Uninterrupted and smooth chain of ITC is one of the key features of Goods and Services Tax. ITC is a method to avoid cascading effect of taxes. In a simple language it is known as tax on tax. However, section 17(5) of CGST Act, 2017 specifies certain Goods and Services as Blocked credit. Blocked ITC means that a taxable person is not eligible to take ITC on Goods and Services specified as per Section 17 sub clause (5) of CGST Act. This provision has been amended vide GST amendment Act 2018 applicable from 1st Feb, 2019. Here you will get to know about all the provisions, interpretations, and amendments with respect to Blocked ITC under Goods and services tax.

Section 17 (5) of CGST Act, 2017

Notwithstanding whatever is contained in section 16(1) and section 18(1), ITC should not be available in the following conditions:-

Motor vehicles and other transportation -17(5)(a) of CGST Act

ITC is not available with respect to motor vehicle for transportation of persons having seating capacity not more than 13 persons (including driver).

ITC is not available in respect of services such as servicing, repairing, maintenance, leasing, renting and insurance of Motor Vehicles, Aircrafts and Vessels.

CMS Infor Systems Ltd. In re (AAAR) 2018

As per the case cited, ITC is not admissible on purchase of vehicle used towards transportation of cash.

As per Motor Vehicle Act, ITC is not available on excavators or road rollers.

Exceptions (ITC available)

When Motor Vehicles, Aircrafts and Vessels are used for further Supply:-

- Supply of aircraft and vessels;

- Navigation training on vessels;

- Training on flying the aircraft;

- Transportation of goods.

Read our article:Implementation of Delinking Credit/Debit Notes on the GSTN Portal

Goods and Services provided in Relation

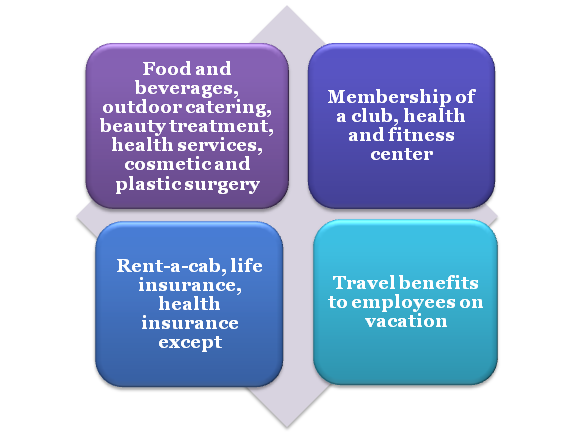

ITC is not available as per Section 17(5) (b) in the following circumstances-

Mohana Ghosh In re (AAR-WEST BENGAL)

As per the case cited, ITC is not available on purchase of motor vehicles for supplying rent-a-cab service in terms of section 17(5) (a) of CGST Act.

Nipha Exports P Ltd., In re AAR (West Bengal)

As per the case cited, the exception only exists in respect of rent-a-cab, life insurance and health insurance services

Exception (ITC available)

- Inward and Outward Supply of goods and services;

- Supplies to employees under any law (proviso to section 17(5)(b) of CGST Act inserted with effect from 1st Feb 2019);

- Notification by the government, if any.

Works Contract Services -Section 17(5) (c) of CGST Act.

ITC is not available for any works contract services. Input Tax Credit for construction of any immovable property, except for input of services used for further allocation of Work contracts services.

Jabalpur Entertainment Complexes P Ltd. In re (2018) (AAR-MP)

As per the case cited, ITC of works contract services received for maintenance and repairs of mall is not available.

Construction of Immovable Property for own use- Section 17(5) (d) of CGST Act

ITC is not available for construction of any immovable property on his own account when used in course of business. This rule does not apply to inputs used to manufactures plants and machinery for own use.

Tewari Warehousing Co. (P.) Ltd., In re 102 -295/72 GST 485 (AAR – West Bengal)

As per the case cited, warehouse construction using assembled structure is immovable property and ITC is not available for such constructions.

Maruti Ispat and Energy P Ltd. In re (AAR-AP).2018

As per the case cited, ITC is not available for Shed to protect plant and machinery as shed is a common structure and ITC is not applicable on common structure.

Tax paid under composition scheme- Section 17 (5) (e) of CGST Act

ITC is not available for Goods and services or both on which tax has been paid under Section 10 of CGST Act[1] i.e., composition scheme.

Goods and Services used by taxable non-resident person- Section 17(5) (f) of CGST Act

ITC cannot be availed on non-resident taxable person, except for goods imported by them.

For personal consumption- Section 17 (5) (g) of CGST Act

ITC is not available for goods and services used for personal or private consumptions of goods. Personal Consumptions means consumptions by partners or directors of the company for non-business activities.

Goods lost, destroyed, stolen or written off or given for promotion – Section 17 (5) (h) of CGST Act

ITC is not available for goods lost, destroyed, stolen, written off or disposed by way of gift or free samples orgiven for promotion.

Exide Industries Ltd. v. CCGST (2019)

As per the case cited, it was held that if factory is not in possession of the goods then ITC cannot be availed as goods are not received by the factory.

Biostadt India Ltd. In re [2019] (AAR-Maharashtra)

As per the case cited, ITC is not available on gold coins distributed among customers as gift based on sales target.

CBIC circular No. 92/11/2019-GST dated 7-3-2019

ITC on free samples given to related persons is available as it will subject to GST while free samples to given any unrelated persons will not subject to GST but ITC have to be reversed.

Polycab Wires (P.) Ltd., In re [2019] (AAR – KERALA)

As per the case cited, ITC is not available for free supply against Corporate Social Responsibility.

Sanofi India Ltd., In re [2019] (AAR – Maharashtra)

As per the case cited, ITC is not available on GST paid on expenses incurred towards promotional schemes and goods given as free vouchers as brand reminders. These schemes are performed under any contractual obligations which are voluntarily given on certain situation to the customers.

Any tax paid according to the provisions of sections 74, 129 and 130.

ITC is not available for any tax paid due to short payment on account of fraud, suppression, mis-declaration, seizure or detention.

Section 74

Determination of tax not paid or erroneously refunded or ITC wrongly availed or utilized by fraud or any mis-declaration or suppression of facts.

Section 129

ITC is not availed in case of Detention, seizure or release of goods.

Section 130

ITC cannot be availed when goods are confiscated and penalty is imposed.

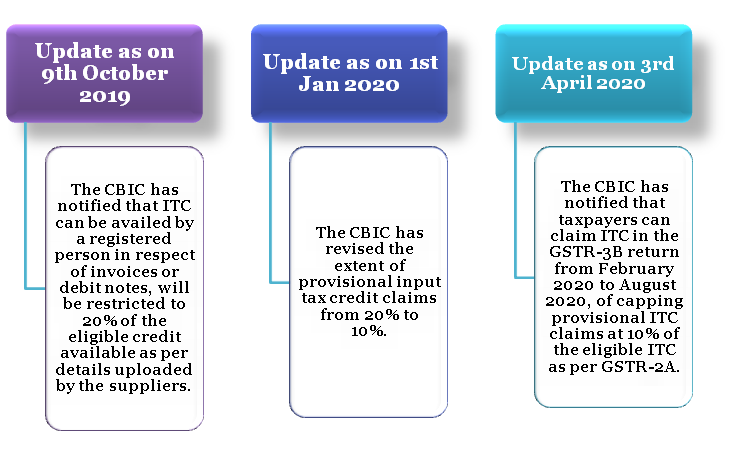

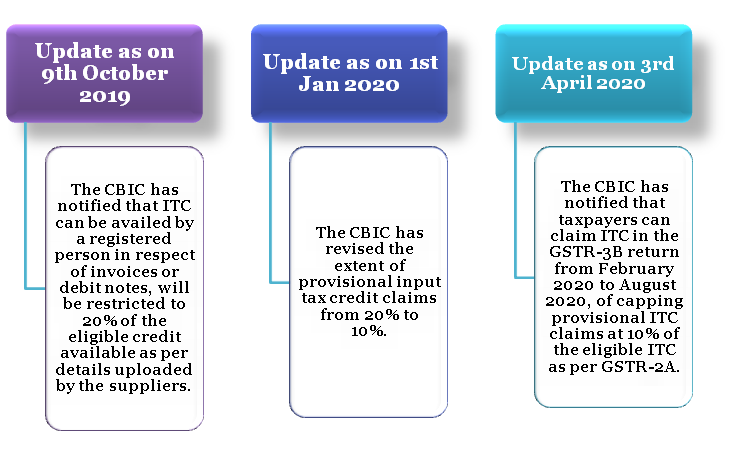

Recent Changes with respect to Blocked ITC

Conclusion

Section 17(5) of CGST Act, 2017 specifies certain Goods and Services as Blocked ITC. Blocked credit means that a taxable person is not eligible to take ITC on Goods and Services specified as per Section 17 sub clause (5) of CGST Act. Contact CorpBiz to know more about Blocked ITC under GST.

Read our article:Inverted Duty Structure under GST