Under a Limited Liability Partnership, two or more partners can form a unique partnership while having the limited liabilities. It gets registered according to the compliance and regulatory guidelines of the (MCA) Ministry of Corporate Affairs.

Sometimes, things do not work out between the partners of a partnership; therefore it is important to have an LLP agreement before starting an LLP. However, with the time and new changes an amendment in LLP agreement can also be done.

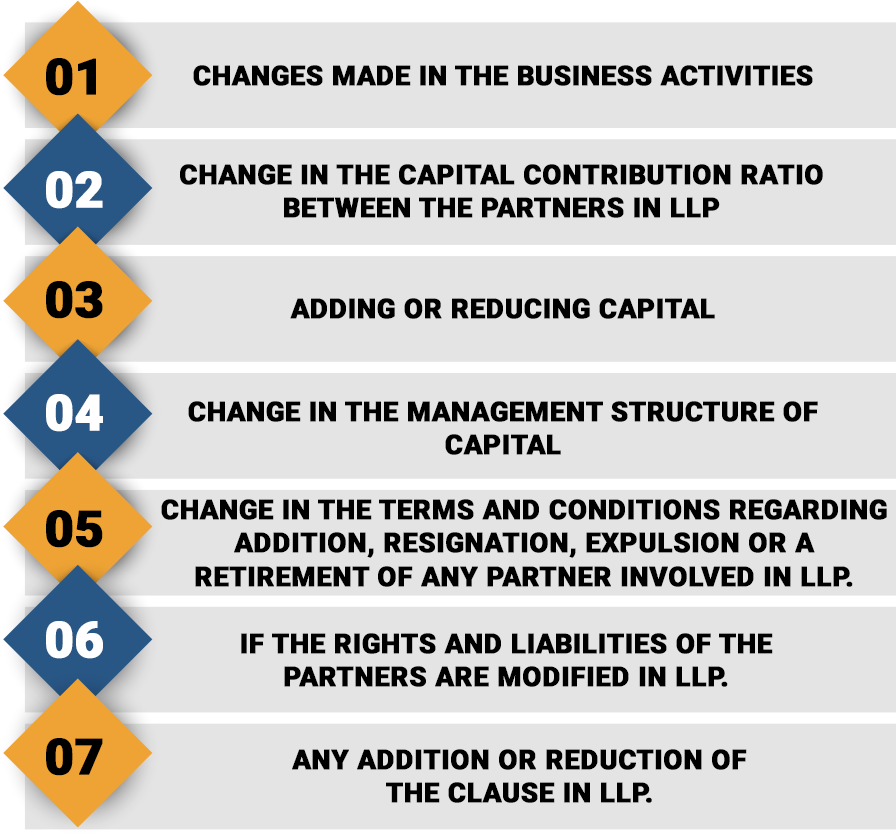

Reasons for Amendment in LLP Agreement

Things one has to Keep in Mind before Making LLP Agreement

Before an LLP registration and form filling process, some of the basic steps which required to be followed are:-

- The first step involves the meeting of partners and having consent each one of partner involved in LLP.

- To fulfil all the requirements and conditions of an appointment along with filing with the MCA[1], an authorization is provided to any one of the partner.

- The execution of the LLP agreement is must which is further done after a payment of stamp duty. The following are mandatory to have:

- The requirement of Stamp Duty

- The supplementary deed & LLP agreement validity

- The Signature required to be done by the partners

- The attestation must be done by at least 2 witnesses.

Steps for Making Amendments in LLP Agreement

The steps are as follows:-

Step 1

Passing of the resolution must be done for an amendment in LLP Agreement.

Step 2

Once a resolution is passed, within 30 days, form-3 has to be filed with the (ROC) Registrar.

The details must be filled in Form-3 are:-

- Modification date of LLP agreement

- The LLP before amendments

- The LLP after amendments is done.

The reason in whose accounts these changes have to be made such as:-

- Change in the nature of business

- Change in partners

- Change in the ratio of profit/loss sharing between the partners

- Change in the duties and rights of the partners.

- Restricting authority for partners.

- Change in management or administration of the partners

- Alteration in the procedure of conducting meetings.

Other change in details which are related to partners such as:-

- Retirement

- Expulsion

- Termination

- Resignation

- Admission

Resolving the disputes between:-

- Partners

- Partners and the LLP

- Other clauses which are related to LLP

- The business activity details after amendment in LLP agreement is done.

- The main division of industrial activities (NIC-2004).

- Details regarding the shares (both profit and loss) of the partners after the amendment.

STEP-3

In case of change in the designated partner, Form-4 requires be file along with Form-3. In case of change in the details such as name, address, designation, and others, Form-4 has to be filed.

Documents must filed with Form-4:-

- Document with the consent of a partner

- The proof of the termination.

- The proof of change in the name or an affidavit.

- In case, a designated partner is a company, a resolution must be given by a company in order to become a partner with an LLP.

- The authorization letter requires to be submitted mentioning the name and address of the person who is nominated as the representatives and partner.

The amendment in LLP agreement are only applied and completed once they are approved by the Ministry of Corporate Affairs. The LLP agreement will be downloaded from the website of the Ministry of Corporate Affairs.

The e-form will be downloaded, filled and be submitted or else it can also directly be filled online by using the (DSC) digital signature certificate method. In case of offline filling, the scanned document can directly be uploaded on the portal.

Rights of Partners Mentioned in LLP Agreement

The partners have following rights, which are given below:-

- The partners can take part in the management of an LLP.

- Partners can pledge/mortgage assets of LLP for borrowing money for the purpose of the business of the LLP as permissible.

- Partners have right, title interest share claim demand in all the assets and properties in the LLP in their respective profit sharing ratio.

- Partners have access to and be entitled to inspect and copy any books of accounts and other records of the LLP.

- Partners are entitled to continue to carry on or engage in their own, separate and independent business carried except any business directly or indirectly competing with the business of the LLP. He shall not use the name or assets or goodwill or reputation of the LLP to carry on his own business.

Duties of Partners Mentioned in LLP Agreement

The partners have following rights, which are given below:-

- The Partners have to work diligently and faithfully for purpose of the business of LLP and must be loyal towards LLP.

- The Partners have to give time and attention as may be required for the fulfilment of the objectives of the LLP business.

- The Partners must render true accounts and full information of all things affecting the LLP, or their Legal representatives.

- The Partners must work for the benefit of LLP and must not do anything without the consent of the Limited Liability Partnership

- In case any Partner of the LLP desires to transfer or assign his interest or shares in the LLP, he is bound to first offer the same to the other partner by giving 15 days’ notice. In an absence of any communication by the other partner, the concerned partner can transfer or assign his share in the market.

Conclusion

After a submission and completion of LLP Agreement, further amendment in LLP agreement can be made. The updates and alterations can be done after an online upload of an application is completed.

Considering a dynamic and forever changing nature of the business industry and the companies, the changes in the Agreement will be made anytime by the company/individuals and thereafter, it is also an easy process.

Read our article: No Restriction on Registering Manufacturing Business as LLP