If you wish to start an NGO, you need to follow specific protocols and parameters set by the government. It is because; starting an NGO is a noble cause. A non-governmental organization (NGO) operates independently without government interference, which is a legally established organization created by natural persons. This term “NGO” refers to entities with no government status, usually used by the government. NGOs are primarily engaged without any profit motive in cultural, legal, social, & environmental activities. In this article, we will be emphasizing how you can register an NGO in India.

NGO Registration enables you to be evident in the eyes of the law if you want to establish a non-profit organization and want to work with an object of betterment or improvement of any specific arena of the society. What are the ways to register? There are three methods by which you will be able go for NGO Registration in India if you are planning to establish an NGO.

Those are as follows:-

- Trust Organization under the Indian Trust Act, 1882

- Society Registration under Societies Registration Act, 1860

- Section-8 Company under the Companies Act, 2013

Critical features of NGOs in India

- NGOs are self-governed by committee or managing body or trustees.

- NGOs exist independent of the state.

- NGOs are non-profit, making organizations.

- It produces money for the profit of others and not for the members.

What are Different NGO types known by?

There are three ways by which you can go for NGO Registration if you are planning to start an NGO in India.

Trust Organization under the Indian Trust Act, 1882

Trust is registered when a building is involved and property in the form of land. Diverse states in India have diverse Trust Acts which govern the trust. The Indian Trust Act, 1882, is applicable in case a state doesn’t have the Trust Act.

Public Trust

A beneficiary in the case of public trust is the general public at large because Public trust is established to provide benefit to the public at large only. Public Trust is further subdivided into two parts:

- Public Religious Trust

- Public Charitable Trust

Private Trust

Often families or individuals are beneficiaries in the case of private trust. A private trust is further subdivided into two parts:

- Private Trusts who’s both or either their imperative offers and the recipients can’t be resolved

- Private Trusts whose recipients and their indispensable offers both can be resolved

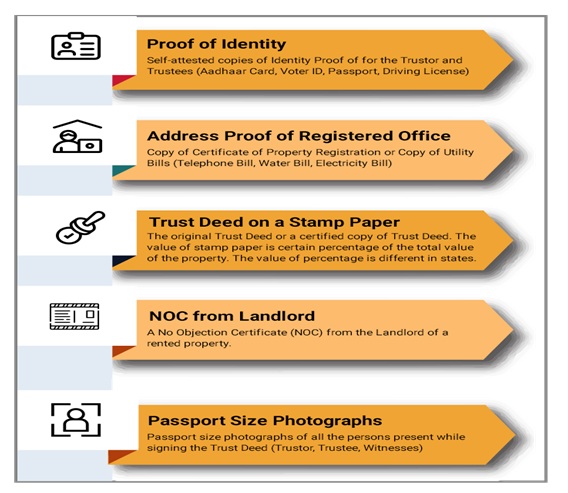

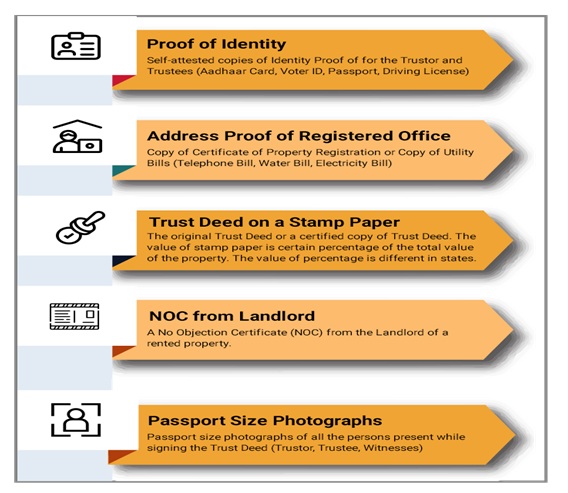

Documents you would require submitting to register a trust in India.

Once you have all the below-mentioned documents for Trust Registration in India, submit the form and the payment for the registration process. As per The Indian Trust Act, 1882, it takes approx. 8-10 working days for the online process.

Society Registration under Societies Registration Act, 1860

Societies as NGO, Registration are structured to promote literature, science, or the fine arts and the diffusion of valuable knowledge/political education or charitable determinations and purposes. You would need at least seven members to form a society. Moreover, there is no limit to the number of members, but the simple demarcated minimum quantities are 7 members. Section 20 of the principal Act mentions the following objectives for which society registration can be done under the Act One can register the following societies as per Section 20 of the Society Registration Act 1860[1].

- Charitable societies

- Society for maintenance of libraries

- Societies for encouraging science, culture, fine arts, etc.

- Military orphan fund Centres

- Society for the diffusion of political education

- Funding for charitable assistance

- Societies established at the General Presidencies of India

- Public museum and galleries of paintings,

- Designs

- Mechanical and philosophical inventions,

- Collections of innate history Instruments, etc.

Documents you would require submitting to register a Society in India.

You need to submit the documents along with payment for NGO Registration as a society. It takes 7-11 days once the paperwork is done to draft By-laws of the society and Memorandum of Association. Moreover, it takes 21-30 days for the completion of the registration procedure.

- Name of the society

- Copies of Memorandum Of Association and By-laws of the society

- Covering letter on behalf for society registration stating in the body of message various records attached with it.

- Memorandum of Association (MOA) in copy along with a certified copy.

- In matters of current places of worship like a temple, masjid, gurdwara, etc. sufficient documentary proof verifying legal competence and control of applicant society over such sites should be filed.

- Affidavit valued by the President or Secretary of the service.

- Documentary proof of residential tax receipt, rent receipt of the registered office of a society, or ‘No Objection Certificate’ (NOC) from the keeper of the proposed society.

- PAN card for identification of all the members of the society for NGO Registration

- Residency proof of members of society which may include ‘Aadhar card/electricity bill/bank statement/gas bill’ etc.

- Comprehensive List of all the members like name, address, contact details, etc.

- Copy of rules & regulations of society,

- Minutes of the preceding meeting of society authorizing the society registration.

- Declaration by the president of the society affirming his willingness and competency to embrace the post of president

Section-8 Company under the Companies Act, 2013

You can go for NGO Registration as a non-profit organization-Section 8 company also. The objective is to promote commerce, education, religion, social welfare, trade, charity, sports, and exploration/research. To form an NGO under Section-8 Company, it must have at least three directors (public limited Company) and two directors (for private limited Company). On occasions where the Company gains the profit, it is put to use for advancement of work for which the Company has been recognized.

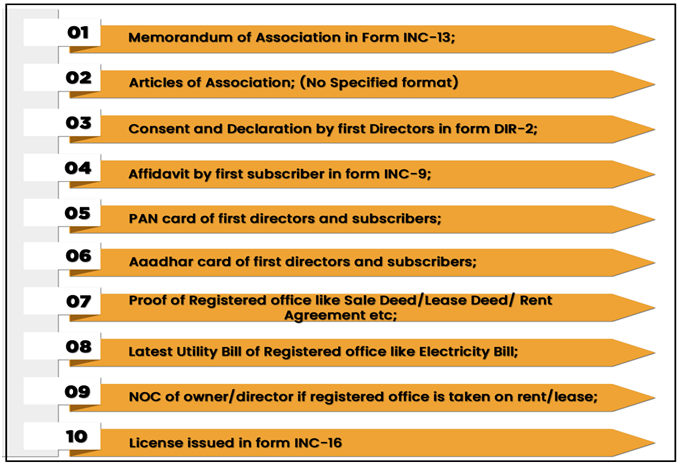

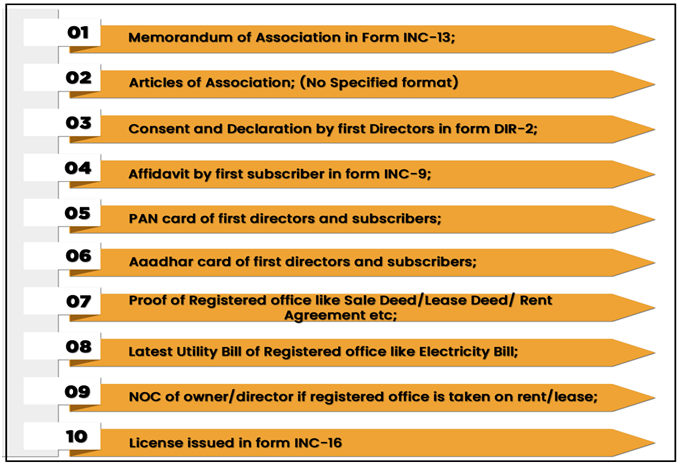

Documents you would require submitting to register a Section-8 Company in India.

- The name of the Company for authorization

- Address proof of the registered office that can be included of electricity or water bill or house tax receipt

- Driving License

- Aadhaar card

- Digital Signature or DSC of the recommended directors

- Copy of Passport

- Voter ID

- Get the DIN or Director Identification Number for the recommended directors

- The Memorandum of Association(MOA) and Articles of Association (AOA) of the Company

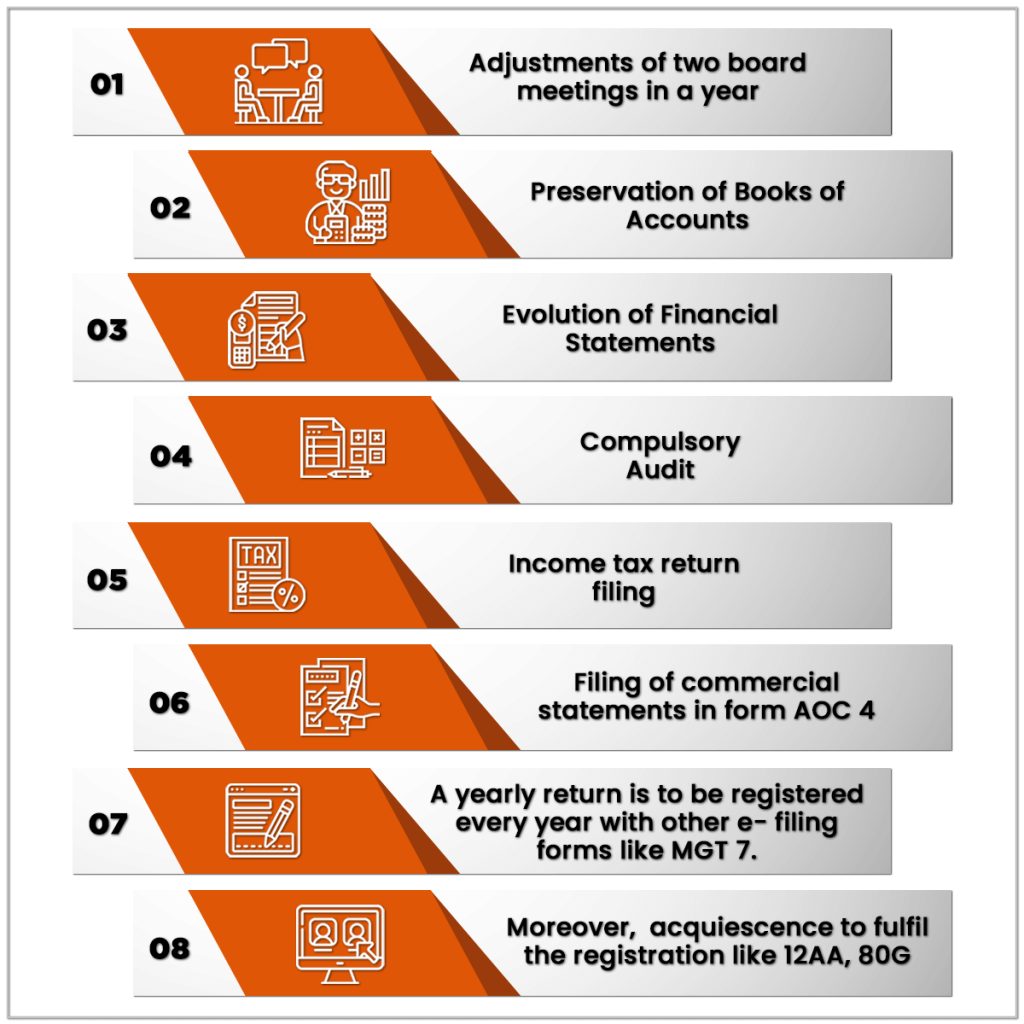

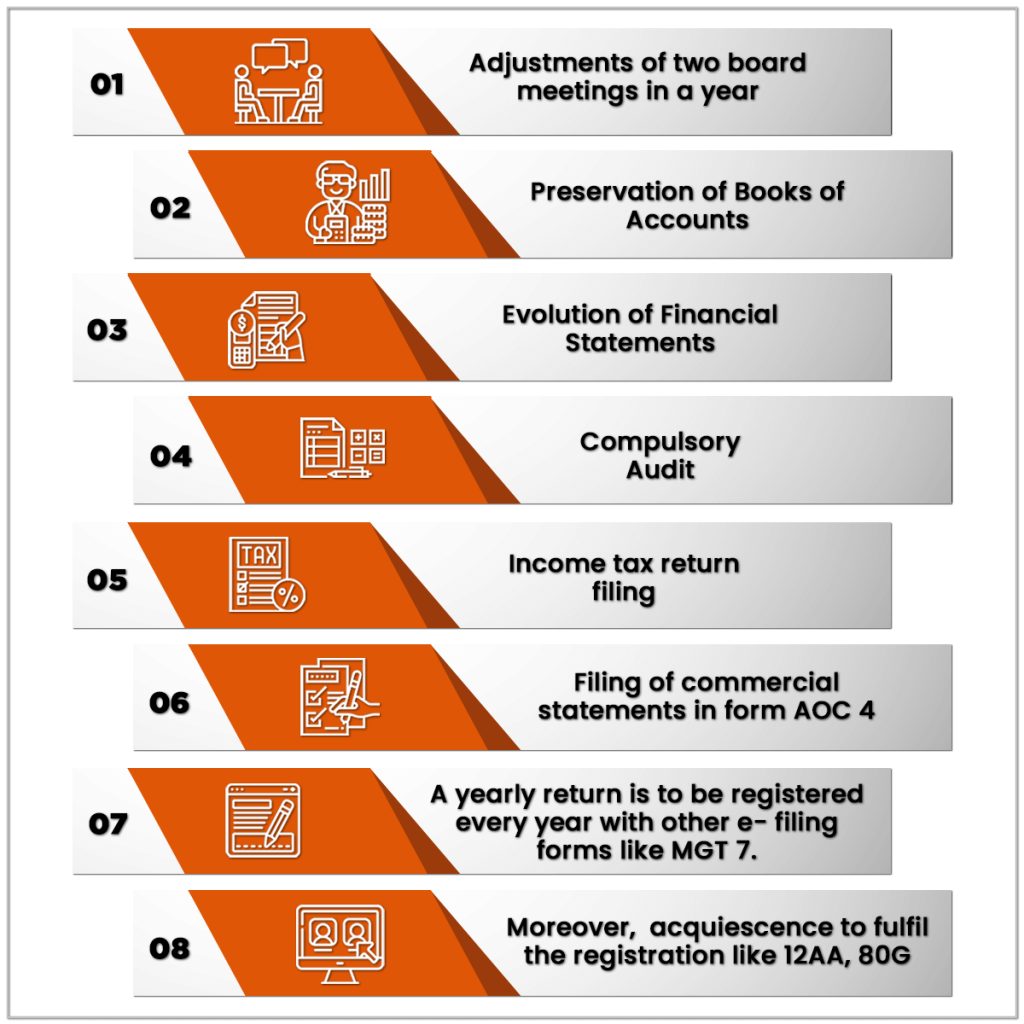

Annual Compliance as per the Companies Act 2013 for Section 8 companies

What are the Eligibility Criteria for Section 8 Company Registration in India

- A Person or HUF (Hindu Undivided Company) or limited Company is qualified to establish and go for NGO Registration as a Section- 8 company registration within India.

- Two or more person who may act as a shareholder or director of the Company must satisfy all the conditions of the Section 8 Company registration.

- At least one of the directors must be a resident of India only.

- The intention must be the advancement of sports, social welfare, science and art, education, and financial aid to lower-income societies.

- The surplus received must be used for reaching the principal purpose of section 8 company solely.

- Any of the Company’s members cannot draw any compensation in any cash or character in kind.

- No profit must be distributed among the members and director of the Association which may be directly or indirectly, by any means.

- The Company must have a distinct vision and outline plan for the following three years.

- Property Management: The property ownership lies in the name of the Company, and it can only be sold as per the rules determined under the Companies Act, 2013. (Example-: With the consent of the Board of Directors in the form of a recommendation).

- Yearly filing of accounts, financial reports, and the returns of the Association with the ROC is needed to meet the compliance expected.

Read our article:What are Section 8 Companies? Know its provisions and Incorporation Procedures

What is the Method for Section 8 Company Registration?

Concerning simplifying the process of incorporating Section 8 section companies on 7th June 2019 terms of earlier filling of INC-12 has been dispensed by the Companies Sixth Amendment Rules,2019 (Incorporation).

- Application in the SPICe+ Form for Name Availability

Apply through SPICe+ form facility for name availability. Section 8 Company must possess words like Foundation, Forum, Association, Federation, Chambers, Confederation, Council, Electoral Trust, in its title.

The applicant can give two names at a time and can make only one resubmission in the SPICe+ form.

- Preparation of MOA and AOA

Memorandum of Association works as a code of the Company and clears the field of the Company’s activity. While an article of Association (AOA) of the Company determines about the internal management of the Company

Use Form INC-13 to file MOA of a Section 8 Company. Also, there is no designated format mentioned for AOA of a Section 8 Company.

Each subscriber has to sign the memorandum and article of Association, who shall also require giving his name, address, description, and occupation. It should be done in the proximity of a minimum one witness who will affirm the signature and will appear to sign and add his name, address, description, and profession.

- Filling of SPICe+ Form

Once you have obtained Central Government approval, it’s time for you to move a step ahead and file form SPICEe+ for NGO Registration in India as Section 8 Company.

Attachment of SPICe+:

What are the NGO Registration Forms?

| Objective | Form Numbers |

| Approval of Name | INC 1 |

| Declaration | INC 8 |

| Affidavit as of each directors | INC 9 |

| Application for Licence | INC 12 |

| Memorandum Of Association | INC 13 |

| Declaration Note from CAs | INC 14 |

| Declaration Note from every person who is relating to apply | INC 15 |

| to incorporate Section 8-License | INC 16 |

| State of affairs of Registered Office | INC 22 |

| Consensus of proposed directors | DIR 2 |

| Application to get DIN | DIR 3 |

| Appointment of directors | DIR 12 |

Conclusion

Forming an NGO in India is an uncomplicated process if you have complete documents and other papers available as per the rules for NGO Registration. The data mentioned above gives the details of different types of NGO registration in India and the various advantages of cultivating for the same. Therefore, the paperwork specification may vary based on different types of NGOs that you want to express your registration.

Irrespective of its various forms, it is done to aid the underprivileged or encourage and promote science, commerce, arts, treatment, language, culture, and many more. The profits received are supposed to be utilized for the growth and well-being of particular societies and well-being. CorpBiz is one of the leading consultants in India, which is recognized for its most active distribution of NGO license. If you have any queries concerning NGO registration, then you can contact our experts.

Read our article:Guide on NGO Registration: Types and Benefits