A new TDS section 194O was unveiled in the Union Budget 2020. E-commerce has become the primary choice for traders and buyers in the recent past. With the increase in online sales, there has been a significant increase in the number of buyers and sellers who trade via online platforms (e-Commerce website). The seller must address their tax liabilities on such income.

Therefore, the Budget 2020 brought new section 194O for the deduction of TDS on e-commerce sales. In the view of the said section, the e-commerce operator must deduct TDS on the payment made to the seller @ 1% on the aggregated amount of sales if it surpasses INR 5, 00,000 in the financial year. Section 194O has become effective from 1st October 2020.

What the Concept behind the Introduction of Section 194O?

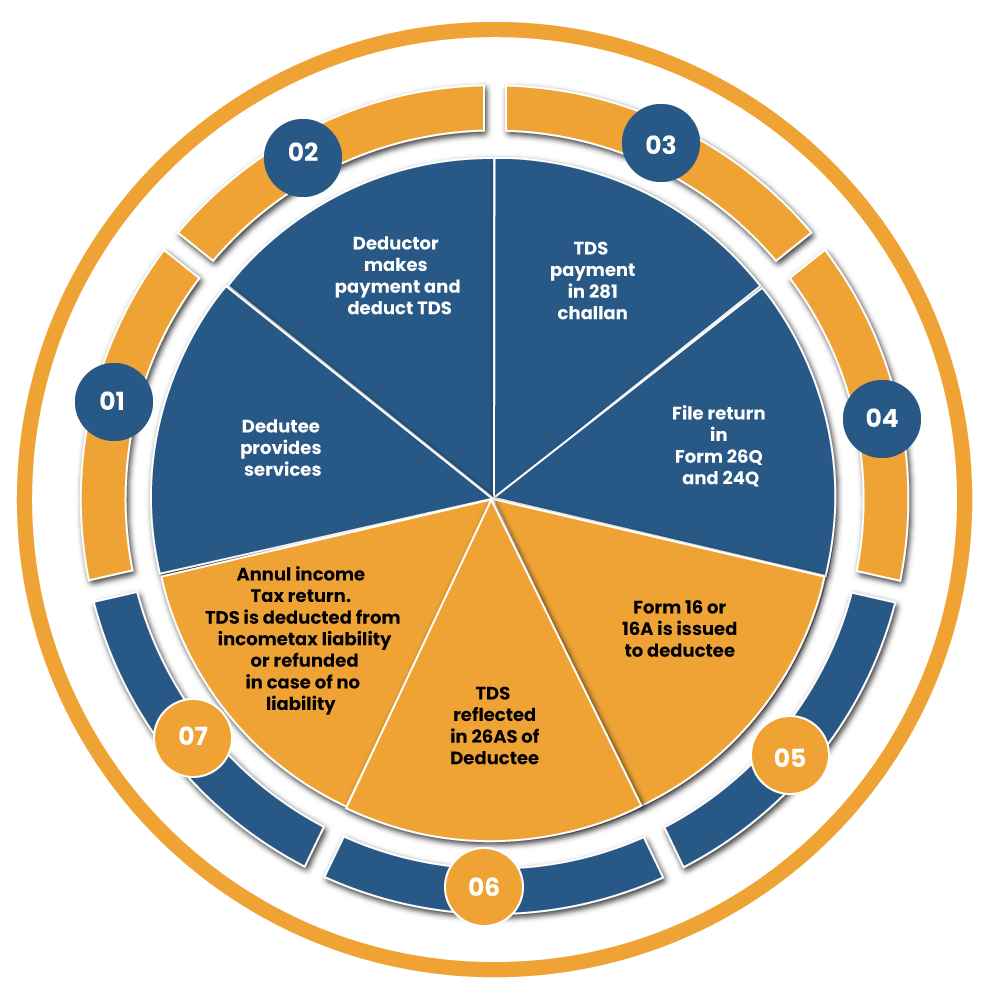

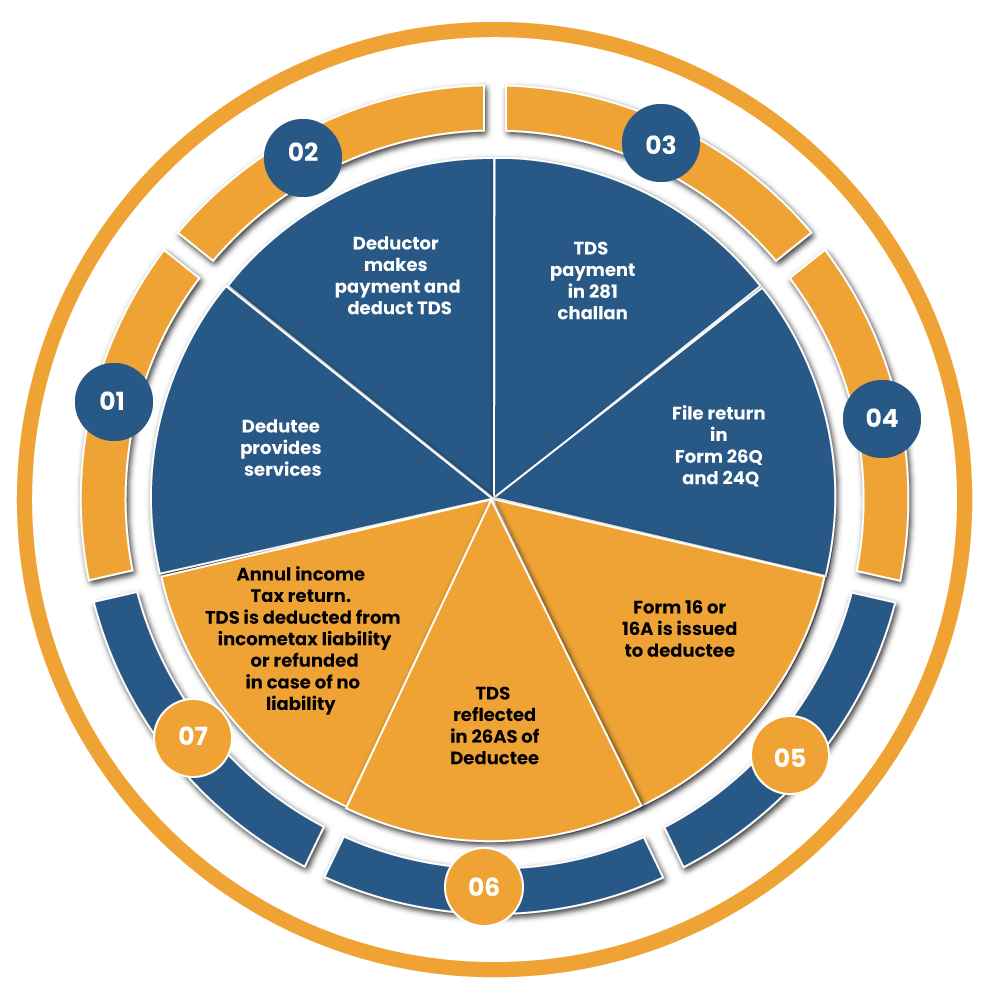

The concept behind the Introduction of Section 194O primarily revolves around the concept of Deductor, Deductee, nature of Payment & time, applicable rates and TDS Returns & certificates. The illustrations for each criterion are given below:-

Who is the Deductor u/s 194O?

An E-Commerce operator is an individual who controls and operates the online platform for the trading of goods and services. Thus, e-Commerce Operators are under the legal obligations to deduct TDS (Tax deduction at source) on making payments to the sellers of the e-commerce platform. Henceforth, the TDS ought to be deposited with the IT department and a TDS return must be filed.

Who is the Deductee u/s 194O?

E-Commerce Seller or E-Commerce participant is an individual from the Indian Territory who engaged in the selling of goods and services on an online platform. Income generated by the seller on the e-Commerce platform shall be deducted u/s 194O. E-commerce sellers who are not from the Indian province would also have to comply with the same provision.

Nature of Payment

E-commerce operators must have to deduct TDS on the aggregate sales of goods and services. This includes GST (Goods and services tax) and commission imposed by the e-commerce operator.

Moreover, if the buyer who made a payment to the e-commerce sellers would be deemed as the payment made by the e-commerce operator and the amount will consolidate in aggregate sales on which the deduction regarding the TDS has to be done.

Time of Payment

The deduction regarding the TDS must be done at the time of credit of the amount to the seller’s account or at the time of payment, whichever is applicable.

Rate

If the Deductee is from the Indian Territory or HUF having aggregate sales in the excess of five lakh rupees in a financial year, deduct TDS under section 194O @ 1% on aggregate sales. For any other category of deductee, deduct TDS (tax deduction at source) @ 1% on aggregate sales regardless of the number of gross sales. In the absence of Aadhaar or PAN, the TDS will be deducted by @ 5% regardless of the gross sale amount.

TDS Certificate

Deductor must provide Form 16A to the seller as the tax credit certificate for the deduction of TDS. With the help of such a form, the seller can claim credit for the tax deducted while filing Income tax return.

TDS Return

Once the e-Commerce operator deposits the TDS with the IT department, the next step is to file Form 26Q on TRACES to provide info regarding dividend payment. After filing TDS return, the deductor i.e. Ecommerce operator must forward Form 16A to the deductee.

After depositing TDS with the IT department, the deductor should file Form 26Q on TRACES to submit details of dividend payment.

As soon as the return is filed, the deductor should provide Form 16A to the deductee

Understanding the Concept of Section 194O through Examples

The following examples will let you understand the notion of Section 194O.

Example 1

Arun is a legitimate e-Commerce-seller on Flipkart, a leading eCommerce store. The following are the particulars of sales that he made on this very platform.

- Aggregate Sales : Rs 7,08,000 (Sales from Arun to Champak through Amazon)

- GST @ 18% included in the above sales = Rs. 108,000

- Commission @ 6% charged by Amazon included in above sales = Rs. 42,480

- Champak directly made payment to Arun of Rs. 30,000 (including GST)

Solution:–

- Amazon India is the E-Commerce Operator

- Arun is the E-commerce Seller

Aggregate Sales = Rs. 7,08,000+ Rs. 30,000 = Rs. 7,38,000.

Since the aggregate sales surpass Rs. 5, 00,000 and Arun is an Indian national, the eCommerce operator i.e. Amazon India is liable to deduct TDS @ 1% on aggregate sales before making payment Arun.

- TDS = 1% of 7,38,000 = Rs. 7,380

- Payment to Arun = 7,38,000 – 42,480 – 7380 = 688,140

- The ecommerce operator shall deposit TDS of Rs 7380 with the IT department also file Form 26Q

If Arun do not posses Aadhar or PAN, then TDS @ 5% shall be deducted regardless of the aggregate sales amount

Example 2

Magnus global Pvt Ltd is a registered Amazon client engaged in selling FMCG products to the customers. Following are the particular sales made by the company on Amazon:

- Total Sales = Rs. 2,36,000

- GST @ 18% included in the above sales = Rs. 36,000

- Commission @ 6% charged by Amazon included in above sales = Rs. 14160

- Sales from Magnus global to Rakesh through Amazon. However, Rakesh directly made a payment to Magnus global of Rs. 10,000 (including GST)

Solution

- E-Commerce Operator – Amazon India

- E-Commerce Seller – Magnus global Pvt. Ltd

- Gross Sales = Rs. 2,36,000+ Rs. 10,000 = Rs. 2,46,000

Amazon India is liable to deduct TDS @ 1% of Aggregate sales before making payment to Magnus Global, TDS ought to be deducted regardless of the sales amount.

- TDS = 1% of 2,46,000= Rs. 2460

- Payment to Magnus global Pvt. Ltd =2,46,000– 14160 – 2460 = Rs. 229,380

- Amazon shall deposit the TDS of Rs 2460 with the IT Department and file return form 26Q.

- TDS should be deducted @5% if Magnus global Pvt. Ltd does not holds PAN Card for verification and authentication processes.

TDS process Chart

Conclusion

In past, the eCommerce operators rejoice many tax exemptions due to the unavailability of a proper framework. The advent of Section 194O will make them liable to deduct TDS every time whenever made payment to the participant. Get in touch with Corpbiz expert to get in-depth information and services on tax-related matters.

Read our article:Form 16B – TDS Certificate Regarding Sale of Property