP) and JLF shall be a part of the process on account of such stressed assets.

SCs/RCs shall avail permission from RBI when transfers result in considerable change.

Registration of Company under SARFAESI Act

- Every Reconstruction Company is required to make an application in a form prescribed by the authority.

- The company must avail a registration certification from the bank as mentioned u/s 3 of the Act.

- Such a company can carry activities regarding securitization and asset reconstruction after availing of the required certificate.

- The company must start a business within six months from the date of issuance of the registration certificate. However, the authority can furnish additional 12 months to the company in this regard under special circumstances.

- NBFC authorized as SC/RC with the bank as per Section 3 of the SARFAESI Act, 2002 shall not be subjected to sections 45 -IA, 45-IB, and 45-IC of RBI Act, 1934.

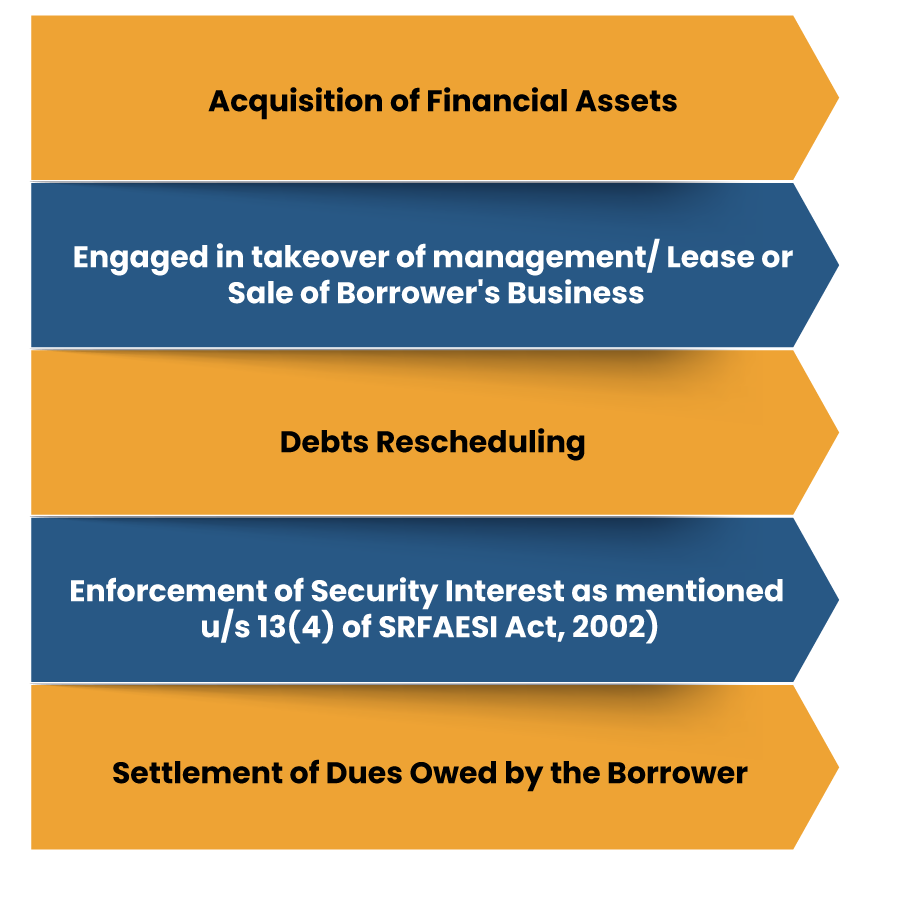

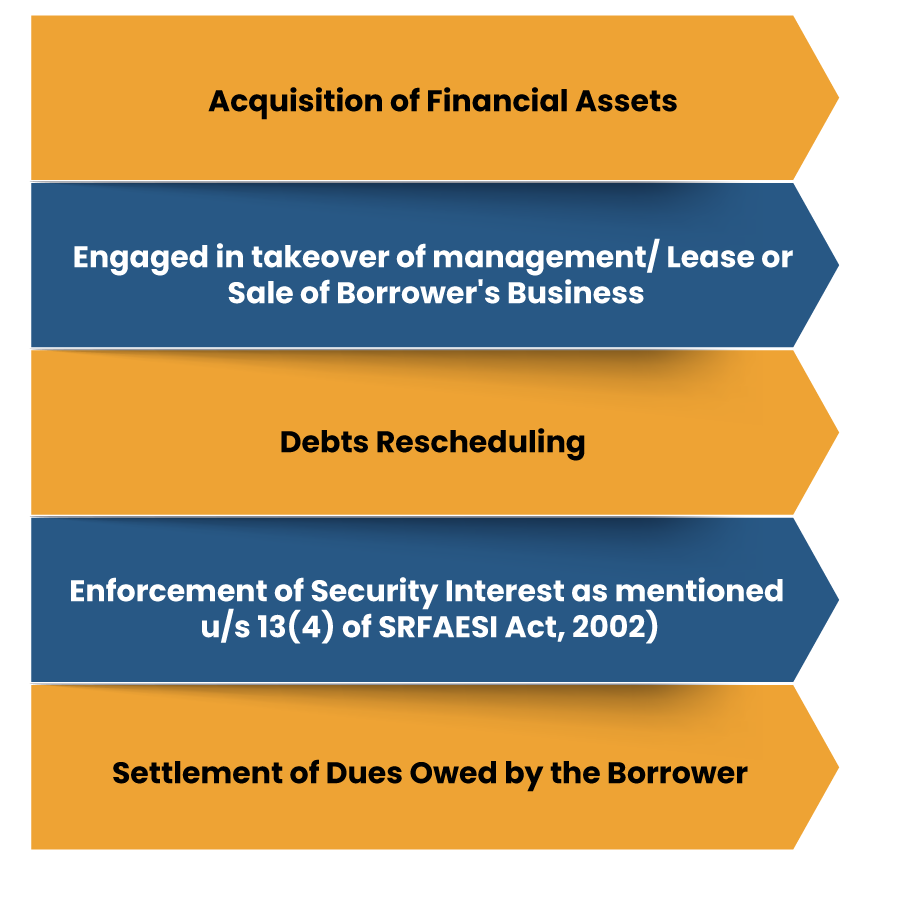

What are the Allowable Business Activities for Asset Reconstruction Company ?

A Securitization Company or Reconstruction Company,

- Shall carry out activities related to securitization and asset reconstruction only.

- Cannot utilize deposits to procure funds.

- The company undertaking business that doesn’t align with the law would result in the cancellation of registration.

Read our article:What is Cost of Company Registration in India?

Prerequisites Regarding Asset Reconstruction Companies

There are few Prerequisites Regarding Asset Reconstruction Companies in terms of net owned funds; Capital, etc are as follows:-

Net Owned Fund

The Reconstruction Company’s Net-owned fund should not fall below the lower threshold limit, i.e., Rs 2 crore or other higher amount set by the RBI.

Any SC/RC pursuing business activities must possess a minimum Net Owned Fund of 15% of the total financial assets acquired by the SC / RC on an aggregate basis, or Rs 100 crore, whichever is less. The minimum net owned fund shall be maintained on an ongoing basis.

Capital Adequacy Requirement

All Securitization Company or Reconstruction Company (SC/RC) is liable to maintain a capital adequacy ratio, which should not be lower than 15% of its total risk-weighted assets. The calculation of risk-weighted assets must be carried out on account of a weighted aggregate of on-balance sheet and off-balance sheet particulars as mentioned.

How Securitization Company (SC)/ Reconstruction Company (RC) Deploy Funds?

- An SC/RC, as a promoter and with the aim to set up a joint venture, invests in the equity share capital for the purpose of asset reconstruction.

- SC/RC may opt to invest any surplus funds on account of policy framed in this context by its BODs, only in Government securities with Small Industries Development Bank of India, scheduled commercial banks, National Bank for Agriculture, or such other entity may be prescribed by bank occasionally.

- SC/RC is not liable to make an investment in land or building provided that the restriction shall not be applicable to the investment by SC/RC in buildings and land for its own use up to 10% of its fund.

Regulatory Reporting

Every SC/RC requires submitting a quarterly statement, namely SCRC 1 & SCRC 2, to the Bank within 15 days of the end of the quarter.

Every SC/RC requires furnishing a copy of the audited balance sheet to banks. They are also required to provide directors’ / auditors’ report within one month from the date of AGM in which the audited SC/RC’s audited account is adopted. Companies may be scrutinized periodically by internal/external agencies.

Conclusion

Helping banks settle fiscal issues that occur due to avalanche of bad debts is the primary goal of Asset Reconstruction Company. After dispensing the bad debt to such companies, banks can shift their entire focus on activities that matter the most.

Being a central agency, Asset Reconstruction Company works through a legitimate protocol to acquire bad loans from financial institutions. By doing so, they let banks operate in a seamless fashion as long as possible.

Read our article:Exciting Benefits of Private Company Registration That You Can’t Ignore!