The FLA Return is described as Foreign Liabilities And Assets Return, which is required to be submitted by all the Indian Companies which have been received Foreign Direct Investment (FDI) or made Overseas Investment abroad in the previous years, including the current year, i.e., who holds foreign Assets or Liabilities in their Balance Sheets.

What is FLA Return?

Annual return on the Foreign Liabilities and Assets has been notified under the FEMA Act 1999. It must be submitted by all the Indian resident companies which have received FDI and made overseas investment in any of the last years, including the current year by 15 July every year. The non-filing of a return before the due date will be treated as the violation of FEMA and penalty clause will be invoked for violation of FEMA.

When the companies involve themselves with foreign investments, it becomes important to follow the rules and regulations of the (FEMA) Foreign Exchange Management Act and the compliances thereunder. FLA return is one of the most necessary compliance that has to be met by the companies that have either received FDI or made ODI.

Read our article:COVID-19: Overall Measures taken by MCA for businesses in India, 2020

Who required filing it?

Entities are required to file FLA Return are stated below:

- A Company which falls within the meaning of section 1(4) of the Companies Act, 2013

- A Limited Liability Partnership is registered under the Limited Liability Partnership Act, 2008

- Others, including SEBI, registered Alternative Investment Funds (AIFs), Partnership Firms, Public-Private Partnerships (PPP), Branches, or Trustees.

Companies Exempted from Filing FLA Return

- Companies that have only issued shares on a non-repatriable basis to India’s non-residents are exempt from filing FLA return.

- By the end of the financial year, companies that do not have any outstanding balance of FDI or ODI are exempt from filing FLA return.

- Companies that have only received share application money and have not received any FDI or not made any ODI are exempt from filing FLA return.

Due Date of Filing FLA Return

FLA return is mandatory under the FEMA Act 1999, and companies are required to submit the same based on audited/ unaudited accounts by 15 July every year. However, for submitting Form FLA for the FY 2019-20, the due date has been extended to 31 July 2020.

If a company’s accounts are not audited before the due date of submission, i.e., 15 July, the FLA Return must be submitted based on an unaudited (provisional) account. Once the accounts get audited, and there are revisions from the company’s provisional information, they are supposed to submit a revised FLA return based on audited accounts by the end – Sept, i.e., 30 September of the year.

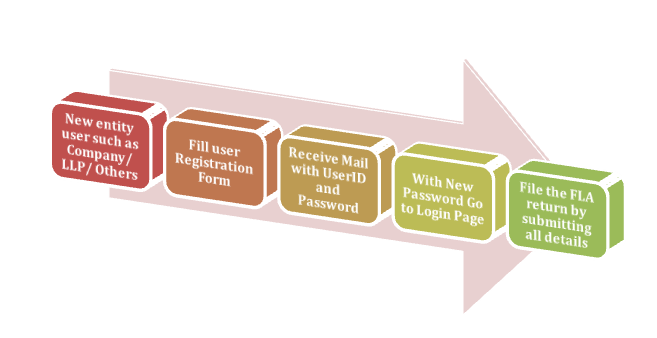

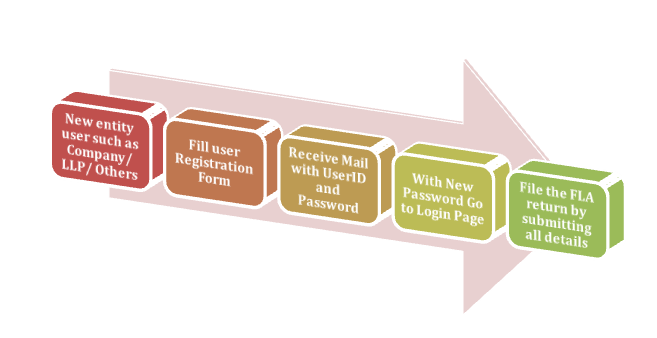

How to file Form- FLA Return?

The Reserve Bank of India has operationalized the web-based system online reporting portal for Foreign Liabilities and Assets Information Reporting system for submission of foreign liabilities and assets FLA return by 15 July of every year. This replaces the current email-based reporting system for the submission of the FLA return.

The main features of a FLAIR system are as follows:

- FLA return is to be submitted by the entities that have received foreign direct investment and made an overseas investment:

- Reporting entities must create a login name and password and register themselves on the web portal: https://flair.rbi.org.in.

- The existing mechanism of an email-based submission of FLA forms will be discontinued.

- The directions have come into force and would be applicable for reporting information, i.e., FLA return due on 15 July. It also needs to be filed on the new portal.

- RBI’s FAQs in this regard provide that RBI approval would be required if an entity wants to

- File the FLA return beyond a due date or file the returns for any previous years.

- Delete or modify the previous version of the FLA return.

- Indian entities that do not comply with it will be treated as a defaulter under the Foreign Exchange Management Act and the regulations made hereunder.

Penalty if no FLA Return filed

There are no specific penalties for FLA, as per Circular No. 29, dated 02 February 2017), however Non-filing of the FLA return before the due date will be treated as the violation of FEMA and penalty will be levied on defaulters which must be–

- If an amount against which offence is quantifiable, then a penalty will be “THRICE” the sum involved in the contravention.

- Where an amount cannot be quantified, the penalty may be imposed up to 2 lakh rupees.

- If any contravention is continuing every day, then Rs. 5000 for every day after a first day during which the contravention continues

Further, in addition to a penalty, any currency, security, or other money or property involved in the contravention may also be confiscated.

Conclusion

FLA’s annual return should cover all the foreign investments made by the company and to the company, and the company must directly submit it to the Reserve Bank of India. The details filed must comprise the financial details and other required details in accordance with the companies audited accounts. The details filed must comprise the financial details and other required details in accordance with the companies’ audited accounts. We at CorpBiz help our clients keep the accounts, and like other services, we help them file the return.

Read our article:5 Actionable Strategies to secure your finances amid COVID-19