In India, Section 8 Company is governed by the Companies Act, 2013 and it is managed by MCA, GOI via offices of Registrar of companies (ROC). The company incorporation rules and procedures heavily depend on the classification of the company that is to be incorporated. Formerly, Section 8 companies are regarded as Section 25 Company which was regulated by the Companies Act, 1956. The said Act encloses the objects like; promoting research, education, religion, sports, and charity. This article talks about the relaxations given to Section 8 companies under company law. The profit earned by these companies strictly applied to the said object and hence no dividend is paid to its active members. In this blog, you will come across the different relaxations applies to section 8 companies.

Charitable Works Within the Framework by Section 8 Company

Section 8 Company is an organization that is committed to pursuing charitable works within the framework of the bylaws. However, section 8 company and trust are not alike, at least in front of registration. Meaning- section 8 companies are the MCA driven entities, meanwhile; trust and society are registered under the regulations of state government[1]. In general, section 8 companies have higher credibility when contrasted with trust or societies among the donors, stakeholders, and government departments. Also, these companies are free some any obligation that enforces them to incorporate the word like Limited or private limited in their name.

Read our article:What are the Differences in Between Section 8 Company from Trust and Society under NGO?

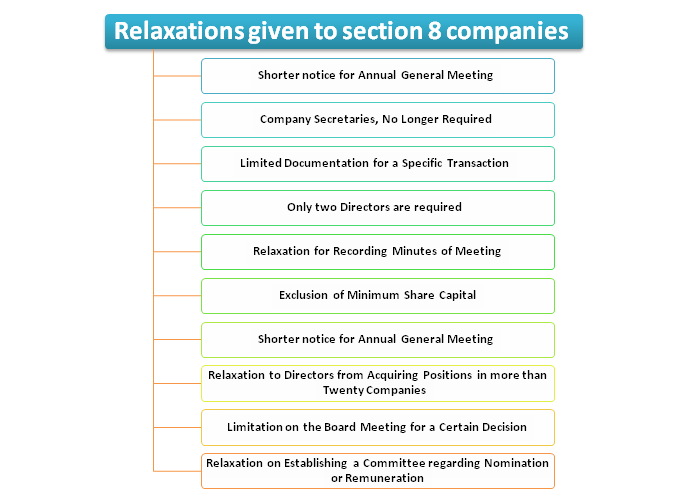

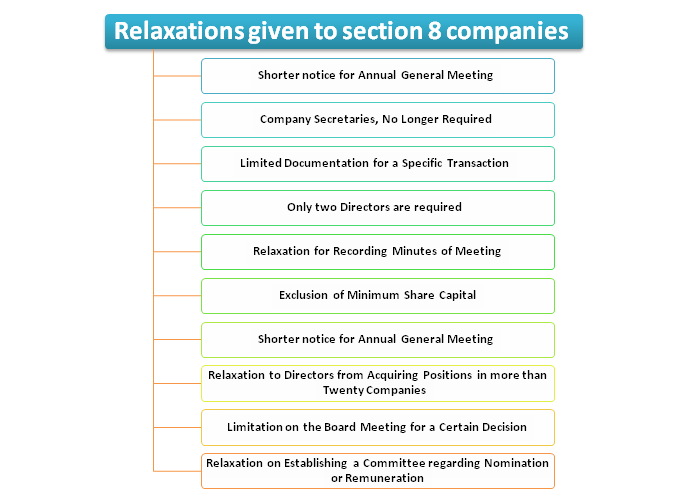

Relaxations given to section 8 companies

The following section explains the list of relaxations given to section 8 companies. Those are as follows:-

Company Secretaries, No Longer Required

Section 8 companies are now not required to appoint a Company Secretary to look into the compliances related matters as per Company Act 2013. This might help the company to shred off extra burden for appointing high-salaried individual for handling the compliances.

Exclusion of Minimum Share Capital

In the purview of relaxation declared for privately owned entities, section 8 companies are free from any obligation to procure a certain threshold of the share capital. The Act, in the view of this announcement, has been further amended to provide relaxation for non-profit companies that comes under section 2(71) and section 2 (68) of the act.

Shorter notice for Annual General Meeting

Section 101 provides the provision for the issuance of the notification to core members pertaining to the date of the General Meeting. The earlier limit was 21 days which is now slashed down to 14 days. This alternation to the timeline will also cover the scope of the meeting where a decision regarding the financial transaction took place.

Relaxation for Recording Minutes of Meeting

Section 118 which provide the provision for the recording of general meetings and passing of resolutions, shall no longer apply to non-profit companies. However, the company can record the minutes of meetings within thirty days of the conclusion of the meeting if the company’s articles need confirmation via the circulation of minutes.

Only two Directors are required

Section 149(1) will no longer applicable to section 8 companies, this gives the implication that non-profit organizations will be needed to have a minimum number of directors on the board. But the quorum of meeting for the board has been capped at 2. Similarly, provisions related to the appointment of an independent director have been relaxed. Now, section 8 companies are not liable to appoint independent directors to manage the day to day operations.

Moreover, section 8 firms will no longer be needed to convene the first meeting of the board within thirty days of incorporation. However, these companies still need to organize the director meeting once every 6 months.

The right of individuals other than retiring directors to claim the position of the director has been dissolve in section 8 companies. Identical to the relaxation provided top the privately-owned entities. But, such relaxation does not apply to the companies where the ballot system is utilized for the nomination of the director.

Relaxation to Directors from Acquiring Positions in more than Twenty Companies

The provision related to acquiring the position of directorship in more than 20 companies has been relaxed for section 8 companies. Thus; a person, if he meets the eligibility criteria, can hold the position of director in more than twenty sections 8 companies. The limitation however remains in existence for other forms of companies.

Relaxation on Establishing a Committee regarding Nomination or Remuneration

Section 8 companies are would no longer required to constitute committees to look into the candidature of the individuals for nomination to the board or determining the remuneration of incoming and existing directors.

Limitation on the Board Meeting for a Certain Decision

The board has been conferred the right to make decisions related to investments, borrowing, and granting of credit and advances via circulation as contrasted to deciding by convening a board meeting.

Limited Documentation for a Specific Transaction

A director shall be accountable for disclosing his interest in any company in case of financial transactions. Plus the company is required to enclose the detail of such transaction in a proper register in the purview of section 188 if the limit of transaction surpasses one lakh rupees in value.

Conclusions

Section 8 companies have an upper hand when it comes to ease of operation and meeting compliances. The aforementioned relaxations will allow these companies to operate more freely. With unnecessary legal obstructions overcame, section 8 companies can now operate in a hassle-free environment. All in all, relaxations given to section 8 companies are practical and make sense in the real-world scenario. If you need some professional advice or services regarding Section 8 company registration, kindly head over to CorpBiz team.

Read our article:NGO Organizational Structure & Section 8 Company Registration Process