Incorporating an LLP has a blend of the benefits of a Company and a Partnership Firm. It has mainly the features of limited liability of a company and also the flexibility of a Partnership firm. Considering an upward moving trend, many new LLP’s were incorporated during this year with various objects, and one of them was the manufacturing business as LLP.

Earlier before 8th April 2019 a restriction on LLP’s was imposed, according to which if LLP desires to register with manufacturing activity as its main objects was NOT allowed. Currently, there are now more than 12,000 active LLPs already into the manufacturing sector.

Why were Manufacturing units restricted to have LLP Registration?

Conceptually, a manufacturing & allied activities were not covered under LLP law. According to the LLP Act, 2008, manufacturing activities do not come under the definition of “Business”. On these grounds, MCA[1] has stated in the OM (Office of Memorandum) on 6th March 2019 that an incorporation of LLPs and also the conversions into LLPs with a proposed business activity such as manufacturing and allied activities were not allowed. However, now the rule has been changed an LLP can be registered with its main business activity as a manufacturing activity.

MCA has withdrawn Restriction from Manufacturing units for LLP registration

What Earlier Clarification by MCA?

The Manufacturing units are now allowed to register as LLPs under Limited Liability Partnership Act, 2008. However, there is an apprehension that if the manufacturing unit having an LLP registration expands its scale of operation, then it wouldn’t be suitable for it to operate as an LLP.

In regard to this, MCA has clarified that certain threshold limit on the share capital or annual turnover must be fixed soon for a manufacturing unit to get LLP registration. It was similar to the case of One Person Company (OPC) and other small companies.

Threshold Limit

The MCA imposed certain restrictions on the manufacturing businesses vide order memo on CRC/LLP/e-Forms dated 06.03.2019. The memo has stated that-

- Manufacturing activities does not satisfy the definition of ‘Business’ mentioned in the Limited Liability Partnership Act, 2008.

- Similarly, on this ground, the businesses which mention manufacturing & allied activity as the main activity are barred from LLP Registration.

- The memo raised doubts about the status of more than 12000 active LLPs which were already into manufacturing sector.

MCA’S Strong Decision

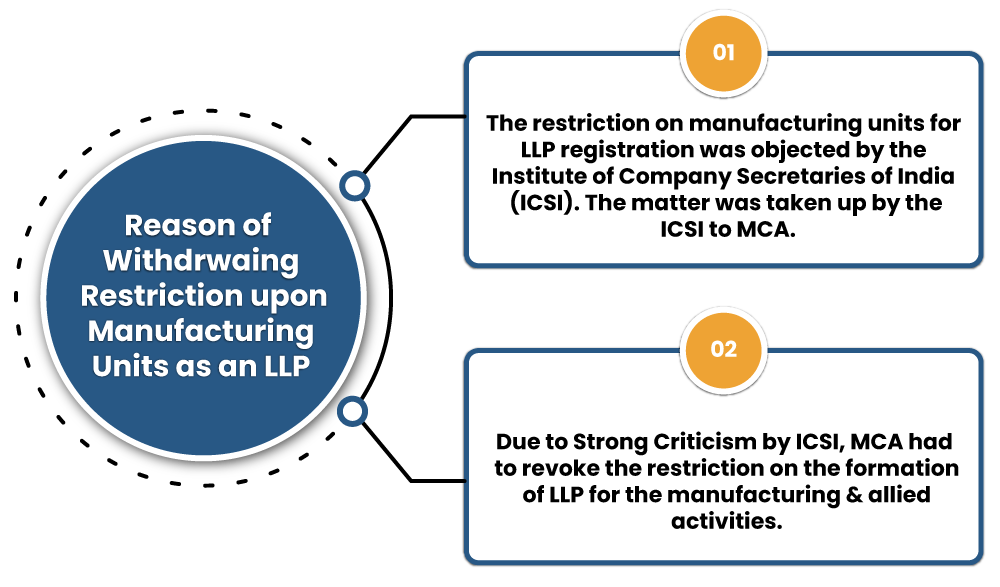

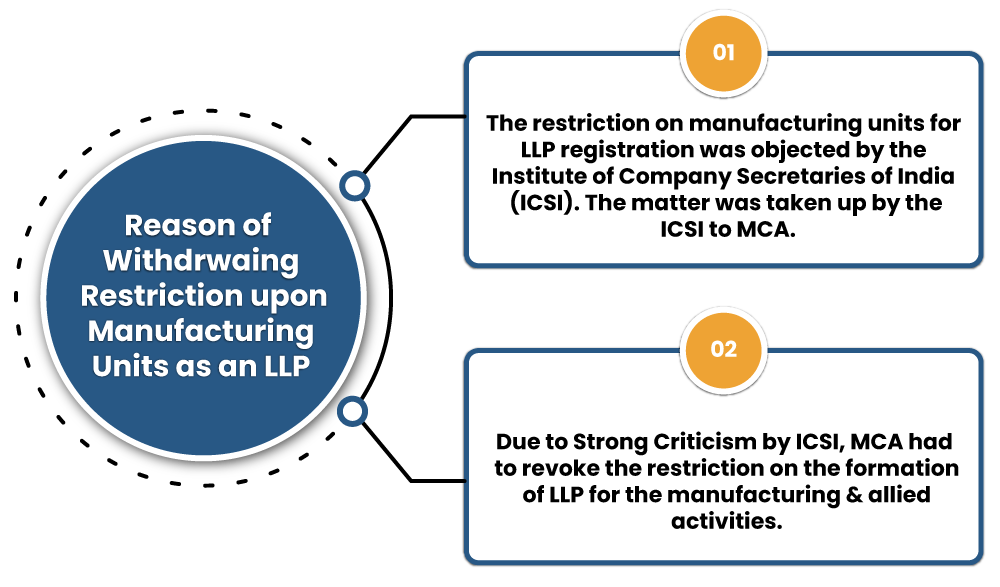

When this came to the notice of Institute of Company Secretaries of India (ICSI), it has objected to the restriction imposed and finally made up a representation on 8th April 2019. In its representation ICSI said that “it has been noticed that in recent times a manufacturing businesses was being restricted from incorporating as LLP on the ground that manufacturing activities do not fall under the definition of `Business‘ according to the Limited Liability Partnership Act, 2008. Similarly, the conversion of private and unlisted companies into LLP has been restricted now on the same grounds.”

Considering Strong Criticism of MCA move in Media and representation of ICSI, MCA invoked OM (Office Memorandum) No. CRC/LLP/e-Forms dated 06.03.2019 restricting formation of the LLP for manufacturing & allied activities w.e.f 17th April, 2019. Hence now the LLP’s can be registered with manufacturing and allied activity also.

Withdrawal of the MCA memo

However, there was an apprehension in an industry spheres. The section has raised doubt if the manufacturing business having LLP incorporation will still be allowed to operate as an LLP then it can scale up its operations on a later date. However, MCA has come up with the clarification. It has announced that it would fix a threshold limit of annual turnover or share capital for the manufacturing unit intending to do LLP registration. Further, these guidelines are expected to be similar to those issued for the OPCs and other such small companies.

Good News for Manufacturing Business

- The withdrawal of MCA memorandum dated 06.03.2019 meant that manufacturing businesses can now register as limited liability partnerships.

- Many regular partnership firms prefer to get register themselves as an LLPs because of the attractive features and additional benefits such as-

- Protection of limited liability available to partners, with a flexibility for organizing the internal company structure as a partnership

- Protection of thev business name

- Ease of business listing with ROC

- An LLP enjoys better professional recognition among the clients, as compare to partnership firm.

- Recognition under flagship “Startup India – Standup India scheme” of Central Government

Conclusion

The eligibility for manufacturing units to get registered under the Limited Liability Partnership Act, 2008 has been clarified. The one can register manufacturing business as LLPs. If a business is involved in manufacturing & allied activities, and wish to incorporate it as an LLP, we at CorpBiz can help you throughout the process of an LLP registration.

Read our article: Is it easy to maintain Annual Compliance for LLP? Let us know in detail!